It’s been widely reported that electric vehicle (EV) sales growth has slowed this year, but new data from the third quarter shows continued growth in the sector, as backed by incentive programs and a wider variety of options available to consumers this year than the last few.

According to Kelley Blue Book estimates reported by Cox Automotive in a press release last week, EV sales in the U.S. grew 11 percent year over year in Q3—reaching record highs in both overall market share and total delivery volume.

Total EVs sold in the third quarter reached 346,309, marking a 5-percent jump from Q2. Meanwhile, total EV market share reached 8.9 percent in Q3, which is the highest level recorded yet and marks a jump from 7.8 percent in the same quarter last year.

“While year-over-year growth has slowed, EV sales in the U.S. continue to march higher,” said Stephanie Valdez Streaty, Cox Automotive’s Director of Industry Insights. “The growth is being fueled in part by Incentives and discounts, but as more affordable EVs enter the market and infrastructure improves, we can expect even greater adoption in the coming years.”

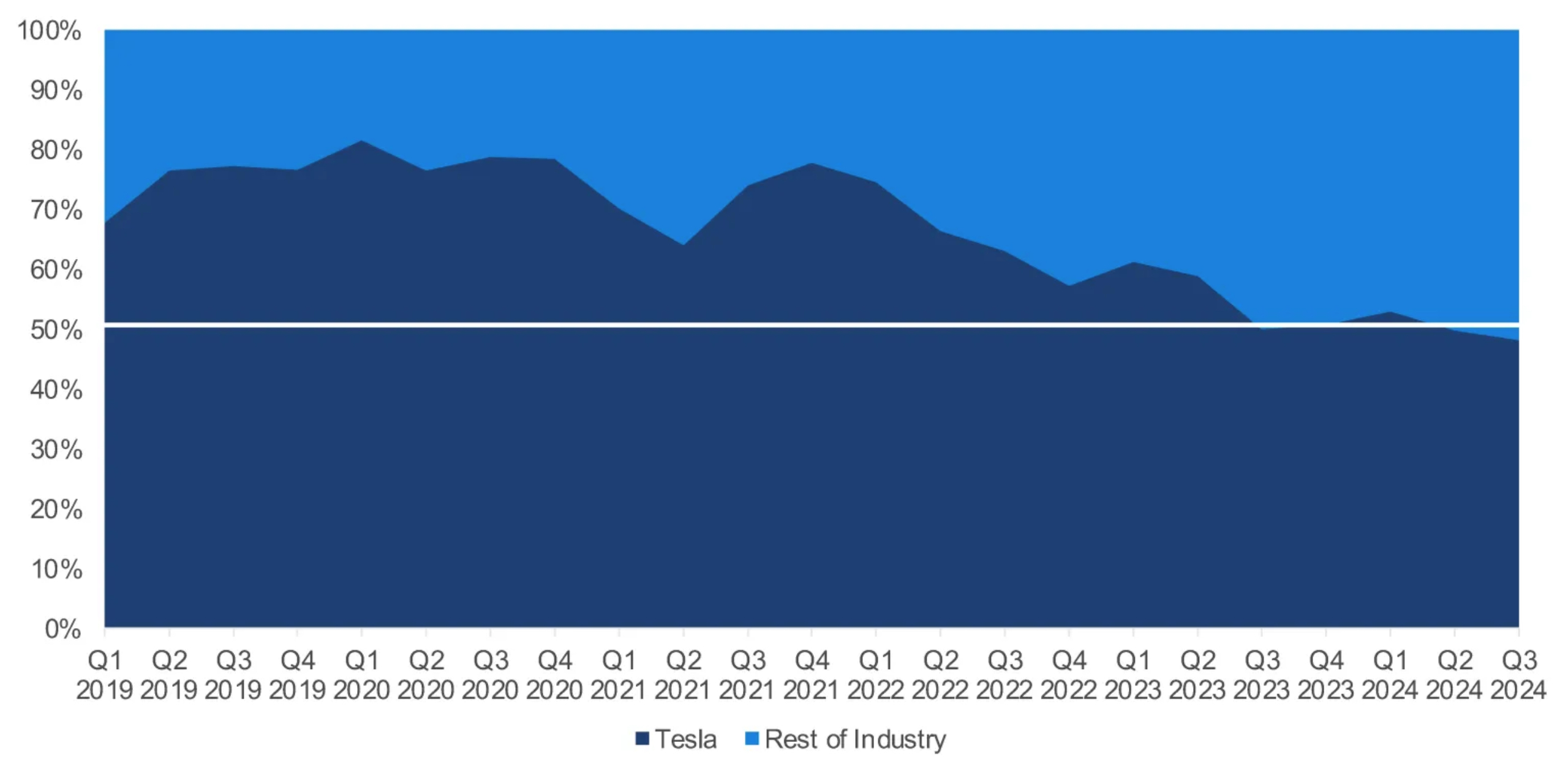

Tesla’s share of total EV sales vs. the rest of the industry

Credit: Cox Automotive

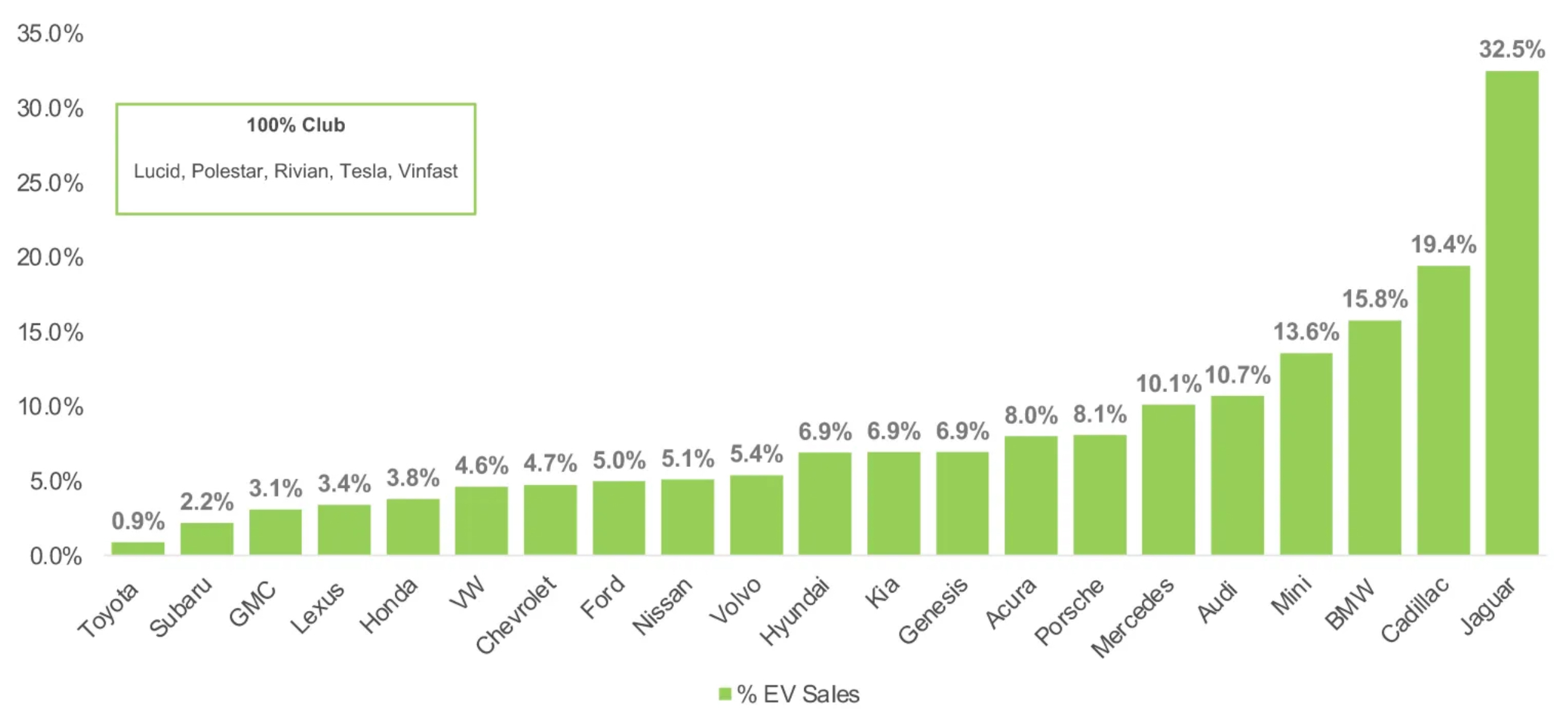

Q3 EV Share of Total Brand Sales

Credit: Cox Automotive

Cox says it expects increased growth in the coming months, and it says market share of 10 percent is “well within reach,” especially with increased charging infrastructure and EV options on the market, as well as great incentives and discounts.

