News

Tesla’s near-obsessive efforts to improve efficiency shown in new ventilated seat patent

It is no secret that Tesla’s electric vehicles are among the most efficient in the auto industry. This is shown in the gap between Tesla and its competitors when it comes to battery tech and just how far the company’s vehicles can last between charges.

The Model X, for example, is Tesla’s largest vehicle available today, yet it is far more efficient than competitors from veteran automakers such as the Audi e-tron and the Jaguar I-PACE, both of which are smaller and newer than the Silicon Valley-based company’s flagship crossover. Part of this is likely due to Tesla’s proprietary battery chemistry, as well as the design and components of its vehicles themselves.

Tesla optimizes its vehicles’ efficiency in several ways, from equipping its cars with software that optimizes the battery pack to using materials that simply consume less power. The less power is consumed by the car’s systems, after all, the more power there is that could be used to turn the wheels of the vehicle.

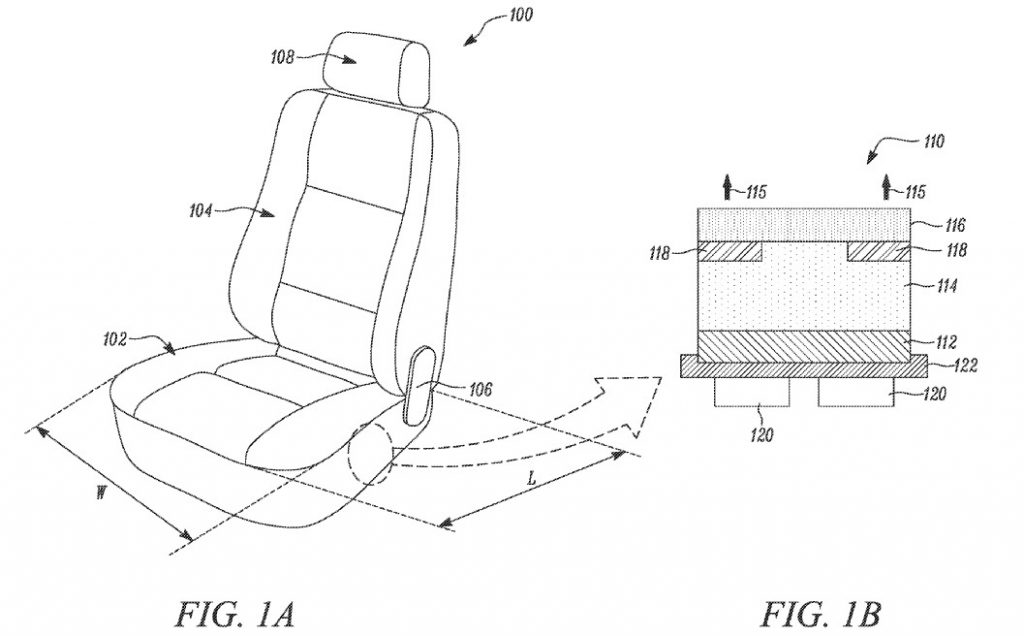

An example of this is described in a recently-published patent titled “Vehicle Seat with Integrated Temperature-Control System.” Tesla notes in its patent that heated seats could easily be very inefficient, as they require heat to travel through multiple layers of material.

“Attempts to provide air ventilation through the seat foam are typically insufficient to remove excess heat and provide a comfortable environment for the occupant. Further, conventional heating systems are bulky, occupy space in the seat which typically requires the seat to be thicker, and are inefficient in heating the seat as the heat typically must travel through multiple layers and heats regions of the seat that the occupant does not contact. Hence, there is a need for an improved temperature-control system for vehicle seats,” Tesla noted.

The electric car maker describes how its ventilated seat patent works as follows.

“The temperature-control system is associated with at least one of a seating portion and a backrest portion of the seat. The temperature control system includes a base layer. The temperature-control system includes an intermediate layer disposed adjacent to the base layer. The intermediate layer allows fluid to flow through it. The temperature-control system includes a cover layer disposed adjacent to the intermediate layer. The temperature-control system also includes at least one heating element disposed between the intermediate layer and the cover layer. The temperature-control system further includes a fluid pump to provide the flow of fluid through the intermediate layer,” the company wrote.

