News

SpaceX’s upgraded Starship set for test flight despite sore NASA contract losers

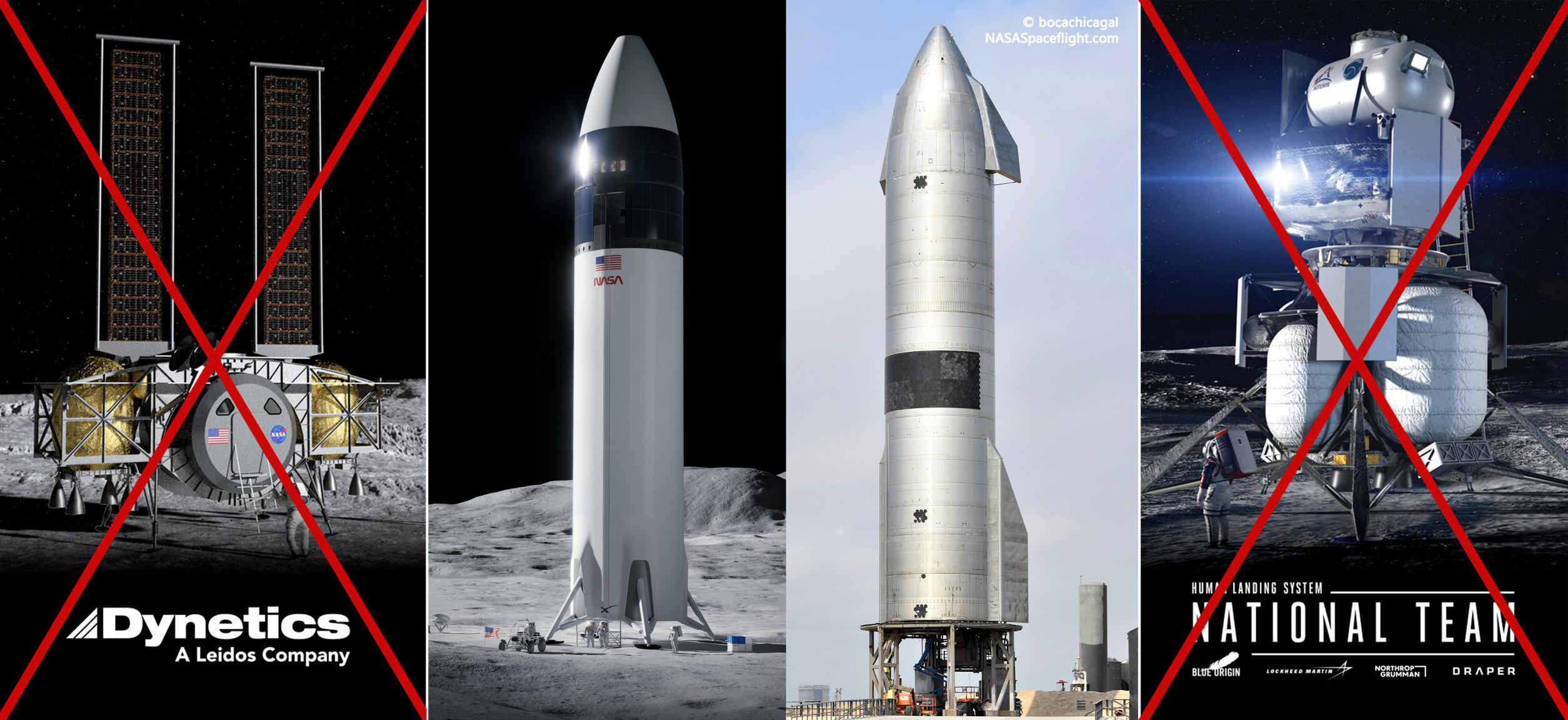

Within the last week, while SpaceX has been diligently working to ready an upgraded Starship prototype for its first launch, former competitors Blue Origin and Dynetics – both of which recently lost a historic NASA Moon lander contract to SpaceX – have filed “protests” and forced the space agency to freeze work (and funds).

That means that NASA is now legally unable to use funds or resources related to its Human Lander System (HLS) program or the $2.9 billion contract it awarded SpaceX on April 16th to develop a variant of Starship to return humanity to the Moon. However, just like SpaceX has already spent a great deal of its own time and money on Starship development and – more recently – a rapid-fire series of launches, the company appears to have no intention of letting sore losers hamper its rocket factory or test campaign.

