News

SpaceX’s Starship Moon lander under fire yet again as Blue Origin sues NASA

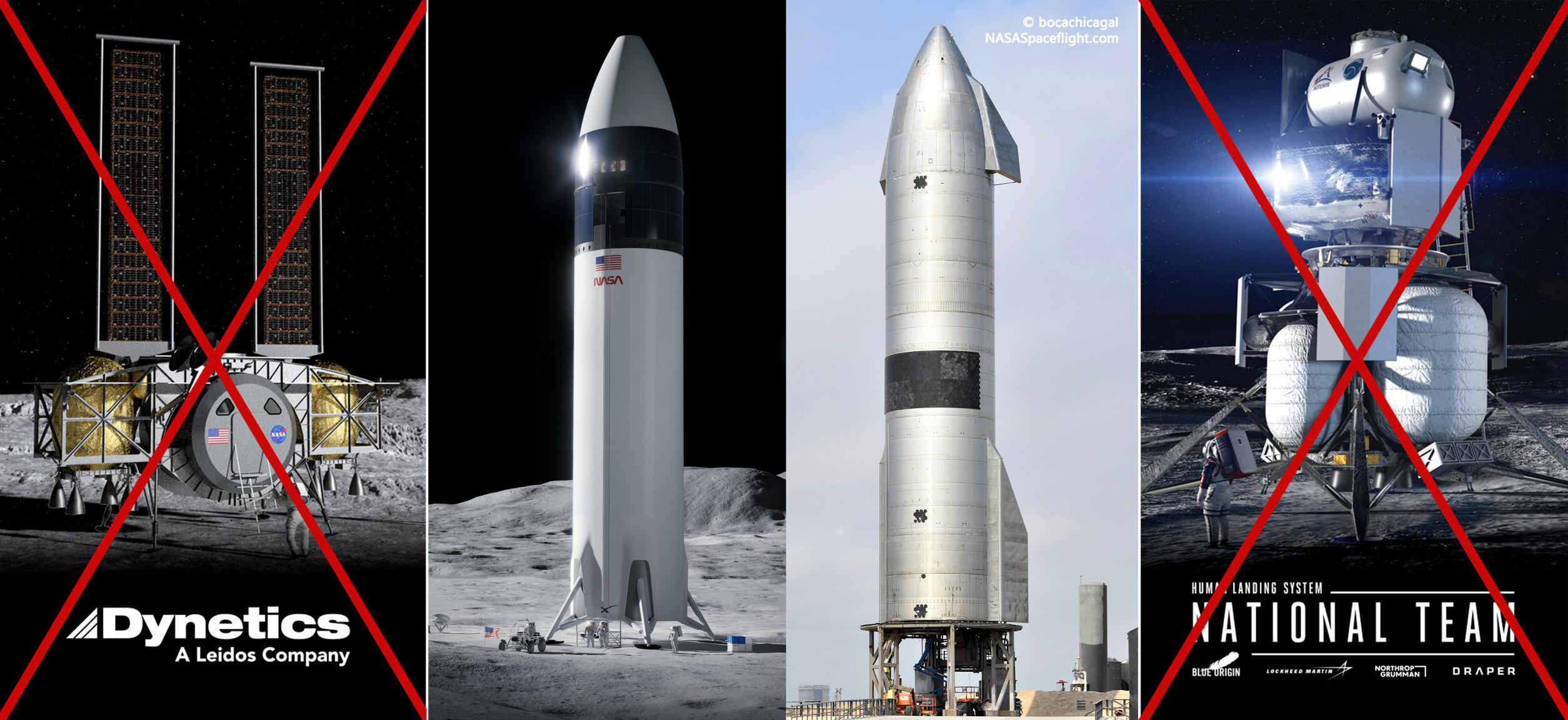

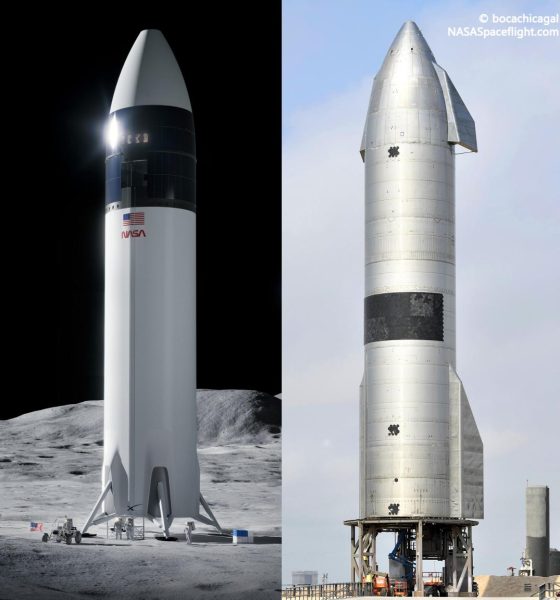

Less than three weeks after the US Government Accountability Office (GAO) categorically denied protests from Blue Origin and Dynetics over NASA’s decision to award SpaceX a Moon lander development contract, the former company has sued the space agency.

