Teslas have garnered a reputation for many things, and having a great resale value is one of them. This was recently highlighted in a study conducted by car search engine iSeeCars.com, which analyzed over 6.9 million car sales to identify which vehicles experienced the most and least depreciation in the past three years. As it turns out, the Tesla Model 3 is able to retain its value over five times better than other EVs in the market.

As noted by iSeeCars in its recent study, a vehicle generally depreciates 39.1% after the average lease term of three years. According to iSeeCars CEO Phong Ly, three years is a popular age for used car buyers because vehicles would have taken a major depreciation hit by the three year mark, and the cars generally are equipped with a good amount of recent features.

“Three years is a popular age for used car buyers because the cars have taken a major depreciation hit, but likely have many of the latest modern safety and technology features. Some of these bargains provide good opportunities for car shoppers as reliable vehicles that are discounted because they simply aren’t as popular in their vehicle segments,” Ly noted.

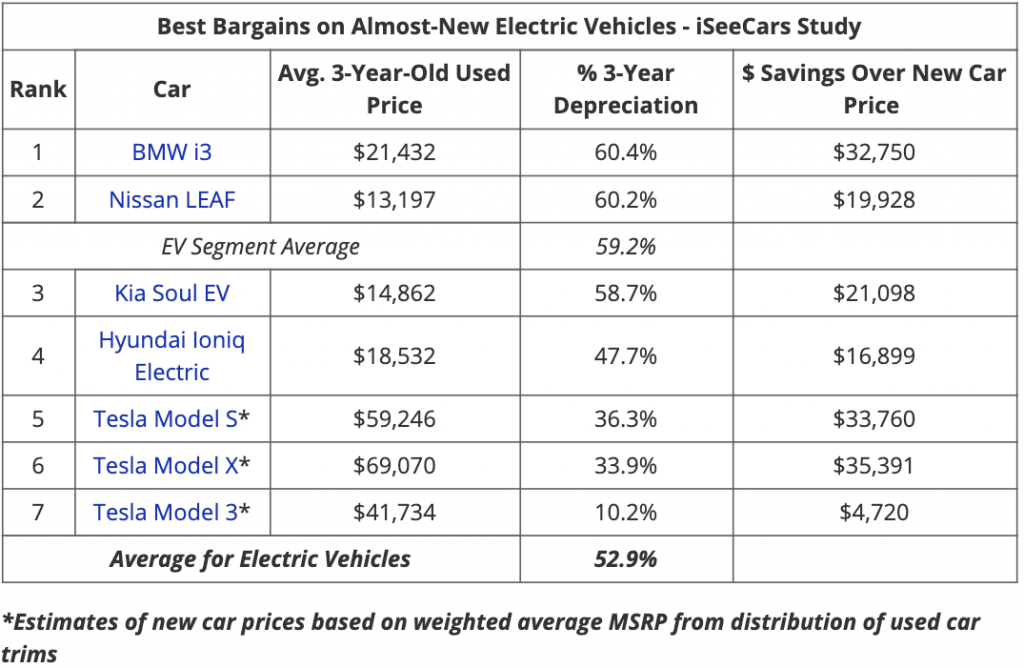

Electric vehicles usually depreciate faster than their internal combustion counterparts, with the study stating that the average depreciation of EVs over a three year lease period is about 52.9%. That’s almost 1.4 times greater than the average for all cars in the market. This, according to Ly, is partly because most EVs in the market today were bought with the $7,500 tax credit, and electric car technology moves at a rapid pace.

“Categorically, electric vehicles depreciate more than the average vehicle because resale values take into account the $7,500 federal tax credit and other state and local credits that were applied to these vehicles when they were bought new. Because the technology of EVs changes at a rapid pace, obsolescence also plays a role in their dramatic depreciation as well as consumer range anxiety and lack of public charging infrastructure,” the CEO explained.

This is particularly true for two of the most popular EVs from legacy automakers, the BMW i3 and the Nissan LEAF. According to the recent study, the BMW i3 depreciates 60.4% over a three year period, while the Nissan LEAF depreciates 60.2%. This trend, however, is completely broken by Tesla, whose Model S, Model X, and Model 3 depreciates far lower than the EV industry average. The Model S, for example, depreciates 36.3% over a three-year period, while the Model X depreciates 33.9%.

What is rather remarkable is that the Tesla Model 3, the electric car maker’s most affordable vehicle in its lineup today, retains its value even more than its more expensive siblings. According to iSeeCars.com’s data, the Model 3 only loses 10.2% of its value over a three year period. This means that the Model 3’s depreciation is over five times less than the EV industry’s average, and over three times less than the overall auto market’s average. Part of this, according to the study, is due to the Model 3’s bang for your buck nature.

“The Tesla Model 3 is still very much in high demand since it started production in 2017. Even though it doesn’t present a bargain compared to its new car price, it offers consumers a more affordable option for owning a Tesla,” the study noted.

