Investor's Corner

Tesla’s CATL partnership in China is a strategic play that sets the stage for market domination

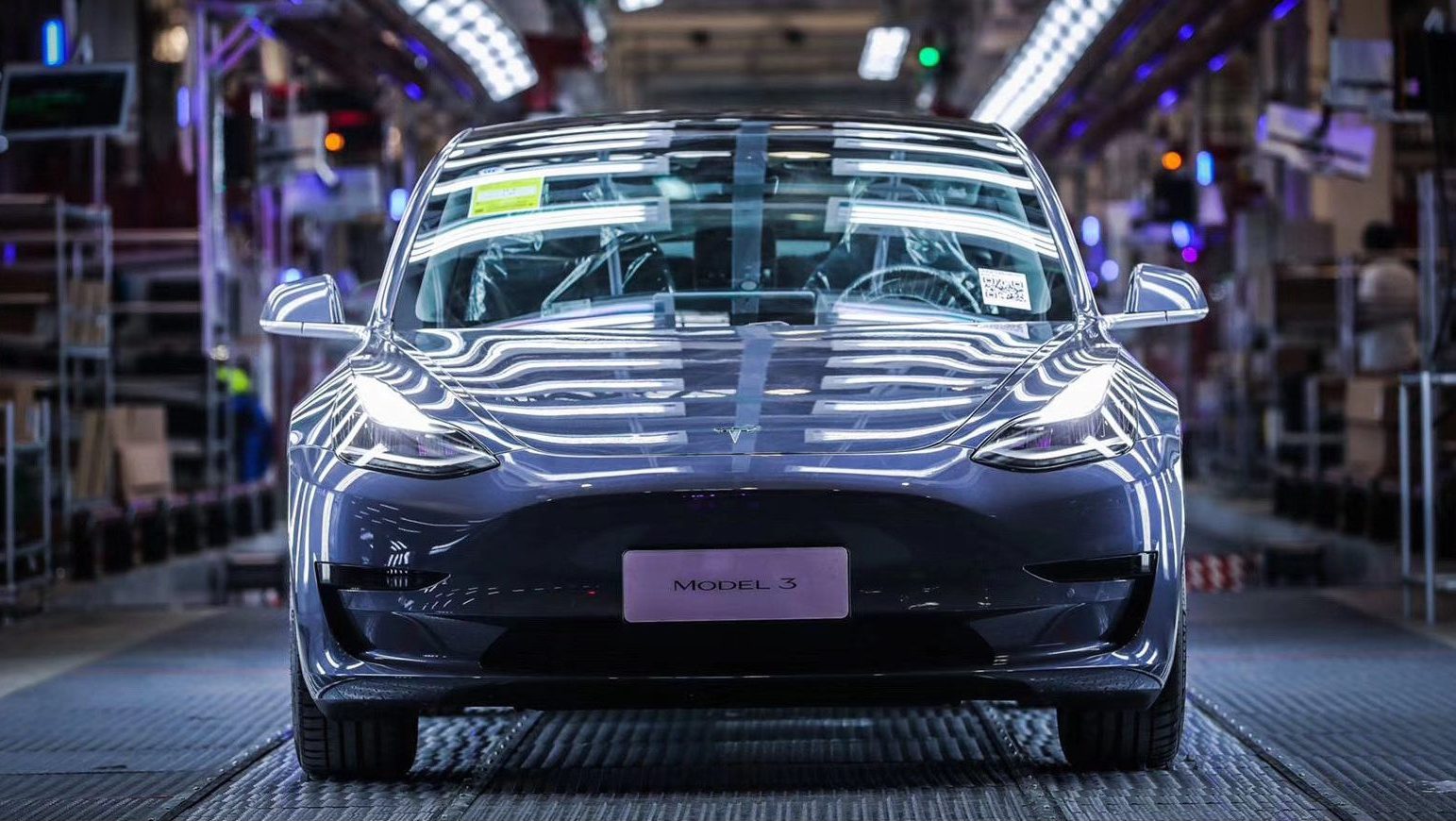

Tesla’s deal with battery supplier Contemporary Amperex Technology Co Ltd (CATL) for its Made-in-China Model 3 is a strategic move that will deepen the company’s roots in the world’s largest automotive market.

CATL is expected to supply a “zero cobalt” prismatic lithium iron phosphate (LFP) batteries that the carmaker would use in its Model 3 sedan for the domestic market.

Reduce Battery Costs While Doing Good

The LFP batteries are expected to be cheaper by a “double-digit percent” compared to the existing batteries Tesla is using for its locally-produced Model 3. Benchmark Mineral Intelligence, a price reporting agency that specializes in lithium-ion batteries for EVs, estimates that Tesla will save more than 25% in cost compared to what the carmaker spends for batteries used for Model 3s in the United States.

Tesla uses cylindrical nickel-cobalt-aluminum (NCA) batteries for its vehicles which typically have lower cobalt content than industry-popular nickel-cobalt-aluminum (NCM) batteries used by other electric vehicle manufacturers. However, as the world begins to better understand the human toll for cobalt mining, Tesla CEO Elon Musk has expressed his intentions to cut cobalt-use in Tesla batteries. Thereby paving the way for a partnership with a battery cell manufacturer that has a zero to limited-need for cobalt – CATL.

