News

SpaceX vs. Blue Origin: The bickering titans of new space

In the past three years, SpaceX has made incredible progress in their program of reusability. In the practice’s first year, the young space company led by serial tech entrepreneur Elon Musk has performed three successful commercial reuses of Falcon 9 boosters in approximately eight months, and has at least two more reused flights scheduled before 2017 is out. Blue Origin, headed and funded by Jeff Bezos of Amazon fame, is perhaps most famous for its supreme confidence, best illustrated by Bezos offhandedly welcoming SpaceX “to the club” after the company first recovered the booster stage of its Falcon 9 rocket in 2015.

Blue Origin began in the early 2000s as a pet project of Bezos, a long-time fan of spaceflight and proponent of developing economies in space. After more than a decade of persistent development and increasingly complex testbeds, Blue Origin began a multi-year program of test flights with its small New Shepard launch vehicle. Designed to eventually launch tourists to the veritable edge of Earth’s atmosphere in a capsule atop it, New Shepard began its test flights in 2015 and after one partial failure, has completed five successful flights in a row. The space tourism company has subtly and not-so-subtly belittled SpaceX’s accomplishments over the last several years, and has engendered a fair bit of hostility towards it as a result.

Admittedly, CEO Elon Musk nurtured high expectations for the consequences of reuse, and has frequently discussed SpaceX’s ambition to reduce the cost of access to orbit by a factor of 10 to 100. However, after several reuses, it is clear that costs have decreased no more than 10-20%. What gives?

Well, Musk’s many comments on magnitudes of cost reduction were clearly premised upon rapid and complete reuse of both stages of Falcon 9, best evidenced by a concept video the company released in 2011.

The reality was considerably harder and Musk clearly underestimated the difficulty of second stage reuse, something he himself has admitted. COO Gwynne Shotwell was interviewed earlier this summer and discussed SpaceX’s updated approach to complete reusability, and acknowledged that second stage reuse was no longer a real priority, although the company will likely attempt second stage recovery as a validation of future technologies. Instead of pursuing the development of a completely reusable Falcon 9, SpaceX is instead pushing ahead with the development of a much larger rocket, BFR. BFR being designed to enable the sustainable colonization of space by realizing Musk’s original ambition of magnitudes-cheaper orbital launch capabilities.

Competition on the horizon?

Meanwhile, SpaceX’s only near-term competitor interested in serious reuse has made gradual progress over the last several years, accelerating its pace of development more recently. Blue Origin’s second New Shepard vehicle, designed to serve the suborbital space tourism industry, conducted an impressive five successful launches and landings over the course of 2016 before being summarily retired. NS2’s antecedent suffered a failure while attempting its first landing and was destroyed in 2015, but Blue learned quickly from the issues of Shepard 1 and has already shipped New Shepard 3 to its suborbital launch facilities near Van Horn, Texas. While NS3 is aiming for an inaugural flight later this year, NS4 is under construction in Kent, Washington and could support Blue’s first crewed suborbital launches in 2018.

More significant waves were made with an announcement in 2016 that Blue was pursuing development of a partially reusable orbital-class launch vehicle, the massive New Glenn. On paper, New Glenn is quite a bit larger than even SpaceX’s Falcon 9, and appears to likely be more capable than the company’s “world’s most powerful rocket” while completely recovering its boost stage. In a completed, manufactured, and demonstrably reliable form, New Glenn would be an extraordinarily impressive and capable launch vehicle that could undoubtedly catapult Blue Origin into position of true competition with SpaceX’s reusability efforts.

