News

SpaceX fairing recovery vessel Mr. Steven’s owner abruptly files for bankruptcy

The legal owners of SpaceX’s sole fairing recovery vessel are in dire financial straits, signaled by business owner Steven Miguez’s decision to file for bankruptcy as a last chance of protecting Seatran Marine, a company which owns and leases eight utility vessels known as crew boats.

Mr. Steven, leased by SpaceX in late 2017, is one of those crew boats, although he has since been dramatically modified to support a series of consecutively larger arms, nets, and other various components in hopes of eventually catching Falcon 9 payload fairings out of the air. While there is most likely no serious risk of SpaceX actually losing access to Mr. Steven, this development still raises the question of what will happen to the ship in the near and more distant future.

The bankruptcy paperwork filed is chapter 11 – "proposing a plan of reorganisation to keep a business alive." The paperwork protects Mr Steven from foreclosure for now so there is no immediate change to anything.

— Gav Cornwell (@SpaceOffshore) November 21, 2018

As indicated in the tweet above, the ultimate outcome – at least for the time being – is simple uncertainty, as Chapter 11 bankruptcy filings will prevent Miguez from having to foreclose on Mr. Steven in the short term. If the Miguez family can rapidly find a solution for its money troubles, all could proceed unchanged. However, with all due respect to the owners and to Seatran Marine’s employees, Chapter 11 bankruptcy simply is not easily undone and is generally a last resort to be used only after all alternative solutions have been exhausted. Chapter 11 bankruptcy proceedings can take anywhere from a few months to several years to complete, tending to take longer as the scale and complexity of the filing party grows.

Making the best of a bad situation

Leased by Seatran to operator Guice Offshore (GO), SpaceX’s primary fleet manager on both coasts, GO (and thus SpaceX) had contracted to pay at least $3300 a day to use Mr. Steven, although that contract expired in October 2018. The new terms are unclear and it’s unknown if a replacement contract has yet to be signed.

Given the situation at hand and despite the sad financial circumstances facing the vessel’s owners, SpaceX may be in the best position yet to purchase Mr. Steven outright, assuming the company expects to continue attempting Falcon fairing recoveries for the indefinite future. In 2015, namesake Steven Miguez took out a $22.5M loan to cover Mr. Steven’s construction costs, offering a rough price ceiling for the modern, high-performance Fast Supply Vessel (FSV). While the most obvious interested buyer would be GO itself, it’s unlikely that the company has a sum of that size to offer, meaning that GO would need to take out its own loan to acquire the ship.

- Mr. Steven took to sea to test out a new recovery-related appendage – purpose unknown – on November 12. (Pauline Acalin)

- After an afternoon attempting to catch Falcon fairings dropped by a helicopter, Mr. Steven returned to port on Nov. 14. (Pauline Acalin)

- (Pauline Acalin)

- One half of SpaceX’s Iridium-6/GRACE-FO just moments before touchdown on the Pacific Ocean. (SpaceX)

SpaceX, on the other hand, quite literally just closed a debt funding round of $250M, terms unknown, leaving the company more than enough liquid capital to enable a cash transaction assuming there is some interest in becoming Mr. Steven’s legal owner. SpaceX already owns its two operational autonomous spaceport drone ships (ASDS) outright and has extensively modified Mr. Steven to support fairing recovery, quite literally building its prototype recovery apparatus around the rented vessel. As the vessel’s new owner, SpaceX could likely keep contracting to GO for general operations and support, perhaps even continuing to lease Mr. Steven to GO to create as few waves as possible.

By selling Mr. Steven outright, Miguez could likely acquire more than enough funds to preserve Seatran Marine and its subsidiaries long enough to recover his financial footing and return his companies to a stable state.

Business as usual?

In the meantime, it does not appear that these unfortunate legal issues have had a tangible impact on GO and SpaceX’s near-term ability to operate Mr. Steven. Around November 20th, SpaceX and GO crew performed the most recent of a series of Falcon fairing recovery tests, dropping a half from a helicopter to provide Mr. Steven a comparatively controlled environment to practice catches. Earlier this month, CEO Elon Musk appeared to imply that Mr. Steven would not attempt to catch Falcon 9’s fairing halves following the West Coast launch of SSO-A, at the time scheduled for November 19th.