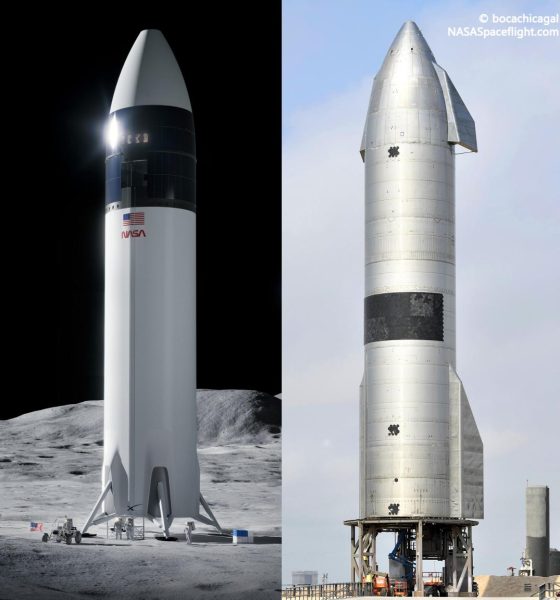

Instead, on the same two days Blue Origin and Dynetics loudly filed official protests with the US Government Accountability Office (GAO), SpaceX performed two back-to-back static fire tests with a Starship prototype and Raptor engines outfitted with “hundreds of improvements.” Technical challenges and unsavory weather conditions forced SpaceX to call off a launch planned sometime last week but the company now appears to be on track to launch Starship prototype SN15 as early as Tuesday, May 4th.

In principle, the ability for companies to protest US government contracting decisions is a necessity and (nominally) a net good but it can easily be misused – and often in damaging ways. In the case of Blue Origin and Dynetics, it’s difficult not to perceive both protests as examples of the latter.

Blue Origin effectively disagrees with every single major point made and conclusion drawn by NASA’s Source Selection Authority (Kathy Lueders) and a separate panel of experts – often to the point that the company is strongly implying that it understands NASA’s contracting process better than the space agency itself. Blue Origin partners Northrop Grumman and Lockheed Martin are both partially or fully responsible for several of their own catastrophic acquisition boondoggles (F-35, Orion, SLS, James Webb Space Telescope, etc.) and are part of the military-industrial complex primarily responsible for turning US military and aerospace procurement into the quagmire of political interests, quasi-monopolies, and loopholes it is today.

The primary argument is generally shared by both protestors. In essence, Dynetics [p. 23; PDF] and Blue Origin [PDF] believe that it was unfair or improper for NASA to select just a single provider from the three companies or groups that competed. They argue that downselecting to one provider in lieu of budget shortfalls changed the procurement process and competition so much that NASA should have effectively called it quits and restarted the entire five-month process. Blue Origin and Dynetics also both imply that they were somehow blindsided by NASA’s concerns about a Congressional funding shortfall.

In reality, NASA could scarcely have been clearer that it was exceptionally sensitive about HLS funding and extremely motivated to attempt to return humans to the Moon by 2024 with or without the full support of Congress – albeit in fewer words. As Lueders herself noted in the HLS Option A award selection statement, the solicitation Blue, Dynetics, and SpaceX responded to states – word for word – that “the overall number of awards will be dependent upon funding availability and evaluation results.”

Additionally, implications that NASA somehow blindsided offerors with its lack of funding are woefully ignorant at best and consciously disingenuous at worse. Anyone with even the slightest awareness of the history of large-scale NASA programs would know that the space agency’s budget is all but exclusively determined by Congress each year and liable to change just as frequently if political winds shift. Short of blackmailing members of Congress or wistfully hoping that other avenues of legal political influence and partnership actually lead to desired funding and priorities appearing in appropriations legislation, NASA knows the future of its budget about as well as anyone else with access to the internet and a rudimentary awareness of history and current events.

It became clear that Congress was likely to drastically underfund NASA’s HLS program as early as November 2020 – weeks before HLS Option A proposals were due. The latest appropriations bill was passed on January 3rd, 2021, providing NASA $850 million of the ~$3.4 billion it requested for HLS. Historically, NASA’s experience with the Commercial Crew Program – public knowledge available to anyone – likely made it clear to the agency that it could not trust Congress to fund its priorities in good faith when half a decade of drastic underfunding ultimately delayed the critical program by several years. That damage was done by merely halving NASA Commercial Crew budget request from 2010 to 2013, whereas Congress had already set itself on a path to provide barely a quarter of the HLS funds NASA asked for in the weeks before Moon lander proposals were due.

Ultimately, the protests filed by Blue Origin and Dynetics are packed to the brim with petty axe-grinding, attempts to paint SpaceX in a negative light, and a general lack of indication that either company is operating in good faith. Instead, their protests appear all but guaranteed to fail while simultaneously forcing NASA to freeze HLS work and delay related disbursements for up to 100 days. Given that SpaceX is now technically working to design, build, qualify, and fly an uncrewed Lunar Starship prototype by 2023 and a crewed demonstration landing by 2024, 100 days represents a full 7-10% of the time that’s available to complete that extraordinary task.