We use less than 3% cobalt in our batteries & will use none in next gen

— Elon Musk (@elonmusk) June 13, 2018

CATL will use its cell-to-pack (CTP) technology to improve the energy density and safety of the zero-cobalt batteries. Using the technology that involves more than 70 core patents, CATL can up the mass-energy density of the LFP batteries by 10 to 15 percent, reduce the number of parts of battery packs by around 40 percent, and improve volume utilization efficiency by 15 to 20 percent. The battery manufacturer also claims that it is taking steps to increase the energy density of its LPF batteries using CTP technology by 2024.

All of these factors make the equation a win-win for Tesla. Aside from the cost savings, the zero-cobalt batteries for the China Model 3 may also help improve the production process and help Giga Shanghai hit a 3,000 units per week run rate, consistently. Plus, Tesla’s partnership with a Chinese supplier can only help further improve its relationship with the government that has welcomed it with open arms.

Small Step To Reduce Cost, Big Step To Conquer China

Tesla’s Giga Shanghai has so far been impressive. The first vehicle production plant for Tesla outside of the US is practically a miracle by all standards. The facility was built from the ground up and it churned out its first locally-made Model 3s after 10 months.

It also makes sense to set up a car factory in the biggest automotive market in the world that brought roughly $3 billion in revenues to Tesla’s coffers in 2019 and positioned Tesla to conquer China.

“I feel there is a pretty big fundamental efficiency gain that Tesla has by just making cars, especially affordable cars than 3 and Y, at least on the continent where the customers are. what we’re doing — or have been doing in the past was really pretty silly in making cars in California and then shipping them halfway around the world…,” Musk said during the Q4 2019 earnings call.

With the CATL zero-cobalt batteries for MIC Model 3s, Tesla further localizes its supply chain in China. With localization, analysts believe that the China-made Model 3 can practically be a cash cow for Tesla.

A partnership with CATL can also put Tesla on a path to achieving higher profit margins for the China Model 3 while still being able to lower the price of its vehicles, thereby stimulating local demand even more.

According to Tesla CFO Zachary Kirkhorn, the margins coming out of Giga Shanghai is expected to match that of vehicles coming out of Fremont. “And so if you add all of this up, our internal estimates are a pretty significant reduction in the cost of Model 3 in China relative to Fremont, but I think it’s also important to keep in mind that the cost of the Standard Plus that we’re selling out of Shanghai is also lower than that of the similar car coming out of Fremont from price perspective. And so and I’ve said this on previous earnings calls, I think it’s fair to expect the margin coming out of the Shanghai facility to match the same margin for the vehicle in Fremont,” noted Kirkhorn in Tesla’s Q4 earnings call.

With Tesla’s MIC Model 3 as an electric car for the masses, Elon Musk and his car brand can help change China. The government sees Tesla as a catalyst for its slumping automotive industry and a spark to help transition the wider population from internal combustion engines to electric vehicles, which in turn can help combat air pollution that causes over 1 million deaths per year in the country and costing its economy roughly $40 billion annually.

The zero-cobalt batteries by the CATL for the China Tesla Model 3 might be one of the essential ingredients to further help TSLA skyrocket and drive the brand to consistent profitability.

Elon Musk

Tesla to a $100T market cap? Elon Musk’s response may shock you

There are a lot of Tesla bulls out there who have astronomical expectations for the company, especially as its arm of reach has gone well past automotive and energy and entered artificial intelligence and robotics.

However, some of the most bullish Tesla investors believe the company could become worth $100 trillion, and CEO Elon Musk does not believe that number is completely out of the question, even if it sounds almost ridiculous.

To put that number into perspective, the top ten most valuable companies in the world — NVIDIA, Apple, Alphabet, Microsoft, Amazon, TSMC, Meta, Saudi Aramco, Broadcom, and Tesla — are worth roughly $26 trillion.

Will Tesla join the fold? Predicting a triple merger with SpaceX and xAI

Cathie Wood of ARK Invest believes the number is reasonable considering Tesla’s long-reaching industry ambitions:

“…in the world of AI, what do you have to have to win? You have to have proprietary data, and think about all the proprietary data he has, different kinds of proprietary data. Tesla, the language of the road; Neuralink, multiomics data; nobody else has that data. X, nobody else has that data either. I could see $100 trillion. I think it’s going to happen because of convergence. I think Tesla is the leading candidate [for $100 trillion] for the reason I just said.”

Musk said late last year that all of his companies seem to be “heading toward convergence,” and it’s started to come to fruition. Tesla invested in xAI, as revealed in its Q4 Earnings Shareholder Deck, and SpaceX recently acquired xAI, marking the first step in the potential for a massive umbrella of companies under Musk’s watch.

SpaceX officially acquires xAI, merging rockets with AI expertise

Now that it is happening, it seems Musk is even more enthusiastic about a massive valuation that would swell to nearly four-times the value of the top ten most valuable companies in the world currently, as he said on X, the idea of a $100 trillion valuation is “not impossible.”

