Investor's Corner

Wall St. can’t make up its mind about Tesla: TSLA ups and downs this quarter

Tesla’s portfolio of products and services extends well beyond transportation to energy storage systems and includes solar and energy storage products. As the world’s only vertically integrated energy company, Tesla is truly unique among alternative energy stock offerings. With end-to-end clean energy products — including generation, storage, and consumption — as well as an established a global network of vehicle stores, service centers, and Supercharger stations, Tesla is well situated to accelerate the widespread adoption of its line.

Many people admire Tesla, Inc. for its visionary approach to a sustainable future. Indeed, the company’s most recent SEC 10-K filing spoke to the company’s mission to provide an “intense focus to accelerate the world’s transition to sustainable transport, ” a business model that differentiates Tesla from other manufacturers.

That report also pointed to possible market uncertainties which could affect the 2017 performance of the Tesla brand.

“We have experienced in the past, and may experience in the future, significant delays or other complications in the design, manufacture, launch and production ramp of new vehicles and other products such as our energy storage products and the solar roof, which could harm our brand, business, prospects, financial condition and operating results.”

As Q1 2017 nears its conclusion, this is a good stopping point to begin to review the ups and downs of the Tesla brand and how stock market analysts have assessed and questioned the resiliency and robust character of the stock.

A global look at TSLA

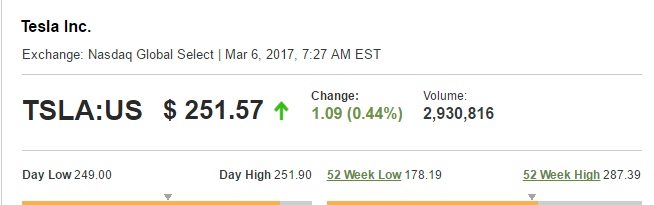

- Tesla, Inc. (NASDAQ:TSLA) opened at $246.23 on Friday, March 3, 2017. Today, March 6, 2017, that number rose to $251.57 to start the day.

- Tesla‘s stock had its “hold” rating reiterated by Deutsche Bank AG in a report released on Friday, March 3, 2017. Deutsche Bank AG had a $215.00 target price on the Tesla stock.

- Eight investment analysts have recently rated the stock with a sell rating, eleven have assigned a hold rating, and twelve have given a buy rating to the company. The stock presently has an average rating of “Hold” and an average price target of $256.33.

- Goldman Sachs Group, Inc. downgraded the Tesla stock from Neutral to a Sell rating after the company’s December quarter results. Like several other brokerages, the firm cited about cash requirements and worries on operational execution.

- Tesla has a 12 month low of $178.19 and a 12 month high of $287.39.

- The firm has a 50-day moving average price of $254.33 and a 200 day moving average price of $215.51.

- The company’s market cap is $38.17 billion.

Why analysts fail to come to consensus on Tesla stock valuation

As the first car company in a very long time to be homegrown and a real challenge to Detroit’s Big 3 automakers, Tesla experiences numerous influences on its stock value, from supply chain difficulties, to currency fluctuations, competition, and even factors like emotion and superstition. These factors can push the Tesla stock high and low, even within a short period of time. A closely watched stock like Tesla is often accused variously of being overvalued, misunderstood, or overextended.

Yet the demand for Tesla’s Model S and X, as well as initial orders for its more cost effective Model 3 sedan, have continued to support Tesla’s fiscal premises that U.S. and global citizens really want to own cleaner vehicles.

Tesla issued its 2016 Q4 earnings results on Wednesday, February 22, 2017 and reported $0.69 earnings per share for the quarter, missing the Zacks’ consensus estimate of $0.43 by $0.26. As 2017 began, Tesla stocks had accrued a number of positive analyst reports and had continued to rise since the 2016 presidential election. The firm earned $2.29 billion during the quarter, compared to analyst estimates of $2.21 billion. During the same period in the prior year, the firm earned $0.87 earnings per share.

Analysts’ estimates of Tesla stock prior to the 2016 annual report

It’s interesting to look back over the past several months and see how variable and uncertain many analysts have been about Tesla. In a cultural climate in which the largest economic downturn since the Great Depression looms large in many people’s consciousnesses, it may be reasonable for many people to be skeptical about Tesla’s value. But, as with any revolutionary change in social thinking, Tesla will likely continue to experience its share of scrutiny as well as celebration as it contributes to a sustainable future.

- Deutsche Bank AG’s price target suggests a potential downside of 12.68% from the company’s current price as of March 3, 2017.