Tesla explains that the design outlined in its patent provides a low-cost, low-noise, power-efficient, and effective way of cooling or heating a vehicle’s seats. The company also explained that its patent could be incorporated in any seat, regardless of size and shape.

Tesla’s patent for its “Vehicle Seat with Integrated Temperature-Control System” could be accessed in full here.

Being a patent application, it is unknown if Tesla has or will utilize the design it described in the recently published document. Yet, regardless of this, it is difficult to not acknowledge the electric car maker’s constant efforts to improve its vehicles’ efficiency. In a way, the publication of this patent comes at a rather appropriate time for Tesla too, as the company is preparing to unveil its next vehicle, a pickup truck, later this year.

Pickup trucks are by tradition not the most efficient cars on the road, and even the Rivian R1T, a vehicle designed from the ground up to be all-electric, requires a massive 180 kWh battery pack to hit 400 miles of range. That’s a range that the Raven Tesla Model S is already approaching with its 100 kWh battery pack.

At this point in the EV race, it’s evident that the efficiency of Tesla’s electric cars is top-notch, and it will likely take a while before competitors can come close. Rivals will come for the company from several fronts, including veteran automakers and young, upstart manufacturers. But by being a moving target, it will likely be a very challenging task to catch up to Tesla. Very few companies out there could be just as dedicated and near-obsessive with improvement and innovation, after all.

Elon Musk

Tesla hits major milestone with Full Self-Driving subscriptions

Tesla has announced it has hit a major milestone with Full Self-Driving subscriptions, shortly after it said it would exclusively offer the suite without the option to purchase it outright.

Tesla announced on Wednesday during its Q4 Earnings Call for 2025 that it had officially eclipsed the one million subscription mark for its Full Self-Driving suite. This represented a 38 percent increase year-over-year.

This is up from the roughly 800,000 active subscriptions it reported last year. The company has seen significant increases in FSD adoption over the past few years, as in 2021, it reported just 400,000. In 2022, it was up to 500,000 and, one year later, it had eclipsed 600,000.

NEWS: For the first time, Tesla has revealed how many people are subscribed or have purchased FSD (Supervised).

Active FSD Subscriptions:

• 2025: 1.1 million

• 2024: 800K

• 2023: 600K

• 2022: 500K

• 2021: 400K pic.twitter.com/KVtnyANWcs— Sawyer Merritt (@SawyerMerritt) January 28, 2026

In mid-January, CEO Elon Musk announced that the company would transition away from giving the option to purchase the Full Self-Driving suite outright, opting for the subscription program exclusively.

Musk said on X:

“Tesla will stop selling FSD after Feb 14. FSD will only be available as a monthly subscription thereafter.”

The move intends to streamline the Full Self-Driving purchase option, and gives Tesla more control over its revenue, and closes off the ability to buy it outright for a bargain when Musk has said its value could be close to $100,000 when it reaches full autonomy.

It also caters to Musk’s newest compensation package. One tranche requires Tesla to achieve 10 million active FSD subscriptions, and now that it has reached one million, it is already seeing some growth.

The strategy that Tesla will use to achieve this lofty goal is still under wraps. The most ideal solution would be to offer a less expensive version of the suite, which is not likely considering the company is increasing its capabilities, and it is becoming more robust.

Tesla is shifting FSD to a subscription-only model, confirms Elon Musk

Currently, Tesla’s FSD subscription price is $99 per month, but Musk said this price will increase, which seems counterintuitive to its goal of increasing the take rate. With that being said, it will be interesting to see what Tesla does to navigate growth while offering a robust FSD suite.

News

Tesla confirms Robotaxi expansion plans with new cities and aggressive timeline

Tesla plans to launch in Dallas, Houston, Phoenix, Miami, Orlando, Tampa, and Las Vegas. It lists the Bay Area as “Safety Driver,” and Austin as “Ramping Unsupervised.”

Tesla confirmed its intentions to expand the Robotaxi program in the United States with an aggressive timeline that aims to send the ride-hailing service to several large cities very soon.

The Robotaxi program is currently active in Austin, Texas, and the California Bay Area, but Tesla has received some approvals for testing in other areas of the U.S., although it has not launched in those areas quite yet.

However, the time is coming.

During Tesla’s Q4 Earnings Call last night, the company confirmed that it plans to expand the Robotaxi program aggressively, hoping to launch in seven new cities in the first half of the year.