There are other factors that are at play that help Teslas retain their value. Unlike other EVs on the market, Teslas receive frequent over the air software updates that give vehicles new features, and at times even better performance, over time. This allows even older Teslas to be comparable to their newly produced counterparts. Unfortunately for legacy automakers, over the air software updates are one thing that is proving to be quite difficult to crack.

News

Tesla Full Self-Driving (Supervised) v14.1.7 real-world drive and review

On an hour-long drive, we tested v14.1.7 and tested its new capabilities, which are mostly overall performance and smoothness fixes rather than integrations of new features that are unknown to routine FSD users.

Tesla started rolling out its Full Self-Driving (Supervised) v14.1.7 suite last night to owners, and there are several improvements to note within the new update that are at least the start of fixes to highly-mentioned issues.

On an hour-long drive, we tested v14.1.7 and tested its new capabilities, which are mostly overall performance and smoothness fixes rather than integrations of new features that are unknown to routine FSD users. However, there are a handful of shortcomings that are still present within the suite, which are not something that will be fixed within the span of a single update.

For what it is, Full Self-Driving does an excellent job of navigating — once you get it on its correct path. Our issues tend to be confined to navigation, routing, and the decision-making process that has to do with the way the car wants to get you to your destination. There were five things that happened on our first drive with v14.1.7 that are worth mentioning. The full drive will be available at the bottom of this article.

Navigation and Routing Still Seems to Be a Major Challenge

In past content, we’ve discussed the issues with routing and navigation, and how a Tesla chooses its path. Most noticeably, these issues occur in the same areas; for me, it’s my local Supercharger. My 2026 Model Y with AI4 continues to pick less-than-optimal routes out of the Supercharger, and in this instance, it actually chose to turn down a road, pull over, and give me the wheel, essentially asking, “Hey, can you get me on the right track here?”

This is still my biggest bone to pick with FSD, even more so than some of the bonehead moves it’s made in tougher scenarios (mostly parking lots with very limited visibility due to shrubs being planted in the worst possible locations). It’s rare that it happens, but this particular Supercharger has been a true thorn in the side of my Tesla.

This is not an issue that is confined to v14.1.7, or even v14 in general. Unfortunately, it is an issue that has persisted throughout my ownership experience, as well as during Demo Drives.

Still dealing with this Navigation/Routing issue. FSD still hasn’t figured out how to exit this Supercharger.

FSD chose to pull over and let me work it out of its predicament: pic.twitter.com/ZOIsA7eW2C— TESLARATI (@Teslarati) November 13, 2025

Stuttering and Hesitation at Intersections was Non-Existent

There was some confusion regarding my language in a recent article where I stated Tesla is confronting the issues that have been reported regarding the “stabbing” with braking.

“Tesla began the v14.1.4 launch last night, which included minor improvements and addressed brake-stabbing issues many owners have reported. In my personal experience, the stabbing has been awful on v14.1.3, and is a major concern.

However, many things have improved, and only a couple of minor issues have been recurring. Many of the issues v13 addressed are no longer an issue, so Tesla has made significant progress.”

It has undoubtedly improved, but it is not resolved.

With that being said, I did not feel a single example of hesitation, stabbing, or stuttering at a single intersection or instance when it has been present in the past. CEO Elon Musk said it would be fixed with v14.2, so it seems like Tesla is well on its way to resolving it.

Proper Handling of Crosswalks

It’s crazy how many people still do not stop for pedestrians at clearly-marked crosswalks. I had two instances of it happen during the drive, with FSD stopping for those pedestrians both times.

Human drivers did not stop either time:

Two instances of FSD stopping for pedestrians at crosswalks while human drivers proceed: pic.twitter.com/b4W7GXsXwH

— TESLARATI (@Teslarati) November 13, 2025

Handled Merging onto a Highway with an Inconsiderate Driver Well

Routinely, drivers will get over into the left lane, if they are able, to allow merging traffic to safely enter the freeway. It does not always happen this way, and it’s not required by law.

Not exclusive to v14.1.7, as many past iterations would have done this as well, but it was nice to watch the vehicle slow down to let that traffic pass. It then entered the freeway safely, and the entire maneuver was well done.

Not exclusive to v14.1.7, but just a great job of allowing highway traffic to pass before merging: pic.twitter.com/Hl9Hr0N5Jc

— TESLARATI (@Teslarati) November 13, 2025

Took an Appropriate Move with Oncoming Foot Traffic and Debris in a Tight Alleyway

This was probably the most on-edge I was during the drive because: 1) FSD chose to take an unnecessary alleyway, and 2) there was a box and oncoming pedestrians.

The car was aware of everything that was going on. In order to avoid the box, it would have had to turn toward the pedestrians, and in order to avoid the pedestrians, it would have had to turn into the box.

It chose to wait patiently, and after the pedestrians were past the car, FSD chose to proceed.