- TheStreet raised Tesla Motors from a “d+” rating to a “c-” rating in a research note on Wednesday, January 25th.

- Robert W. Baird reaffirmed an “outperform” rating and issued a $338.00 price target on shares of Tesla Motors in a research note on Thursday, January 5th.

- Global Equities Research reaffirmed an “overweight” rating and issued a $385.00 price target on shares of Tesla Motors in a research note on Tuesday, December 6th.

- Cowen and Company reaffirmed an “underperform” rating and issued a $155.00 price target (down from $160.00) on shares of Tesla Motors in a research note on Sunday, December 4th.

- Vetr raised Tesla Motors from a “buy” rating to a “strong-buy” rating and set a $203.80 price target on the stock in a research note on Tuesday, November 15th.

Investor's Corner

Tesla (TSLA) Q4 and FY 2025 earnings call: The most important points

Executives, including CEO Elon Musk, discussed how the company is positioning itself for growth across vehicles, energy, AI, and robotics despite near-term pressures from tariffs, pricing, and macro conditions.

Tesla’s (NASDAQ:TSLA) Q4 and FY 2025 earnings call highlighted improving margins, record energy performance, expanding autonomy efforts, and a sharp acceleration in AI and robotics investments.

Executives, including CEO Elon Musk, discussed how the company is positioning itself for growth across vehicles, energy, AI, and robotics despite near-term pressures from tariffs, pricing, and macro conditions.

Key takeaways

Tesla reported sequential improvement in automotive gross margins excluding regulatory credits, rising from 15.4% to 17.9%, supported by favorable regional mix effects despite a 16% decline in deliveries. Total gross margin exceeded 20.1%, the highest level in more than two years, even with lower fixed-cost absorption and tariff impacts.

The energy business delivered standout results, with revenue reaching nearly $12.8 billion, up 26.6% year over year. Energy gross profit hit a new quarterly record, driven by strong global demand and high deployments of MegaPack and Powerwall across all regions, as noted in a report from The Motley Fool.

Tesla also stated that paid Full Self-Driving customers have climbed to nearly 1.1 million worldwide, with about 70% having purchased FSD outright. The company has now fully transitioned FSD to a subscription-based sales model, which should create a short-term margin headwind for automotive results.

Free cash flow totaled $1.4 billion for the quarter. Operating expenses rose by $500 million sequentially as well.

Production shifts, robotics, and AI investment

Musk further confirmed that Model S and Model X production is expected to wind down next quarter, and plans are underway to convert Fremont’s S/X line into an Optimus robot factory with a capacity of one million units.

Tesla’s Robotaxi fleet has surpassed 500 vehicles, operating across the Bay Area and Austin, with Musk noting a rapid monthly expansion pace. He also reiterated that CyberCab production is expected to begin in April, following a slow initial S-curve ramp before scaling beyond other vehicle programs.

Looking ahead, Tesla expects its capital expenditures to exceed $20 billion next year, thanks to the company’s operations across its six factories, the expansion of its fleet expansion, and the ramp of its AI compute. Additional investments in AI chips, compute infrastructure, and future in-house semiconductor manufacturing were discussed but are not included in the company’s current CapEx guidance.

More importantly, Tesla ended the year with a larger backlog than in recent years. This is supported by record deliveries in smaller international markets and stronger demand across APAC and EMEA. Energy backlog remains strong globally as well, though Tesla cautioned that margin pressure could emerge from competition, policy uncertainty, and tariffs.

Investor's Corner

LIVE BLOG: Tesla (TSLA) Q4 and FY 2025 earnings call

Tesla’s (NASDAQ:TSLA) earnings call follows the release of the company’s Q4 and full-year 2025 update letter.

Tesla’s (NASDAQ:TSLA) earnings call follows the release of the company’s Q4 and full-year 2025 update letter, which was published on Tesla’s Investor Relations website after markets closed on January 28, 2025.

The results cap a quarter in which Tesla produced more than 434,000 vehicles, delivered over 418,000 vehicles, and deployed 14.2 GWh of energy storage products. For the full year, Tesla produced 1.65 million vehicles and delivered 1.63 million, while total energy storage deployments reached 46.7 GWh.

Tesla’s Q4 and FY 2025 Results

According to Tesla’s Q4 and FY 2025 Update Letter, the company posted GAAP earnings per share of $0.24 and non-GAAP EPS of $0.50 in the fourth quarter. Total revenue for Q4 came in at $24.901 billion, while GAAP net income was reported at $840 million.