Ironically, the protests made by Blue Origin and Dynetics have already helped demonstrate why NASA’s decision – especially in light of unambiguous budgetary restrictions – to sole-source its HLS Moon lander contract to SpaceX was an astute one. Had a victorious Blue Origin or Dynetics been in a similar position to SpaceX, it’s almost impossible to imagine either team continuing work to a significant degree in lieu of NASA funding or direction. SpaceX, on the other hand, hasn’t missed a beat and looks set to continue Starship development, production, and testing around the clock regardless of NASA’s capacity to help.

In other words, with a little luck, the actual schedule impact of a maximum 100-day work and funding freeze should be a tiny fraction of what it could have been if NASA had selected an HLS provider more interested in profit margins and stock buybacks than creating a sustainable path for humanity’s expansion beyond Earth.

News

Tesla wins another award critics will absolutely despise

Tesla earned an overall score of 49 percent, up 6 percentage points from the previous year, widening its lead over second-place Ford (45 percent, up 2 points) to a commanding 4-percentage-point gap. The company also excelled in the Fossil Free & Environment category with a 50 percent score, reflecting strong progress in reducing emissions and decarbonizing operations.

Tesla just won another award that critics will absolutely despise, as it has been recognized once again as the company with the most sustainable supply chain.

Tesla has once again proven its critics wrong, securing the number one spot on the 2026 Lead the Charge Auto Supply Chain Leaderboard for the second consecutive year, Lead the Charge rankings show.

NEWS: Tesla ranked 1st on supply chain sustainability in the 2026 Lead the Charge auto/EV supply chain scorecard.

“@Tesla remains the top performing automaker of the Leaderboard for the second year running, and increased its overall score by 6 percentage points, while Ford only… pic.twitter.com/nAgGOIrGFS

— Sawyer Merritt (@SawyerMerritt) March 4, 2026

This independent ranking, produced by a coalition of environmental, human rights, and investor groups including the Sierra Club, Transport & Environment, and others, evaluates 18 major automakers on their efforts to build equitable, sustainable, and fossil-free supply chains for electric vehicles.

Tesla earned an overall score of 49 percent, up 6 percentage points from the previous year, widening its lead over second-place Ford (45 percent, up 2 points) to a commanding 4-percentage-point gap. The company also excelled in the Fossil Free & Environment category with a 50 percent score, reflecting strong progress in reducing emissions and decarbonizing operations.

Perhaps the most impressive achievement came in the batteries subsection, where Tesla posted a massive +20-point jump to reach 51 percent, becoming the first automaker ever to surpass 50 percent in this critical area.

Tesla achieved this milestone through transparency, fully disclosing Scope 3 emissions breakdowns for battery cell production and key materials like lithium, nickel, cobalt, and graphite.

The company also requires suppliers to conduct due diligence aligned with OECD guidelines on responsible sourcing, which it has mentioned in past Impact Reports.

While Tesla leads comfortably in climate and environmental performance, it scores 48 percent in human rights and responsible sourcing, slightly behind Ford’s 49 percent.

The company made notable gains in workers’ rights remedies, but has room to improve on issues like Indigenous Peoples’ rights.

Overall, the leaderboard highlights that a core group of leaders, Tesla, Ford, Volvo, Mercedes, and Volkswagen, are advancing twice as fast as their peers, proving that cleaner, more ethical EV supply chains are not just possible but already underway.

For Tesla detractors who claim EVs aren’t truly green or that the company cuts corners, this recognition from sustainability-focused NGOs delivers a powerful rebuttal.

Tesla’s vertical integration, direct supplier contracts, low-carbon material agreements (like its North American aluminum deal with emissions under 2kg CO₂e per kg), and raw materials reporting continue to set the industry standard.

As the world races toward electrification, Tesla isn’t just building cars; it’s building a more responsible future.

News

Tesla Full Self-Driving likely to expand to yet another Asian country

“We are aiming for implementation in 2026. [We are] doing everything in our power [to achieve this],” Richi Hashimoto, president of Tesla’s Japanese subsidiary, said.

Tesla Full Self-Driving is likely to expand to yet another Asian country, as one country seems primed for the suite to head to it for the first time.

The launch of Full Self-Driving in yet another country this year would be a major breakthrough for Tesla as it continues to expand the driver-assistance program across the world. Bureaucratic red tape has held up a lot of its efforts, but things are looking up in some regions.

