News

SpaceX ready for 31st Starlink launch of 2022

SpaceX is on track to launch its 31st Starlink mission of 2022 later this morning.

No earlier than (NET) 10:50 am EDT (14:50 UTC) on Thursday, October 20th, a Falcon 9 rocket is scheduled to lift off from SpaceX’s Cape Canaveral Air Force Station (CCAFS) LC-40 launch pad with 54 internet satellites in tow. Weighing in at 16.75 tons (~36,900 lb), the batch of Starlink V1.5 satellites is one of just a few left for SpaceX to complete the second of five ‘shells’ that make up its first constellation.

Even before today’s Starlink 4-36 launch, more than two-thirds of the 4408 satellites required to complete the constellation are already in orbit and (by all appearances) working as expected. Of the 3131 working satellites in orbit, approximately 2700 are at their operational altitudes and theoretically capable of serving customers on Earth. Another ~390 satellites are in the process of climbing to their operational orbits. Once they’re done, SpaceX’s first Starlink constellation will be more than two-thirds complete.

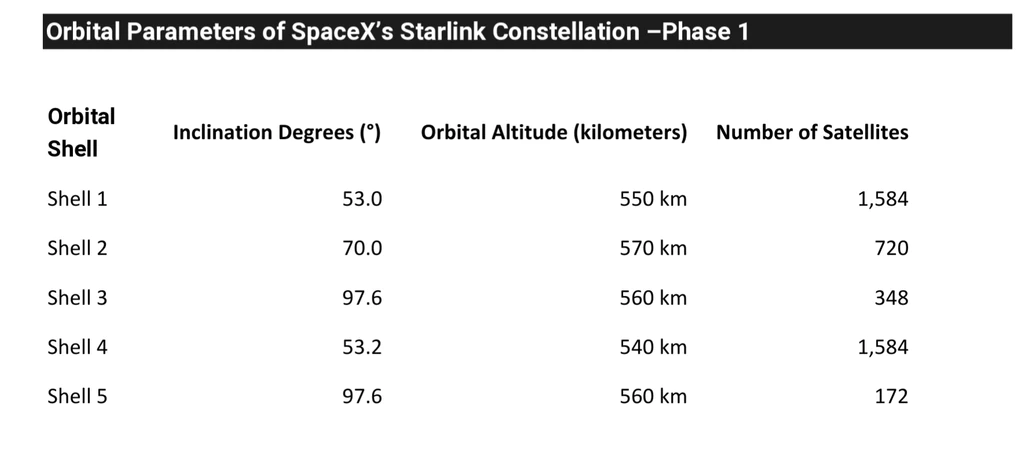

The constellation is made up of five orbital ‘shells’ – distinct groups of satellites that share a similar orbital inclination (the angle between the satellite’s orbit and Earth’s equator) and altitude. Two of those shells, known as Group 1 and Group 4, contain 3168 satellites or more than two-thirds of the constellation. They’re nearly identical and focus on Earth’s mid-latitudes, where almost every person (and customer) on Earth resides. Both are almost complete: astrophysicist Jonathan McDowell estimates that 1456 of 1584 possible Group 1 satellites are operational. Group 4 is one launch behind, with about 1405 working satellites in orbit.

In addition to Starlink 4-36, SpaceX has one more Starlink launch (4-31) tentatively scheduled in late October. The company’s November manifest is jam-packed with up to five commercial launches, potentially precluding any additional Starlink launches next month. December could be an even more commercially productive month if just a handful of schedules hold. But there’s a chance that SpaceX will find space to complete two more Starlink launches within the next ten weeks, allowing it to nearly complete Group 4 by the end of the year.

Once #4 is complete, all future launches for SpaceX’s first-generation Starlink constellation will likely head to one of three shells with semi-polar or polar inclinations. Group 2, the largest of the remaining shells with a planned 720 satellites, can be launched from any of SpaceX’s three pads. SpaceX has already launched one batch of Group 2 satellites and will need to complete ~13 more launches to finish the shell. Finally, more than half of Group 3’s 348 satellites have already been launched, but SpaceX has yet to start Group 5 (172 satellites). Both Group 3 and Group 5 will likely be launched out of SpaceX’s California launch pad.

Including an allowance for several dozen on-orbit satellite failures over the same period, SpaceX’s first Starlink constellation thus appears to be about 23 launches away from completion. If SpaceX matches its 2022 cadence in 2023, the entire 4408-satellite constellation could be fully operational before the end of next year. If SpaceX can hit its target of 100 total launches in 2023, the first Starlink constellation could be fully operational months before the end of 2023.

Even with a third of its satellites still on the ground, Starlink is close to an order of magnitude larger than any other constellation in history. Confirming an estimate shared by Teslarati earlier this year, CEO Elon Musk says that SpaceX now owns and operates more than half of all active satellites in orbit less than three years after the company began operational Starlink launches.

Tune in below to watch SpaceX’s 31st Starlink mission and 48th launch this year.

News

Tesla Sweden strikers see tax issues over IF Metall union error

To address the issue, IF Metall is encouraging Tesla strikers to return the refunded tax amounts to the union.

A tax correction is set to return two years of income tax payments to Tesla strikers in Sweden, after authorities determined that conflict compensation during a labor dispute should not have been taxed.

The issue is caused by a decision by IF Metall to treat strike compensation for Tesla workers as taxable income during the ongoing labor dispute with Tesla Sweden. That approach has now been reversed following guidance from the Swedish Tax Agency.

