Investor's Corner

Tesla (TSLA) Q2 2019 production and delivery report: What Wall St analysts are saying

Tesla stock (NASDAQ: TSLA) is surging on Wednesday on the heels of the release of the company’s Q2 2019 delivery and production report. With deliveries and production far exceeding forecasts from Wall St, several analysts have weighed in on the electric car maker’s record-setting quarter, which saw Tesla producing a total of 87,048 vehicles, comprised of 14,517 Model S and Model X, and 72,531 Model 3; and delivering a total of 95,200 cars, comprised of 17,650 Model S and X and 77,550 Model 3.

Morgan Stanley analyst Adam Jonas, who quoted a “worst case” $10 price target on TSLA stock back in May, admitted that despite the number of leaked Elon Musk emails and reports pointing to a record quarter, Tesla’s over 95,000 vehicle deliveries were unexpected. “We had not spoken to any investors that expected deliveries to be this high. We expect the stock to squeeze and then fade on this news,” Jonas wrote in a note. Nevertheless, the analyst still pointed out that continued concerns about “sustainable” demand and competition in regions such as China would likely weigh down the stock.

“It isn’t clear how much of the beat was due to underlying demand, more attractive pricing, sales bonuses, or pull-forward from (the) third quarter after tax credit reduction. Based on year-to-date deliveries, if Tesla achieves 95,000 units in the third and fourth quarters, it would take them to about 350,000 units for 2019, just shy of guidance of 360,000-400,000 units,” Jonas, who currently has an Equalweight rating on Tesla stock with a price target of $230 per share, noted.

Nomura analyst Christopher Eberle, who has a Neutral rating and a $300 price target for TSLA, also weighed in on the electric car maker’s Q2 results. “Tesla noted that orders generated during the quarter exceeded deliveries, implying the company enters 3Q19 with an increase in its backlog,” he stated. Eberle remained cautious, adjusting his third-quarter delivery estimate by just 5% to 80,000 units.

Joseph Osha of JMP Securities, who maintains a Market Perform rating and a $347 price target on the electric car maker, stated that he expects to see Tesla’s cash balance rise to $2.67 billion in the second quarter. Osha also argued that the second quarter results prove that the company’s lower-than-expected first quarter figures were not an indicator of real end demand in the United States. “Overall, the message we hear is that Tesla’s weak first quarter was not, in fact, an indicator of real end demand in the U.S. market. The combination of U.S. demand and export volume appears sufficient to support an outlook of ~380,000 deliveries this year, and our outlook for the second half of the year remains unchanged,” the analyst stated.

Wedbush Securities analyst Daniel Ives, who has a Neutral rating and a $230 price target on Tesla stock, noted that the company’s strong Q2 delivery numbers were “a clear step in the right direction,” which could help restore the credibility of Elon Musk’s story. Ives was among the most vocal critics of Tesla following its first-quarter results, at one point calling Q1’s results “one of (the) top debacles we have ever seen.” Ives also mocked Tesla for maintaining its optimistic forecast for the rest of 2019, stating that “Musk & Co., in an episode out of the Twilight Zone, act as if demand and profitability will magically return to the Tesla story.” Prior to the release of Tesla’s Q2 2019 production and delivery report, Ives expected the company to deliver 84,001 vehicles.

Goldman Sachs analyst David Tamberrino, one of TSLA’s most ardent critics who currently has a Sell rating and a $158 price target on the electric car maker, stood by his pessimistic outlook on the company. Tamberrino stated that “second-quarter deliveries and order flow were helped by the release of Tesla’s Standard Model 3 variant, right-hand drive Model 3s and the upcoming phasing out of U.S. tax incentives.” The Goldman Sachs analyst also expects a “sequential” stepdown in demand in the third quarter, on account of Tesla’s decision to offer lower-priced Model 3 variants and a leasing option, which he notes could have negative impacts on the vehicle’s gross margins and FCF generation. Interestingly, Tamberrino expected Tesla to deliver 91,124 vehicles in the second quarter (one of the highest on Wall Street, exceeding even that of Tesla bull and Baird analyst Ben Kallo), which is quite ironic considering his constant pessimistic stance against the electric car maker. Goldman Sachs’ investment bank is also among TSLA’s prominent shareholders.

As of writing, Tesla stock is trading +6.13% at $238.31 per share.

Disclosure: I have no ownership in shares of TSLA and have no plans to initiate any positions within 72 hours.

Elon Musk

Tesla to a $100T market cap? Elon Musk’s response may shock you

There are a lot of Tesla bulls out there who have astronomical expectations for the company, especially as its arm of reach has gone well past automotive and energy and entered artificial intelligence and robotics.

However, some of the most bullish Tesla investors believe the company could become worth $100 trillion, and CEO Elon Musk does not believe that number is completely out of the question, even if it sounds almost ridiculous.

To put that number into perspective, the top ten most valuable companies in the world — NVIDIA, Apple, Alphabet, Microsoft, Amazon, TSMC, Meta, Saudi Aramco, Broadcom, and Tesla — are worth roughly $26 trillion.

