News

Tesla supplier developing dry electrode tech to establish facility in Texas

Reported Tesla supplier Saueressig Engineering plans to establish a facility in San Antonio’s East Side—about 80 miles away from Gigafactory Texas. Saueressig is a division of Matthews International Corp. and may be linked to Tesla’s 4680 battery cell initiatives.

On April 1st, the San Antonio City Council approved an economic incentive package that gave Saueressig a 75% tax abatement on a property located in Profit Drive. According to the official tax abatement agreement, Matthews must invest $9 million in property improvements to avail of the incentive package.

Saueressig Engineering was linked to Tesla when it hinted at a major order from an American automobile manufacturer. According to its official website, Saueressig focuses on “special machine construction” for several industries, including the battery sector.

Previous reports have suggested that Saueressig could be involved in making machines for Tesla’s battery cell production lines for Giga Texas and Giga Berlin. Tesla plans to produce its 4680 cells in its new Gigafactories. Tesla’s 4680 cells will be essential to larger vehicles like the Cybertruck and Semi in the United States, as well as the Made-in-Germany Model Y.

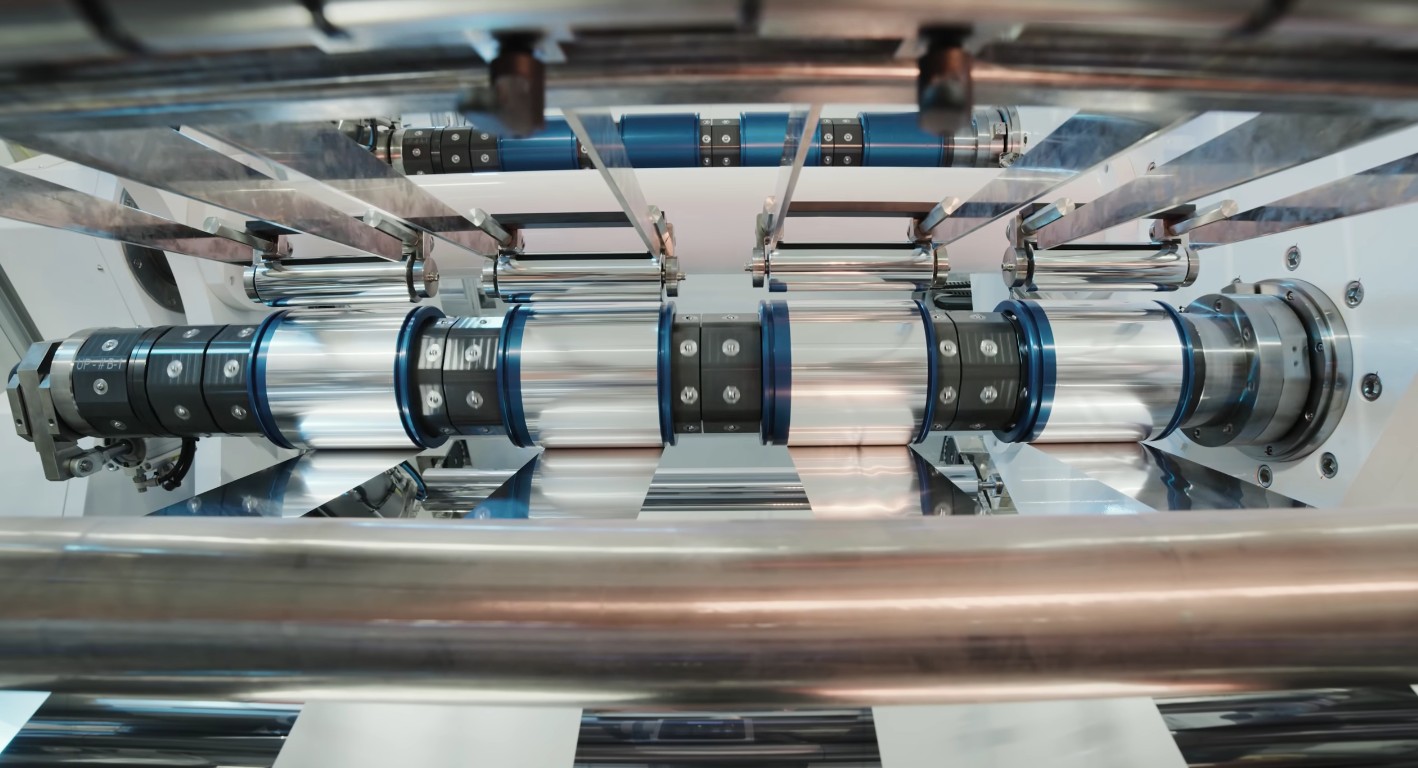

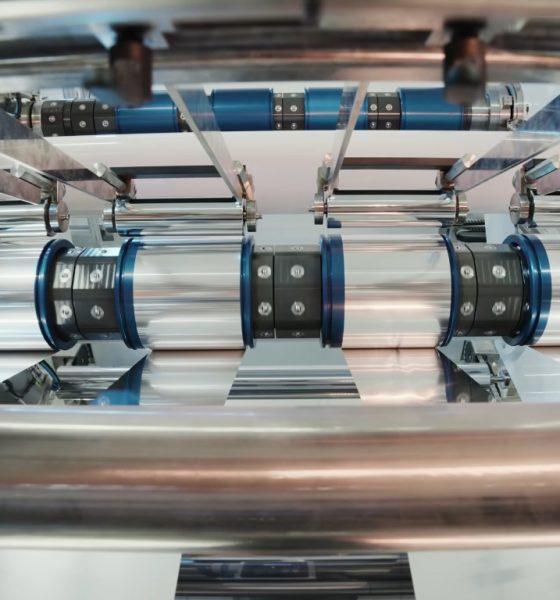

In 2019, the Fraunhofer Institute for Material and Beam Technology IWS shared that it partnered with companies such as Saueressig Engineering to develop a dry electrode coating process for EV batteries.

Fraunhofer IWS started developing a new production process for batteries that coated electrodes with dry film instead of liquid chemicals. Fraunhofer IWS project manager Dr. Benjamin Schumm noted that dry coating would reduce process costs in electrode coating.

“Our transfer process for dry coating aims to noticeably reduce process costs in electrode coating. This means that manufacturers can do without toxic and expensive solvents and save energy costs during drying. In addition, with our technology, electrode materials can also be used that can hardly or not at all be processed wet-chemically,” Dr. Schumm said.

Tesla executives such as Elon Musk and Jerome Guillen have noted in the past that Gigafactory Berlin and Gigafactory Texas would be home to their own 4680 battery cell production facilities. Considering that Tesla’s 4680 cells would utilize dry electrode technology, Saueressig Engineering’s upcoming Texas site would likely be invaluable for Tesla’s operations in the Lone Star state.

Do you have anything to share with the Teslarati Team? We’d love to hear from you, email us at tips@teslarati.com or reach out to me at maria@teslarati.com.

News

Tesla Semi’s latest adoptee will likely encourage more of the same

