Investor's Corner

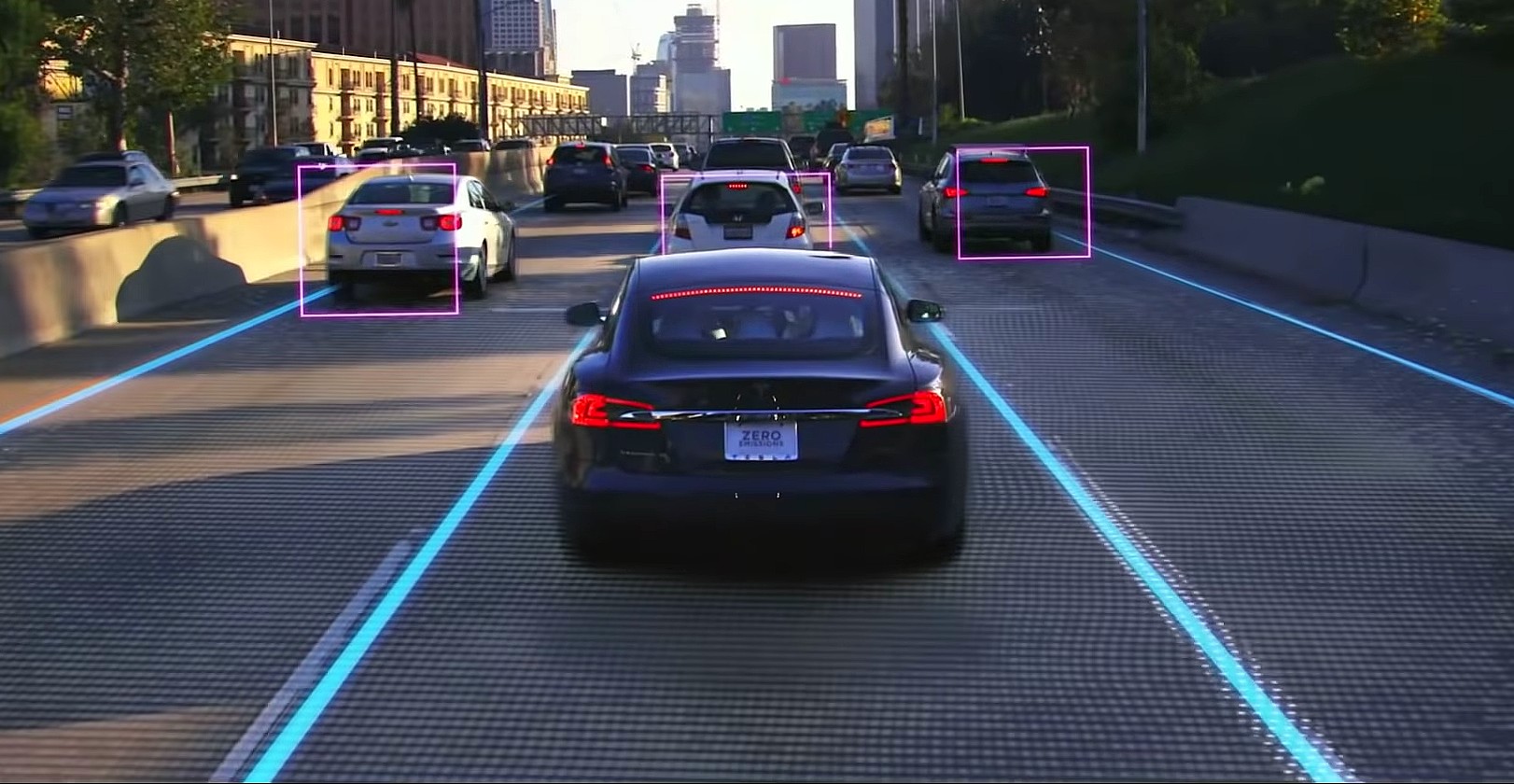

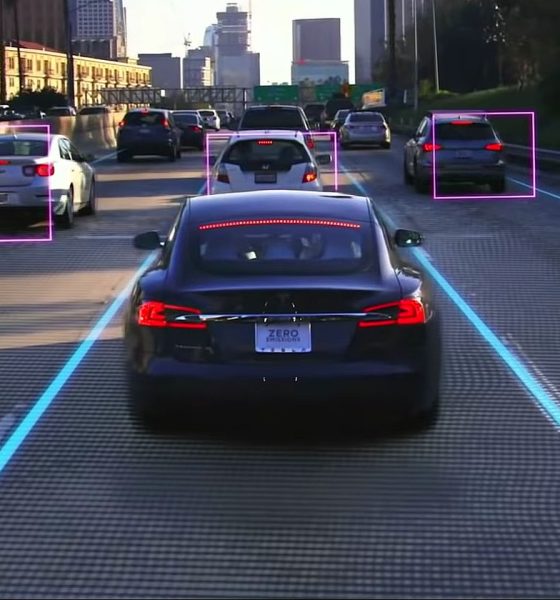

Tesla (TSLA) Robotaxi’s influence on price targets is already taking effect

Tesla (NASDAQ: TSLA) received a boosted price target from Morgan Stanley’s Adam Jonas this morning from $272 to $333. The new, raised outlook is based on Tesla’s Robotaxi fleet, which Jonas believes shows extreme upside potential for the automaker through the next ten years.