First reported by The Verge, Blue Origin filed its lawsuit against NASA with the US Court of Federal Claims on Monday, August 16th and continues to spout the same kind of rhetoric that GAO wholeheartedly refuted on July 30th. Namely, the office explicitly upheld the procurement process and reasoning behind NASA’s decision to award SpaceX – and SpaceX alone – a contract to develop a crewed Moon lander.

Thus far, the central argument put forth by Blue Origin and Dynetics is that NASA effectively invalidated the entire Human Landing System (HLS) “Option A” procurement when it didn’t award two HLS development contracts. Option A refers to a limited portion of the HLS program focused on funding the development of crewed Moon landers and the completion of two crucial flight tests – one uncrewed and one with NASA astronauts aboard.

Program-wise, HLS is quite similar to NASA’s Commercial Crew Program (CCP), which began as a series of smaller contracts focused on capability demonstrations that culminated in a major competition to ferry NASA astronauts to and from the International Space Station (ISS). Ultimately, NASA selected Boeing and SpaceX and the rest is now history (SpaceX flourished; Boeing floundered) and despite unsurprising delays, the program has been an extraordinary success and a financial bargain.

As part of the major Commercial Crew Transportation Capability contracts SpaceX and Boeing won, both companies were tasked with designed, building, and qualifying crewed spacecraft to NASA specifications. The centerpiece of those contracts was a pair of full-up demonstration flights to and from the ISS – one uncrewed and the other with two NASA astronauts. NASA then separately purchased “post-certification missions” – operational crew transport flights – from both companies a few years into development.

The corollaries between Commercial Crew and HLS are clear and unsurprising. However, unlike the Commercial Crew Program, NASA has been able to structure HLS with the benefits of hindsight. This time around, already faced with a Congressional funding shortfall even worse than years of half-funding that directly delayed CCtCap, NASA used a different procurement ‘vessel’ for HLS and repeatedly warned competitors that while it wanted two Moon lander providers, the ability to award two contracts would be entirely dependent on funding availability.

In other words, NASA had learned an important lesson from the Commercial Crew Program and wasn’t about to trap itself with contractual obligations that far outmatched recent Congressional funding trends. Intentionally or not, NASA structured HLS in such a way that it only awarded major Option A lander contracts after Congress had already appropriated its FY2021 funding. As it turned out, Congress ultimately provided a pathetic 25% of the full $3.4 billion NASA had requested, leaving the agency no choice but to downselect to just a single provider – SpaceX. Put simply, NASA has assumed that Congress will continue to supply just a tiny fraction of the funding it would need to develop two landers on time and SpaceX’s Starship proposal was just cheap enough to make any Option A award possible.

The fixed-price contract will cost NASA $2.9B over four or so years – narrowly within the space agency’s reach if Congress continues to appropriate around $850M annually ($3.4B over four years). The numbers are very simple. As GAO notes, the Broad Agency Announcement (BAA) vehicle NASA used for its HLS Option A procurement also strictly allows the agency to select as many or as few proposals as it wants, including none at all. In the lead-up to proposal submission, official NASA documents repeatedly cautioned as much, warning that the agency might not even award one contract depending on funding or the quality of proposals it received.

For Blue Origin’s lawsuit to succeed, the increasingly desperate company will have to convince a federal judge that basic realities and longstanding precedents of federal procurement – not just NASA’s HLS award to SpaceX – are flawed and need to be changed. The odds of success are thus spectacularly low. However, if the presiding judge allows the case to proceed and awards Blue Origin an injunction against NASA, it could force the space agency to cease work on SpaceX’s HLS contract for months and potentially freeze SpaceX’s access to the $300M NASA recently disbursed.