Public visibility matters. When shoppers see a trusted name like Ralph’s running clean, high-tech trucks on public roads, skepticism fades. Competitors such as Albertsons, which pre-ordered Semis years ago, and other chains chasing ESG targets now have proof that electric autonomy works in real-world grocery fleets.

The latest adoptee of the Tesla Semi will likely encourage more businesses in the same realm to adopt the all-electric Class 8 truck, as a new company utilizing the Semi has been spotted in Southern California.

A sleek, futuristic Tesla Semi truck branded for Ralph’s Supermarkets was spotted cruising a Los Angeles highway in a viral 13-second dashcam video posted March 2, by X user ChargePozitive.

Tesla Semi Truck in the wild pic.twitter.com/SnQY8ShMMJ

— ChargePozitive ⚡️➕ (@ChargePozitive) March 2, 2026

This sighting confirms Kroger’s March 2025 partnership with Tesla to deploy up to 500 autonomous electric Semis.

While the initial announcement targeted Midwest supply chains, the California appearance under the Ralph’s banner shows the program expanding to Kroger’s West Coast operations. Ralph’s, a staple for millions of Southern California shoppers, is now hauling groceries with the Semi, which has zero tailpipe emissions and claims up to 500 miles of range per charge.

Tesla Semi pricing revealed after company uncovers trim levels

The timing could not be better for sustainable logistics. Traditional trucking accounts for a massive share of retail emissions, but Tesla’s Semi slashes fuel and maintenance costs while leveraging full autonomy to ease driver shortages and improve safety.

Tesla’s expanding Megacharger network, including new sites along major freight corridors and partnerships like the recently-announced one with Pilot Travel Centers, is removing range anxiety and making nationwide scaling realistic. There’s still a long way to go, but things are moving in the right direction.

Public visibility matters. When shoppers see a trusted name like Ralph’s running clean, high-tech trucks on public roads, skepticism fades. Competitors such as Albertsons, which pre-ordered Semis years ago, and other chains chasing ESG targets now have proof that electric autonomy works in real-world grocery fleets.

PepsiCo’s successful pilots already demonstrated viability, and Ralph’s sighting adds retail credibility.

As Tesla ramps high-volume Semi production through 2026, this isn’t an isolated curiosity. Instead, it’s a catalyst. More grocers adopting the platform will accelerate industry-wide decarbonization, cut operating expenses, and deliver tangible environmental wins.

The future of sustainable supply chains is already on the highway, and Ralph’s just made it impossible to ignore.

Moving forward, Tesla hopes to expand the Semi program into other regions, including Europe, which CEO Elon Musk recently said is a total possibility next year.