For full-year 2025, Tesla reported GAAP EPS of $1.08 and non-GAAP EPS of $1.66 per share. Total revenue reached $94.83 billion, including $69.53 billion from automotive operations and $12.78 billion from the company’s energy generation and storage business. GAAP net income for the year totaled $3.79 billion.

Earnings call updates

The following are live updates from Tesla’s Q4 and FY 2025 earnings call. I will be updating this article in real time, so please keep refreshing the page to view the latest updates on this story.

16:25 CT – Good day to everyone, and welcome to another Tesla earnings call live blog. There’s a lot to unpack from Tesla’s Q4 and FY 2025 update letter, so I’m pretty sure this earnings call will be quite interesting.

16:30 CT – The Q4 and FY 2025 earnings call officially starts. IR exec Travis Axelrod opens the call. Elon and other executives are present.

16:30 CT – Elon makes his opening statement and explains why Tesla changed its mission to “Amazing Abundance.” “With the continued growth of AI and robotics, I think we’re headed towards a future of universal high income,” Musk said, adding that along the way, Tesla will still be improving its products while keeping the environment safe and healthy.

16:34 CT – Elon noted that the first steps for this future are happening this year, thanks to Tesla’s autonomy and robotics programs, which will be launching and ramping this year. He also highlighted that Tesla will be making major investments this year, though the company will be very strategic when it comes to its funding. “I think it makes a ton of strategic sense,” Musk said.

16:36 CT – Elon also announces the end of the Model S and Model X programs “with an honorable discharge.” If you’re interested in buying a Model S or X, it’s best to do it now, Musk said. The Model S and Model X factory in Fremont will be replaced by an Optimus line. “It’s slightly sad, but it is time to bring the S and X program to an end. It’s part of our overall shift to an autonomous future,” Musk said.

16:38 CT – Elon discusses how Unsupervised FSD is now starting for the Robotaxi service. He noted that these Unsupervised Robotaxis don’t have any chase cars as of yesterday. He reiterated Tesla’s plans for owners to be able to add their own vehicles to the Robotaxi fleet. Autonomy target for the end of the year is about a quarter or half of the United States, Musk said.

16:41 CT – Elon noted that the Tesla Energy team is absolutely killing it. He also stated that Tesla expects its Energy business to continue growing, and that the “solar opportunity is underrated.”

16:43 CT –Elon also added that Tesla Optimus 3 will be unveiled in about three months, probably. The Model S and Model X line in Fremont will be a million-unit Optimus production line. Looks like Optimus is really coming out of the gate with large, meaningful volumes. “The normal S curve for manufacturing ramps is longer for Optimus,” Musk stated. “Long term, I think Optimus will have a significant impact on the US GDP.”

16:44 CT – Elon closes his opening statements with a sincere thanks to the Tesla team. He also noted that he feels fortunate to be able to work alongside such a talented workforce.

Elon ends his opening remarks with an optimistic prediction about the future.“The future is more exciting than you can imagine,” he concluded.

16:47 CT – Tesla CFO Vaibhav Taneja makes his opening remarks. He discusses several aspects of Tesla’s Q4 milestones. He noted that Tesla Energy achieved yet another gross profit record during the fourth quarter. There’s insane demand for the Megapack and Powerwall. Backlogs for these products are healthy this 2026. He also noted that Tesla ended 2025 with a bigger vehicle order backlog compared to recent years.

16:53 CT – Investor questions from Say begin. The first question is about Tesla’s expectations for the Robotaxi Network. Lars Moravy noted that it has the advantage of manufacturing and scale, and Tesla believes that the Robotaxi Network will significantly grow year over year. Elon highlighted that the Cybercab will be produced with no steering wheel or pedals. No fallback. Elon also noted that Tesla expects to produce more Cybercabs than all its other vehicles combined in the future.

16:51 CT – The next question is if Tesla still expects to launch new models, such as affordable cars. Lars Moravy noted that Tesla did release affordable variants last year, and Tesla is still pushing hard to lower its costs. That being said, Tesla is really pushing the Cybercab as its total addressable market is larger than consumer-owned cars. Lars also mentioned that Tesla will produce different vehicles for its Robotaxi services.

16:56 CT – Elon noted that eventually, Tesla will produce mostly autonomous cars. The exception would be the next-generation Roadster, which will be a true driver’s car.

17:03 CT – A question about Elon’s past comments about a potential next pickup truck was asked. Lars noted that the Cybertruck is still performing well in the electric pickup truck segment, though Tesla is known for flexibility. Elon added that Tesla will be transitioning the Cybertruck line to a fully autonomous vehicle line. He also stated that the Cybertruck is a useful vehicle. “An autonomous Cybertruck will be useful for that.”

