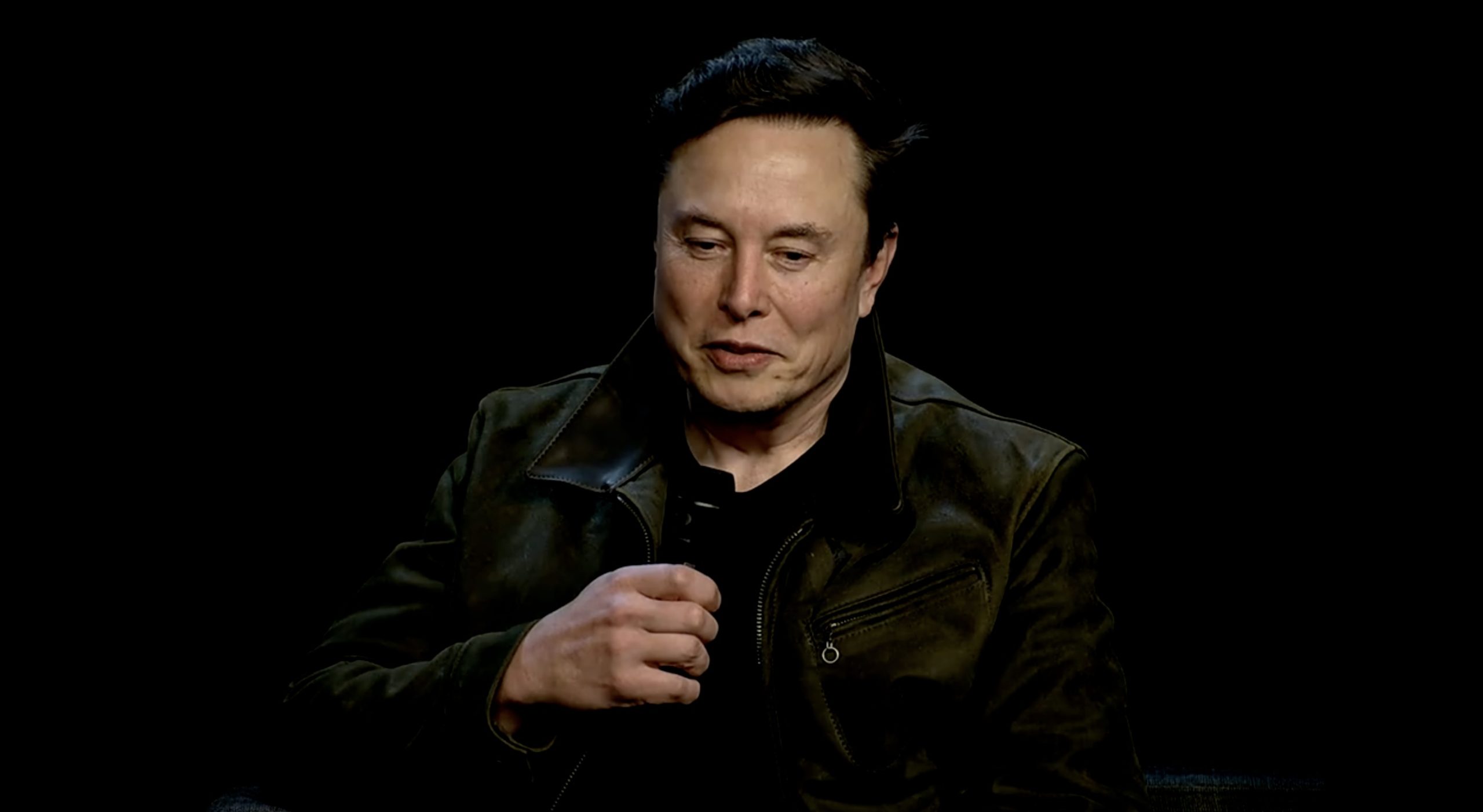

Elon Musk

Elon Musk’s X valued at $44 billion in latest funding round: report

Investors reportedly valued Elon Musk’s X at $44 billion in a secondary deal earlier this month.

Elon Musk’s X has clawed its way back to a valuation of $44 billion, a sharp rebound from its estimated value following the Tesla CEO’s turbulent takeover in 2022.

Information about the social media platform’s recent valuation was shared by the Financial Times in a recent report.

Back to $44 Billion

Citing people reportedly familiar with the matter, the FT noted that investors valued Elon Musk’s X at $44 billion in a secondary deal earlier this month. During the deal, investors reportedly exchanged existing stakes in the social media platform. The publication’s sources also claimed that X is working on raising fresh capital in a primary round that is aimed at raising around $2 billion, which would be used to pay off over $1 billion in junior debt from Musk’s 2022 Twitter buyout.

X’s $44 billion valuation is a stunning reversal from the company’s previous estimates. Just last September, Fidelity Investments valued X below $10 billion. Interestingly enough, Fidelity was also one of the investors in X’s recent funding round. Other investors included Andreessen Horowitz, Sequoia Capital, 8VC, and Goanna Capital.

Musk’s Cost-Cutting Pays Off

Musk’s serious cost-cutting measures caught a lot of flak following his acquisition of Twitter. So notable were the criticisms of Musk’s drastic cuts that critics were expecting Twitter to go offline and die. This, however, did not come to pass, though the company had to crawl its way out of the ditch to get to where it is now.

During the last full year before Musk’s takeover, Twitter reported adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) of about $682 million and about $5 billion in revenue. In 2024, X had an EBITDA of about $1.25 billion and annual revenue of $2.7 billion. As per the Wall Street Journal, these figures were better than expected for X’s investors.

