Investor's Corner

Elon Musk stands his ground against SEC as Tesla heads towards historic Q3

Tesla was rocked on Thursday after news emerged that the SEC has filed a lawsuit against CEO Elon Musk over his tweets last August stating that he was considering taking the company private at $420 per share, and that he had “funding secured.” As Tesla feels the fallout resulting from the SEC’s lawsuit, details of the commissions’ filing, including a failed settlement with Musk and his legal team, are coming to light.

It should be noted that Elon Musk himself is the only entity named in the SEC lawsuit, not Tesla as a company. No criminal charges against Musk have been put forward as well. Nevertheless, several of the company’s skeptics have welcomed the news. Former GM executive Bob Lutz, for one, who recently claimed that Tesla is “headed for the graveyard” since it has “no tech advantage, no software advantage, and no battery advantage” against established automakers, noted in an email to the Los Angeles Times that Musk is “toast.” The steep 9.9% drop during after-hours trading also weighed down on Tesla stock (NASDAQ:TSLA) heavily, ironically dealing damage to the company’s investors.

A report published by the Wall Street Journal outlines a rather unique set of events that led up to the SEC’s decision to file a suit against Elon Musk. According to individuals reportedly familiar with the matter, the SEC had actually crafted a settlement for Elon Musk that was approved by the agency’s commissioners. Musk’s legal team reportedly called SEC’s lawyers in San Francisco on Thursday, stating that they were no longer interested in proceeding with the settlement. With this, the SEC reportedly rushed to craft a complaint against Musk, which was filed later during the day.

The reasons behind Elon Musk’s decision to walk away from a settlement with the SEC are yet to be revealed, but by doing so, Musk has taken on what could very well be his most dangerous legal battle to date. The SEC, after all, is not only demanding that Musk pay civil penalties; the commission is also demanding that he be prohibited from acting as an officer or director of a publicly-traded company. Musk, for his part, gave a brief statement to CNBC regarding the SEC’s lawsuit against him.

“This unjustified action by the SEC leaves me deeply saddened and disappointed. I have always taken action in the best interests of truth, transparency, and investors. Integrity is the most important value in my life, and the facts will show I never compromised this in any way,” Musk said.

Tesla’s Board of Directors has issued a statement expressing its full support for Elon Musk. The board’s statement, while brief, emphasized that apart from standing behind the beleaguered CEO, Tesla is focused on its fundamentals, particularly the ongoing Model 3 production ramp. Following is the Telsa Board of Directors’ statement about the SEC filing.

“Tesla and the board of directors are fully confident in Elon, his integrity, and his leadership of the company, which has resulted in the most successful U.S. auto company in over a century. Our focus remains on the continued ramp of Model 3 production and delivering for our customers, shareholders, and employees.”

Considering that he opted to walk away from a settlement with the SEC, it appears that Elon Musk is once more choosing to pursue a more difficult path forward. Such tendencies are classic Elon Musk, though past announcements from the CEO do suggest that he foresaw adverse developments coming in Tesla’s direction. In a letter to the company’s employees earlier this month, for example, Musk urged employees to stand firm and focus on meeting its ambitious and self-imposed targets.

