News

Tesla and other EV makers could see higher prices for battery materials in 2022

Tesla recently made history by being the first automaker to hit a market cap of over $1 trillion. This all but proved that the electric vehicle transition is here, and EVs are here to stay. With the automotive industry seemingly now waking up to the notion that a shift to electric cars is inevitable, however, a shift in the battery industry seems to be happening.

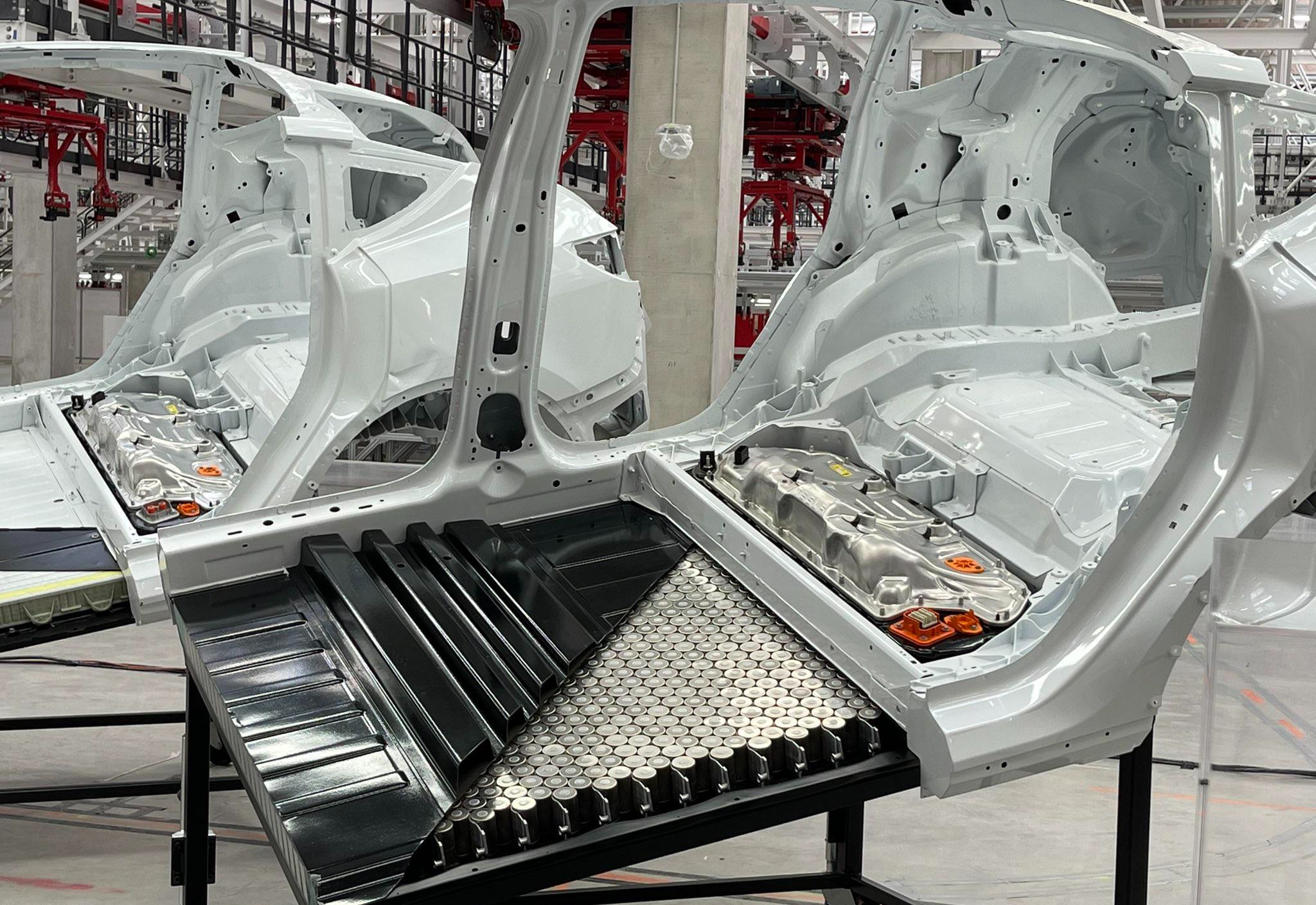

Batteries for electric vehicles are now seeing a price hike in China, with the cost of raw materials such as lithium seeing a substantial increase in price. With this trend in mind, industry research group Benchmark Mineral Intelligence (BMI) noted in a recent report that electric vehicles may face rising battery costs in the coming year.

