News

SpaceX aces Starlink launch and landing, reveals more than half a million preorders

SpaceX has successfully completed its 25th operational Starlink satellite launch, stuck a bullseye Falcon 9 booster landing, and revealed that satellite internet service has already received more than half a million preorders.

Aside from a quiet announcement of more than 10,000 active users in early February, this is the first time SpaceX has offered real data on the extent of demand for Starlink satellite internet.

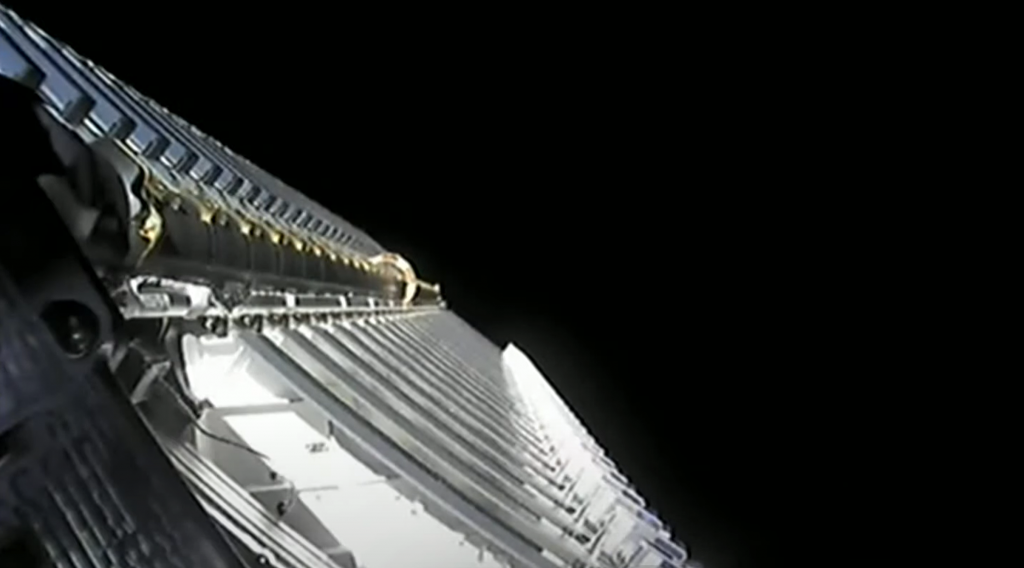

Right on schedule, Falcon 9 booster B1049 lifted off at 3:01 pm EDT on its ninth orbital-class launch and lifted the rocket’s ~125 metric ton (~275,000 lb) second stage and Starlink payload out of Earth’s atmosphere and well on its way to orbit. Less than nine minutes later, the massive first stage aced its ninth touchdown, hitting the bullseye on drone ship Of Course I Still Love You (OCISLY). Almost simultaneously, Falcon 9’s second stage wrapped up a six-minute orbital insertion burn in what has become a well-worn routine for SpaceX.

Around 40 minutes after liftoff, the second stage reignited for an extremely brief one-second orbit-raising burn, shut down, and began spinning up for another successful deployment of 60 Starlink satellites. Assuming all sixty are healthy, SpaceX will have more than 1460 functional satellites in orbit, some 900 of which are operational.

While every Starlink launch is important, perhaps the most interesting thing to come from Starlink-25 was SpaceX’s official confirmation that it has received more than 500,000 orders and deposits for Starlink internet service. As the Starlink constellation expands and rapidly approaches uninterrupted coverage, SpaceX has begun accepting preorders – with a $99 deposit – from prospective customers in almost any country that the company is already working on regulatory approval with.

Some prospective customers can simply order outright at a cost of approximately $600 upfront and $99 per month to purchase a Starlink dish, router, and satellite internet with unlimited bandwidth and no data caps. With more than 500,000 orders and preorders already in hand, that means Starlink has already earned SpaceX a bare minimum of $50 million in deposits alone.

If SpaceX can produce enough dishes – and do so quickly enough – to turn all of those preorders into active users, it would represent some $250 million in upfront revenue and – far more importantly – annual revenue on the order of $600 million. SpaceX is currently selling its cutting-edge dishes to customers at a significant loss but the company should be able to easily recoup that loss – now believed to be less than $1000 per dish – with a single year of internet service.

Of course, SpaceX is paying a substantial sum – likely on the order of $5 billion or more – to build and launch thousands of satellites, construct ground stations, and manufacture user terminals, but the company has historically expressed little interest in ‘recouping’ infrastructure investments. In that sense, as long as investors continue to eagerly dump billions into SpaceX’s coffers to fund Starlink buildout and can overlook the largely symbolic idea of ‘recouping’ non-debt investments, Starlink could become self-sustaining far sooner than almost anyone likely suspects.

News

Tesla is coming to Estonia and Latvia in latest European expansion: report

Tesla seems to be accelerating its regional expansion following its recent launch in Lithuania.

Recent reports have indicated that Tesla has taken a step toward entering the Baltic states by registering new subsidiaries in Latvia and Estonia.

Filings suggest that Tesla is accelerating its regional expansion following its recent launch in Lithuania, with service centers likely coming before full sales operations.

Official entities in Latvia and Estonia

Tesla has established two new legal entities, Tesla Latvia SIA and Tesla Estonia OÜ, both owned by Tesla International B.V., as noted in an EV Wire report. Corporate records show the Estonian entity was formed on December 16, 2025, while the Latvian subsidiary was registered earlier, on November 7.