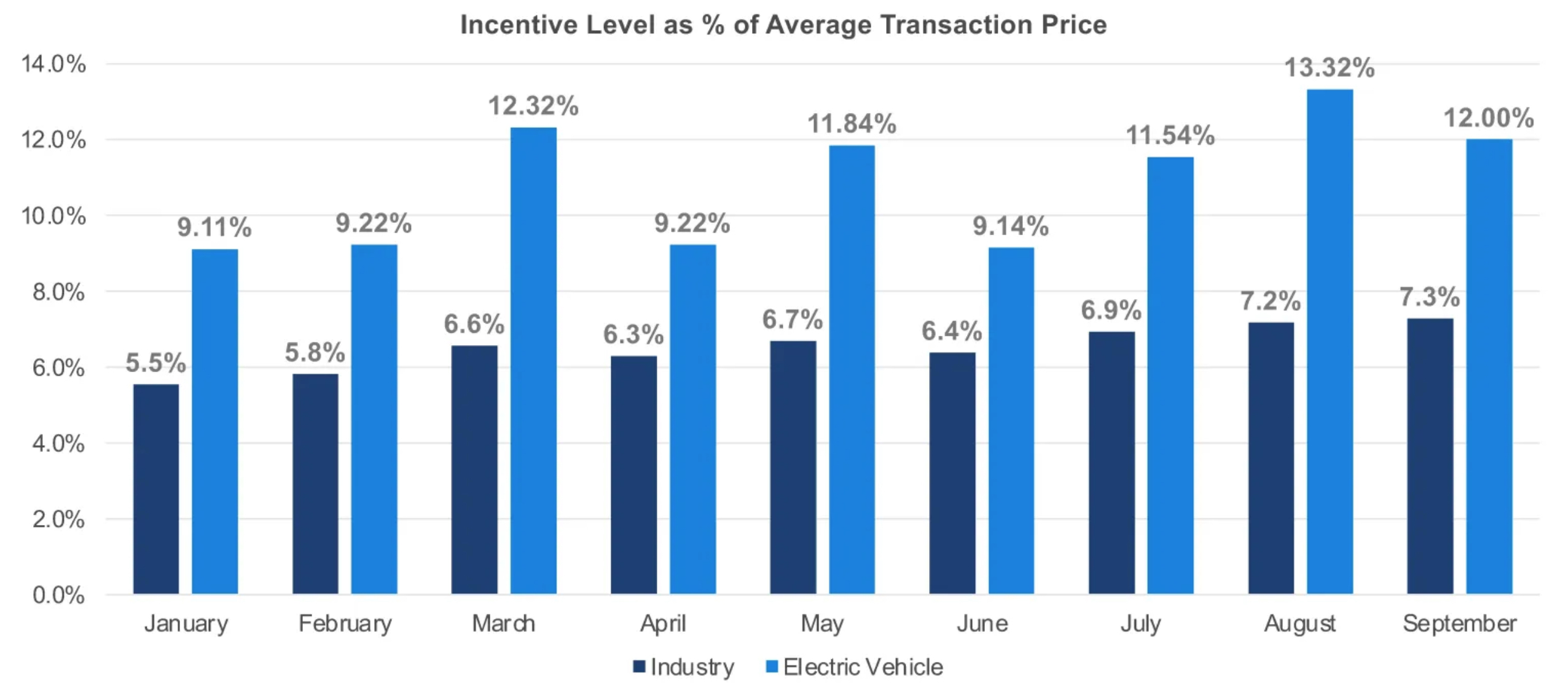

EV incentives also reached a high in the third quarter, along with leasing programs that gave automakers access to even more generous government incentives. During Q3, incentives averaged over 12 percent of the Average Transaction Price (ATP) on sales, above that of the industry average of around 7 percent.

Cox reported in July that incentives had reached a three-year high at about 11.54 percent of the ATP on sales, before climbing even higher in August to 13.32 percent. It dropped off again slightly in September, landing at 12 percent of the ATP.

