Energy

Tesla's Virtual Power Plant rescues grid after coal peaker fails, and it's only 2% finished

Tesla’s Virtual Power Plant project in South Australia is only around ~2% complete, but it is already proving to be a difference-maker, rescuing Queensland’s grid during an unexpected power outage. The response time and efficiency of the Virtual Power Plant mirror that of Tesla’s other large-scale energy project in the region, the highly-acclaimed Hornsdale Power Reserve.

Back in October, Queensland’s Kogan Creek coal power station, one of the largest in the region, tripped and caused the power system to drop well below the normal level of system frequency. Tesla’s Virtual Power Plant promptly stepped in, detecting the frequency drop and injecting power into the grid from Powerwall batteries loaded with energy from solar panels installed in SA Housing Trust properties across the state.

In a statement about the VPP’s feat, South Australia Energy Minister Dan van Holst Pellekaan highlighted the fact that Tesla’s Virtual Power Plant is still in its early days. Despite this, it was able to respond quickly. The feat was no joke, considering that the Kogan Creek station is a fairly large coal power plant. “Although the Virtual Power Plant is in its early days, it is already demonstrating how it can provide the network support traditionally performed by large conventional generators,” he said.

The Energy Minister’s statement is notable, considering that there are only about 900 homes forming the Virtual Power Plant as of date. Tesla’s target for the full VPP is a whopping 50,000 solar-powered, Powerwall-equipped homes. If less than 2% of the planned Virtual Power Plant can already rescue Queensland’s grid when a large coal plant fails, one can only imagine how much stability a fully-completed VPP could accomplish.

Violette Mouchaileh, the executive general manager of emerging markets and services for the Australian Energy Market Operator (AEMO), expressed her optimism about the potential of Tesla’s Virtual Power Plant. “The SA VPP has proven the aggregation of distributed energy resources can benefit the power system and participating consumers. The opportunity for VPPs to reach a large scale will benefit all energy users through added competition to deliver services at reducing prices. We encourage more VPPS to register to accelerate the shared learning on how to safely and efficiently integrate, operate and regulate these emerging technologies into the NEM,” she said.

The buildout of Tesla’s Virtual Power Plant in South Australia is expected to be completed in three phases. In Phase 1, energy systems will be delivered to 100 SA Housing properties. Phase 2 increases this number with an additional 1,000 homes equipped with solar panels and Powerwall batteries. Phase 3, provided that it does push through, would expand the system to 50,000 homes. So far, Phase 1 has been completed, and Phase 2 appears to be nearing completion as well.

Once complete, Tesla’s Virtual Power Plant in South Australia will deliver 250MW of solar energy and store 650 MWh of backup energy for the region. That’s notably larger than the Hornsdale Power Reserve, which is already changing South Australia’s energy landscape with its 100MW/129MWh capacity. In a way, Tesla’s Virtual Power Plant may prove to be a dark horse for the company’s Energy Business, which is unfortunately underestimated most of the time. Couple this with the 50% expansion of the Hornsdale Power Reserve, and Tesla Energy might very well be poised to surprise in the coming quarters.

Energy

Tesla launches Cybertruck vehicle-to-grid program in Texas

The initiative was announced by the official Tesla Energy account on social media platform X.

Tesla has launched a vehicle-to-grid (V2G) program in Texas, allowing eligible Cybertruck owners to send energy back to the grid during high-demand events and receive compensation on their utility bills.

The initiative, dubbed Powershare Grid Support, was announced by the official Tesla Energy account on social media platform X.