A patient FSD debates pedestrians and debris.

It chooses to not turn toward the humans or the box, instead waiting for a clear path to proceed. EXCELLENT and my favorite part of the drive pic.twitter.com/JNVxuxkhmn— TESLARATI (@Teslarati) November 13, 2025

Closing Thoughts

Overall, we’re very impressed with v14.1.7, and we think this is Tesla’s best iteration of the FSD suite yet, as it should be since it’s the newest version available. Tesla’s attention to detail regarding the brake stabbing is really well done, and it seems evident that a complete fix is on its way.

Other than the navigation issue at the very beginning, which was not an intervention, at least in my opinion, this was a really successful drive.

Elon Musk

Elon Musk debunks report claiming xAI raised $15 billion in funding round

xAI also responded with what appeared to be an automated reply, stating, “Legacy Media Lies.”

Elon Musk has debunked a report claiming his AI startup xAI had raised $15 billion from a funding round. Reports of the alleged funding round were initially reported by CNBC, which cited sources reportedly familiar with the matter.

CNBC’s report

The CNBC story cited unnamed sources that claimed that the new capital injection would help fund GPUs that xAI needs to train its large language model, Grok. The news outlet noted that following the funding round, xAI was valued at $200 billion.

Artificial intelligence startups have been raising funds from investors as of late. OpenAI raised $6.6 billion in October, valuing the startup at a staggering $500 billion. Reuters also reported last month that OpenAI was preparing for an IPO with a valuation of $1 trillion. Elon Musk’s xAI is looking to catch up and disrupt OpenAI, as well as its large language model, ChatGPT, which has become ubiquitous.

Elon Musk and xAI’s responses

In his response on X, Elon Musk simply stated that the CNBC story was “false.” He did not, however, explain if the whole premise of the publication’s article was fallacious, or if only parts of it were inaccurate.

Amusingly enough, xAI also issued a response when asked about the matter by Reuters, which also reported on the story. The artificial intelligence startup responded with what appeared to be an automated reply, which read, “Legacy Media Lies.”

xAI, founded in July 2023 as an alternative to OpenAI and Anthropic, has aggressively built out infrastructure to support its flagship products, including Grok and its recently launched Grokipedia platform. The company is developing its Colossus supercomputer in Memphis, which is heralded as one of the world’s largest supercomputer clusters.

News

Tesla reportedly testing Apple CarPlay integration: report

Citing insiders reportedly familiar with the matter, Bloomberg News claimed that CarPlay is being trialed by the EV maker internally.

Tesla is reportedly testing Apple’s CarPlay software for its vehicles, marking a major shift after years of resisting the tech giant’s ecosystem.

Citing insiders reportedly familiar with the matter, Bloomberg News claimed that CarPlay is being trialed by the EV maker internally. The move could help Tesla gain more market share, as surveys have shown many buyers consider CarPlay as an essential feature when choosing a car.

Not the usual CarPlay experience

Bloomberg claimed that Tesla’s tests involve a rather unique way to integrate CarPlay. Instead of replacing the vehicle’s entire infotainment display, Tesla’s integration will reportedly feature a CarPlay window on the infotainment system. This limited approach will ensure that Tesla’s own software, such as Full Self-Driving’s visuals, remains dominant.

The feature is expected to support wireless connectivity as well, bringing Tesla in line with other luxury automakers that already offer CarPlay. While plans remain fluid and may change before public release, the publication’s sources claimed that the rollout could happen within months.

A change of heart

Tesla has been reluctant to grant Apple access to its in-car systems, partly due to Elon Musk’s past criticism of the tech giant’s App Store policies and its poaching of Tesla engineers during the failed Apple Car project. Tesla’s in-house software is also deemed by numerous owners as a superior option to CarPlay, thanks to its sleek design and rich feature set.

With Apple’s retreat from building cars and Elon Musk’s relationship with Apple for X and Grok, however, the CEO’s stance on the tech giant seems to be improving. Overall, Tesla’s potential CarPlay integration would likely be appreciated by owners, as a McKinsey & Co. survey last year found that roughly one-third of buyers considered the lack of such systems a deal-breaker.

-

News6 days ago

News6 days agoTesla shares rare peek at Semi factory’s interior

-

Elon Musk6 days ago

Elon Musk6 days agoTesla says texting and driving capability is coming ‘in a month or two’

-

News5 days ago

News5 days agoTesla makes online ordering even easier

-

News5 days ago

News5 days agoTesla Model Y Performance set for new market entrance in Q1

-

News6 days ago

News6 days agoTesla Cybercab production starts Q2 2026, Elon Musk confirms

-

News6 days ago

News6 days agoTesla China expecting full FSD approval in Q1 2026: Elon Musk

-

News1 week ago

News1 week agoTesla Model Y Performance is rapidly moving toward customer deliveries

-

News4 days ago

News4 days agoTesla is launching a crazy new Rental program with cheap daily rates