Will Tesla join the fold? Predicting a triple merger with SpaceX and xAI

Cathie Wood of ARK Invest believes the number is reasonable considering Tesla’s long-reaching industry ambitions:

“…in the world of AI, what do you have to have to win? You have to have proprietary data, and think about all the proprietary data he has, different kinds of proprietary data. Tesla, the language of the road; Neuralink, multiomics data; nobody else has that data. X, nobody else has that data either. I could see $100 trillion. I think it’s going to happen because of convergence. I think Tesla is the leading candidate [for $100 trillion] for the reason I just said.”

Musk said late last year that all of his companies seem to be “heading toward convergence,” and it’s started to come to fruition. Tesla invested in xAI, as revealed in its Q4 Earnings Shareholder Deck, and SpaceX recently acquired xAI, marking the first step in the potential for a massive umbrella of companies under Musk’s watch.

SpaceX officially acquires xAI, merging rockets with AI expertise

Now that it is happening, it seems Musk is even more enthusiastic about a massive valuation that would swell to nearly four-times the value of the top ten most valuable companies in the world currently, as he said on X, the idea of a $100 trillion valuation is “not impossible.”

It’s not impossible

— Elon Musk (@elonmusk) February 6, 2026

Tesla is not just a car company. With its many projects, including the launch of Robotaxi, the progress of the Optimus robot, and its AI ambitions, it has the potential to continue gaining value at an accelerating rate.

Musk’s comments show his confidence in Tesla’s numerous projects, especially as some begin to mature and some head toward their initial stages.

Elon Musk

Tesla director pay lawsuit sees lawyer fees slashed by $100 million

The ruling leaves the case’s underlying settlement intact while significantly reducing what the plaintiffs’ attorneys will receive.

The Delaware Supreme Court has cut more than $100 million from a legal fee award tied to a shareholder lawsuit challenging compensation paid to Tesla directors between 2017 and 2020.

The ruling leaves the case’s underlying settlement intact while significantly reducing what the plaintiffs’ attorneys will receive.

Delaware Supreme Court trims legal fees

As noted in a Bloomberg Law report, the case targeted pay granted to Tesla directors, including CEO Elon Musk, Oracle founder Larry Ellison, Kimbal Musk, and Rupert Murdoch. The Delaware Chancery Court had awarded $176 million to the plaintiffs. Tesla’s board must also return stock options and forego years worth of pay.

As per Chief Justice Collins J. Seitz Jr. in an opinion for the Delaware Supreme Court’s full five-member panel, however, the decision of the Delaware Chancery Court to award $176 million to a pension fund’s law firm “erred by including in its financial benefit analysis the intrinsic value” of options being returned by Tesla’s board.

The justices then reduced the fee award from $176 million to $70.9 million. “As we measure it, $71 million reflects a reasonable fee for counsel’s efforts and does not result in a windfall,” Chief Justice Seitz wrote.

Other settlement terms still intact

The Supreme Court upheld the settlement itself, which requires Tesla’s board to return stock and options valued at up to $735 million and to forgo three years of additional compensation worth about $184 million.

Tesla argued during oral arguments that a fee award closer to $70 million would be appropriate. Interestingly enough, back in October, Justice Karen L. Valihura noted that the $176 award was $60 million more than the Delaware judiciary’s budget from the previous year. This was quite interesting as the case was “settled midstream.”

The lawsuit was brought by a pension fund on behalf of Tesla shareholders and focused exclusively on director pay during the 2017–2020 period. The case is separate from other high-profile compensation disputes involving Elon Musk.

Investor's Corner

Tesla (TSLA) Q4 and FY 2025 earnings call: The most important points

Executives, including CEO Elon Musk, discussed how the company is positioning itself for growth across vehicles, energy, AI, and robotics despite near-term pressures from tariffs, pricing, and macro conditions.

Tesla’s (NASDAQ:TSLA) Q4 and FY 2025 earnings call highlighted improving margins, record energy performance, expanding autonomy efforts, and a sharp acceleration in AI and robotics investments.

Executives, including CEO Elon Musk, discussed how the company is positioning itself for growth across vehicles, energy, AI, and robotics despite near-term pressures from tariffs, pricing, and macro conditions.

Key takeaways

Tesla reported sequential improvement in automotive gross margins excluding regulatory credits, rising from 15.4% to 17.9%, supported by favorable regional mix effects despite a 16% decline in deliveries. Total gross margin exceeded 20.1%, the highest level in more than two years, even with lower fixed-cost absorption and tariff impacts.

The energy business delivered standout results, with revenue reaching nearly $12.8 billion, up 26.6% year over year. Energy gross profit hit a new quarterly record, driven by strong global demand and high deployments of MegaPack and Powerwall across all regions, as noted in a report from The Motley Fool.

Tesla also stated that paid Full Self-Driving customers have climbed to nearly 1.1 million worldwide, with about 70% having purchased FSD outright. The company has now fully transitioned FSD to a subscription-based sales model, which should create a short-term margin headwind for automotive results.

Free cash flow totaled $1.4 billion for the quarter. Operating expenses rose by $500 million sequentially as well.