What is interesting is that the price hike of battery materials is happening while the industry is becoming more and more prolific. Expectations for electric car batteries have long pointed to the idea that high-performance batteries should decrease in price over time as economies of scale accompany an expanding EV market. And in previous years, this has generally been the case. As per BMI chief executive Simon Moores, however, the price hikes for raw materials in China could end up raising battery prices instead.

Moores noted that if Korean and Japanese battery makers such as LG and Panasonic follow China’s lead, the price of batteries using nickel, cobalt, and manganese cathodes could rise to about $115 per kWh next year. The BMI chief executive noted that this year, nickel, cobalt, and manganese cathodes are already at $105 per kWh. “The market may have to reposition itself for a period of rising battery cell prices, a new phenomenon for an industry conditioned to expect year-on-year falls,” Moores stated.

In a way, the rising prices of battery raw materials from China could be seen as a response to strong demand. As stronger than expected demand outstripped supply in China, for example, Benchmark Mineral Intelligence found that the price of lithium carbonate jumped by over 300% over the past year to $28,675 per tonne as of mid-October. Other raw materials such as nickel sulfate and cobalt hydroxide have also seen steep price increases this year.

The apparent rising costs in battery materials could prove to be a challenge for automakers that are looking to ramp their electric vehicle business next year. The coming year would likely see numerous prolific electric cars being launched and ramped, such as the Ford F-150 Lightning, the Rivian R1S, and the Tesla Cybertruck. It would then be interesting how each respective automaker responds to rising battery costs. Tesla is already putting in a lot of effort to secure key materials for its vehicles’ batteries through independent deals with mining companies across the globe. One can only hope that other EV makers are doing the same.

Don’t hesitate to contact us with news tips. Just send a message to tips@teslarati.com to give us a heads up.

Cybertruck

Tesla Cybertruck’s newest trim will undergo massive change in ten days, Musk says

It appears as if the new All-Wheel-Drive trim of Cybertruck won’t be around for too long, however. Elon Musk revealed this morning that it will be around “only for the next 10 days.”

Tesla’s new Cybertruck trim has already gotten the axe from CEO Elon Musk, who said the All-Wheel-Drive configuration of the all-electric pickup will only be available “for the next ten days.”

Musk could mean the price, which is $59,990, or the availability of the trim altogether.

Last night, Tesla launched the All-Wheel-Drive configuration of the Cybertruck, a pickup that comes in at less than $60,000 and features a competitive range and features that are not far off from the offerings of the premium trim.

Tesla launches new Cybertruck trim with more features than ever for a low price

It was a nice surprise from Tesla, considering that last year, it offered a Rear-Wheel-Drive trim of the Cybertruck that only lasted a few months. It had extremely underwhelming demand because it was only $10,000 cheaper than the next trim level up, and it was missing a significant number of premium features.

Simply put, it was not worth the money. Tesla killed the RWD Cybertruck just a few months after offering it.

With the news that Tesla was offering this All-Wheel-Drive configuration of the Cybertruck, many fans and consumers were encouraged. The Cybertruck has been an underwhelming seller, and this seemed to be a lot of truck for the price when looking at its features:

- Dual Motor AWD w/ est. 325 mi of range

- Powered tonneau cover

- Bed outlets (2x 120V + 1x 240V) & Powershare capability

- Coil springs w/ adaptive damping

- Heated first-row seats w/ textile material that is easy to clean

- Steer-by-wire & Four Wheel Steering

- 6’ x 4’ composite bed

- Towing capacity of up to 7,500 lbs

- Powered frunk

It appears as if this trim of Cybertruck won’t be around for too long, however. Musk revealed this morning that it will be around “only for the next 10 days.”

Only for the next 10 days https://t.co/82JnvZQGh2

— Elon Musk (@elonmusk) February 20, 2026

Musk could mean the price of the truck and not necessarily the ability to order it. However, most are taking it as a cancellation.

