Lifestyle

What Tax Incentives Are Available When Buying My Tesla?

There are a number of tax incentives available when purchasing your Tesla depending on which model you choose and where you live. Here’s my overview of incentives available to US residents. Please note that I’m not a tax advisor, so be sure to do your own research and consult a tax professional.

Federal Tax Incentives

When I purchased my Tesla Model S back in 2014, I received a $7,500 Federal tax credit, an incentive that’s still available to new car buyers as of today (not available to CPO models). But what are the rules behind it and what does the credit mean to me?

According to the Internal Revenue Code Section 30D entitled “Plug-In Electric Drive Vehicle Credit”,

For vehicles acquired after December 31, 2009, the credit is equal to $2,500 plus, for a vehicle which draws propulsion energy from a battery with at least 5 kilowatt hours of capacity, $417, plus an additional $417 for each kilowatt hour of battery capacity in excess of 5 kilowatt hours. The total amount of the credit allowed for a vehicle is limited to $7,500.”

The smallest size battery for the Model S, at the time of this writing, is 70 kWh and will max out the federal credit at $7,500, not to be mistaken for a rebate or refund.

Too bad there’s a $7,500 cap! Just for fun, and assuming there weren’t a cap, a 70 kWh Model S would receive $417 for every kWh exceeding 5 kWh resulting in over $27,000 in tax credits! A 90 kWh Tesla would receive an additional $8,340 in credits making for a grand total of over $35,000 in tax credits.

These credits are issued by the Fed to incentivize adoption of clean energy vehicles and will go into a phase out period once 200,000 vehicles are manufactured by that automaker.

Qualified Plug-In Electric Drive Motor Vehicle Credit (IRC 30D) Phase Out

The qualified plug-in electric drive motor vehicle credit phases out for a manufacturer’s vehicles over the one-year period beginning with the second calendar quarter after the calendar quarter in which at least 200,000 qualifying vehicles manufactured by that manufacturer have been sold for use in the United States (determined on a cumulative basis for sales after December 31, 2009) (“phase-out period”). Qualifying vehicles manufactured by that manufacturer are eligible for 50 percent of the credit if acquired in the first two quarters of the phase-out period and 25 percent of the credit if acquired in the third or fourth quarter of the phase-out period.

With Tesla’s leading production and sales figures, it will be interesting to see what happens to Federal incentives once Tesla crosses the 200,000 vehicles manufactured threshold.

There are implications on which year the tax credit applies to based on when you took delivery of your vehicle. If you were one of the lucky people that took delivery of a Model X in 2015, be sure to have read the fine print on IRC 30D when you file your taxes.

State Incentives

In addition to the Federal tax credit, some states offer state rebates for qualifying battery electric vehicle (BEV) and plug-in hybrid electric vehicle (PHEV) purchases. The following states provide BEV incentives in the form of a refund for your qualifying purchase of a Tesla:

- California – $2,500

- Delaware – $2,200

- Colorado – $6,000

- Louisiana – $8,000

- Massachusetts – $2,500

- Maryland – $3,000

- Pennsylvania – $2,000

- Tennessee – $2,500

- Utah – $1,500

Note that each one of these programs can have its own nuances. There are minimum ownership periods (3 years in Massachusetts), income caps ($500K for joint filers in CA) and other qualifying circumstances to consider. Before you count your money, check the rules for your specific state and make sure you qualify.

For example, when I purchased my Model S in 2014 the current MA state tax credit was no longer available. Since then it’s been put back in place. That was certainly bad timing on my part!

Business Deductions

The door sticker of Model X VIN #001, owned by Tesla CEO Elon Musk. Photo via Twitter, posted by @kalud.

You may have heard about a “$25,000 Hummer Tax Loophole” especially as it relates to the Model X, but what is that and does it apply to you?

Tax Section 179 allows businesses to take deductions for equipment and investments that are put into service. For vehicles, there’s a specific section that states cars used for 50% or more in your business can deduct up to $11,060, and slightly more for trucks.

SUVs or Crossover Vehicles with GVWR above 6,000 lbs. get an even larger deduction of $25,000. This is the “Hummer Tax Loophole” as the Hummer weighed in at somewhere around 6,500 pounds. GVWR is the weight of the vehicle with passengers and/or equipment. The Model X has a curb weight of 5,334 lbs. but it turns out that its GVWR is 6,768 pounds hence it qualifies for the Section 179 deduction.

That said, if you buy or lease a Model X and use it 50% or more for business you could deduct up to $25,000 in depreciation in the first year you acquire the vehicle versus depreciating it over time. The rationale is that businesses are incentivized to take the tax deductions up front there by allowing them to invest more into the business, earlier.

Note that the Section 179 deduction applies to both new and used vehicles, although I think we’ll see few used Model Xs in 2016.

Lifestyle

Tesla Model S Plaid battles China’s 1500 hp monster Nurburgring monster, with surprising results

There is just something about Tesla’s tuning and refinement that makes raw specs seem not as game-changing.