Texas’ Cybertruck V2G program

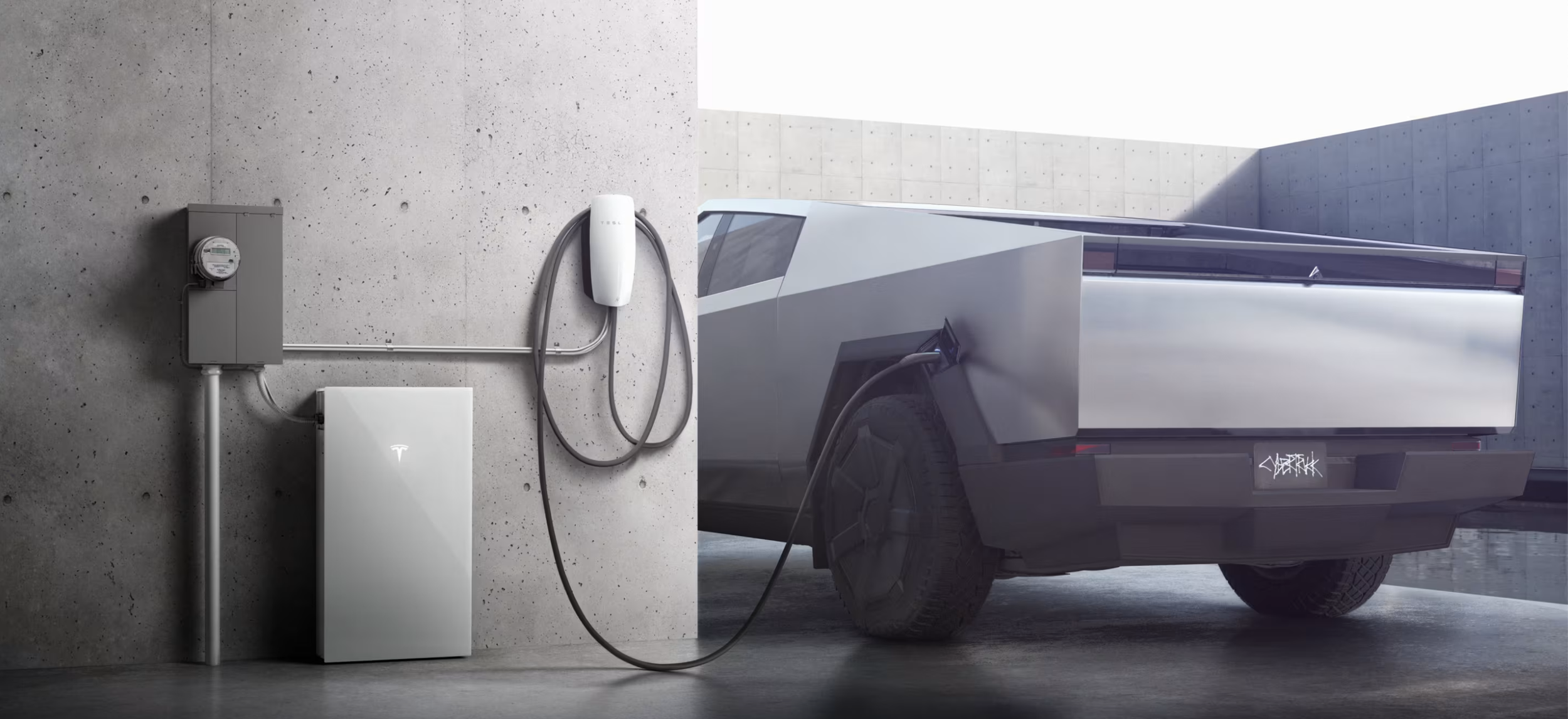

In its post on X, Tesla Energy confirmed that vehicle-to-grid functionality is “coming soon,” starting with select Texas markets. Under the new Powershare Grid Support program, owners of the Cybertruck equipped with Powershare home backup hardware can opt in through the Tesla app and participate in short-notice grid stress events.

During these events, the Cybertruck automatically discharges excess energy back to the grid, supporting local utilities such as CenterPoint Energy and Oncor. In return, participants receive compensation in the form of bill credits. Tesla noted that the program is currently invitation-only as part of an early adopter rollout.

The launch builds on the Cybertruck’s existing Powershare capability, which allows the vehicle to provide up to 11.5 kW of power for home backup. Tesla added that the program is expected to expand to California next, with eligibility tied to utilities such as PG&E, SCE, and SDG&E.

Powershare Grid Support

To participate in Texas, Cybertruck owners must live in areas served by CenterPoint Energy or Oncor, have Powershare equipment installed, enroll in the Tesla Electric Drive plan, and opt in through the Tesla app. Once enrolled, vehicles would be able to contribute power during high-demand events, helping stabilize the grid.

Tesla noted that events may occur with little notice, so participants are encouraged to keep their Cybertrucks plugged in when at home and to manage their discharge limits based on personal needs. Compensation varies depending on the electricity plan, similar to how Powerwall owners in some regions have earned substantial credits by participating in Virtual Power Plant (VPP) programs.

