Energy

Redwood Materials opens up new facility just miles from Tesla Giga Nevada

Redwood Materials, a battery and e-waste recycling venture from former Tesla executive J.B. Straubel, has opened up a new manufacturing facility in the Tahoe-Reno Industrial Park, just miles from Tesla’s Giga Nevada production facility.

Redwood’s new facility is just miles from Tesla Giga Nevada, where the automaker has a joint venture with Panasonic to produce electric vehicle batteries. Tesla also manufactures electric motors for the Model 3 in the Nevada Gigafactory.

In 2017, JB Straubel founded Redwood Materials to work on the recycling processes of lithium-ion batteries and electronic waste materials. He kept his post as Tesla’s Chief Technical Officer until July 2019, where the company gave him an advisory role. Over the past several years, Redwood has started to expand its business, taking on new products to recycle like solar panels and establishing new partnerships and recycling deals with companies like Nissan LEAF battery supplier AESC and Tesla. The partnerships contribute to around 3 GWh annually, equating to about 45,000 cars or 60 tons of waste every day.

Two Tesla Execs linked to advanced recycling startup Redwood Materials

With more partnerships and more products being taken on by Redwood in their attempts to expand the recycling of batteries and sustainable energy products, the company recently purchased a 100-acre land plot in the Tahoe-Reno Industrial Center. The purchase of a new property expands Redwood’s potential battery recycling efforts. With the ever-growing electric vehicle market, battery recycling efforts and ventures will be a highly sought-after entity in the coming years as vehicles begin to reach the end of their life cycle. However, it goes past EVs because cell phones, laptops, solar panels, and other consumer products that utilize lithium-ion batteries for operation will also need to be sustainably handled at the end of their life cycle.

While Redwood is only a few short years into its journey as a company, it has been working on expanding its potential footprint into the industry. While its initial facility in Carson City, Nevada, sits just 20 miles south of the new property in Reno-Sparks, Straubel says that Redwood is working on expanding, but it’s not concerned about publicity.

“We’ve been on the quiet side because we prefer to make progress and get things done,” he said to the Reno Gazette Journal. “All that said, (the company) has been growing rapidly, and business has been great. We felt it was time to connect a bit more with the local community and help raise awareness for hiring and make sure people realize this is a worthy and unique opportunity here as well.”

The expanding market of consumer products that utilize lithium-ion batteries is huge. Not to mention, it’s also global. AirPods, electric bikes, toothbrushes, cell phones. You name it, it probably has a battery in it, and Straubel says that the environmental impact is great during the product’s lifetime is great. However, when it breaks or dies, what to do with the batteries afterward is what the real concern is. Recycling the batteries to give them a second use, especially in the application of electric vehicles, is what Straubel seems mostly concerned about.

Credit: Redwood Materials

“It’s a great thing for the environment, but it puts massive pressure on the supply chain and resources to build all these cars and batteries,” he added.

The Carson City facility is currently undergoing a 150,000 square foot expansion project, making it 550,000 square feet in total. The reason for the Tahoe-Reno location in Reno-Sparks is simple: Tesla Gigafactory.

In 2019, Panasonic and Redwood inked a deal that would allow the company to take the scrap generated from the Gigafactory and recycle it. It also has a deal with Amazon and will recycle the e-commerce giant’s lithium-ion batteries and other e-waste materials. Another reason for the Nevada location was Straubel’s familiarity with the area, he said. “It’s a very business-friendly climate politically and economically, and there’s generally more space to grow. You could also build a company a little bit faster and do so without some of the constraints…you have in California or other places like that.”

The act of recycling EV batteries and other lithium-ion-based products adds an extra environmental element to the entire process. Of course, the lifespan of electric vehicles is extremely environmentally conscious. Still, with Redwood’s recycling efforts, it’s becoming a completely well-rounded supply chain in terms of Earth-safe production and manufacturing. Redwood is also looking to expand its workforce by creating around 500 additional jobs starting this year, a drastic increase from its 130 current employees.

Energy

Tesla launches Cybertruck vehicle-to-grid program in Texas

The initiative was announced by the official Tesla Energy account on social media platform X.

Tesla has launched a vehicle-to-grid (V2G) program in Texas, allowing eligible Cybertruck owners to send energy back to the grid during high-demand events and receive compensation on their utility bills.

The initiative, dubbed Powershare Grid Support, was announced by the official Tesla Energy account on social media platform X.