The Tesla Model S Plaid has been around for some time. Today, it is no longer the world’s quickest four-door electric sedan, nor is it the most powerful. As per a recent video from motoring YouTube channel Carwow, however, it seems like the Model S Plaid is still more than a match for some of its newer and more powerful rivals.

The monster from China

The Xiaomi SU7 Ultra is nothing short of a monster. Just like the Model S Plaid, it features three motors. It also has 1,548 hp and 1,770 Nm of torque. It’s All Wheel Drive and weighs a hefty 2,360 kg. The vehicle, which costs just about the equivalent of £55,000, has been recorded setting an insane 7:04.957 at the Nurburgring, surpassing the previous record held by the Porsche Taycan Turbo GT.

For all intents and purposes, the Model S Plaid looked outgunned in Carwow’s test. The Model S Plaid is no slouch with its three motors that produce 1,020 hp and 1,420 Nm of torque. It’s also a bit lighter at 2,190 kg despite its larger size. However, as the Carwow host pointed out, the Model S Plaid holds a 7:25.231 record in the Nurburgring. Compared to the Xiaomi SU7 Ultra’s record, the Model S Plaid’s lap time is notably slower.

Real-world tests

As could be seen in Carwow’s drag races, however, Tesla’s tech wizardry with the Model S Plaid is still hard to beat. The two vehicles competed in nine races, and the older Model S Plaid actually beat its newer, more powerful counterpart from China several times. At one point in the race, the Xiaomi SU7 Ultra hit its power limit due to its battery’s temperature, but the Model S Plaid was still going strong.

The Model S Plaid was first teased five years ago, in September 2020 during Tesla’s Battery Day. Since then, cars like the Lucid Air Sapphire and the Xiaomi SU7 Ultra have been released, surpassing its specs. But just like the Model Y ended up being the better all-rounder compared to the BYD Sealion 7 and the MG IM6, there is just something about Tesla’s tuning and refinement that makes raw specs seem not as game-changing.

Check out Carwow’s Model S Plaid vs Xiaomi SU7 drag race video below.

Lifestyle

500-mile test proves why Tesla Model Y still humiliates rivals in Europe

On paper, the BYD Sealion 7 and MG IM6 promised standout capabilities against the Model Y.

BYD is seeing a lot of momentum in Europe, so much so that mainstream media has taken every opportunity to argue that the Chinese automaker has beaten Tesla in the region. But while BYD sales this year in Europe are rising and Tesla’s registrations remain challenged, the raw capabilities of vehicles like the Model Y are difficult to deny.

This was highlighted in a 500-mile challenge by What Car? magazine, which showed that the new Tesla Model Y is more efficient, cheaper to run, and more reliable than rivals like the BYD Sealion 7, and even the nearly 400 KW-charging MG IM6.

Range and charging promises

On paper, the BYD Sealion 7 and MG IM6 promised standout capabilities against the Model Y. The Sealion 7 had more estimated range and the IM6 promised significantly faster charging. When faced with real-world conditions, however, it was still the Model Y that proved superior.

During the 500-mile test, the BYD nearly failed to reach a charging stop, arriving with less range than its display projected, as noted in a CarUp report. MG fared better, but its charging speeds never reached its promised nearly-400 kW charging speed. Tesla’s Model Y, by comparison, managed energy calculations precisely and arrived at each stop without issue.

Tesla leads in areas that matter

Charging times from 25% to 80% showed that the MG was the fastest at 17 minutes, while Tesla and BYD were close at 28 and 29 minutes, respectively. Overall efficiency and cost told a different story, however. The Model Y consumed 19.4 kWh per 100 km, compared to 22.2 for MG and 23.9 for BYD. Over the full trip, Tesla’s charging costs totaled just £82 thanks to its supercharger network, far below BYD’s £130 and MG’s £119.

What Car? Magazine’s testers concluded that despite BYD’s rapid sales growth and the MG IM6’s seriously impressive charging speeds, Tesla remains the more compelling real-world choice. The Model Y just offers stability, efficiency, and a proven charging infrastructure through its Supercharging network. And as per the magazine’s hosts, the Model Y is even the cheapest car to own among the three that were tested.

Watch What Car? Magazine’s 500-mile test in the video below.

Lifestyle

Tesla Cybertruck slapped with world’s least intimidating ticket, and it’s pure cringe

One cannot help but cringe and feel second-hand embarrassment at the idea of a person just driving around with a stack of these babies.