Tesla is poised to transform Japan’s roads with Full Self-Driving (FSD) technology by 2026.

Richi Hashimoto, president of Tesla’s Japanese subsidiary, announced the ambitious timeline, building on successful employee test drives that began in 2025 and earned positive media reviews. Test drives, initially limited to the Model 3 since August 2025, expanded to the Model Y on March 5.

Once regulators approve, Over-the-Air (OTA) software updates could activate FSD across roughly 40,000 Teslas already on Japanese roads. Japan’s orderly traffic and strict safety culture make it an ideal testing ground for autonomous driving.

Hashimoto said:

“We are aiming for implementation in 2026. [We are] doing everything in our power [to achieve this].”

The push aligns with Hashimoto’s leadership, which has been credited for Tesla’s sales turnaround.

In 2025, Tesla delivered a record 10,600 vehicles in Japan — a nearly 90% jump from the prior year and the first time exceeding 10,000 units annually.

BREAKING 🇯🇵 FSD IS LIKELY LAUNCHING IN JAPAN IN 2026 🚨

Richi Hashimoto, President of Tesla’s Japanese subsidiary, stated: “We are aiming for implementation in 2026” and added that they are “doing everything in our power” to achieve this 🔥

Test drives in Japan began in August… pic.twitter.com/jkkrJLszXN

— Ming (@tslaming) March 5, 2026

The strategy shifted from online-only sales to adding 29 physical showrooms in high-traffic malls, plus staff training and attractive financing offers launched in January 2026. Tesla also plans to expand its Supercharger network to over 1,000 points by 2027, boosting accessibility.

This Japanese momentum reflects Tesla’s broader international expansion. In Europe, Giga Berlin produced more than 200,000 vehicles in 2025 despite a temporary halt, supplying over 30 markets with plans for sequential production growth in 2026 and battery cell manufacturing by 2027.

While regional EV sales faced headwinds, the factory remains a cornerstone for Model Y deliveries across the continent.

In Asia, Giga Shanghai continues to be recognized as Tesla’s powerhouse. China, the company’s largest market, saw January 2026 deliveries from the plant rise 9 percent year-over-year to 69,129 units, with affordable new models expected later this year.

FSD advancements, already progressing in the U.S. and South Korea, are slated for Europe and further Asian rollout, complementing plans to expand Cybercab and Optimus to new markets as well.

With OTA-enabled autonomy on the horizon and retail strategies paying dividends, Tesla is strengthening its footprint from Tokyo showrooms to Berlin assembly lines and Shanghai exports. As Hashimoto continues to push Tesla forward in Japan, the company’s global vision for sustainable, self-driving mobility gains traction across Europe and Asia.

News

Tesla ships out update that brings massive change to two big features

“This change only updates the name of certain features and text in your vehicle,” the company wrote in Release Notes for the update, “and does not change the way your features behave.”

Tesla has shipped out an update for its vehicles that was caused specifically by a California lawsuit that threatened the company’s ability to sell cars because of how it named its driver assistance suite.

Tesla shipped out Software Update 2026.2.9 starting last week; we received it already, and it only brings a few minor changes, mostly related to how things are referenced.

“This change only updates the name of certain features and text in your vehicle,” the company wrote in Release Notes for the update, “and does not change the way your features behave.”

The following changes came to Tesla vehicles in the update:

- Navigate on Autopilot has now been renamed to Navigate on Autosteer

- FSD Computer has been renamed to AI Computer

Tesla faced a 30-day sales suspension in California after the state’s Department of Motor Vehicles stated the company had to come into compliance regarding the marketing of its automated driving features.

The agency confirmed on February 18 that it had taken a “corrective action” to resolve the issue. That corrective action was renaming certain parts of its ADAS.

Tesla discontinued its standalone Autopilot offering in January and ramped up the marketing of Full Self-Driving Supervised. Tesla had said on X that the issue with naming “was a ‘consumer protection’ order about the use of the term ‘Autopilot’ in a case where not one single customer came forward to say there’s a problem.”

This was a “consumer protection” order about the use of the term “Autopilot” in a case where not one single customer came forward to say there’s a problem.

Sales in California will continue uninterrupted.

— Tesla North America (@tesla_na) December 17, 2025

It is now compliant with the wishes of the California DMV, and we’re all dealing with it now.

This was the first primary dispute over the terminology of Full Self-Driving, but it has undergone some scrutiny at the federal level, as some government officials have claimed the suite has “deceptive” names. Previous Transportation Secretary Pete Buttigieg was one of those federal-level employees who had an issue with the names “Autopilot” and “Full Self-Driving.”

Tesla sued the California DMV over the ruling last week.