Jonas holds a 51% success rate and an average return of 8.8%, according to TipRanks.com.

In a note to investors, Jonas describes a new, more positive outlook for Tesla’s planned ridesharing service, which he believes shows tremendous potential compared to Morgan Stanley’s previous forecasts.

“We believe that the company is in a better position to deploy its ride-hail/transportation as a service business faster and more profitably than our previous forecast,” Jonas writes to investors in a note. “Reductions in the price of the car and battery, improvements in the EV charging infrastructure, insurance costs, residual value retention, and other factors have also increased the economic inputs of our Mobility model for Tesla.”

The announcement of Jonas’ price target boost comes just days after Tesla CEO Elon Musk announced that a Beta of the company’s Full Self-Driving suite would be released “in a few weeks.” It turns out that a very limited number of people will receive the capability on Tuesday, a day ahead of the company’s Q3 Earnings Call.

“Limited FSD beta releasing on Tuesday next week, as promised. This will, at first, be limited to a small number of people who are expert & careful drivers,” Musk said in a Tweet.

If the self-driving Beta program yields positive results, Tesla could launch its Robotaxi program before the end of the year, matching Musk’s expectations from early 2020, when he stated it would be ready by 2021. “I think we could see robotaxis in operation with network fleet next year. Not in all markets, but in some,” he said.

With Tesla’s record quarter in deliveries and production, Morgan Stanley also adjusted its forecast of how many cars will use the autonomous ride-hailing platform.

“We forecast a launch of 1,000 cars (from the existing fleet) in Tesla Mobility by 2021, rising to 500k cars by 2030, which would account for 2.7% of our Tesla global fleet estimate (18.6mm units) by that year. Our previous assumption for the Tesla Mobility fleet was 240k units by 2030,” Jonas wrote. “We assume $45,000 per cost car (vs. $60k previously) and a 7-year useful life, and other savings, driving our exit OP margin of Tesla mobility to 14.7% (10.4% previously). We use a 10% WACC (11% previously) and a 4% terminal growth rate (2% previously) implying an exit PE multiple of 17.3x (11.3x previously). Taken together, our valuation of Tesla Mobility rises to $42bn ($41/share) vs. $7.3bn ($7/share) previously.”

With increased production rates in the U.S., along with a new facility being built in Texas, Tesla will have more than enough opportunities to bring a new wave of ride-sharing to the United States. Eventually, the service will make an international debut, but this depends on regulatory permissions that vary in each market.

Jonas’ $333 price target is met with a $716 bull case price target, and a $108 bear case.

At the time of writing, TSLA shares were trading at $452.45, up about .8% for the session.

Disclaimer: Joey Klender is a TSLA Shareholder.

Elon Musk

Tesla stock gets latest synopsis from Jim Cramer: ‘It’s actually a robotics company’

“Turns out it’s actually a robotics and Cybercab company, and I want to buy, buy, buy. Yes, Tesla’s the paper that turned into scissors in one session,” Cramer said.

Tesla stock (NASDAQ: TSLA) got its latest synopsis from Wall Street analyst Jim Cramer, who finally realized something that many fans of the company have known all along: it’s not a car company. Instead, it’s a robotics company.

In a recent note that was released after Tesla reported Earnings in late January, Cramer seemed to recognize that the underwhelming financials and overall performance of the automotive division were not representative of the current state of affairs.

Instead, we’re seeing a company transition itself away from its early identity, essentially evolving like a caterpillar into a butterfly.

The narrative of the Earnings Call was simple: We’re not a car company, at least not from a birds-eye view. We’re an AI and Robotics company, and we are transitioning to this quicker than most people realize.

Tesla stock gets another analysis from Jim Cramer, and investors will like it

Tesla’s Q4 Earnings Call featured plenty of analysis from CEO Elon Musk and others, and some of the more minor details of the call were even indicative of a company that is moving toward AI instead of its cars. For example, the Model S and Model X will be no more after Q2, as Musk said that they serve relatively no purpose for the future.

Instead, Tesla is shifting its focus to the vehicles catered for autonomy and its Robotaxi and self-driving efforts.

Cramer recognizes this:

“…we got results from Tesla, which actually beat numbers, but nobody cares about the numbers here, as electric vehicles are the past. And according to CEO Elon Musk, the future of this company comes down to Cybercabs and humanoid robots. Stock fell more than 3% the next day. That may be because their capital expenditures budget was higher than expected, or maybe people wanted more details from the new businesses. At this point, I think Musk acolytes might be more excited about SpaceX, which is planning to come public later this year.”

