News

Tesla China files 5 Model Y variants for MIIT approval, living up to its export hub title

Tesla recently filed to produce five Model Y variants in Giga Shanghai with China’s Ministry of Industry and Information Technology (MIIT). The filings hint that Giga Shanghai has indeed become Tesla’s main export hub.

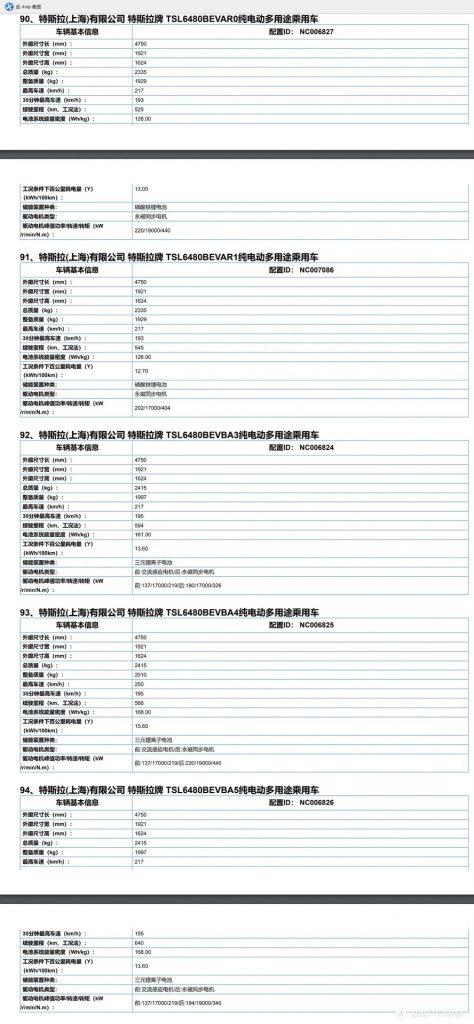

Tesla China submitted filings for two Standard Range Model Y variants, both of which are equipped with a 60 kWh battery pack. The company also filed for two Long Range Model Y versions, one of which is fitted with a 76.8 kWh battery and the other a 78.4 kWh pack. Filings for the Model Y Performance, which is also equipped with a 78.4 kWh battery, rounded out the set.

Based on the filings, Giga Shanghai will be producing Model Ys with lithium-ion batteries and lithium-iron-phosphate batteries as well. This should allow Tesla to take a varied approach that would be best for both the local and international market.

In Tesla’s Q2 2021 Update Letter, the company announced that Gigafactory Shanghai had fully transitioned into the company’s main export hub. Giga Shanghai reached an annualized vehicle production rate of 450,000 recently. Tesla China was already exporting vehicles to Europe at the time, but the announcement made Giga Shanghai’s role official. In Q3, Tesla plans to start Model Y deliveries to Europe.

Giga Shanghai will probably be producing most of the Model Ys sold in Europe for now because Giga Berlin is still no operational. Although, recently, a few Model Y bodies were spotted at Giga Berlin, speculated to be used for machine calibration at the factory. The Model Y officially arrived in Europe a few days ago and is expected to be presented to the Berlin press this month, as per BEV advocate @alex_avoigt.

Demand for the Model Y seems to be strong this quarter. Model Y delivery estimates reached as far back as September, just as Q3 started. So far, Tesla appears to be on track to beat its 2020 delivery guidance. The third quarter could solidify its victory this year.

The Teslarati team would appreciate hearing from you. If you have any tips, reach out to me at maria@teslarati.com or via Twitter @Writer_01001101.

Elon Musk

Elon Musk’s Boring Company opens Vegas Loop’s newest station

The Fontainebleau is the latest resort on the Las Vegas Strip to embrace the tunneling startup’s underground transportation system.

Elon Musk’s tunneling startup, The Boring Company, has welcomed its newest Vegas Loop station at the Fontainebleau Las Vegas.

The Fontainebleau is the latest resort on the Las Vegas Strip to embrace the tunneling startup’s underground transportation system.

Fontainebleau Loop station

The new Vegas Loop station is located on level V-1 of the Fontainebleau’s south valet area, as noted in a report from the Las Vegas Review-Journal. According to the resort, guests will be able to travel free of charge to the stations serving the Las Vegas Convention Center, as well as to Loop stations in Encore and Westgate.

The Fontainebleau station connects to the Riviera Station, which is located in the northwest parking lot of the convention center’s West Hall. From there, passengers will be able to access the greater Vegas Loop.

Vegas Loop expansion

In December, The Boring Company began offering Vegas Loop rides to and from Harry Reid International Airport. Those trips include a limited above-ground segment, following approval from the Nevada Transportation Authority to allow surface street travel tied to Loop operations.