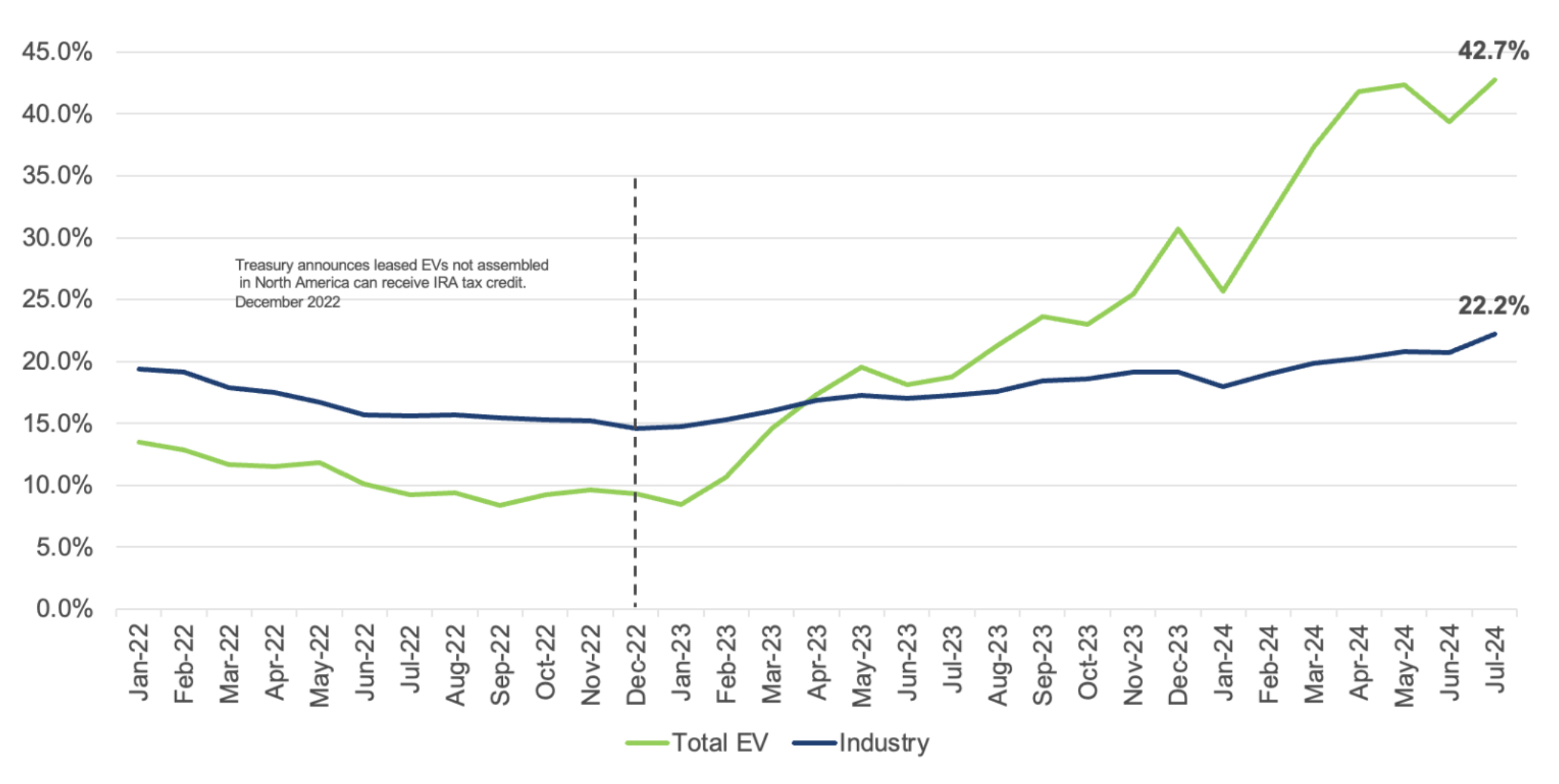

EV Lease penetration of retail sales vs. industry

Credit: Cox Automotive Credit: Cox Automotive

Tesla has remained the clear EV market leader, though consumer options have continued to increase, along with the market share of other automakers attempting to ramp up their EV programs. In Q3, Tesla delivered 166,923 vehicles in the U.S., marking a 6.6 percent increase year over year.

The report also notes that Tesla returned to growth mode in Q3 with sales jumping 6.6 percent, as supported by the increasingly popular Cybertruck. Tesla sold 16,692 Cybertrucks in Q3, outselling every other EV with the exception of the Model 3 (58,423) and Model Y (86,801).

As for individual brands, Tesla was followed by Ford and Chevy in Q3, which sold 23,509 and 19,933 EVs, respectively.

Notably, General Motors (GM) EVs overall saw a 60-percent jump to 32,095 total units across brands, and surpassed Hyundai, which saw sales plateau year over year at 29,609 units.

You can see the full data from Cox Automotive here.

What are your thoughts? Let me know at zach@teslarati.com, find me on X at @zacharyvisconti, or send us tips at tips@teslarati.com.

News

Tesla confirms that it finally solved its 4680 battery’s dry cathode process

The suggests the company has finally resolved one of the most challenging aspects of its next-generation battery cells.

Tesla has confirmed that it is now producing both the anode and cathode of its 4680 battery cells using a dry-electrode process, marking a key breakthrough in a technology the company has been working to industrialize for years.

The update, disclosed in Tesla’s Q4 and FY 2025 update letter, suggests the company has finally resolved one of the most challenging aspects of its next-generation battery cells.