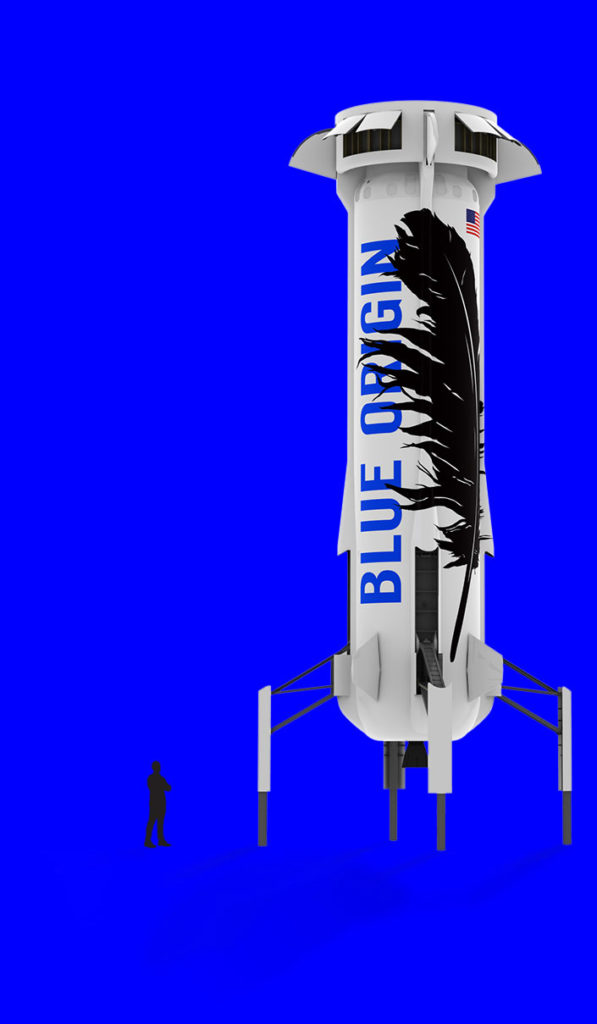

- The New Shepard booster. (Blue Origin)

- Blue Origin’s New Shepard capsule could carry passengers as high as 100km in 2018. (Blue Origin)

- A render of Blue Origin’s larger New Glenn vehicle. (Blue Origin)

However, while Blue Origin executives brag about “operational reusability” and tastelessly lampoon efforts that “decided to slap some legs on [to] see if [they] could land it”, the unmentioned company implicated in those barbs has begun to routintely and commercially reuse orbital-class boosters five times the size of Blue’s suborbital testbed, New Shepard.

Apples to oranges

The only point at which Blue Origin poses a risk to SpaceX’s business can be found in a comparison of funding sources. SpaceX first successes (and failures) were funded out of Elon Musk’s own pocket, but nearly all of the funding that followed was won through competitive government contracts and rounds of private investment. To put it more simply, SpaceX is a business that must balance costs and returns, while Blue Origin is funded exclusively out of billionaire CEO Jeff Bezos’ pocket.

As a result of being completely privately funded, Bezos’ deep pockets could render Blue more flexible than SpaceX when pricing launches. If Blue chooses to aggressively price New Glenn by accounting for booster reusability, it could pose a threat to SpaceX’s own business strategy. If SpaceX is unable to recoup its investment in reusability before New Glenn is regularly conducting multiple commercial missions per year, likely no earlier than 2021 or 2022, SpaceX’s Falcon 9 pricing could be rendered distinctly noncompetitive.

However, this concern seems almost entirely misplaced. SpaceX has half a decade of experience mass-producing orbital-class (reusable) rockets, (reusable) fairings, and propulsion systems, whereas Blue Origin at best has minimal experience manufacturing a handful of suborbital vehicles over a period of a few years. Blue has a respectable amount of experience with their BE-3 hydrolox propulsion system, and that will likely transfer over to the BE-3U vacuum variant to be used for New Glenn’s third stage. The large methalox rocket engine (BE-4) that will power New Glenn’s first stage also conducted its first-ever hot-fire just weeks ago, a major milestone in propulsion development but also a reminder that BE-4 has an exhaustive regime of engineering verification and flight qualification testing ahead of it.

First hotfire of our BE-4 engine is a success #GradatimFerociter pic.twitter.com/xuotdzfDjF

— Blue Origin (@blueorigin) October 19, 2017

Perhaps more importantly, the company’s relative success with New Shepard’s launch, recovery, and reuse has not and cannot move beyond small suborbital hops, and thus cannot provide the experience at the level of orbital rocketry. New Shepard is admittedly capable of reaching an altitude of 100km, but the suborbital vehicle’s flight regime does not require it to travel beyond Mach 4 (~1300 m/s). The first stage of Falcon 9, however, is approximately four times as tall and three times the mass of New Shepard, and boosters attempting recovery during geostationary missions routinely reach almost twice the velocity of New Shepard, entering the thicker atmosphere at more than 2300 m/s (1500-1800 m/s for LEO missions). Falcon 9’s larger mass and velocity translates into intense reentry heating and aerodynamic forces, best demonstrated by the glowing aluminum grid fins that can often be seen in SpaceX’s live coverage of booster recovery. Blue Origin’s New Glenn concept is extremely impressive on paper, but the company will have to pull off an extraordinary leap of technological maturation to move directly from suborbital single-stage hops to multi-stage orbital rocketry. Blue’s accomplishments with New Shepard are nothing to scoff at, but they are a far cry from routine orbital launch services.

SpaceX’s future fast approaches

Translating back to the new establishment, Falcon 9 will likely remain SpaceX’s workhorse rocket for some five or more years, at least until BFR can prove itself to be a reliable and affordable replacement. This change in focus, combined with the downsides of second stage recovery and reuse on a Falcon 9-sized vehicle, means that SpaceX will ‘only’ end up operationally reusing first stages and fairings from the vehicle. The second stage accounts for approximately 20-30% of Falcon 9’s total cost, suggesting that rapid and complete reuse of the fairing and first stage could more than halve its ~$62 million price. Yet this too ignores another mundane fact of corporate life SpaceX must face. Its executives, Musk included, have lately expressed a desire to at least partially recoup the ~$1 billion that was invested to develop reuse. Assuming a partial 10% reduction in cost to reuse customers and profit margins of 50% with rapid and total reuse of the first stage and fairing, 20 to 30 commercial reuses would recoup most or all of SpaceX’s reusability investment.