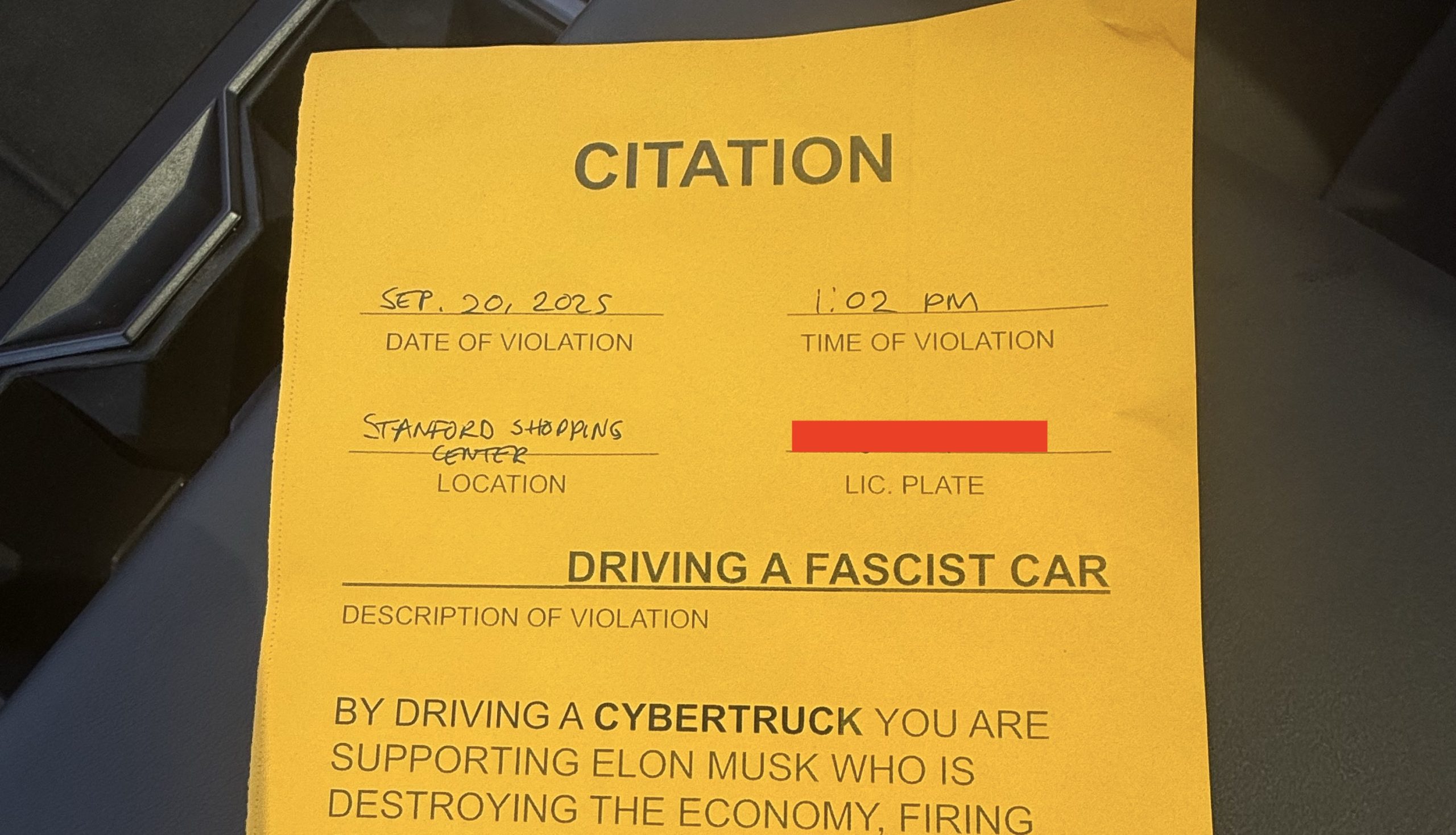

A Cybertruck parked at Stanford Shopping Center in California was recently hit with what might be the most try-hard piece of paper ever slipped under a wiper blade: a “fake citation” accusing the driver of supporting a “fascist car.”

The note, shared on X by Tesla staff program manager Ryan Torres, quickly made the rounds on X, where it quickly gained attention as an example of how not to protest.

The world’s least intimidating ticket

According to the citation, the supposed “violation” was “driving a fascist car.” The remedial action? Take the bus, call an Uber, or ride a bike. The note also dubbed Elon Musk a “chainsaw-wielding Nazi billionaire.” Now, protests against Tesla and Elon Musk have become commonplace this year, but one cannot help but cringe and feel second-hand embarrassment at the idea of a person just driving around with a stack of fake anti-Tesla/Musk citations.

Torres pointed out the irony himself in his post on X. Tesla currently employs over 140,000 Americans, and SpaceX has put the U.S. firmly back at the top of space technology. As Torres put it, maybe the person behind the world’s least intimidating ticket should “read a book on innovation before vandalizing” other people’s property.

Peak performative clownery

Not to mention that the fake ticket’s logic collapses under its own weight. EVs like the Cybertruck are literally designed to reduce emissions, not “destroy the economy.” If anything, Tesla has bolstered the United States’ economy by fueling jobs in engineering, manufacturing, and clean energy. It’s not the first time a Tesla has been the target of vandalism or politically charged notes, but this one stands out for sheer cringe value.

Torres summed it up neatly: “Peak clownery.” On that point, at least, the citation earns full marks. In a way, though, perhaps cringe fake tickets are not as bad as the literal firebombs that were being thrown at Tesla stores and cars earlier this year because some critics were gleefully misinformed about Elon Musk.