News

The Year of the ‘Giga Press’: How Tesla’s monster machines can complete Elon Musk’s 2nd Master Plan

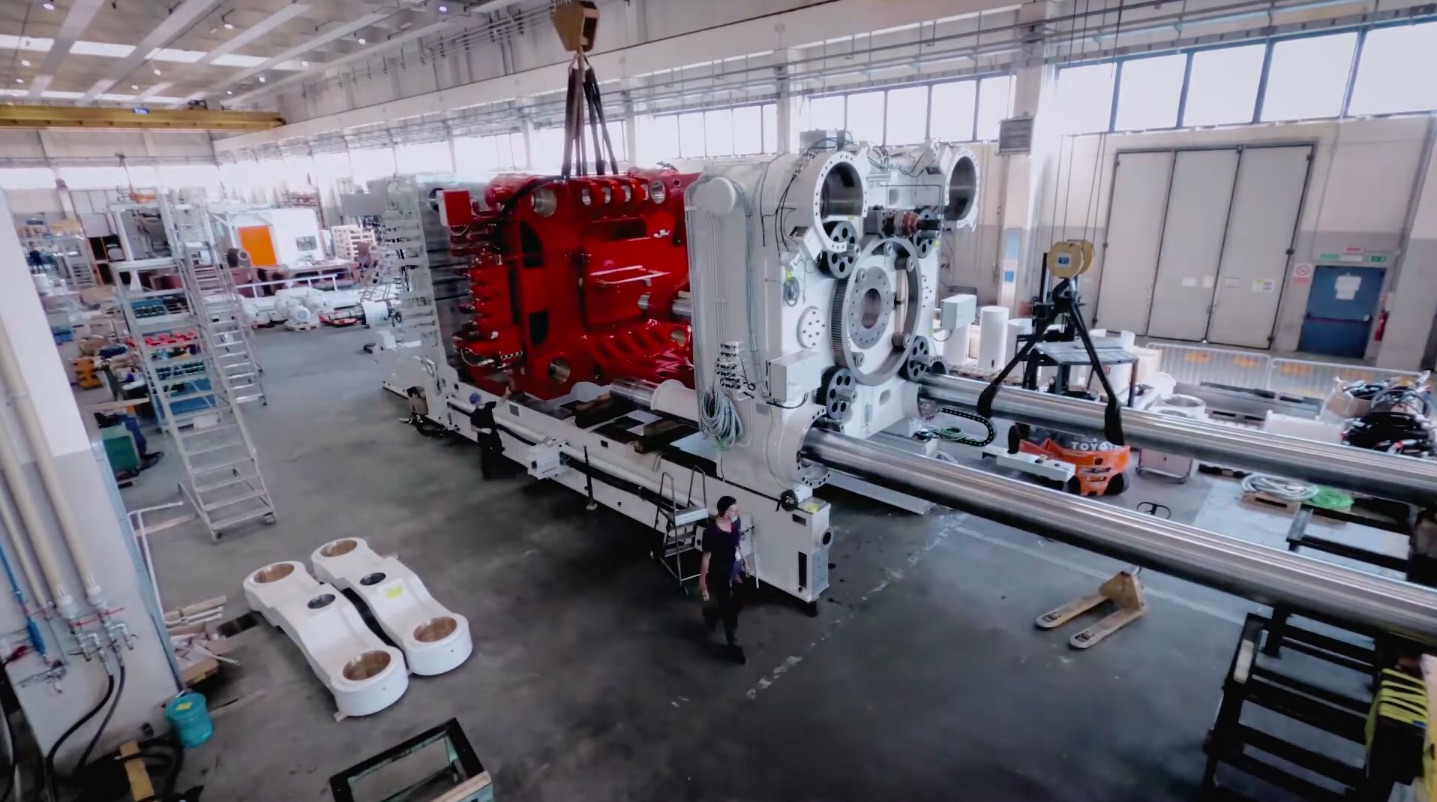

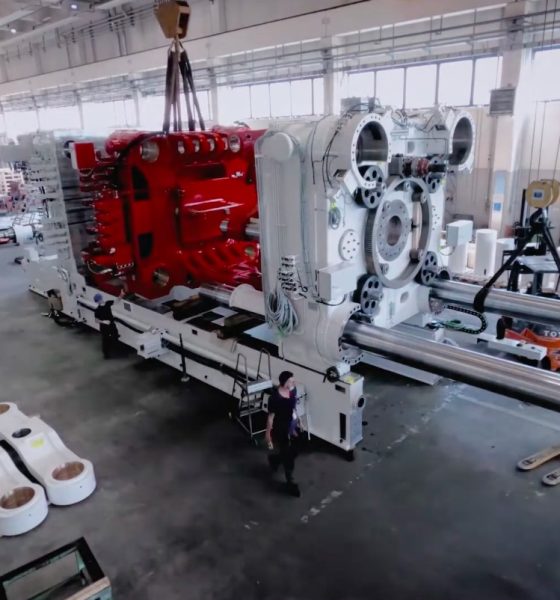

One of the most exciting developments from Tesla eagerly awaited by the electric car community is the company’s use of its giant casting machines. Dubbed by its maker IDRA as the “Giga Press,” the house-sized monster machines are capable of producing single-cast pieces for Tesla’s vehicles, starting with the Model Y.

The Giga Press lives up to its name. Its physical footprint is formidable, measuring 20 meters x 7.5 meters x 6 meters. It also weighs a whopping 430 tons, or about five Space Shuttles. So massive is the Giga Press that it takes up to 24 flatbed trucks to transport its components.

When operating, the Giga Presses are no slouch, as they have a cycle time of ~80‒90 seconds, which translates to an output rate of 40‒45 completed castings per hour, or about ~1,000 castings per day. That’s over 300,000 castings per year, per machine.

A Platoon of Giga Presses

So far, Tesla has set up two Giga Presses on the grounds of the Fremont Factory. Flyovers of the site show that the two machines are already set up, though it remains to be seen when they would formally be deployed. Over in China, three other Giga Presses have been spotted in the Giga Shanghai complex, though the units were reportedly built by LK Machinery, IDRA’s parent company.

But what is rather remarkable is that Tesla has several more Giga Presses in order. Sandy Munro, in a recent interview with electric vehicle advocate Sean Mitchell, noted that he has heard through the grapevine that Tesla has ordered 11 more units of the Giga Presses. Previous reports point to Giga Berlin receiving eight of the machines, and flyovers at the Giga Texas site seem to reveal three isolation pits for the monster machines in the area.