Dry cathode 4680 cells

In its Q4 and FY 2025 update letter, Tesla stated that it is now producing 4680 cells whose anode and cathode were produced during the dry electrode process. The confirmation addresses long-standing questions around whether Tesla could bring its dry cathode process into sustained production.

The disclosure was highlighted on X by Bonne Eggleston, Tesla’s Vice President of 4680 batteries, who wrote that “both electrodes use our dry process.”

Tesla first introduced the dry-electrode concept during its Battery Day presentation in 2020, pitching it as a way to simplify production, reduce factory footprint, lower costs, and improve energy density. While Tesla has been producing 4680 cells for some time, the company had previously relied on more conventional approaches for parts of the process, leading to questions about whether a full dry-electrode process could even be achieved.

4680 packs for Model Y

Tesla also revealed in its Q4 and FY 2025 Update Letter that it has begun producing battery packs for certain Model Y vehicles using its in-house 4680 cells. As per Tesla:

“We have begun to produce battery packs for certain Model Ys with our 4680 cells, unlocking an additional vector of supply to help navigate increasingly complex supply chain challenges caused by trade barriers and tariff risks.”

The timing is notable. With Tesla preparing to wind down Model S and Model X production, the Model Y and Model 3 are expected to account for an even larger share of the company’s vehicle output. Ensuring that the Model Y can be equipped with domestically produced 4680 battery packs gives Tesla greater flexibility to maintain production volumes in the United States, even as global battery supply chains face increasing complexity.

