News

SpaceX first orbital spacecraft set to smash reusability record on last launch

The first orbital spacecraft designed and built by SpaceX is set to smash a reusability record on its 20th and final International Space Station (ISS) resupply launch, hopefully ending an exceptional career with yet another noteworthy achievement.

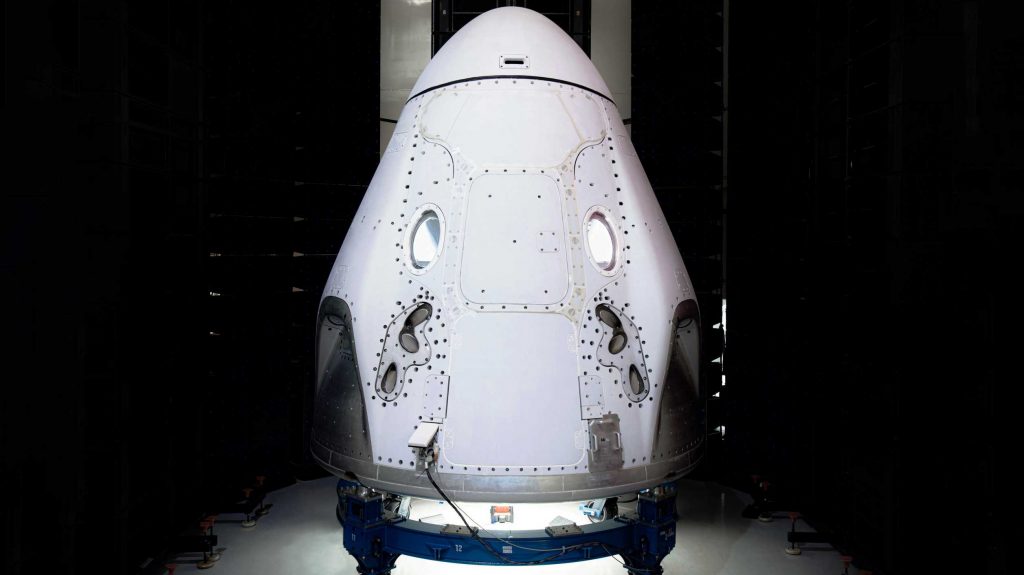

After a rocket-related hardware issue forced a four-day delay, a flight-proven Cargo Dragon spacecraft and Falcon 9 rocket are set to lift off no earlier than (NET) 11:50 pm EST, March 6th (04:50 UTC, March 7th) on NASA’s 20th and final SpaceX Commercial Resupply Services (CRS-20) mission. Although SpaceX’s final CRS1 launch, 20th mission milestone, flight-proven Dragon, and fairly quick Falcon 9 booster turnaround are all significant and exciting in their own ways, the most noteworthy technical aspect of CRS-20 can be found in the Dragon capsule that will soon be perched atop the tip of the rocket.

Shared on March 1st alongside confirmation of a successful Falcon 9 wet dress rehearsal (WDR) and static fire at its Cape Canaveral, Florida Launch Complex 40 (LC-40) pad, SpaceX revealed that Cargo Dragon capsule C112 (C1: Dragon 1; 12: capsule #12) will be supporting CRS-20 as early as this Friday. If all goes according to plan, it will be the spacecraft’s third cargo mission to the ISS since February 2017, becoming the third orbital SpaceX vehicle to do so. Even more significantly, C112 is poised to crush Cargo Dragon’s own previous record for the shortest time between two orbital launches.

Back in June 2017, SpaceX became the first private company in history to successfully reuse an orbital-class spacecraft on its CRS-11 Cargo Dragon mission, itself the first private spacecraft in history to successfully rendezvous with the space station. Since then, all but one CRS mission has featured an orbit-proven Dragon capsule, making CRS-20 the ninth time SpaceX will attempt to launch a spacecraft into orbit for the second (or third) time.

In other words, nearly half of all of SpaceX’s NASA CRS missions have featured flight-proven spacecraft, while several have also launched with flight-proven Falcon 9 boosters. Still, while extremely impressive that SpaceX has managed to convince the risk-averse space agency to fly several dozen tons of critical hardware on flight-proven rockets and spacecraft, Cargo Dragon capsule reuse has always been a comparatively lengthy and complex process.