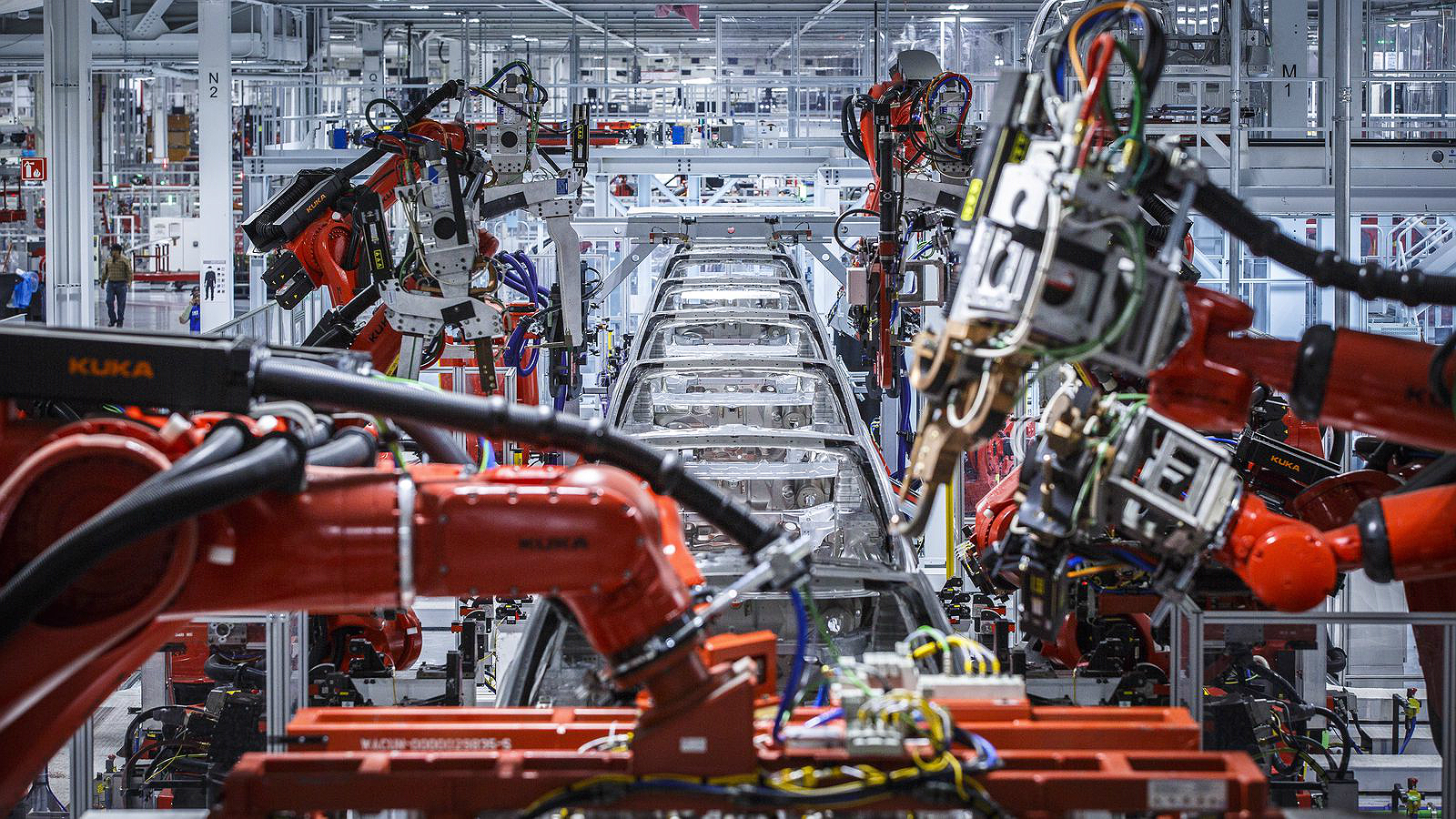

One of Tesla’s electric car assembly lines at its Fremont, CA factory.

“We are about to have the most amazing quarter in our history, building and delivering more than twice as many cars as we did last quarter. For a while, there will be a lot of fuss and noise in the media. Just ignore them. Results are what matter and we are creating the most mind-blowing growth in the history of the automotive industry,” Musk wrote.

Elon Musk’s statement in his letter to employees does not seem to be an exaggeration. In true Tesla fashion, the company is now in the process of delivering as many of its electric cars to as many reservation holders as possible. The Model 3 production ramp, which seems to have hit its stride since Tesla managed to hit its goal of producing 5,000 units per week at the end of Q2, appears to be going strong as well. Deliveries have also increased to the point where some owners of the company’s electric cars have volunteered to help out Tesla’s delivery centers by orienting new owners with the features and functions of their vehicles.