Texas’ Cybertruck V2G program

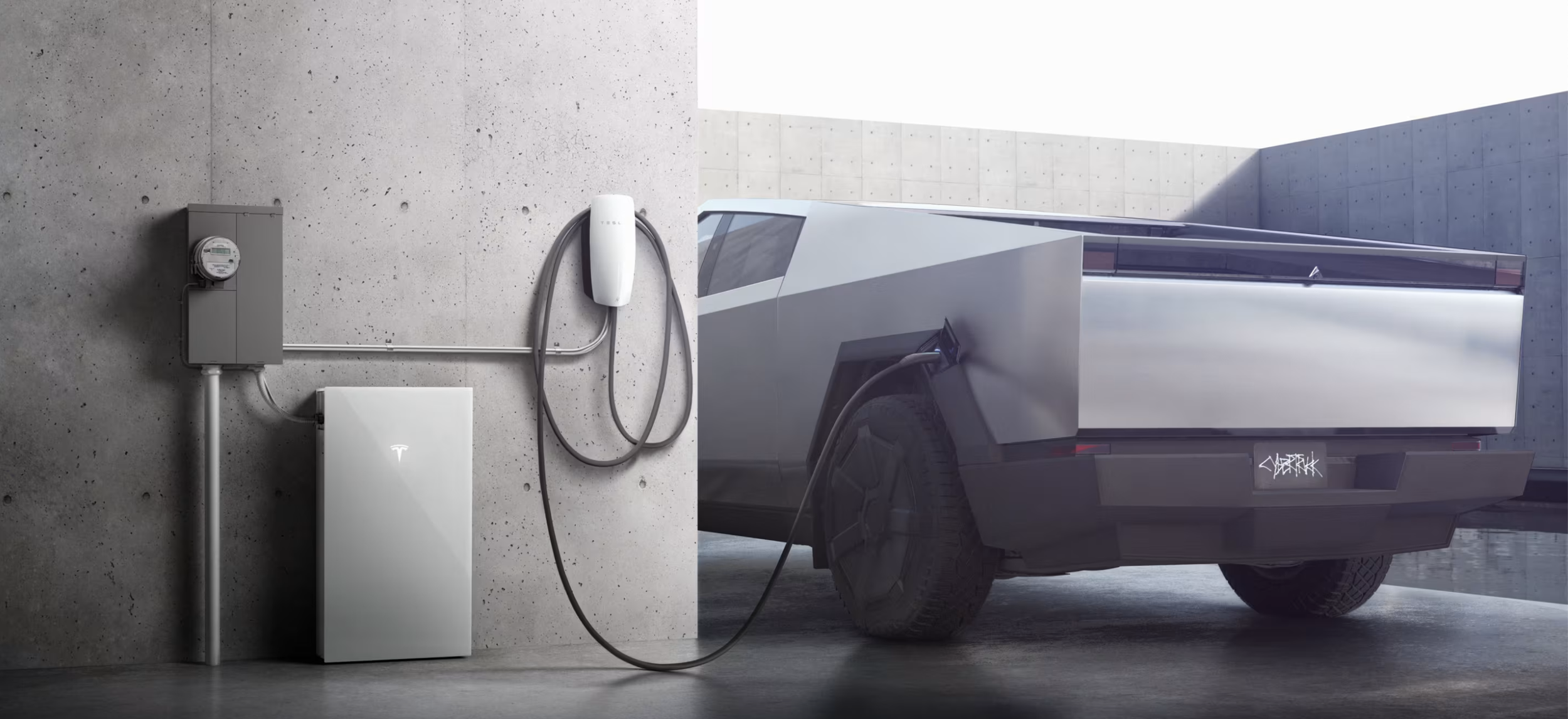

In its post on X, Tesla Energy confirmed that vehicle-to-grid functionality is “coming soon,” starting with select Texas markets. Under the new Powershare Grid Support program, owners of the Cybertruck equipped with Powershare home backup hardware can opt in through the Tesla app and participate in short-notice grid stress events.

During these events, the Cybertruck automatically discharges excess energy back to the grid, supporting local utilities such as CenterPoint Energy and Oncor. In return, participants receive compensation in the form of bill credits. Tesla noted that the program is currently invitation-only as part of an early adopter rollout.

The launch builds on the Cybertruck’s existing Powershare capability, which allows the vehicle to provide up to 11.5 kW of power for home backup. Tesla added that the program is expected to expand to California next, with eligibility tied to utilities such as PG&E, SCE, and SDG&E.

Powershare Grid Support

To participate in Texas, Cybertruck owners must live in areas served by CenterPoint Energy or Oncor, have Powershare equipment installed, enroll in the Tesla Electric Drive plan, and opt in through the Tesla app. Once enrolled, vehicles would be able to contribute power during high-demand events, helping stabilize the grid.