Since then, SSO-A’s flight-proven Falcon 9 launch has slipped a full two weeks thanks to a combination of additional inspections and bad weather, now targeting launch NET December 2. It’s a stretch, but there is at least a slight chance that SSO-A’s excessive launch slips could mean that Mr. Steven will be able to attempt fairing recovery after all, at least per Musk’s suggestion that SpaceX would “try again next month”.

https://www.instagram.com/p/BqtGWFxADOk/

Elon Musk

Tesla Supercharger Diner food menu gets a sneak peek as construction closes out

What are you ordering at the Tesla Diner?

The Tesla Supercharger Diner in Los Angeles is nearing completion as construction appears to be winding down significantly. However, the more minor details, such as what the company will serve at its 50s-style diner for food, are starting to be revealed.

Tesla’s Supercharger Diner is set to open soon, seven years after CEO Elon Musk first drafted the idea in a post on X in 2018. Musk has largely come through on most of what he envisioned for the project: the diner, the massive movie screens, and the intended vibe are all present, thanks to the aerial and ground footage shared on social media.

We already know the Diner will be open 24/7, based on decals placed on the front door of the restaurant that were shared earlier this week. We assume that Tesla Optimus will come into play for these long and uninterrupted hours.

The Tesla Diner is basically finished—here’s what it looks like

As far as the food, Tesla does have an email also printed on the front door of the Diner, but we did not receive any response back (yet) about what cuisine it will be offering. We figured it would be nothing fancy and it would be typical diner staples: burgers, fries, wings, milkshakes, etc.

According to pictures taken by @Tesla_lighting_, which were shared by Not a Tesla App, the food will be just that: quick and affordable meals that diners do well. It’s nothing crazy, just typical staples you’d find at any diner, just with a Tesla twist:

Tesla Diner food:

• Burgers

• Fries

• Chicken Wings

• Hot Dogs

• Hand-spun milkshakes

• And more https://t.co/kzFf20YZQq pic.twitter.com/aRv02TzouY— Sawyer Merritt (@SawyerMerritt) July 17, 2025

As the food menu is finalized, we will be sure to share any details Tesla provides, including a full list of what will be served and its prices.

Additionally, the entire property appears to be nearing its final construction stages, and it seems it may even be nearing completion. The movie screens are already up and showing videos of things like SpaceX launches.

There are many cars already using the Superchargers at the restaurant, and employees inside the facility look to be putting the finishing touches on the interior.

🚨 Boots on the ground at the Tesla Diner:

— TESLARATI (@Teslarati) July 17, 2025

It’s almost reminiscent of a Tesla version of a Buc-ee’s, a southern staple convenience store that offers much more than a traditional gas station. Of course, Tesla’s version is futuristic and more catered to the company’s image, but the idea is the same.

It’s a one-stop shop for anything you’d need to recharge as a Tesla owner. Los Angeles building permits have not yet revealed the date for the restaurant’s initial operation, but Tesla may have its eye on a target date that will likely be announced during next week’s Earnings Call.

News

Tesla’s longer Model Y did not scale back requests for this vehicle type from fans

Tesla fans are happy with the new Model Y, but they’re still vocal about the need for something else.

Tesla launched a slightly longer version of the Model Y all-electric crossover in China, and with it being extremely likely that the vehicle will make its way to other markets, including the United States, fans are still looking for something more.

The new Model Y L in China boasts a slightly larger wheelbase than its original version, giving slightly more interior room with a sixth seat, thanks to a third row.

Tesla exec hints at useful and potentially killer Model Y L feature

Tesla has said throughout the past year that it would focus on developing its affordable, compact models, which were set to begin production in the first half of the year. The company has not indicated whether it met that timeline or not, but many are hoping to see unveilings of those designs potentially during the Q3 earnings call.

However, the modifications to the Model Y, which have not yet been officially announced for any markets outside of China, still don’t seem to be what owners and fans are looking forward to. Instead, they are hoping for something larger.

A few months ago, I reported on the overall consensus within the Tesla community that the company needs a full-size SUV, minivan, or even a cargo van that would be ideal for camping or business use.