New Cash Streams and AI Power Up

X’s valuation is also boosted by the company’s stake in Elon Musk’s artificial intelligence startup, xAI, which develops Grok, a large language model. X CEO Linda Yaccarino also noted that X Money, a Visa-backed payment service, is expected to be rolled out later this year.

Elon Musk

SpaceX weighs Nasdaq listing as company explores early index entry: report

The company is reportedly seeking early inclusion in the Nasdaq-100 index.

Elon Musk’s SpaceX is reportedly leaning toward listing its shares on the Nasdaq for a potential initial public offering (IPO) that could become the largest in history.

As per a recent report, the company is reportedly seeking early inclusion in the Nasdaq-100 index. The update was reported by Reuters, citing people familiar with the matter.

According to the publication, SpaceX is considering Nasdaq as the venue for its eventual IPO, though the New York Stock Exchange is also competing for the listing. Neither exchange has reportedly been informed of a final decision.

Reuters has previously reported that SpaceX could pursue an IPO as early as June, though the company’s plans could still change.

One of the publication’s sources also suggested that SpaceX is targeting a valuation of about $1.75 trillion for its IPO. At that level, the company would rank among the largest publicly traded firms in the United States by market capitalization.

Nasdaq has proposed a rule change that could accelerate the inclusion of newly listed megacap companies into the Nasdaq-100 index.

Under the proposed “Fast Entry” rule, a newly listed company could qualify for the index in less than a month if its market capitalization ranks among the top 40 companies already included in the Nasdaq-100.

If SpaceX is successful in achieving its target valuation of $1.75 trillion, it would become the sixth-largest company by market value in the United States, at least based on recent share prices.

Newly listed companies typically have to wait up to a year before becoming eligible for major indexes such as the Nasdaq-100 or S&P 500.

Inclusion in a major index can significantly broaden a company’s shareholder base because many institutional investors purchase shares through index-tracking funds.

According to Reuters, Nasdaq’s proposed fast-track rule is partly intended to attract highly valued private companies such as SpaceX, OpenAI, and Anthropic to list on the exchange.

Elon Musk

The Boring Company’s Prufrock-2 emerges after completing new Vegas Loop tunnel

The new tunnel measures 2.28 miles, making it the company’s longest single Vegas Loop tunnel to date.

The Boring Company announced that its Prufrock-2 tunnel boring machine (TBM) has completed another Vegas Loop tunnel in Las Vegas. The company shared the update in a post on social media platform X.

According to The Boring Company’s post, the new tunnel measures 2.28 miles, making it the company’s longest single Vegas Loop tunnel to date.

The new tunnel marks the fourth tunnel constructed near Westgate Las Vegas as the Vegas Loop network continues expanding across the city.

The Boring Company also noted that the new tunnel surpassed its previous internal record of 2.26 miles for a single Vegas Loop segment.

Construction of the tunnel involved moving roughly 68,000 cubic yards of dirt. The excavation process also used about 4.8 miles of continuous conveyor belt, powered by six motors totaling 825 horsepower.

The Boring Company’s Prufrock-series all-electric tunnel boring machines are designed to support the rapid expansion of company’s underground transportation projects, including the growing Vegas Loop network. Prufrock machines are designed for reusability, thanks in no small part to their capability to be deployed and retrieved easily through their “porposing” feature.

The Vegas Loop, specifically the Las Vegas Convention Center (LVCC) Loop segment, has already been used during major events. Most recently, the LVCC Loop supported the 2026 CONEXPO-CON/AGG construction trade show, which was held from March 3-7, 2026.

As per The Boring Company, the LVCC Loop transported roughly 82,000 passengers across the convention center campus during the event’s duration.

CONEXPO-CON/AGG is one of the largest construction trade shows in North America, drawing more than 140,000 construction professionals from 128 countries this year.

The LVCC Loop forms the initial segment of the broader Vegas Loop network, which remains under active development as The Boring Company continues building new tunnels throughout the city.

Elon Musk

Elon Musk’s xAI, creator of Grok and Grokipedia, celebrates its third birthday

xAI Memphis highlighted several of its milestones over the years in its celebratory post.

Elon Musk’s artificial intelligence startup xAI has marked its third anniversary. The update was shared in a post from the xAI Memphis account on social media platform X.

xAI Memphis highlighted several of its milestones over the years in its celebratory post.

As per xAI, it has built three massive data centers in the city, launched a coherent cluster of 330,000 GBs, created over 3,000 jobs, and paid over $30 million in taxes to local communities.

xAI’s Memphis operation has become a key part of the company’s infrastructure as the company works to train and deploy its Grok artificial intelligence models. Elon Musk has been quite optimistic about Grok’s potential, noting in the past that the large language model might have a shot at achieving artificial general intelligence (AGI).

xAI’s Memphis’ crown jewel is its Colossus supercomputer cluster. The project was announced in 2024 and has since become the home of one of the world’s largest AI compute facilities. The first phase of Colossus reached its initial 100,000 GPU operational milestone in just 122 days, or just about four months.

Industry figures such as Nvidia CEO Jensen Huang have praised the facility, noting that projects of similar scale typically take two to four years to complete.

xAI has cited Memphis’ central location, skilled workforce, and industrial infrastructure as key reasons for selecting the city as the home of its AI training operations. The company has also emphasized plans to expand the site further as it scales compute capacity for Grok and future AI models.