Elon Musk

Tesla ramps Cybercab test manufacturing ahead of mass production

Tesla still has plans for volume production, which remains between four and eight weeks away, aligning with Musk’s statements that early ramps would be deliberately measured given the Cybercab’s novel architecture and full reliance on Tesla’s vision-based Full Self-Driving technology.

Tesla is seemingly ramping Cybercab test manufacturing ahead of mass production, which is scheduled to begin next month, the company said.

At Tesla’s Gigafactory Texas, production of the Cybercab, the company’s groundbreaking purpose-built Robotaxi vehicle, is accelerating markedly. Drone footage from Joe Tegtmeyer captured striking aerial footage today, revealing what appears to be the largest public sighting of Cyebrcabs to date.

A total of 25 units were observed by Tegtmeyer across the Gigafactory Texas property, marking a clear step-up in testing and validation activities as Tesla prepares for a broader output.

Tesla Cybercab production begins: The end of car ownership as we know it?

In the footage, 14 metallic gold Cybercabs were parked in a tight formation outside the factory exit, showcasing their sleek, autonomous-only design with no steering wheels, pedals, or traditional controls. Another 9 units sat at the crash testing facility, likely undergoing structural and safety validations, while two more appeared at the west end-of-line area for final checks.

Big day for Cybercab at Giga Texas today! Actually, yesterday to kick off March, the production line went into a higher volume & today we see 25 at three main locations, and there were several others I observed driving around too!

I think this may be the largest single grouping… pic.twitter.com/HZDMNv57lJ

— Joe Tegtmeyer 🚀 🤠🛸😎 (@JoeTegtmeyer) March 3, 2026

Tegtmeyer noted additional Cybercabs driving around the complex, hinting at active movement and real-world testing beyond static parking.

This surge follows the first production Cybercab rolling off the line in mid-February 2026, several weeks ahead of the originally anticipated April start.

That milestone, celebrated by Tesla employees and confirmed by CEO Elon Musk, kicked off low-volume builds on the dedicated “unboxed” manufacturing line, a modular process designed to slash costs, reduce factory footprint, and enable faster assembly compared to conventional methods.

Industry observers interpret the jump to dozens of visible units in early March as evidence that Tesla has transitioned into higher-volume test manufacturing.

Tesla still has plans for volume production, which remains between four and eight weeks away, aligning with Musk’s statements that early ramps would be deliberately measured given the Cybercab’s novel architecture and full reliance on Tesla’s vision-based Full Self-Driving technology.

The Cybercab, envisioned as a sub-$30,000 autonomous two-seater for robotaxi fleets, represents Tesla’s bold pivot toward scalable autonomy and robotics.

Tesla fans and enthusiasts on X praised the imagery, with many expressing excitement over the visible progress toward deployment. While challenges remain, including software maturity, regulatory hurdles, and supply chain scaling, the increased factory activity underscores Tesla’s momentum in turning the Cybercab vision into reality.

As Giga Texas continues expanding and refining the manufacturing process of the Cybercab, the coming months will prove to be a pivotal time in determining how quickly this revolutionary vehicle reaches roads in the U.S. and internationally.

Elon Musk

SpaceX to launch Starlink V2 satellites on Starship starting 2027

The update was shared by SpaceX President Gwynne Shotwell and Starlink Vice President Mike Nicolls.

SpaceX is looking to start launching its next-generation Starlink V2 satellites in mid-2027 using Starship.

The update was shared by SpaceX President Gwynne Shotwell and Starlink Vice President Mike Nicolls during remarks at Mobile World Congress (MWC) in Barcelona, Spain.

“With Starship, we’ll be able to deploy the constellation very quickly,” Nicolls stated. “Our goal is to deploy a constellation capable of providing global and contiguous coverage within six months, and that’s roughly 1,200 satellites.”

Nicolls added that once Starship is operational, it will be capable of launching approximately 50 of the larger, more powerful Starlink satellites at a time, as noted in a Bloomberg News report.

The initial deployment of roughly 1,200 next-generation satellites is intended to establish global and contiguous coverage. After that phase, SpaceX plans to continue expanding the system to reach “truly global coverage, including the polar regions,” Nicolls said.

Currently, all Starlink satellites are launched on SpaceX’s Falcon 9 rocket. The next-generation fleet will rely on Starship, which remains in development following a series of test flights in 2025. SpaceX is targeting its next Starship test flight, featuring an upgraded version of the rocket, as soon as this month.

Starlink is currently the largest satellite network in orbit, with nearly 10,000 satellites deployed. Bloomberg Intelligence estimates the business could generate approximately $9 billion in revenue for SpaceX in 2026.

Nicolls also confirmed that SpaceX is rebranding its direct-to-cell service as Starlink Mobile.

The service currently operates with 650 satellites capable of connecting directly to smartphones and has approximately 10 million monthly active users. SpaceX expects that figure to exceed 25 million monthly active users by the end of 2026.