Needless to say, the Giga Press is poised to become a key part of Tesla’s Gigafactories from now on. As Tesla rolls out its single-piece cast design for the vehicles in its lineup, the company’s platoon of Giga Press machines will likely play an even bigger role. This role will likely become prominent starting next year, 2021.

The Year of the Giga Press

Tesla has always been a rebel of sorts, and this became extremely prominent this year. 2020 will likely be known as the year when the world stopped, and automakers suffered deep wounds due to the pandemic. Tesla, being a company that has always swum against the current, thrived instead of dropped. It is even poised to end the year as the newest member of the S&P 500.

But 2020 is only the beginning of a new chapter in the Tesla story. With the company now on more stable footing, the electric car maker can focus on executing its ramp for 2021. This ramp would likely involve Tesla aiming to produce close to, or perhaps up to, a million vehicles in one year. Such a ramp would require the full deployment of its Giga Press machines.

There is little doubt that Giga Press No.1 and No.2 at the Fremont Factory will be deployed fully soon. Giga Press No.3, No.4, and No.5 at Gigafactory Shanghai will likely be operational in early 2021 as well. And with Gigafactory Berlin likely starting Model Y production sometime next year, there is a good chance that several of its Giga Presses would go live next year as well. These, as well as the speculated machines in the Cybertruck Gigafactory in Texas, should allow Tesla to turn 2021 into the year of the Giga Press.

A Multi-Segment Approach

Tesla is a company with a big goal, one which focuses on the Master Plan of its CEO. So far, Tesla has pretty much completed Elon Musk’s first Master Plan, but Part Deux still needs some worth to accomplish. This is especially true for one aspect of the CEO’s target—expanding the company’s vehicle product line to address all major segments.