If it is, in fact, a short-term availability decision, it is baffling, especially as Tesla fans and analysts claim that metrics like quarterly deliveries are no longer important. This seems like a way to boost sales short-term, and if so many people are encouraged about this offering, why would it be kept around for such a short period of time?

Some are even considering the potential that Tesla axes the Cybertruck program as a whole. Although Musk said during the recent Q4 Earnings Call that Cybertruck would still be produced, the end of the Model S and Model X programs indicates Tesla might be prepared to do away with any low-volume vehicles that do not contribute to the company’s future visions of autonomy.

The decision to axe the car just ten days after making it available seems like a true head-scratcher.

Elon Musk

Elon Musk’s Neuralink sparks BCI race in China

One of the most prominent is NeuroXess, which launched in 2021 and is already testing implants in patients.

Neuralink, founded by Elon Musk, is helping spark a surge of brain-computer interface (BCI) development in China, where startups are moving quickly into human trials with strong state backing.

One of the most prominent is NeuroXess, which launched in 2021 and is already testing implants in patients.

Neuralink’s clinical work and public demonstrations have drawn worldwide attention to invasive brain implants that allow patients to control digital devices using their minds. The company is currently running a global clinical trial and is also busy preparing for its next product, Blindsight, which would restore vision to people with visual impairments.

Neuralink’s visibility has helped accelerate similar efforts in China. Beijing last year classified brain-computer interfaces as a strategic sector and issued a roadmap calling for two or three globally competitive companies by 2030, as per the Financial Times. Since February last year, at least 10 clinical trials for invasive brain chips have launched in the country.

NeuroXess recently reported that a paralyzed patient was able to control a computer cursor within five days of implantation. Founder Tiger Tao credited government support for helping shorten the path from research to trials.

Investment activity has followed the policy push. Industry data show dozens of financing rounds for Chinese BCI startups over the past year, reflecting rising capital interest in the field. Ultimately, while Neuralink remains one of the most closely watched players globally, its momentum has clearly energized competitors abroad.

News

Tesla Supercharger vandalized with frozen cables and anti-Musk imagery amid Sweden union dispute

The incident comes amid Tesla’s ongoing labor dispute with IF Metall.

Tesla’s Supercharger site in Vansbro, Sweden, was vandalized during peak winter travel weeks. Images shared to local media showed frozen charging cables and a banner reading “Go home Elon,” which was complete with a graphic of Musk’s controversial gesture.

The incident comes amid Tesla’s ongoing labor dispute with IF Metall, which has been striking against the company for more than two years over collective bargaining agreements, as noted in a report from Expressen.

Local resident Stefan Jakobsson said he arrived at the Vansbro charging station to find a board criticizing Elon Musk and accusing Tesla of strikebreaking. He also found the charging cables frozen after someone seemingly poured water over them.

“I laughed a little and it was pretty nicely drawn. But it was a bit unnecessary,” Jakobsson said. “They don’t have to do vandalism because they’re angry at Elon Musk.”

The site has seen heavy traffic during Sweden’s winter sports holidays, with travelers heading toward Sälen and other mountain destinations. Jakobsson said long lines formed last weekend, with roughly 50 Teslas and other EVs waiting to charge.

Tesla Superchargers in Sweden are typically open to other electric vehicle brands, making them a reliable option for all EV owners.

Tesla installed a generator at the location after sympathy strikes from other unions disrupted power supply to some stations. The generator itself was reportedly not working on the morning of the incident, though it is unclear whether that was connected to the protest.

The dispute between Tesla and IF Metall centers on the company’s refusal to sign a collective agreement covering Swedish workers. The strike has drawn support from other unions, including Seko, which has taken steps affecting electricity supply to certain Tesla facilities. Tesla Sweden, for its part, has insisted that its workers are already fairly compensated and it does not need a collective agreement,

Jesper Pettersson, press spokesperson for IF Metall, criticized Tesla’s use of generators to keep charging stations running. Still, IF Metall emphasized that it strongly distances itself from the vandalism incident at the Vansbro Supercharger.

“We think it is remarkable that instead of taking the easy route and signing a collective agreement for our members, they are choosing to use every possible means to get around the strike,” Pettersson said.