News

Tesla FSD (Supervised) fleet passes 8.4 billion cumulative miles

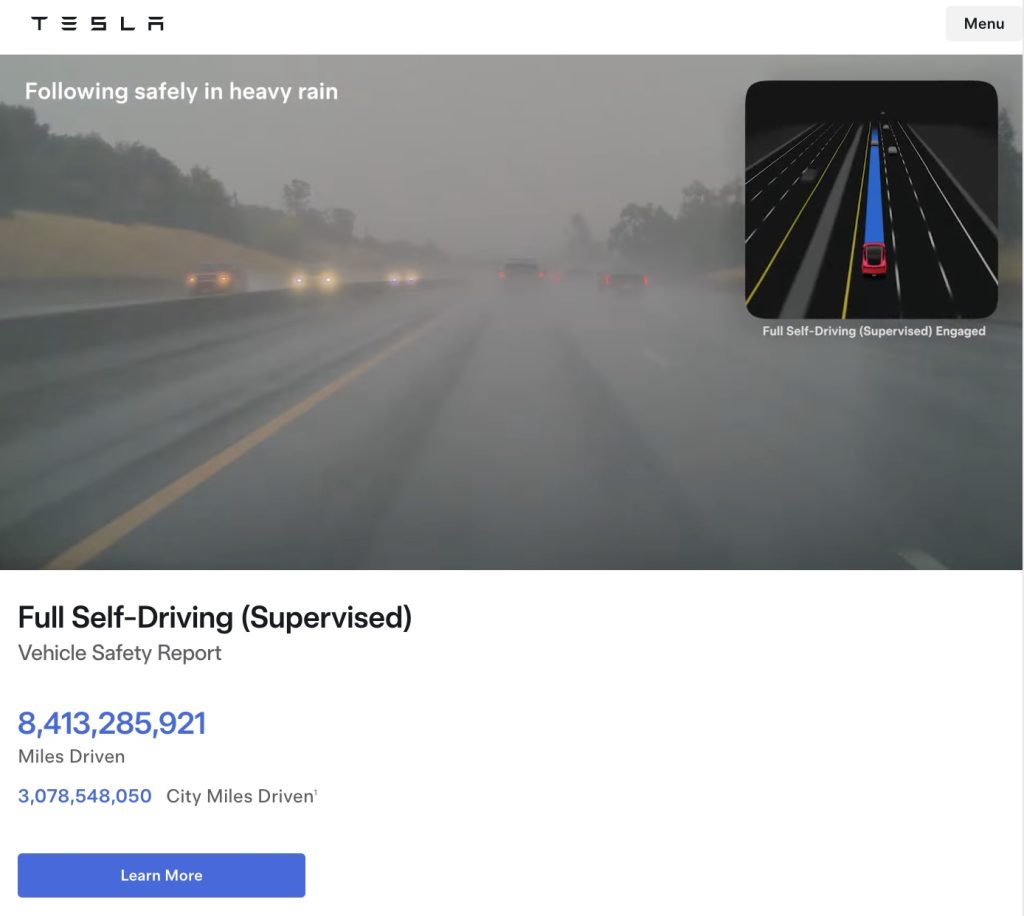

The figure appears on Tesla’s official safety page, which tracks performance data for FSD (Supervised) and other safety technologies.

Tesla’s Full Self-Driving (Supervised) system has now surpassed 8.4 billion cumulative miles.

The figure appears on Tesla’s official safety page, which tracks performance data for FSD (Supervised) and other safety technologies.

Tesla has long emphasized that large-scale real-world data is central to improving its neural network-based approach to autonomy. Each mile driven with FSD (Supervised) engaged contributes additional edge cases and scenario training for the system.

The milestone also brings Tesla closer to a benchmark previously outlined by CEO Elon Musk. Musk has stated that roughly 10 billion miles of training data may be needed to achieve safe unsupervised self-driving at scale, citing the “long tail” of rare but complex driving situations that must be learned through experience.

The growth curve of FSD Supervised’s cumulative miles over the past five years has been notable.

As noted in data shared by Tesla watcher Sawyer Merritt, annual FSD (Supervised) miles have increased from roughly 6 million in 2021 to 80 million in 2022, 670 million in 2023, 2.25 billion in 2024, and 4.25 billion in 2025. In just the first 50 days of 2026, Tesla owners logged another 1 billion miles.

At the current pace, the fleet is trending towards hitting about 10 billion FSD Supervised miles this year. The increase has been driven by Tesla’s growing vehicle fleet, periodic free trials, and expanding Robotaxi operations, among others.

With the fleet now past 8.4 billion cumulative miles, Tesla’s supervised system is approaching that threshold, even as regulatory approval for fully unsupervised deployment remains subject to further validation and oversight.