So far, Tesla has vehicles that compete in the large sedan, midsize sedan, SUV, and crossover market. This is one of the reasons why there is still so much more for Tesla to do. Granted, the Cybertruck will address the pickup market, the Semi will address the long-haul segment, and the new Roadster will compete in the supercar market. But there are still other segments to tap. One of these is the compact car market, which is populated with small, low-cost vehicles that are extremely aggressively priced.

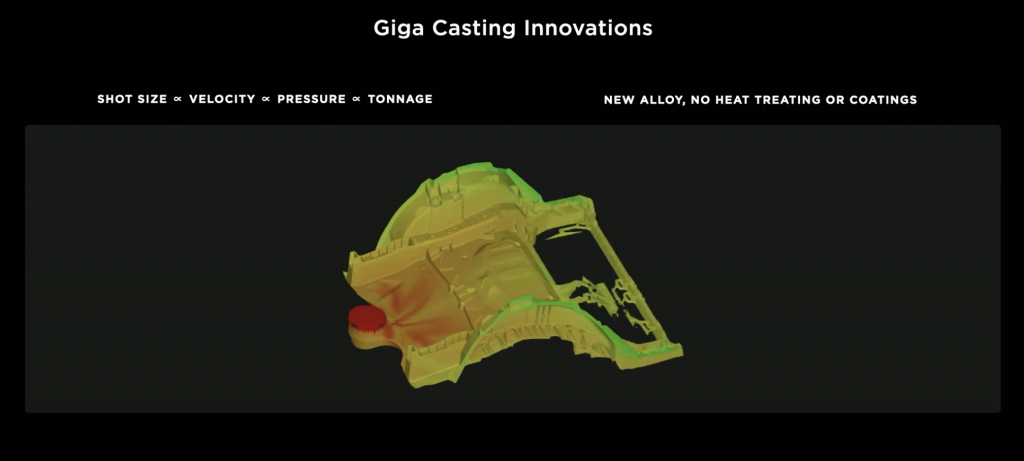

Tesla and Elon Musk have both noted that the company will be producing a $25,000 electric car that is smaller and cheaper than the Model 3. Such a vehicle would likely be equipped with the best innovations that the company can offer for it to be profitable. These include low-cost and disruptive tabless 4680 battery cells and massive single-piece casts that are produced with the Giga Press. And considering that both Giga Shanghai and Giga Berlin seem poised to produce the $25,000 Tesla, there seems to be a good chance that the company’s Giga Press platoon is only bound to get bigger in the near future.

Watch Sandy Munro and Sean Mitchell’s conversations about Tesla and its innovations in the video below.

Don’t hesitate to contact us for news tips. Just send a message to tips@teslarati.com to give us a heads up.

Cybertruck

Tesla set to activate long-awaited Cybertruck feature

Tesla will officially activate the Active Noise Cancellation (ANC) feature on Cybertruck soon, as the company has officially added the feature to its list of features by trim on its website.

Tesla is set to activate a long-awaited Cybertruck feature, and no matter when you bought your all-electric pickup, it has the hardware capable of achieving what it is designed to do.

Tesla simply has to flip the switch, and it plans to do so in the near future.

Tesla will officially activate the Active Noise Cancellation (ANC) feature on Cybertruck soon, according to Not a Tesla App, as the company has officially added the feature to its list of features by trim on its website.

Tesla rolls out Active Road Noise Reduction for new Model S and Model X

The ANC feature suddenly appeared on the spec sheet for the Premium All-Wheel-Drive and Cyberbeast trims, which are the two configurations that have been delivered since November 2023.

However, those trims have both had the ANC disabled, and although they are found in the Model S and Model X, and are active in those vehicles, Tesla is planning to activate them.

In Tesla’s Service Toolbox, it wrote:

“ANC software is not enabled on Cybertruck even though the hardware is installed.”

Tesla has utilized an ANC system in the Model S and Model X since 2021. The system uses microphones embedded in the front seat headrests to detect low-frequency road noise entering the cabin. It then generates anti-noise through phase-inverted sound waves to cancel out or reduce that noise, creating quieter zones, particularly around the vehicle’s front occupants.

The Model S and Model X utilize six microphones to achieve this noise cancellation, while the Cybertruck has just four.