Tesla is missing one type of vehicle in its lineup and fans want it fast

That mentality still seems very present amongst fans and owners, who state that a full-size SUV with enough seating for a larger family, more capability in terms of cargo space for camping or business operation, and something to compete with gas cars like the Chevrolet Tahoe, Ford Expedition, or electric ones like the Volkswagen ID.BUZZ.

We asked the question on X, and Tesla fans were nearly unanimously in support of a larger SUV or minivan-type vehicle for the company’s lineup:

🚨 More and more people are *still* saying that, despite this new, longer Model Y, Tesla still needs a true three-row SUV

Do you agree? https://t.co/QmbRDcCE08 pic.twitter.com/p6m5zB4sDZ

— TESLARATI (@Teslarati) July 16, 2025

Here’s what some of the respondents said:

100% agree, we need a larger vehicle.

Our model Y is quickly getting too small for our family of 5 as the kids grow. A slightly longer Y with an extra seat is nice but it’s not enough if you’re looking to take it on road trips/vacations/ kids sports gear etc.

Unfortunately we…

— Anthony Hunter (@_LiarsDice_) July 17, 2025

Had to buy a Kia Carnival Hybrid because Tesla doesn’t have a true 3 row vehicle with proper space and respectable range. pic.twitter.com/pzwFyHU8Gi

— Neil, like the astronaut (@Neileeyo) July 17, 2025

Agreed! I’m not sure who created this but I liked it enough to save it. pic.twitter.com/Sof5nMehjS

— 🦉Wise Words of Wisdom – Inspirational Quotes (IQ) (@WiseWordsIQ) July 16, 2025

Tesla is certainly aware that many of its owners would like the company to develop something larger that competes with the large SUVs on the market.

However, it has not stated that anything like that is in the current plans for future vehicles, as it has made a concerted effort to develop Robotaxi alongside the affordable, compact models that it claims are in development.

It has already unveiled the Robovan, a people-mover that can seat up to 20 passengers in a lounge-like interior.

The Robovan will be completely driverless, so it’s unlikely we will see it before the release of a fully autonomous Full Self-Driving suite from Tesla.