Strike compensation is typically tax-free under Sweden’s Income Tax Act, as noted in a report from Dagens Arbete (DA). However, two years ago, IF Metall’s board decided to classify payments to Tesla strikers as taxable.

“We did it to secure SGI, unemployment insurance and public pension. Those were the risks we saw when the strike had already dragged on,” Kent Bursjöö, financial manager at IF Metall, stated.

According to Bursjöö, the union wanted to ensure that members continued to register earned income with the tax agency, protecting benefits tied to income history. At the end of January, however, the Swedish Tax Agency informed the union that compensation during a labor dispute must be tax-free.

“Of course, we knew that it could be tax-free. But we clearly didn’t know that it couldn’t be taxable,” Bursjöö said.

Following discussions with auditors and tax authorities, IF Metall began correcting the payments. As a result, two years of paid income tax will now be credited back to the affected strikers’ tax accounts. The union will also recover previously paid employer contributions.

However, the correction creates secondary effects. Since the payments will now be treated as tax-free, pension contributions tied to those earnings will be withdrawn, potentially affecting state pension accrual and income-based benefits such as parental or sickness benefits.

To address this, IF Metall is encouraging members to return the refunded tax amounts to the union. In exchange, the union plans to pay 18.5% into occupational pensions on their behalf. “Otherwise, it will be a form of overcompensation when they get the tax paid back,” Bursjöö said.

That being said, the IF Metall officer acknowledged that the union’s legal ability to reclaim the funds from its improperly paid Tesla Sweden strikers is limited. “The legal possibilities are probably limited, from what we can see. But we assume that most people see the value of securing their pension,” Bursjöö said.

News

Tesla sues California DMV over Autopilot and FSD advertising ruling

The complaint seeks to remove the agency’s conclusion that Tesla falsely promoted the capabilities of Autopilot and Full Self-Driving.

Tesla has filed a lawsuit against the California Department of Motor Vehicles (DMV) in an effort to overturn a prior ruling that found the automaker engaged in false advertising related to its driver-assistance systems.

The complaint seeks to remove the agency’s conclusion that Tesla misled customers about the capabilities of Autopilot and Full Self-Driving.

Tesla’s legal action follows a decision by California’s Office of Administrative Hearings (OAH), which concluded that Tesla’s earlier marketing of “Autopilot” and “Full Self-Driving” violated state law, as noted in a CNBC report.

While the DMV opted not to suspend Tesla’s license after determining the company had updated its marketing language for its advanced driver-assistance systems, Tesla is asking the court to go further and reverse the agency’s conclusion.

In its Feb. 13 complaint, Tesla’s attorneys argued that the DMV “wrongfully and baselessly” labeled the company a “false advertiser” for its Autopilot and FSD systems. The filing argued that regulators failed to demonstrate that consumers were actually misled about the capabilities of Tesla’s systems.

According to Tesla’s complaint, the DMV “never proved consumers in the state had been confused about whether its cars were safe to drive without a human at the wheel.”

Tesla’s legal team further stated: “It was impossible to buy a Tesla equipped with either Autopilot or Full Self-Driving Capability, or to use any of their associated features, without seeing clear and repeated statements that they do not make the vehicle autonomous.”

Tesla now promotes its driver-assistance system as “Full Self-Driving (Supervised),” a name that overemphasizes the need for active driver attention.

Tesla’s autonomous driving program is a pivotal part of the company’s future, with CEO Elon Musk stating that self-driving technology will truly be the solution that will push Tesla into its full potential. The company is currently operating a Robotaxi pilot in Austin and the Bay Area, and the company recently announced that it has produced the first Cybercab from Giga Texas’ production line.

News

Tesla is making two big upgrades to the Model 3, coding shows

According to coding found in the European and Chinese configurators, Tesla is planning to make two big upgrades: Black Headliner offerings and a new 16-inch QHD display, similar to that on the Model Y Performance.

Tesla is making two big upgrades to the Model 3, one of which is widely requested by owners and fans, and another that it has already started to make on some trim levels of other models within the lineup.

The changes appear to be taking effect in the European and Chinese markets, but these are expected to come to the United States based on what Tesla has done with the Model Y.

According to coding found in the European and Chinese configurators, Tesla is planning to make two big upgrades: Black Headliner offerings and a new 16-inch QHD display, similar to that on the Model Y Performance.

These changes in the coding were spotted by X user BERKANT, who shared the findings on the social media platform this morning:

🚨 Model 3 changes spotted in Tesla backend

• New interior code: IN3PB (Interior 3 Premium Black)

• Linked to Alcantara-style black headliner

• Mapped to 2026 Model 3 Performance and Premium VINs• EPC now shows: “Display_16_QHD”

• Multiple 2026 builds marked with… pic.twitter.com/OkDM5EdbTu— BERKANT (@Tesla_NL_TR) February 23, 2026

It appears these new upgrades will roll out with the Model 3 Performance and Tesla’s Premium trim levels of the all-electric sedan.

The changes are welcome. Tesla fans have been requesting that its Model 3 and Model Y offerings receive a black headliner, as even with the black interior options, the headliner is grey.

Tesla recently upgraded Model Y vehicles to this black headliner option, even in the United States, so it seems as if the Model 3 will get the same treatment as it appears to be getting in the Eastern hemisphere.

Tesla has been basically accentuating the Model 3 and Model Y with small upgrades that owners have been wanting, and it has been a focal point of the company’s future plans as it phases out other vehicles like the Model S and Model X.

Additionally, Tesla offered an excellent 0.99% APR last week on the Model 3, hoping to push more units out the door to support a strong Q1 delivery figure at the beginning of April.