It’s not impossible

— Elon Musk (@elonmusk) February 6, 2026

Tesla is not just a car company. With its many projects, including the launch of Robotaxi, the progress of the Optimus robot, and its AI ambitions, it has the potential to continue gaining value at an accelerating rate.

Musk’s comments show his confidence in Tesla’s numerous projects, especially as some begin to mature and some head toward their initial stages.

Elon Musk

Tesla director pay lawsuit sees lawyer fees slashed by $100 million

The ruling leaves the case’s underlying settlement intact while significantly reducing what the plaintiffs’ attorneys will receive.

The Delaware Supreme Court has cut more than $100 million from a legal fee award tied to a shareholder lawsuit challenging compensation paid to Tesla directors between 2017 and 2020.

The ruling leaves the case’s underlying settlement intact while significantly reducing what the plaintiffs’ attorneys will receive.

Delaware Supreme Court trims legal fees

As noted in a Bloomberg Law report, the case targeted pay granted to Tesla directors, including CEO Elon Musk, Oracle founder Larry Ellison, Kimbal Musk, and Rupert Murdoch. The Delaware Chancery Court had awarded $176 million to the plaintiffs. Tesla’s board must also return stock options and forego years worth of pay.

As per Chief Justice Collins J. Seitz Jr. in an opinion for the Delaware Supreme Court’s full five-member panel, however, the decision of the Delaware Chancery Court to award $176 million to a pension fund’s law firm “erred by including in its financial benefit analysis the intrinsic value” of options being returned by Tesla’s board.

The justices then reduced the fee award from $176 million to $70.9 million. “As we measure it, $71 million reflects a reasonable fee for counsel’s efforts and does not result in a windfall,” Chief Justice Seitz wrote.

Other settlement terms still intact

The Supreme Court upheld the settlement itself, which requires Tesla’s board to return stock and options valued at up to $735 million and to forgo three years of additional compensation worth about $184 million.

Tesla argued during oral arguments that a fee award closer to $70 million would be appropriate. Interestingly enough, back in October, Justice Karen L. Valihura noted that the $176 award was $60 million more than the Delaware judiciary’s budget from the previous year. This was quite interesting as the case was “settled midstream.”

The lawsuit was brought by a pension fund on behalf of Tesla shareholders and focused exclusively on director pay during the 2017–2020 period. The case is separate from other high-profile compensation disputes involving Elon Musk.

Investor's Corner

Tesla (TSLA) Q4 and FY 2025 earnings call: The most important points

Executives, including CEO Elon Musk, discussed how the company is positioning itself for growth across vehicles, energy, AI, and robotics despite near-term pressures from tariffs, pricing, and macro conditions.

Tesla’s (NASDAQ:TSLA) Q4 and FY 2025 earnings call highlighted improving margins, record energy performance, expanding autonomy efforts, and a sharp acceleration in AI and robotics investments.

Executives, including CEO Elon Musk, discussed how the company is positioning itself for growth across vehicles, energy, AI, and robotics despite near-term pressures from tariffs, pricing, and macro conditions.

Key takeaways

Tesla reported sequential improvement in automotive gross margins excluding regulatory credits, rising from 15.4% to 17.9%, supported by favorable regional mix effects despite a 16% decline in deliveries. Total gross margin exceeded 20.1%, the highest level in more than two years, even with lower fixed-cost absorption and tariff impacts.

The energy business delivered standout results, with revenue reaching nearly $12.8 billion, up 26.6% year over year. Energy gross profit hit a new quarterly record, driven by strong global demand and high deployments of MegaPack and Powerwall across all regions, as noted in a report from The Motley Fool.

Tesla also stated that paid Full Self-Driving customers have climbed to nearly 1.1 million worldwide, with about 70% having purchased FSD outright. The company has now fully transitioned FSD to a subscription-based sales model, which should create a short-term margin headwind for automotive results.

Free cash flow totaled $1.4 billion for the quarter. Operating expenses rose by $500 million sequentially as well.

Production shifts, robotics, and AI investment

Musk further confirmed that Model S and Model X production is expected to wind down next quarter, and plans are underway to convert Fremont’s S/X line into an Optimus robot factory with a capacity of one million units.

Tesla’s Robotaxi fleet has surpassed 500 vehicles, operating across the Bay Area and Austin, with Musk noting a rapid monthly expansion pace. He also reiterated that CyberCab production is expected to begin in April, following a slow initial S-curve ramp before scaling beyond other vehicle programs.

Looking ahead, Tesla expects its capital expenditures to exceed $20 billion next year, thanks to the company’s operations across its six factories, the expansion of its fleet expansion, and the ramp of its AI compute. Additional investments in AI chips, compute infrastructure, and future in-house semiconductor manufacturing were discussed but are not included in the company’s current CapEx guidance.

More importantly, Tesla ended the year with a larger backlog than in recent years. This is supported by record deliveries in smaller international markets and stronger demand across APAC and EMEA. Energy backlog remains strong globally as well, though Tesla cautioned that margin pressure could emerge from competition, policy uncertainty, and tariffs.