Cybertruck

Tesla updates Cybertruck owners about key Powershare feature

Tesla is updating Cybertruck owners on its timeline of a massive feature that has yet to ship: Powershare with Powerwall.

Powershare is a bidirectional charging feature exclusive to Cybertruck, which allows the vehicle’s battery to act as a portable power source for homes, appliances, tools, other EVs, and more. It was announced in late 2023 as part of Tesla’s push into vehicle-to-everything energy sharing, and acting as a giant portable charger is the main advantage, as it can provide backup power during outages.

Cybertruck’s Powershare system supports both vehicle-to-load (V2L) and vehicle-to-home (V2H), making it flexible and well-rounded for a variety of applications.

However, even though the feature was promised with Cybertruck, it has yet to be shipped to vehicles. Tesla communicated with owners through email recently regarding Powershare with Powerwall, which essentially has the pickup act as an extended battery.

Powerwall discharge would be prioritized before tapping into the truck’s larger pack.

However, Tesla is still working on getting the feature out to owners, an email said:

“We’re writing to let you know that the Powershare with Powerwall feature is still in development and is now scheduled for release in mid-2026.

This new release date gives us additional time to design and test this feature, ensuring its ability to communicate and optimize energy sharing between your vehicle and many configurations and generations of Powerwall. We are also using this time to develop additional Powershare features that will help us continue to accelerate the world’s transition to sustainable energy.”

Owners have expressed some real disappointment in Tesla’s continuous delays in releasing the feature, as it was expected to be released by late 2024, but now has been pushed back several times to mid-2026, according to the email.

Foundation Series Cybertruck buyers paid extra, expecting the feature to be rolled out with their vehicle upon pickup.

Cybertruck’s Lead Engineer, Wes Morrill, even commented on the holdup:

As a Cybertruck owner who also has Powerwall, I empathize with the disappointed comments.

To their credit, the team has delivered powershare functionality to Cybertruck customers who otherwise have no backup with development of the powershare gateway. As well as those with solar…

— Wes (@wmorrill3) December 12, 2025

He said that “it turned out to be much harder than anticipated to make powershare work seamlessly with existing Powerwalls through existing wall connectors. Two grid-forming devices need to negotiate who will form and who will follow, depending on the state of charge of each, and they need to do this without a network and through multiple generations of hardware, and test and validate this process through rigorous certifications to ensure grid safety.”

It’s nice to see the transparency, but it is justified for some Cybertruck owners to feel like they’ve been bait-and-switched.

Energy

Tesla starts hiring efforts for Texas Megafactory

Tesla’s Brookshire site is expected to produce 10,000 Megapacks annually, equal to 40 gigawatt hours of energy storage.

Tesla has officially begun hiring for its new $200 million Megafactory in Brookshire, Texas, a manufacturing hub expected to employ 1,500 people by 2028. The facility, which will build Tesla’s grid-scale Megapack batteries, is part of the company’s growing energy storage footprint.

Tesla’s hiring efforts for the Texas Megafactory are hinted at by the job openings currently active on the company’s Careers website.

Tesla’s Texas Megafactory

Tesla’s Brookshire site is expected to produce 10,000 Megapacks annually, equal to 40 gigawatt hours of energy storage, similar to the Lathrop Megafactory in California. Tesla’s Careers website currently lists over 30 job openings for the site, from engineers, welders, and project managers. Each of the openings is listed for Brookshire, Texas.

The company has leased two buildings in Empire West Business Park, with over $194 million in combined property and equipment investment. Tesla’s agreement with Waller County includes a 60% property tax abatement, contingent on meeting employment benchmarks: 375 jobs by 2026, 750 by 2027, and 1,500 by 2028, as noted in a report from the Houston Business Journal. Tesla is required to employ at least 1,500 workers in the facility through the rest of the 10-year abatement period.

Tesla’s clean energy boom

City officials have stated that Tesla’s arrival marks a turning point for the Texas city, as it highlights a shift from logistics to advanced clean energy manufacturing. Ramiro Bautista from Brookshire’s economic development office, highlighted this in a comment to the Journal.

“(Tesla) has great-paying jobs. Not just that, but the advanced manufacturing (and) clean energy is coming to the area,” he said. “So it’s not just your normal logistics manufacturing. This is advanced manufacturing coming to this area, and this brings a different type of job and investment into the local economy.”