17:10 CT – A question was asked about when FSD will be 100% Unsupervised. Elon noted that 100% Unsupervised FSD is already being used today, though only in the Austin Robotaxi program. Tesla is still being extremely careful with its rollout.

When asked about Tesla’s chip program, Elon noted that he feels pretty good about Tesla’s chip strategy. But in terms of selling Tesla’s chips outside Tesla, the company has to make sure it has enough chips for Optimus robots, data centers, and other programs first.

17:18 CT – Analyst questions begin. First up is Wolf Research. He asks about Tesla’s increasing Capex, specifically where the majority of it is going. The Tesla CFO noted that programs in six factories are going live this year, so that consumes Capex. The Optimus program also consumes a lot of resources. The growth of Tesla’s current capacity is also consuming a lot of resources. As for how these programs will be funded, the CFO pointed to Tesla’s massive war chest, as well as initiatives such as the Robotaxi Network.

17:21 CT – Morgan Stanley asks about Tesla’s xAI investment. The analyst asked about more information about how Tesla and xAI will work together. The CFO noted that this investment is part of Master Plan Part IV. Elon also mentioned some advantages for xAI’s technology for Tesla’s products, like Grok being used to manage a Robotaxi fleet or a group of Optimus robots.

17:24 CT – Barclays asks Elon about the constraints on memory. Does Tesla have any near term constraints for Tesla vehicles’ memory? Elon responded that the Tesla AI computer is already very compute and memory-efficient. The intelligence per gigabyte is important. Musk noted that Tesla is ahead of the industry by an order of magnitude or more.

17:29 CT – Cannacord asks about startups from China entering the humanoid market. What competitive advantage does Optimus have compared to these rivals? Elon stated that he believes China will be a key competitor in the humanoid robot market. China will be the toughest competitor for Tesla. That being said, Elon noted that Tesla believes Optimus will be ahead in real-world intelligence, electromechanical dexterity, and hand design.

Investor's Corner

Tesla (TSLA) Q4 and FY 2025 earnings results

Tesla’s Q4 and FY 2025 earnings come on the heels of a quarter where the company produced over 434,000 vehicles, delivered over 418,000 vehicles, and deployed 14.2 GWh of energy storage products.

Tesla (NASDAQ:TSLA) has released its Q4 and FY 2025 earnings results in an update letter. The document was posted on the electric vehicle maker’s official Investor Relations website after markets closed today, January 28, 2025.

Tesla’s Q4 and FY 2025 earnings come on the heels of a quarter where the company produced over 434,000 vehicles, delivered over 418,000 vehicles, and deployed 14.2 GWh of energy storage products.

For the Full Year 2025, Tesla produced 1,654,667 and delivered 1,636,129 vehicles. The company also deployed a total of 46.7 GWh worth of energy storage products.

Tesla’s Q4 and FY 2025 results

As could be seen in Tesla’s Q4 and FY 2025 Update Letter, the company posted GAAP EPS of $0.24 and non-GAAP EPS of $0.50 per share in the fourth quarter. Tesla also posted total revenues of $24.901 billion. GAAP net income is also listed at $840 million in Q4.

Analyst consensus for Q4 has Tesla earnings per share falling 38% to $0.45 with revenue declining 4% to $24.74 billion, as per estimates from FactSet. In comparison, the consensus compiled by Tesla last week forecasted $0.44 per share on sales totaling $24.49 billion.

For FY 2025, Tesla posted GAAP EPS of $1.08 and non-GAAP EPS of $1.66 per share. Tesla also posted total revenues of $94.827 billion, which include $69.526 billion from automotive and $12.771 billion from the battery storage business. GAAP net income is also listed at $3.794 billion in FY 2025.

xAI Investment

Tesla entered an agreement to invest approximately $2 billion to acquire Series E preferred shares in Elon Musk’s artificial intelligence startup, xAI, as part of the company’s recently disclosed financing round. Tesla said the investment was made on market terms consistent with those agreed to by other participants in the round.

The investment aligns with Tesla’s strategy under Master Plan Part IV, which centers on bringing artificial intelligence into the physical world through products and services. While Tesla focuses on real-world AI applications, xAI is developing digital AI platforms, including its Grok large language model.

Below is Tesla’s Q4 and FY 2025 update letter.

TSLA-Q4-2025-Update by Simon Alvarez