Production shifts, robotics, and AI investment

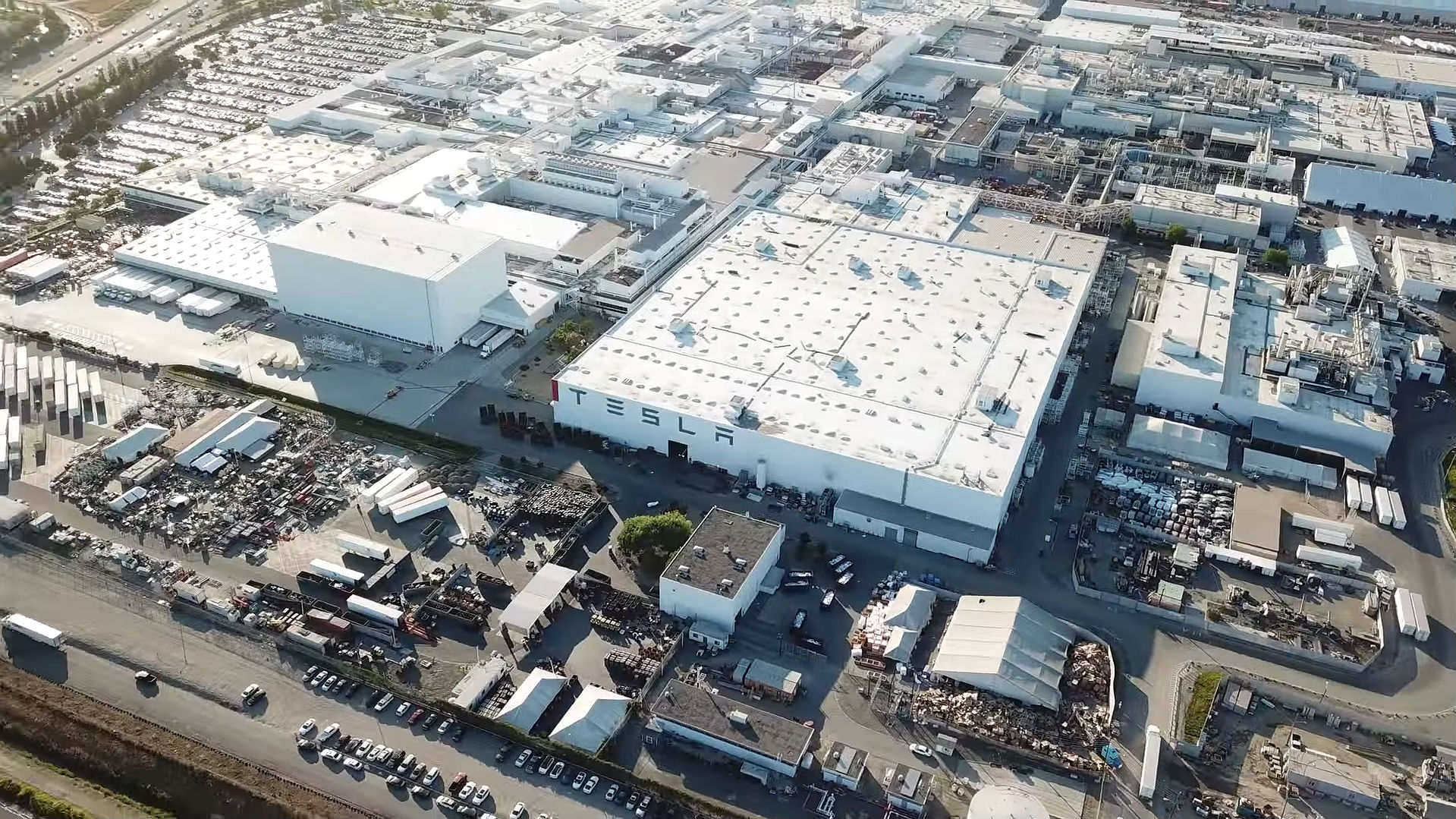

Musk further confirmed that Model S and Model X production is expected to wind down next quarter, and plans are underway to convert Fremont’s S/X line into an Optimus robot factory with a capacity of one million units.

Tesla’s Robotaxi fleet has surpassed 500 vehicles, operating across the Bay Area and Austin, with Musk noting a rapid monthly expansion pace. He also reiterated that CyberCab production is expected to begin in April, following a slow initial S-curve ramp before scaling beyond other vehicle programs.

Looking ahead, Tesla expects its capital expenditures to exceed $20 billion next year, thanks to the company’s operations across its six factories, the expansion of its fleet expansion, and the ramp of its AI compute. Additional investments in AI chips, compute infrastructure, and future in-house semiconductor manufacturing were discussed but are not included in the company’s current CapEx guidance.

More importantly, Tesla ended the year with a larger backlog than in recent years. This is supported by record deliveries in smaller international markets and stronger demand across APAC and EMEA. Energy backlog remains strong globally as well, though Tesla cautioned that margin pressure could emerge from competition, policy uncertainty, and tariffs.