Tesla Cybertruck Dual Motor AWD estimated delivery slips to early fall 2026

As previously mentioned, this will be activated through a software update, as the hardware is already available within Cybertruck and can simply be activated at Tesla’s leisure.

The delays in activating the system are likely due to Tesla Cybertruck’s unique design, which is unlike anything before. In the Model S and Model X, Tesla did not have to do too much, but the Cybertruck has heavier all-terrain tires and potentially issues from the aluminum castings that make up the vehicle’s chassis, which are probably presenting some challenges.

Unfortunately, this feature will not be available on the new Dual Motor All-Wheel-Drive configuration, which was released last week.

News

Tesla Model S and X customization options begin to thin as their closure nears

Tesla’s Online Design Studio for both vehicles now shows the first color option to be listed as “Sold Out,” as Lunar Silver is officially no longer available for the Model S or Model X. This color is exclusive to these cars and not available on the Model S or Model X.

Tesla Model S and Model X customization options are beginning to thin for the first time as the closure of the two “sentimental” vehicles nears.

We are officially seeing the first options disappear as Tesla begins to work toward ending production of the two cars and the options that are available to those vehicles specifically.

Tesla’s Online Design Studio for both vehicles now shows the first color option to be listed as “Sold Out,” as Lunar Silver is officially no longer available for the Model S or Model X. This color is exclusive to these cars and not available on the Model S or Model X.

🚨 Tesla Model S and Model X availability is thinning, as Tesla has officially shown that the Lunar Silver color option on both vehicles is officially sold out

To be fair, Frost Blue is still available so no need to freak out pic.twitter.com/YnwsDbsFOv

— TESLARATI (@Teslarati) February 25, 2026

Tesla is making way for the Optimus humanoid robot project at the Fremont Factory, where the Model S and Model X are produced. The two cars are low-volume models and do not contribute more than a few percent to Tesla’s yearly delivery figures.

With CEO Elon Musk confirming that the Model S and Model X would officially be phased out at the end of the quarter, some of the options are being thinned out.

This is an expected move considering Tesla’s plans for the two vehicles, as it will make for an easier process of transitioning that portion of the Fremont plant to cater to Optimus manufacturing. Additionally, this is likely one of the least popular colors, and Tesla is choosing to only keep around what it is seeing routine demand for.

During the Q4 Earnings Call in January, Musk confirmed the end of the Model S and Model X:

“It is time to bring the Model S and Model X programs to an end with an honorable discharge. It is time to bring the S/X programs to an end. It’s part of our overall shift to an autonomous future.”

Fremont will now build one million Optimus units per year as production is ramped.

News

Tesla Cybertruck Dual Motor AWD estimated delivery slips to early fall 2026

Tesla has also added a note on the Cybertruck design page stating that the vehicle’s price will increase after February 28.

Tesla’s estimated delivery window for new Cybertruck Dual Motor All-Wheel Drive (AWD) orders in the United States has shifted to September–October 2026. This suggests that the vehicle’s sub-$60,000 variant is now effectively sold out until then.

The updated timeline was highlighted in a post on X by Tesla watcher Sawyer Merritt, who noted that the estimated delivery window had moved from June 2026 to September-October 2026, “presumably due to strong demand.”

The Dual Motor AWD currently starts at $59,990 before incentives. Tesla has also added a note on the Cybertruck design page stating that the vehicle’s price will increase after February 28.

If demand remains steady, the combination of a later delivery window and a pending price increase suggests Tesla is seeing sustained interest in the newly-introduced Cybertruck configuration. This was highlighted by Elon Musk on X, when he noted that the Cybertruck Dual Motor AWD’s introductory price will only be available for a limited time.

When the Cybertruck was first unveiled in November 2019, Tesla listed the Dual Motor AWD variant at $49,990. Adjusted for inflation, that figure equates to roughly $63,000 in 2026 dollars, based on cumulative U.S. inflation since 2019.

That context makes a potential post-February price in the $64,000 to $65,000 range less surprising, especially as material, labor, and manufacturing costs have shifted significantly over the past several years.

While Tesla has not announced a specific new MSRP, the updated delivery timeline and pricing note together suggest that the Cybertruck Dual Motor AWD could very well be the variant that takes the all-electric full-sized pickup truck to more widespread adoption.