Both entities list senior Tesla executives on their boards, including regional and finance leadership responsible for new market expansion across Europe. Importantly, the entities are registered under “repair and maintenance of motor vehicles,” rather than strictly vehicle sales. This suggests that Tesla service centers will likely be launched in both countries.

The move mirrors Tesla’s recent Baltic rollout strategy. When Tesla entered Lithuania, it first established a local entity, followed by a pop-up store within weeks and a permanent service center a few months later. It would then not be surprising if Tesla follows a similar strategy in Estonia and Latvia, and service and retail operations arrive in the first half of 2026.

Tesla’s European push

Tesla saw a drop in sales in Europe in 2025, though the company is currently attempting to push more sales in the region by introducing its most affordable vehicles yet, the Model 3 Standard and the Model Y Standard. Both vehicles effectively lower the price of entry into the Tesla ecosystem, which may make them attractive to consumers.

Tesla is also hard at work in its efforts to get FSD approved for the region. In the fourth quarter of 2025, Tesla rolled out an FSD ride-along program in several European countries, allowing consumers to experience the capabilities of FSD firsthand. In early December, reports emerged indicating that the FSD ride-along program would be extended in several European territories until the end of March 2026.

Elon Musk

Elon Musk’s X will start using a Tesla-like software update strategy

The initiative seems designed to accelerate updates to the social media platform, while maintaining maximum transparency.

Elon Musk’s social media platform X will adopt a Tesla-esque approach to software updates for its algorithm.

The initiative seems designed to accelerate updates to the social media platform, while maintaining maximum transparency.

X’s updates to its updates

As per Musk in a post on X, the social media company will be making a new algorithm to determine what organic and advertising posts are recommended to users. These updates would then be repeated every four weeks.

“We will make the new 𝕏 algorithm, including all code used to determine what organic and advertising posts are recommended to users, open source in 7 days. This will be repeated every 4 weeks, with comprehensive developer notes, to help you understand what changed,” Musk wrote in his post.

The initiative somewhat mirrors Tesla’s over-the-air update model, where vehicle software is regularly refined and pushed to users with detailed release notes. This should allow users to better understand the details of X’s every update and foster a healthy feedback loop for the social media platform.

xAI and X

X, formerly Twitter, has been acquired by Elon Musk’s artificial intelligence startup, xAI last year. Since then, xAI has seen a rapid rise in valuation. Following the company’s the company’s upsized $20 billion Series E funding round, estimates now suggest that xAI is worth tens about $230 to $235 billion. That’s several times larger than Tesla when Elon Musk received his controversial 2018 CEO Performance Award.

As per xAI, the Series E funding round attracted a diverse group of investors, including Valor Equity Partners, Stepstone Group, Fidelity Management & Research Company, Qatar Investment Authority, MGX, and Baron Capital Group, among others. Strategic partners NVIDIA and Cisco Investments also continued support for building the world’s largest GPU clusters.

News

Tesla FSD Supervised wins MotorTrend’s Best Driver Assistance Award

The decision marks a notable reversal for the publication from prior years, with judges citing major real-world improvements that pushed Tesla’s latest FSD software ahead of every competing ADAS system.

Tesla’s Full Self-Driving (Supervised) system has been named the best driver-assistance technology on the market, earning top honors at the 2026 MotorTrend Best Tech Awards.

The decision marks a notable reversal for the publication from prior years, with judges citing major real-world improvements that pushed Tesla’s latest FSD software ahead of every competing ADAS system. And it wasn’t even close.

MotorTrend reverses course

MotorTrend awarded Tesla FSD (Supervised) its 2026 Best Tech Driver Assistance title after extensive testing of the latest v14 software. The publication acknowledged that it had previously criticized earlier versions of FSD for erratic behavior and near-miss incidents, ultimately favoring rivals such as GM’s Super Cruise in earlier evaluations.

According to MotorTrend, the newest iteration of FSD resolved many of those shortcomings. Testers said v14 showed far smoother behavior in complex urban scenarios, including unprotected left turns, traffic circles, emergency vehicles, and dense city streets. While the system still requires constant driver supervision, judges concluded that no other advanced driver-assistance system currently matches its breadth of capability.

Unlike rival systems that rely on combinations of cameras, radar, lidar, and mapped highways, Tesla’s FSD operates using a camera-only approach and is capable of driving on city streets, rural roads, and freeways. MotorTrend stated that pure utility, the ability to handle nearly all road types, ultimately separated FSD from competitors like Ford BlueCruise, GM Super Cruise, and BMW’s Highway Assistant.

High cost and high capability

MotorTrend also addressed FSD’s pricing, which remains significantly higher than rival systems. Tesla currently charges $8,000 for a one-time purchase or $99 per month for a subscription, compared with far lower upfront and subscription costs from other automakers. The publication noted that the premium is justified given FSD’s unmatched scope and continuous software evolution.

Safety remained a central focus of the evaluation. While testers reported collision-free operation over thousands of miles, they noted ongoing concerns around FSD’s configurable driving modes, including options that allow aggressive driving and speeds beyond posted limits. MotorTrend emphasized that, like all Level 2 systems, FSD still depends on a fully attentive human driver at all times.

Despite those caveats, the publication concluded that Tesla’s rapid software progress fundamentally reshaped the competitive landscape. For drivers seeking the most capable hands-on driver-assistance system available today, MotorTrend concluded Tesla FSD (Supervised) now stands alone at the top.