Under the approval, airport rides are limited to no more than four miles of surface street travel, and each trip must include a tunnel segment. The Vegas Loop currently includes more than 10 miles of tunnels. From this number, about four miles of tunnels are operational.

The Boring Company President Steve Davis previously told the Review-Journal that the University Center Loop segment, which is currently under construction, is expected to open in the first quarter of 2026. That extension would allow Loop vehicles to travel beneath Paradise Road between the convention center and the airport, with a planned station located just north of Tropicana Avenue.

News

Tesla leases new 108k-sq ft R&D facility near Fremont Factory

The lease adds to Tesla’s presence near its primary California manufacturing hub as the company continues investing in autonomy and artificial intelligence.

Tesla has expanded its footprint near its Fremont Factory by leasing a 108,000-square-foot R&D facility in the East Bay.

The lease adds to Tesla’s presence near its primary California manufacturing hub as the company continues investing in autonomy and artificial intelligence.

A new Fremont lease

Tesla will occupy the entire building at 45401 Research Ave. in Fremont, as per real estate services firm Colliers. The transaction stands as the second-largest R&D lease of the fourth quarter, trailing only a roughly 115,000-square-foot transaction by Figure AI in San Jose.

As noted in a Silicon Valley Business Journal report, Tesla’s new Fremont lease was completed with landlord Lincoln Property Co., which owns the facility. Colliers stated that Tesla’s Fremont expansion reflects continued demand from established technology companies that are seeking space for engineering, testing, and specialized manufacturing.

Tesla has not disclosed which of its business units will be occupying the building, though Colliers has described the property as suitable for office and R&D functions. Tesla has not issued a comment about its new Fremont lease as of writing.

AI investments

Silicon Valley remains a key region for automakers as vehicles increasingly rely on software, artificial intelligence, and advanced electronics. Erin Keating, senior director of economics and industry insights at Cox Automotive, has stated that Tesla is among the most aggressive auto companies when it comes to software-driven vehicle development.

Other automakers have also expanded their presence in the area. Rivian operates an autonomy and core technology hub in Palo Alto, while GM maintains an AI center of excellence in Mountain View. Toyota is also relocating its software and autonomy unit to a newly upgraded property in Santa Clara.

Despite these expansions, Colliers has noted that Silicon Valley posted nearly 444,000 square feet of net occupancy losses in Q4 2025, pushing overall vacancy to 11.2%.

News

Tesla winter weather test: How long does it take to melt 8 inches of snow?

In Pennsylvania, we got between 10 and 12 inches of snow over the weekend as a nasty Winter storm ripped through a large portion of the country, bringing snow to some areas and nasty ice storms to others.

I have had a Model Y Performance for the week courtesy of Tesla, which got the car to me last Monday. Today was my last full day with it before I take it back to my local showroom, and with all the accumulation on it, I decided to run a cool little experiment: How long would it take for Tesla’s Defrost feature to melt 8 inches of snow?

Tesla’s Defrost feature is one of the best and most underrated that the car has in its arsenal. While every car out there has a defrost setting, Tesla’s can be activated through the Smartphone App and is one of the better-performing systems in my opinion.

It has come in handy a lot through the Fall and Winter, helping clear up my windshield more efficiently while also clearing up more of the front glass than other cars I’ve owned.

The test was simple: don’t touch any of the ice or snow with my ice scraper, and let the car do all the work, no matter how long it took. Of course, it would be quicker to just clear the ice off manually, but I really wanted to see how long it would take.

Tesla Model Y heat pump takes on Model S resistive heating in defrosting showdown

Observations

I started this test at around 10:30 a.m. It was still pretty cloudy and cold out, and I knew the latter portion of the test would get some help from the Sun as it was expected to come out around noon, maybe a little bit after.

I cranked it up and set my iPhone up on a tripod, and activated the Time Lapse feature in the Camera settings.

The rest of the test was sitting and waiting.

It didn’t take long to see some difference. In fact, by the 20-minute mark, there was some notable melting of snow and ice along the sides of the windshield near the A Pillar.

However, this test was not one that was “efficient” in any manner; it took about three hours and 40 minutes to get the snow to a point where I would feel comfortable driving out in public. In no way would I do this normally; I simply wanted to see how it would do with a massive accumulation of snow.

It did well, but in the future, I’ll stick to clearing it off manually and using the Defrost setting for clearing up some ice before the gym in the morning.

Check out the video of the test below:

❄️ How long will it take for the Tesla Model Y Performance to defrost and melt ONE FOOT of snow after a blizzard?

Let’s find out: pic.twitter.com/Zmfeveap1x

— TESLARATI (@Teslarati) January 26, 2026