Tesla plans to launch in Dallas, Houston, Phoenix, Miami, Orlando, Tampa, and Las Vegas. It lists the Bay Area as “Safety Driver,” and Austin as “Ramping Unsupervised.”

These details were released in the Earnings Shareholder Deck, which is published shortly before the Earnings Call:

🚨 BREAKING: Tesla plans to launch its Robotaxi service in Dallas, Houston, Phoenix, Miami, Orlando, Tampa, and Las Vegas in the first half of this year pic.twitter.com/aTnruz818v

— TESLARATI (@Teslarati) January 28, 2026

Late last year, Tesla revealed it had planned to launch Robotaxi in Las Vegas, Phoenix, Dallas, and Houston, but Tampa and Orlando were just added to the plans, signaling an even more aggressive expansion than originally planned.

Tesla feels extremely confident in its Robotaxi program, and that has been reiterated many times.

Although skeptics still remain hesitant to believe the prowess Tesla has seemingly proven in its development of an autonomous driving suite, the company has been operating a successful program in Austin and the Bay Area for months.

In fact, it announced it achieved nearly 700,000 paid Robotaxi miles since launching Robotaxi last June.

🚨 Tesla has achieved nearly 700,000 paid Robotaxi miles since launching in June of last year pic.twitter.com/E8ldSW36La

— TESLARATI (@Teslarati) January 28, 2026

With the expansion, Tesla will be able to penetrate more of the ride-sharing market, disrupting the human-operated platforms like Uber and Lyft, which are usually more expensive and are dependent on availability.

Tesla launched driverless rides in Austin last week, but they’ve been few and far between, as the company is certainly easing into the program with a very cautiously optimistic attitude, aiming to prioritize safety.

Investor's Corner

Tesla (TSLA) Q4 and FY 2025 earnings call: The most important points

Executives, including CEO Elon Musk, discussed how the company is positioning itself for growth across vehicles, energy, AI, and robotics despite near-term pressures from tariffs, pricing, and macro conditions.

Tesla’s (NASDAQ:TSLA) Q4 and FY 2025 earnings call highlighted improving margins, record energy performance, expanding autonomy efforts, and a sharp acceleration in AI and robotics investments.

Executives, including CEO Elon Musk, discussed how the company is positioning itself for growth across vehicles, energy, AI, and robotics despite near-term pressures from tariffs, pricing, and macro conditions.

Key takeaways

Tesla reported sequential improvement in automotive gross margins excluding regulatory credits, rising from 15.4% to 17.9%, supported by favorable regional mix effects despite a 16% decline in deliveries. Total gross margin exceeded 20.1%, the highest level in more than two years, even with lower fixed-cost absorption and tariff impacts.

The energy business delivered standout results, with revenue reaching nearly $12.8 billion, up 26.6% year over year. Energy gross profit hit a new quarterly record, driven by strong global demand and high deployments of MegaPack and Powerwall across all regions, as noted in a report from The Motley Fool.

Tesla also stated that paid Full Self-Driving customers have climbed to nearly 1.1 million worldwide, with about 70% having purchased FSD outright. The company has now fully transitioned FSD to a subscription-based sales model, which should create a short-term margin headwind for automotive results.

Free cash flow totaled $1.4 billion for the quarter. Operating expenses rose by $500 million sequentially as well.

Production shifts, robotics, and AI investment

Musk further confirmed that Model S and Model X production is expected to wind down next quarter, and plans are underway to convert Fremont’s S/X line into an Optimus robot factory with a capacity of one million units.

Tesla’s Robotaxi fleet has surpassed 500 vehicles, operating across the Bay Area and Austin, with Musk noting a rapid monthly expansion pace. He also reiterated that CyberCab production is expected to begin in April, following a slow initial S-curve ramp before scaling beyond other vehicle programs.

Looking ahead, Tesla expects its capital expenditures to exceed $20 billion next year, thanks to the company’s operations across its six factories, the expansion of its fleet expansion, and the ramp of its AI compute. Additional investments in AI chips, compute infrastructure, and future in-house semiconductor manufacturing were discussed but are not included in the company’s current CapEx guidance.

More importantly, Tesla ended the year with a larger backlog than in recent years. This is supported by record deliveries in smaller international markets and stronger demand across APAC and EMEA. Energy backlog remains strong globally as well, though Tesla cautioned that margin pressure could emerge from competition, policy uncertainty, and tariffs.