Back in July 2017, just a month after SpaceX’s first successful Cargo Dragon reuse, CEO Elon Musk offered some insight into the capability’s potential value.

“Musk said he expects the next Dragon reuse and all future reuses to save SpaceX nearly 50% of the cost of manufacturing an entirely new spacecraft. Musk admitted that the first refurbishment of Dragon likely ended up costing as much or more than a new vehicle, but this is to be expected for the first attempt to reuse any sort of space hardware that must survive some form of reentry heating and saltwater immersion.”

Teslarati.com — July 21st, 2017

Ultimately, SpaceX has almost certainly realized Musk’s ambition of cutting the cost of orbital space station resupply missions in half (at least). Scheduled to launch on March 6th, Cargo Dragon capsule C112 last launched in December 2018, reentering Earth’s atmosphere and splashing down on January 13th, 2019. With CRS-20, the capsule could thus crush the previous record – 19 months – by more than 25%. Measured from splashdown to the capsule’s shipment to the launch pad, SpaceX may have spent less than a year refurbishing the Cargo Dragon spacecraft, likely more than a 50% improvement over all past refurbishment operations.

CRS-20 should thus mark a climactic and fitting end to Cargo Dragon 1’s nine-year spaceflight career. While bittersweet that the spacecraft and its many siblings will likely never fly again, Musk has said that Dragon 2 (Crew Dragon) – the spacecraft intended to replace it – is dramatically easier (and thus cheaper) to reuse than Dragon 1. As such, SpaceX should have no issue continuing its trend of lowering the cost of access to space after it begins space station cargo deliveries under its CRS2 NASA contract later this year.

Check out Teslarati’s Marketplace! We offer Tesla accessories, including for the Tesla Cybertruck and Tesla Model 3.

News

Tesla China exports 50,644 vehicles in January, up sharply YoY

The figure also places Tesla China second among new energy vehicle exporters for the month, behind BYD.

Tesla China exported 50,644 vehicles in January, as per data released by the China Passenger Car Association (CPCA).

This marks a notable increase both year-on-year and month-on-month for the American EV maker’s Giga Shanghai-built Model 3 and Model Y. The figure also places Tesla China second among new energy vehicle exporters for the month, behind BYD.

The CPCA’s national passenger car market analysis report indicated that total New Energy Vehicle exports reached 286,000 units in January, up 103.6% from a year earlier. Battery electric vehicles accounted for 65% of those exports.

Within that total, Tesla China shipped 50,644 vehicles overseas. By comparison, exports of Giga Shanghai-built Model 3 and Model Y units totaled 29,535 units in January last year and just 3,328 units in December.

This suggests that Tesla China’s January 2026 exports were roughly 1.7 times higher than the same month a year ago and more than 15 times higher than December’s level, as noted in a TechWeb report.

BYD still led the January 2026 export rankings with 96,859 new energy passenger vehicles shipped overseas, though it should be noted that the automaker operates at least nine major production facilities in China, far outnumering Tesla. Overall, BYD’s factories in China have a domestic production capacity for up to 5.82 million units annually as of 2024.

Tesla China followed in second place, ahead of Geely, Chery, Leapmotor, SAIC Motor, and SAIC-GM-Wuling, each of which exported significant volumes during the month. Overall, new energy vehicles accounted for nearly half of China’s total passenger vehicle exports in January, hinting at strong overseas demand for electric cars produced in the country.

China remains one of Tesla China’s most important markets. Despite mostly competing with just two vehicles, both of which are premium priced, Tesla China is still proving quite competitive in the domestic electric vehicle market.

News

Tesla adds a new feature to Navigation in preparation for a new vehicle

After CEO Elon Musk announced earlier this week that the Semi’s mass production processes were scheduled for later this year, the company has been making various preparations as it nears manufacturing.

Tesla has added a new feature to its Navigation and Supercharger Map in preparation for a new vehicle to hit the road: the Semi.

After CEO Elon Musk announced earlier this week that the Semi’s mass production processes were scheduled for later this year, the company has been making various preparations as it nears manufacturing.

Elon Musk confirms Tesla Semi will enter high-volume production this year

One of those changes has been the newly-released information regarding trim levels, as well as reports that Tesla has started to reach out to customers regarding pricing information for those trims.