Musk recently revealed that SpaceX is aiming to complete 30 launches in 2018, and that figure will likely continue to grow in 2019, assuming no major anomalies occur. Manufacturing will rapidly become the main choke point for increased launch cadence, suggesting that drastically higher cadences will largely depend upon first stage reuse with minimal refurbishment, which just so happens to be the goal of the Falcon 9’s upcoming Block 5 iteration. Even if the modifications only manage a handful of launches without refurbishment, rather than the ten flights being pursued, each additional flight without maintenance will effectively multiply SpaceX’s manufacturing capabilities. More bluntly: ten Falcon 9s capable of five reflights could do the same job of 50 brand new rockets with 1/5th of the manufacturing backend.

- BulgariaSat-1 was successfully launched 48 hours before Iridium-2, and marked the second or three successful, commercial reuses of an orbital rocket. (SpaceX)

- SpaceX’s Hawthorne factory routinely churns out one to two complete Falcon 9s every month. (SpaceX)

- Falcon 9 B1040 returns to LZ-1 after the launch of the USAF’s X-37B spaceplane. (SpaceX)

Assuming that upcoming reuses proceed without significant failures and Falcon 9 Block 5 subsumes all manufacturing sometime in 2018 or 2019, it is entirely possible that SpaceX will undergo an extraordinarily rapid phase change from expendability to reusability. Mirroring 2017, we can imagine that SpaceX’s Hawthorne factory will continue to churn out at least 10 to 20 Block 5 Falcon 9s over the course of 2018. Assuming 5 to 10 maintenance-free reuses and a lifespan of as many as 100 flights with intermittent refurb, a single year of manufacturing could provide SpaceX with enough first stages to launch anywhere from 50 to 2000 missions. The reality will inevitably find itself somewhere between those extremely pessimistic and optimistic bookends, and they of course do not account for fairings, second stages, or expendable flights.

If we assume that the proportional cost of Falcon 9’s many components very roughly approximates the amount of manufacturing backend needed to produce them, downsizing Falcon 9 booster production by a factor of two or more could free a huge fraction of SpaceX’s workforce and floor space to be repurposed for fairing and second stage production, as well as the company’s Mars efforts. Such a phase change would also free up a considerable fraction of the capital SpaceX continually invests in its manufacturing infrastructure and workforce, capital that could then be used to ready SpaceX’s facilities for production and testing of its Mars-focused BFR and BFS.

“Gradatim ferociter”

It cannot be overstated that the speculation in this article is speculation. Nevertheless, it is speculation built on real information provided over the years by SpaceX’s own executives. Rough estimates like this offer a glimpse into a new launch industry paradigm that could be only a year or two away and could allow SpaceX to begin aggressively pursuing its goal of enabling a sustainable human presence on Mars and throughout the Solar System.

Blue Origin’s future endeavors shine on paper and their goal of enabling millions to work and live space are admirable, but the years between the present and a future of routine orbital missions for the company may not be kind. The engineering hurdles that litter the path to orbital rocketry are unforgiving and can only be exacerbated by blind overconfidence, a lesson that is often only learned the hard way. Blue Origin’s proud motto “Gradatim ferociter” roughly translates to “Step by step, ferociously.” One can only hope that some level of humility and sobriety might temper that ferocity before customers entrust New Glenn with their infrastructural foundations and passengers entrust New Shepard with their lives.

Elon Musk

Elon Musk’s Boring Company opens Vegas Loop’s newest station

The Fontainebleau is the latest resort on the Las Vegas Strip to embrace the tunneling startup’s underground transportation system.

Elon Musk’s tunneling startup, The Boring Company, has welcomed its newest Vegas Loop station at the Fontainebleau Las Vegas.

The Fontainebleau is the latest resort on the Las Vegas Strip to embrace the tunneling startup’s underground transportation system.

Fontainebleau Loop station

The new Vegas Loop station is located on level V-1 of the Fontainebleau’s south valet area, as noted in a report from the Las Vegas Review-Journal. According to the resort, guests will be able to travel free of charge to the stations serving the Las Vegas Convention Center, as well as to Loop stations in Encore and Westgate.

The Fontainebleau station connects to the Riviera Station, which is located in the northwest parking lot of the convention center’s West Hall. From there, passengers will be able to access the greater Vegas Loop.