He continued, highlighting the company’s true transition away from vehicles to its Cybercab, Optimus, and AI ambitions:

“I know it’s hard to believe how quickly this market can change its attitude. Last night, I heard a disastrous car company speak. Turns out it’s actually a robotics and Cybercab company, and I want to buy, buy, buy. Yes, Tesla’s the paper that turned into scissors in one session. I didn’t like it as a car company. Boy, I love it as a Cybercab and humanoid robot juggernaut. Call me a buyer and give me five robots while I’m at it.”

Cramer’s narrative seems to fit that of the most bullish Tesla investors. Anyone who is labeled a “permabull” has been echoing a similar sentiment over the past several years: Tesla is not a car company any longer.

Instead, the true focus is on the future and the potential that AI and Robotics bring to the company. It is truly difficult to put Tesla shares in the same group as companies like Ford, General Motors, and others.

Tesla shares are down less than half a percent at the time of publishing, trading at $423.69.

Elon Musk

Tesla to a $100T market cap? Elon Musk’s response may shock you

There are a lot of Tesla bulls out there who have astronomical expectations for the company, especially as its arm of reach has gone well past automotive and energy and entered artificial intelligence and robotics.

However, some of the most bullish Tesla investors believe the company could become worth $100 trillion, and CEO Elon Musk does not believe that number is completely out of the question, even if it sounds almost ridiculous.

To put that number into perspective, the top ten most valuable companies in the world — NVIDIA, Apple, Alphabet, Microsoft, Amazon, TSMC, Meta, Saudi Aramco, Broadcom, and Tesla — are worth roughly $26 trillion.

Will Tesla join the fold? Predicting a triple merger with SpaceX and xAI

Cathie Wood of ARK Invest believes the number is reasonable considering Tesla’s long-reaching industry ambitions:

“…in the world of AI, what do you have to have to win? You have to have proprietary data, and think about all the proprietary data he has, different kinds of proprietary data. Tesla, the language of the road; Neuralink, multiomics data; nobody else has that data. X, nobody else has that data either. I could see $100 trillion. I think it’s going to happen because of convergence. I think Tesla is the leading candidate [for $100 trillion] for the reason I just said.”

Musk said late last year that all of his companies seem to be “heading toward convergence,” and it’s started to come to fruition. Tesla invested in xAI, as revealed in its Q4 Earnings Shareholder Deck, and SpaceX recently acquired xAI, marking the first step in the potential for a massive umbrella of companies under Musk’s watch.

SpaceX officially acquires xAI, merging rockets with AI expertise

Now that it is happening, it seems Musk is even more enthusiastic about a massive valuation that would swell to nearly four-times the value of the top ten most valuable companies in the world currently, as he said on X, the idea of a $100 trillion valuation is “not impossible.”

It’s not impossible

— Elon Musk (@elonmusk) February 6, 2026

Tesla is not just a car company. With its many projects, including the launch of Robotaxi, the progress of the Optimus robot, and its AI ambitions, it has the potential to continue gaining value at an accelerating rate.

Musk’s comments show his confidence in Tesla’s numerous projects, especially as some begin to mature and some head toward their initial stages.

Elon Musk

Tesla director pay lawsuit sees lawyer fees slashed by $100 million

The ruling leaves the case’s underlying settlement intact while significantly reducing what the plaintiffs’ attorneys will receive.

The Delaware Supreme Court has cut more than $100 million from a legal fee award tied to a shareholder lawsuit challenging compensation paid to Tesla directors between 2017 and 2020.

The ruling leaves the case’s underlying settlement intact while significantly reducing what the plaintiffs’ attorneys will receive.

Delaware Supreme Court trims legal fees

As noted in a Bloomberg Law report, the case targeted pay granted to Tesla directors, including CEO Elon Musk, Oracle founder Larry Ellison, Kimbal Musk, and Rupert Murdoch. The Delaware Chancery Court had awarded $176 million to the plaintiffs. Tesla’s board must also return stock options and forego years worth of pay.

As per Chief Justice Collins J. Seitz Jr. in an opinion for the Delaware Supreme Court’s full five-member panel, however, the decision of the Delaware Chancery Court to award $176 million to a pension fund’s law firm “erred by including in its financial benefit analysis the intrinsic value” of options being returned by Tesla’s board.

The justices then reduced the fee award from $176 million to $70.9 million. “As we measure it, $71 million reflects a reasonable fee for counsel’s efforts and does not result in a windfall,” Chief Justice Seitz wrote.

Other settlement terms still intact

The Supreme Court upheld the settlement itself, which requires Tesla’s board to return stock and options valued at up to $735 million and to forgo three years of additional compensation worth about $184 million.

Tesla argued during oral arguments that a fee award closer to $70 million would be appropriate. Interestingly enough, back in October, Justice Karen L. Valihura noted that the $176 award was $60 million more than the Delaware judiciary’s budget from the previous year. This was quite interesting as the case was “settled midstream.”

The lawsuit was brought by a pension fund on behalf of Tesla shareholders and focused exclusively on director pay during the 2017–2020 period. The case is separate from other high-profile compensation disputes involving Elon Musk.