Elon Musk

Tesla Giga Texas to feature massive Optimus V4 production line

This suggests that while the first Optimus line will be set up in the Fremont Factory, the real ramp of Optimus’ production will happen in Giga Texas.

Tesla will build Optimus 4 in Giga Texas, and its production line will be massive. This was, at least, as per recent comments by CEO Elon Musk on social media platform X.

Optimus 4 production

In response to a post on X which expressed surprise that Optimus will be produced in California, Musk stated that “Optimus 4 will be built in Texas at much higher volume.” This suggests that while the first Optimus line will be set up in the Fremont Factory, and while the line itself will be capable of producing 1 million humanoid robots per year, the real ramp of Optimus’ production will happen in Giga Texas.

This was not the first time that Elon Musk shared his plans for Optimus’ production at Gigafactory Texas. During the 2025 Annual Shareholder Meeting, he stated that Giga Texas’ Optimus line will produce 10 million units of the humanoid robot per year. He did not, however, state at the time that Giga Texas would produce Optimus V4.

“So we’re going to launch on the fastest production ramp of any product of any large complex manufactured product ever, starting with building a one-million-unit production line in Fremont. And that’s Line one. And then a ten million unit per year production line here,” Musk stated.

How big Optimus could become

During Tesla’s Q4 and FY 2025 earnings call, Musk offered additional context on the potential of Optimus. While he stated that the ramp of Optimus’ production will be deliberate at first, the humanoid robot itself will have the potential to change the world.

“Optimus really will be a general-purpose robot that can learn by observing human behavior. You can demonstrate a task or verbally describe a task or show it a task. Even show it a video, it will be able to do that task. It’s going to be a very capable robot. I think long-term Optimus will have a very significant impact on the US GDP.

“It will actually move the needle on US GDP significantly. In conclusion, there are still many who doubt our ambitions for creating amazing abundance. We are confident it can be done, and we are making the right moves technologically to ensure that it does. Tesla, Inc. has never been a company to shy away from solving the hardest problems,” Musk stated.

Elon Musk

Rumored SpaceX-xAI merger gets apparent confirmation from Elon Musk

The comment follows reports that the rocket maker is weighing a transaction that could further consolidate Musk’s space and AI ventures.

Elon Musk appeared to confirm reports that SpaceX is exploring a potential merger with artificial intelligence startup xAI by responding positively to a post about the reported transaction on X.

Musk’s comment follows reports that the rocket maker is weighing a transaction that could further consolidate his space and AI ventures.

SpaceX xAI merger

As per a recent Reuters report, SpaceX has held discussions about merging with xAI, with the proposed structure potentially involving an exchange of xAI shares for SpaceX stock. The value, structure, and timing of any deal have not been finalized, and no agreement has been signed.

Musk appeared to acknowledge the report in a brief reply on X, responding “Yeah” to a post that described SpaceX as a future “Dyson Swarm company.” The comment references a Dyson Swarm, a sci-fi megastructure concept that consists of a massive network of satellites or structures that orbit a celestial body to harness its energy.

Reuters noted that two entities were formed in Nevada on January 21 to facilitate a potential transaction for the possible SpaceX-xAI merger. The discussions remain ongoing, and a transaction is not yet guaranteed, however.

AI and space infrastructure

A potential merger with xAI would align with Musk’s stated strategy of integrating artificial intelligence development with space-based systems. Musk has previously said that space-based infrastructure could support large-scale computing by leveraging continuous solar energy, an approach he has framed as economically scalable over time.

xAI already has operational ties to Musk’s other companies. The startup develops Grok, a large language model that holds a U.S. Department of Defense contract valued at up to $200 million. AI also plays a central role in SpaceX’s Starlink and Starshield satellite programs, which rely on automation and machine learning for network management and national security applications.

Musk has previously consolidated his businesses through share-based transactions, including Tesla’s acquisition of SolarCity in 2016 and xAI’s acquisition of X last year. Bloomberg has also claimed that Musk is considering a merger between SpaceX and Tesla in the future.