Vegas Loop expansion

In December, The Boring Company began offering Vegas Loop rides to and from Harry Reid International Airport. Those trips include a limited above-ground segment, following approval from the Nevada Transportation Authority to allow surface street travel tied to Loop operations.

Under the approval, airport rides are limited to no more than four miles of surface street travel, and each trip must include a tunnel segment. The Vegas Loop currently includes more than 10 miles of tunnels. From this number, about four miles of tunnels are operational.

The Boring Company President Steve Davis previously told the Review-Journal that the University Center Loop segment, which is currently under construction, is expected to open in the first quarter of 2026. That extension would allow Loop vehicles to travel beneath Paradise Road between the convention center and the airport, with a planned station located just north of Tropicana Avenue.

News

Tesla leases new 108k-sq ft R&D facility near Fremont Factory

The lease adds to Tesla’s presence near its primary California manufacturing hub as the company continues investing in autonomy and artificial intelligence.

Tesla has expanded its footprint near its Fremont Factory by leasing a 108,000-square-foot R&D facility in the East Bay.

The lease adds to Tesla’s presence near its primary California manufacturing hub as the company continues investing in autonomy and artificial intelligence.

A new Fremont lease

Tesla will occupy the entire building at 45401 Research Ave. in Fremont, as per real estate services firm Colliers. The transaction stands as the second-largest R&D lease of the fourth quarter, trailing only a roughly 115,000-square-foot transaction by Figure AI in San Jose.

As noted in a Silicon Valley Business Journal report, Tesla’s new Fremont lease was completed with landlord Lincoln Property Co., which owns the facility. Colliers stated that Tesla’s Fremont expansion reflects continued demand from established technology companies that are seeking space for engineering, testing, and specialized manufacturing.

Tesla has not disclosed which of its business units will be occupying the building, though Colliers has described the property as suitable for office and R&D functions. Tesla has not issued a comment about its new Fremont lease as of writing.

AI investments

Silicon Valley remains a key region for automakers as vehicles increasingly rely on software, artificial intelligence, and advanced electronics. Erin Keating, senior director of economics and industry insights at Cox Automotive, has stated that Tesla is among the most aggressive auto companies when it comes to software-driven vehicle development.

Other automakers have also expanded their presence in the area. Rivian operates an autonomy and core technology hub in Palo Alto, while GM maintains an AI center of excellence in Mountain View. Toyota is also relocating its software and autonomy unit to a newly upgraded property in Santa Clara.

Despite these expansions, Colliers has noted that Silicon Valley posted nearly 444,000 square feet of net occupancy losses in Q4 2025, pushing overall vacancy to 11.2%.

News

Tesla winter weather test: How long does it take to melt 8 inches of snow?

In Pennsylvania, we got between 10 and 12 inches of snow over the weekend as a nasty Winter storm ripped through a large portion of the country, bringing snow to some areas and nasty ice storms to others.

I have had a Model Y Performance for the week courtesy of Tesla, which got the car to me last Monday. Today was my last full day with it before I take it back to my local showroom, and with all the accumulation on it, I decided to run a cool little experiment: How long would it take for Tesla’s Defrost feature to melt 8 inches of snow?

Tesla’s Defrost feature is one of the best and most underrated that the car has in its arsenal. While every car out there has a defrost setting, Tesla’s can be activated through the Smartphone App and is one of the better-performing systems in my opinion.

It has come in handy a lot through the Fall and Winter, helping clear up my windshield more efficiently while also clearing up more of the front glass than other cars I’ve owned.

The test was simple: don’t touch any of the ice or snow with my ice scraper, and let the car do all the work, no matter how long it took. Of course, it would be quicker to just clear the ice off manually, but I really wanted to see how long it would take.

Tesla Model Y heat pump takes on Model S resistive heating in defrosting showdown

Observations

I started this test at around 10:30 a.m. It was still pretty cloudy and cold out, and I knew the latter portion of the test would get some help from the Sun as it was expected to come out around noon, maybe a little bit after.

I cranked it up and set my iPhone up on a tripod, and activated the Time Lapse feature in the Camera settings.

The rest of the test was sitting and waiting.

It didn’t take long to see some difference. In fact, by the 20-minute mark, there was some notable melting of snow and ice along the sides of the windshield near the A Pillar.

However, this test was not one that was “efficient” in any manner; it took about three hours and 40 minutes to get the snow to a point where I would feel comfortable driving out in public. In no way would I do this normally; I simply wanted to see how it would do with a massive accumulation of snow.

It did well, but in the future, I’ll stick to clearing it off manually and using the Defrost setting for clearing up some ice before the gym in the morning.

Check out the video of the test below:

❄️ How long will it take for the Tesla Model Y Performance to defrost and melt ONE FOOT of snow after a blizzard?

Let’s find out: pic.twitter.com/Zmfeveap1x

— TESLARATI (@Teslarati) January 26, 2026