Tesla noted that events may occur with little notice, so participants are encouraged to keep their Cybertrucks plugged in when at home and to manage their discharge limits based on personal needs. Compensation varies depending on the electricity plan, similar to how Powerwall owners in some regions have earned substantial credits by participating in Virtual Power Plant (VPP) programs.

Cybertruck

Tesla updates Cybertruck owners about key Powershare feature

Tesla is updating Cybertruck owners on its timeline of a massive feature that has yet to ship: Powershare with Powerwall.

Powershare is a bidirectional charging feature exclusive to Cybertruck, which allows the vehicle’s battery to act as a portable power source for homes, appliances, tools, other EVs, and more. It was announced in late 2023 as part of Tesla’s push into vehicle-to-everything energy sharing, and acting as a giant portable charger is the main advantage, as it can provide backup power during outages.

Cybertruck’s Powershare system supports both vehicle-to-load (V2L) and vehicle-to-home (V2H), making it flexible and well-rounded for a variety of applications.

However, even though the feature was promised with Cybertruck, it has yet to be shipped to vehicles. Tesla communicated with owners through email recently regarding Powershare with Powerwall, which essentially has the pickup act as an extended battery.

Powerwall discharge would be prioritized before tapping into the truck’s larger pack.

However, Tesla is still working on getting the feature out to owners, an email said:

“We’re writing to let you know that the Powershare with Powerwall feature is still in development and is now scheduled for release in mid-2026.

This new release date gives us additional time to design and test this feature, ensuring its ability to communicate and optimize energy sharing between your vehicle and many configurations and generations of Powerwall. We are also using this time to develop additional Powershare features that will help us continue to accelerate the world’s transition to sustainable energy.”

Owners have expressed some real disappointment in Tesla’s continuous delays in releasing the feature, as it was expected to be released by late 2024, but now has been pushed back several times to mid-2026, according to the email.

Foundation Series Cybertruck buyers paid extra, expecting the feature to be rolled out with their vehicle upon pickup.

Cybertruck’s Lead Engineer, Wes Morrill, even commented on the holdup:

As a Cybertruck owner who also has Powerwall, I empathize with the disappointed comments.

To their credit, the team has delivered powershare functionality to Cybertruck customers who otherwise have no backup with development of the powershare gateway. As well as those with solar…

— Wes (@wmorrill3) December 12, 2025

He said that “it turned out to be much harder than anticipated to make powershare work seamlessly with existing Powerwalls through existing wall connectors. Two grid-forming devices need to negotiate who will form and who will follow, depending on the state of charge of each, and they need to do this without a network and through multiple generations of hardware, and test and validate this process through rigorous certifications to ensure grid safety.”

It’s nice to see the transparency, but it is justified for some Cybertruck owners to feel like they’ve been bait-and-switched.

Energy

Tesla starts hiring efforts for Texas Megafactory

Tesla’s Brookshire site is expected to produce 10,000 Megapacks annually, equal to 40 gigawatt hours of energy storage.

Tesla has officially begun hiring for its new $200 million Megafactory in Brookshire, Texas, a manufacturing hub expected to employ 1,500 people by 2028. The facility, which will build Tesla’s grid-scale Megapack batteries, is part of the company’s growing energy storage footprint.

Tesla’s hiring efforts for the Texas Megafactory are hinted at by the job openings currently active on the company’s Careers website.

Tesla’s Texas Megafactory

Tesla’s Brookshire site is expected to produce 10,000 Megapacks annually, equal to 40 gigawatt hours of energy storage, similar to the Lathrop Megafactory in California. Tesla’s Careers website currently lists over 30 job openings for the site, from engineers, welders, and project managers. Each of the openings is listed for Brookshire, Texas.

The company has leased two buildings in Empire West Business Park, with over $194 million in combined property and equipment investment. Tesla’s agreement with Waller County includes a 60% property tax abatement, contingent on meeting employment benchmarks: 375 jobs by 2026, 750 by 2027, and 1,500 by 2028, as noted in a report from the Houston Business Journal. Tesla is required to employ at least 1,500 workers in the facility through the rest of the 10-year abatement period.

Tesla’s clean energy boom

City officials have stated that Tesla’s arrival marks a turning point for the Texas city, as it highlights a shift from logistics to advanced clean energy manufacturing. Ramiro Bautista from Brookshire’s economic development office, highlighted this in a comment to the Journal.

“(Tesla) has great-paying jobs. Not just that, but the advanced manufacturing (and) clean energy is coming to the area,” he said. “So it’s not just your normal logistics manufacturing. This is advanced manufacturing coming to this area, and this brings a different type of job and investment into the local economy.”