Tesla is aiming to produce and deliver more than 50,000 Model 3 this quarter. While such a number is ambitious, even longtime skeptics of the company such as Goldman Sachs analyst David Tamberrino have noted that Tesla’s production and delivery figures for Q3 2018 would likely be within the company’s target. Tesla board member Kimbal Musk also pointed out in a CNBC Closing Bell segment that “it’s really gonna blow people’s minds how many Model 3s are gonna appear in America in just the next couple of weeks.”

Investor's Corner

Tesla could save $2.5B by replacing 10% of staff with Optimus: Morgan Stanley

Jonas assigned each robot a net present value (NPV) of $200,000.

Tesla’s (NASDAQ:TSLA) near-term outlook may be clouded by political controversies and regulatory headwinds, but Morgan Stanley analyst Adam Jonas sees a glimmer of opportunity for the electric vehicle maker.

In a new note, the Morgan Stanley analyst estimated that Tesla could save $2.5 billion by replacing just 10% of its workforce with its Optimus robots, assigning each robot a net present value (NPV) of $200,000.

Morgan Stanley highlights Optimus’ savings potential

Jonas highlighted the potential savings on Tesla’s workforce of 125,665 employees in his note, suggesting that the utilization of Optimus robots could significantly reduce labor costs. The analyst’s note arrived shortly after Tesla reported Q2 2025 deliveries of 384,122 vehicles, which came close to Morgan Stanley’s estimate and slightly under the consensus of 385,086.

“Tesla has 125,665 employees worldwide (year-end 2024). On our calculations, a 10% substitution to humanoid at approximately ($200k NPV/humanoid) could be worth approximately $2.5bn,” Jonas wrote, as noted by Street Insider.

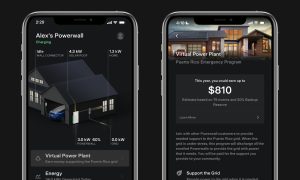

Jonas also issued some caution on Tesla Energy, whose battery storage deployments were flat year over year at 9.6 GWh. Morgan Stanley had expected Tesla Energy to post battery storage deployments of 14 GWh in the second quarter.

Musk’s political ambitions

The backdrop to Jonas’ note included Elon Musk’s involvement in U.S. politics. The Tesla CEO recently floated the idea of launching a new political party, following a poll on X that showed support for the idea. Though a widely circulated FEC filing was labeled false by Musk, the CEO does seem intent on establishing a third political party in the United States.

Jonas cautioned that Musk’s political efforts could divert attention and resources from Tesla’s core operations, adding near-term pressure on TSLA stock. “We believe investors should be prepared for further devotion of resources (financial, time/attention) in the direction of Mr. Musk’s political priorities which may add further near-term pressure to TSLA shares,” Jonas stated.

Investor's Corner

Two Tesla bulls share differing insights on Elon Musk, the Board, and politics

Two noted Tesla bulls have shared differing views on the recent activities of CEO Elon Musk and the company’s leadership.

Two noted Tesla (NASDAQ:TSLA) bulls have shared differing views on the recent activities of CEO Elon Musk and the company’s leadership.

While Wedbush analyst Dan Ives called on Tesla’s board to take concrete steps to ensure Musk remains focused on the EV maker, longtime Tesla supporter Cathie Wood of Ark Invest reaffirmed her confidence in the CEO and the company’s leadership.

Ives warns of distraction risk amid crucial growth phase

In a recent note, Ives stated that Tesla is at a critical point in its history, as the company is transitioning from an EV maker towards an entity that is more focused on autonomous driving and robotics. He then noted that the Board of Directors should “act now” and establish formal boundaries around Musk’s political activities, which could be a headwind on TSLA stock.

Ives laid out a three-point plan that he believes could ensure that the electric vehicle maker is led with proper leadership until the end of the decade. First off, the analyst noted that a new “incentive-driven pay package for Musk as CEO that increases his ownership of Tesla up to ~25% voting power” is necessary. He also stated that the Board should establish clear guidelines for how much time Musk must devote to Tesla operations in order to receive his compensation, and a dedicated oversight committee must be formed to monitor the CEO’s political activities.