Energy

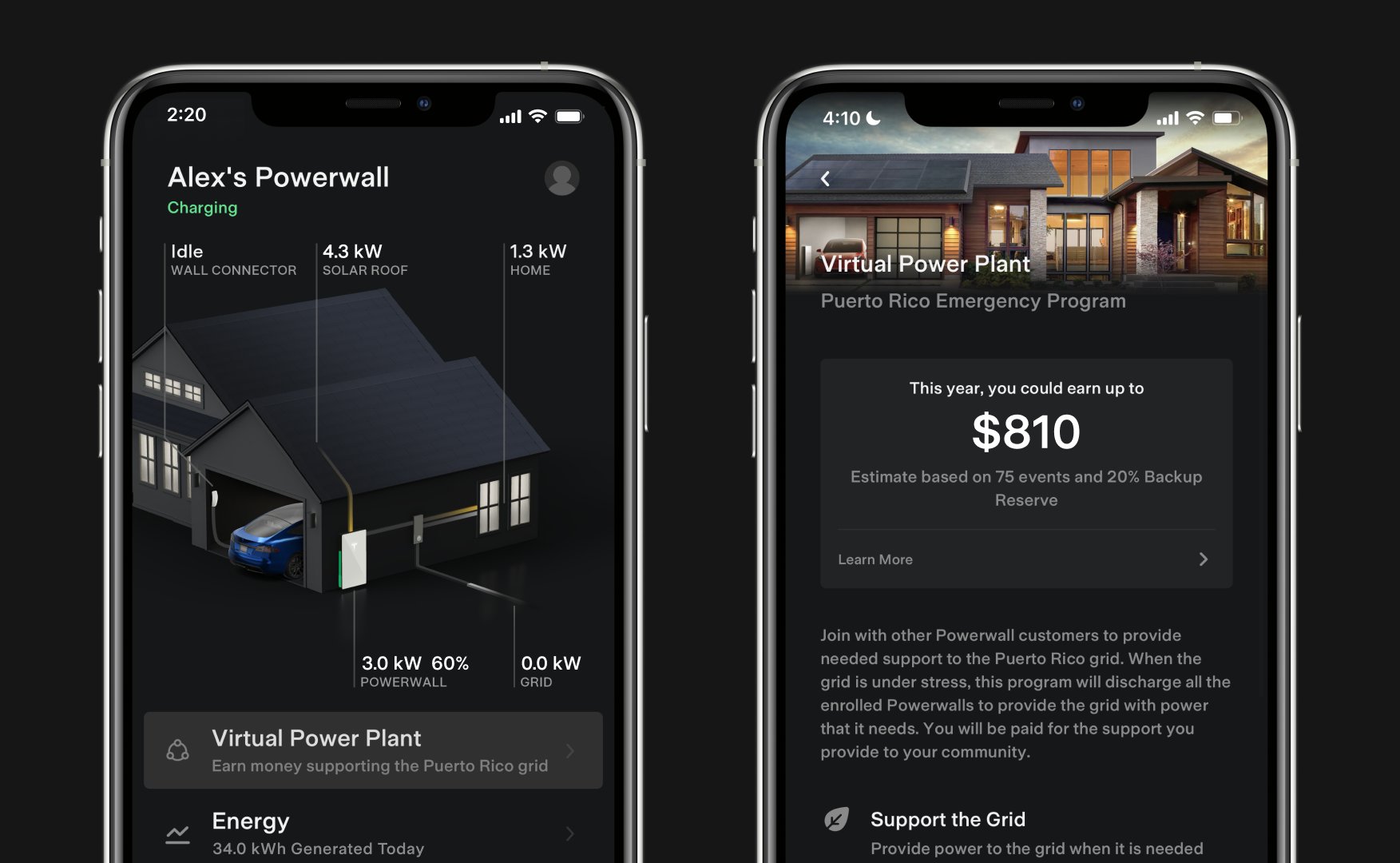

Tesla launches first Virtual Power Plant in UK – get paid to use solar

Tesla has launched its first-ever Virtual Power Plant program in the United Kingdom.

Tesla has launched its first-ever Virtual Power Plant program in the United Kingdom. This feature enables users of solar panels and energy storage systems to sell their excess energy back to the grid.

Tesla is utilizing Octopus Energy, a British renewable energy company that operates in multiple markets, including the UK, France, Germany, Italy, Spain, Australia, Japan, New Zealand, and the United States, as the provider for the VPP launch in the region.

The company states that those who enroll in the program can earn up to £300 per month.

Tesla has operated several VPP programs worldwide, most notably in California, Texas, Connecticut, and the U.S. territory of Puerto Rico. This is not the first time Tesla has operated a VPP outside the United States, as there are programs in Australia, Japan, and New Zealand.

This is its first in the UK:

Our first VPP in the UK

You can get paid to share your energy – store excess energy in your Powerwall & sell it back to the grid

You’re making £££ and the community is powered by clean energy

Win-win pic.twitter.com/evhMtJpgy1

— Tesla UK (@tesla_uk) July 17, 2025

Tesla is not the only company that is working with Octopus Energy in the UK for the VPP, as it joins SolarEdge, GivEnergy, and Enphase as other companies that utilize the Octopus platform for their project operations.

It has been six years since Tesla launched its first VPP, as it started its first in Australia back in 2019. In 2024, Tesla paid out over $10 million to those participating in the program.

Participating in the VPP program that Tesla offers not only provides enrolled individuals with the opportunity to earn money, but it also contributes to grid stabilization by supporting local energy grids.

-

Elon Musk1 day ago

Elon Musk1 day agoWaymo responds to Tesla’s Robotaxi expansion in Austin with bold statement

-

News1 day ago

News1 day agoTesla exec hints at useful and potentially killer Model Y L feature

-

Elon Musk2 days ago

Elon Musk2 days agoElon Musk reveals SpaceX’s target for Starship’s 10th launch

-

Elon Musk3 days ago

Elon Musk3 days agoTesla ups Robotaxi fare price to another comical figure with service area expansion

-

News1 day ago

News1 day agoTesla’s longer Model Y did not scale back requests for this vehicle type from fans

-

News1 day ago

News1 day ago“Worthy of respect:” Six-seat Model Y L acknowledged by Tesla China’s biggest rivals

-

News2 days ago

News2 days agoFirst glimpse of Tesla Model Y with six seats and extended wheelbase

-

Elon Musk2 days ago

Elon Musk2 days agoElon Musk confirms Tesla is already rolling out a new feature for in-car Grok