Elon Musk

Elon Musk fires back after Wikipedia co-founder claims neutrality and dubs Grokipedia “ridiculous”

Musk’s response to Wales’ comments, which were posted on social media platform X, was short and direct: “Famous last words.”

Elon Musk fired back at Wikipedia co-founder Jimmy Wales after the longtime online encyclopedia leader dismissed xAI’s new AI-powered alternative, Grokipedia, as a “ridiculous” idea that is bound to fail.

Musk’s response to Wales’ comments, which were posted on social media platform X, was short and direct: “Famous last words.”

Wales made the comments while answering questions about Wikipedia’s neutrality. According to Wales, Wikipedia prides itself on neutrality.

“One of our core values at Wikipedia is neutrality. A neutral point of view is non-negotiable. It’s in the community, unquestioned… The idea that we’ve become somehow ‘Wokepidea’ is just not true,” Wales said.

When asked about potential competition from Grokipedia, Wales downplayed the situation. “There is no competition. I don’t know if anyone uses Grokipedia. I think it is a ridiculous idea that will never work,” Wales wrote.

After Grokipedia went live, Larry Sanger, also a co-founder of Wikipedia, wrote on X that his initial impression of the AI-powered Wikipedia alternative was “very OK.”

“My initial impression, looking at my own article and poking around here and there, is that Grokipedia is very OK. The jury’s still out as to whether it’s actually better than Wikipedia. But at this point I would have to say ‘maybe!’” Sanger stated.

Musk responded to Sanger’s assessment by saying it was “accurate.” In a separate post, he added that even in its V0.1 form, Grokipedia was already better than Wikipedia.

During a past appearance on the Tucker Carlson Show, Sanger argued that Wikipedia has drifted from its original vision, citing concerns about how its “Reliable sources/Perennial sources” framework categorizes publications by perceived credibility. As per Sanger, Wikipedia’s “Reliable sources/Perennial sources” list leans heavily left, with conservative publications getting effectively blacklisted in favor of their more liberal counterparts.

As of writing, Grokipedia has reportedly surpassed 80% of English Wikipedia’s article count.

News

Tesla Sweden appeals after grid company refuses to restore existing Supercharger due to union strike

The charging site was previously functioning before it was temporarily disconnected in April last year for electrical safety reasons.

Tesla Sweden is seeking regulatory intervention after a Swedish power grid company refused to reconnect an already operational Supercharger station in Åre due to ongoing union sympathy actions.

The charging site was previously functioning before it was temporarily disconnected in April last year for electrical safety reasons. A temporary construction power cabinet supplying the station had fallen over, described by Tesla as occurring “under unclear circumstances.” The power was then cut at the request of Tesla’s installation contractor to allow safe repair work.

While the safety issue was resolved, the station has not been brought back online. Stefan Sedin, CEO of Jämtkraft elnät, told Dagens Arbete (DA) that power will not be restored to the existing Supercharger station as long as the electric vehicle maker’s union issues are ongoing.

“One of our installers noticed that the construction power had been backed up and was on the ground. We asked Tesla to fix the system, and their installation company in turn asked us to cut the power so that they could do the work safely.

“When everything was restored, the question arose: ‘Wait a minute, can we reconnect the station to the electricity grid? Or what does the notice actually say?’ We consulted with our employer organization, who were clear that as long as sympathy measures are in place, we cannot reconnect this facility,” Sedin said.

The union’s sympathy actions, which began in March 2024, apply to work involving “planning, preparation, new connections, grid expansion, service, maintenance and repairs” of Tesla’s charging infrastructure in Sweden.

Tesla Sweden has argued that reconnecting an existing facility is not equivalent to establishing a new grid connection. In a filing to the Swedish Energy Market Inspectorate, the company stated that reconnecting the installation “is therefore not covered by the sympathy measures and cannot therefore constitute a reason for not reconnecting the facility to the electricity grid.”

Sedin, for his part, noted that Tesla’s issue with the Supercharger is quite unique. And while Jämtkraft elnät itself has no issue with Tesla, its actions are based on the unions’ sympathy measures against the electric vehicle maker.

“This is absolutely the first time that I have been involved in matters relating to union conflicts or sympathy measures. That is why we have relied entirely on the assessment of our employer organization. This is not something that we have made any decisions about ourselves at all.

“It is not that Jämtkraft elnät has a conflict with Tesla, but our actions are based on these sympathy measures. Should it turn out that we have made an incorrect assessment, we will correct ourselves. It is no more difficult than that for us,” the executive said.