Now, Tesla has made an additional bit of information available to the public in the form of locations of Megachargers, the infrastructure that will be responsible for charging the Semi and other all-electric Class 8 vehicles that hit the road.

Tesla made the announcement on the social media platform X:

We put Semi Megachargers on the map

→ https://t.co/Jb6p7OPXMi pic.twitter.com/stwYwtDVSB

— Tesla Semi (@tesla_semi) February 10, 2026

Although it is a minor development, it is a major indication that Tesla is preparing for the Semi to head toward mass production, something the company has been hinting at for several years.

Nevertheless, this, along with the other information that was released this week, points toward a significant stride in Tesla’s progress in the Semi project.

Now that the company has also worked toward completion of the dedicated manufacturing plant in Sparks, Nevada, there are more signs than ever that the vehicle is finally ready to be built and delivered to customers outside of the pilot program that has been in operation for several years.

For now, the Megachargers are going to be situated on the West Coast, with a heavy emphasis on routes like I-5 and I-10. This strategy prioritizes major highways and logistics hubs where freight traffic is heaviest, ensuring coverage for both cross-country and regional hauls.

California and Texas are slated to have the most initially, with 17 and 19 sites, respectively. As the program continues to grow, Florida, Georgia, Illinois, Washington, New York, and Nevada will have Megacharger locations as well.

For now, the Megachargers are available in Lathrop, California, and Sparks, Nevada, both of which have ties to Tesla. The former is the location of the Megafactory, and Sparks is where both the Tesla Gigafactory and Semifactory are located.

Elon Musk

Tesla stock gets latest synopsis from Jim Cramer: ‘It’s actually a robotics company’

“Turns out it’s actually a robotics and Cybercab company, and I want to buy, buy, buy. Yes, Tesla’s the paper that turned into scissors in one session,” Cramer said.

Tesla stock (NASDAQ: TSLA) got its latest synopsis from Wall Street analyst Jim Cramer, who finally realized something that many fans of the company have known all along: it’s not a car company. Instead, it’s a robotics company.

In a recent note that was released after Tesla reported Earnings in late January, Cramer seemed to recognize that the underwhelming financials and overall performance of the automotive division were not representative of the current state of affairs.

Instead, we’re seeing a company transition itself away from its early identity, essentially evolving like a caterpillar into a butterfly.

The narrative of the Earnings Call was simple: We’re not a car company, at least not from a birds-eye view. We’re an AI and Robotics company, and we are transitioning to this quicker than most people realize.

Tesla stock gets another analysis from Jim Cramer, and investors will like it

Tesla’s Q4 Earnings Call featured plenty of analysis from CEO Elon Musk and others, and some of the more minor details of the call were even indicative of a company that is moving toward AI instead of its cars. For example, the Model S and Model X will be no more after Q2, as Musk said that they serve relatively no purpose for the future.

Instead, Tesla is shifting its focus to the vehicles catered for autonomy and its Robotaxi and self-driving efforts.

Cramer recognizes this:

“…we got results from Tesla, which actually beat numbers, but nobody cares about the numbers here, as electric vehicles are the past. And according to CEO Elon Musk, the future of this company comes down to Cybercabs and humanoid robots. Stock fell more than 3% the next day. That may be because their capital expenditures budget was higher than expected, or maybe people wanted more details from the new businesses. At this point, I think Musk acolytes might be more excited about SpaceX, which is planning to come public later this year.”

He continued, highlighting the company’s true transition away from vehicles to its Cybercab, Optimus, and AI ambitions:

“I know it’s hard to believe how quickly this market can change its attitude. Last night, I heard a disastrous car company speak. Turns out it’s actually a robotics and Cybercab company, and I want to buy, buy, buy. Yes, Tesla’s the paper that turned into scissors in one session. I didn’t like it as a car company. Boy, I love it as a Cybercab and humanoid robot juggernaut. Call me a buyer and give me five robots while I’m at it.”

Cramer’s narrative seems to fit that of the most bullish Tesla investors. Anyone who is labeled a “permabull” has been echoing a similar sentiment over the past several years: Tesla is not a car company any longer.

Instead, the true focus is on the future and the potential that AI and Robotics bring to the company. It is truly difficult to put Tesla shares in the same group as companies like Ford, General Motors, and others.

Tesla shares are down less than half a percent at the time of publishing, trading at $423.69.