Ives, however, highlighted that Tesla should move forward with Musk at its helm. “We urge the Board to act now and move the Tesla story forward with Musk as CEO,” he wrote, reiterating its Outperform rating on Tesla stock and $500 per share price target.

Tesla CEO Elon Musk has responded to Ives’ suggestions with a brief comment on X. “Shut up, Dan,” Musk wrote.

Cathie Wood reiterates trust in Musk and Tesla board

Meanwhile, Ark Investment Management founder Cathie Wood expressed little concern over Musk’s latest controversies. In an interview with Bloomberg Television, Wood said, “We do trust the board and the board’s instincts here and we stay out of politics.” She also noted that Ark has navigated Musk-related headlines since it first invested in Tesla.

Wood also pointed to Musk’s recent move to oversee Tesla’s sales operations in the U.S. and Europe as evidence of his renewed focus in the electric vehicle maker. “When he puts his mind on something, he usually gets the job done,” she said. “So I think he’s much less distracted now than he was, let’s say, in the White House 24/7,” she said.

TSLA stock is down roughly 25% year-to-date but has gained about 19% over the past 12 months, as noted in a StocksTwits report.

Investor's Corner

Cantor Fitzgerald maintains Tesla (TSLA) ‘Overweight’ rating amid Q2 2025 deliveries

Cantor Fitzgerald is holding firm on its bullish stance for the electric vehicle maker.

Cantor Fitzgerald is holding firm on its bullish stance for Tesla (NASDAQ: TSLA), reiterating its “Overweight” rating and $355 price target amidst the company’s release of its Q2 2025 vehicle delivery and production report.

Tesla delivered 384,122 vehicles in Q2 2025, falling below last year’s Q2 figure of 443,956 units. Despite softer demand in some countries in Europe and ongoing controversies surrounding CEO Elon Musk, the firm maintained its view that Tesla is a long-term growth story in the EV sector.

Tesla’s Q2 results

Among the 384,122 vehicles that Tesla delivered in the second quarter, 373,728 were Model 3 and Model Y. The remaining 10,394 units were attributed to the Model S, Model X, and Cybertruck. Production was largely flat year-over-year at 410,244 units.

In the energy division, Tesla deployed 9.6 GWh of energy storage in Q2, which was above last year’s 9.4 GWh. Overall, Tesla continues to hold a strong position with $95.7 billion in trailing twelve-month revenue and a 17.7% gross margin, as noted in a report from Investing.com.

Tesla’s stock is still volatile

Tesla’s market cap fell to $941 billion on Monday amid volatility that was likely caused in no small part by CEO Elon Musk’s political posts on X over the weekend. Musk has announced that he is forming the America Party to serve as a third option for voters in the United States, a decision that has earned the ire of U.S. President Donald Trump.

Despite Musk’s controversial nature, some analysts remain bullish on TSLA stock. Apart from Cantor Fitzgerald, Canaccord Genuity also reiterated its “Buy” rating on Tesla shares, with the firm highlighting the company’s positive Q2 vehicle deliveries, which exceeded its expectations by 24,000 units. Cannacord also noted that Tesla remains strong in several markets despite its year-over-year decline in deliveries.

-

Elon Musk1 day ago

Elon Musk1 day agoWaymo responds to Tesla’s Robotaxi expansion in Austin with bold statement

-

News1 day ago

News1 day agoTesla exec hints at useful and potentially killer Model Y L feature

-

Elon Musk2 days ago

Elon Musk2 days agoElon Musk reveals SpaceX’s target for Starship’s 10th launch

-

Elon Musk3 days ago

Elon Musk3 days agoTesla ups Robotaxi fare price to another comical figure with service area expansion

-

News1 day ago

News1 day agoTesla’s longer Model Y did not scale back requests for this vehicle type from fans

-

News1 day ago

News1 day ago“Worthy of respect:” Six-seat Model Y L acknowledged by Tesla China’s biggest rivals

-

News2 days ago

News2 days agoFirst glimpse of Tesla Model Y with six seats and extended wheelbase

-

Elon Musk2 days ago

Elon Musk2 days agoElon Musk confirms Tesla is already rolling out a new feature for in-car Grok