News

Updated: Tesla Model Y specification discrepancy has experts scratching their heads

Update: 5/3 12:40 pm est: Tesla has updated the specifications of the Model Y RWD in North America. See para. 3

A discrepancy in the Tesla Model Y’s specifications leaves experts and fans confused and wondering what will come to the United States.

Tesla has always been at least a little tight-lipped about its engineering and design, and this pseudo-secrecy certainly isn’t aided by its lack of a communications team. However, this has come to a head recently as fans have discovered a discrepancy in the specifications of Tesla’s newest offering, the rear-wheel-drive single-motor Model Y, which currently is only sold in select markets.

The Tesla Model Y spec discrepancy was first identified by Mathias Føns on Twitter, who pointed out that the Model Y RWD sold in North America is significantly heavier and charges substantially faster than its counterpart abroad.

The??Tesla Model Y RWD that recently launched has head-scratching specs

It weighs 319kg more than the??MY LR

Furthermore, it weighs 389kg more than the??MY RWD, has 47% higher max supercharging capabilities & ~15 km lower range (WLPT→EPA)

Did Tesla stealth launch new MY tech? pic.twitter.com/tYqoow7x4e

— Mathias Føns (@FonsDK) May 2, 2023

Since its discovery, Tesla has updated its website, decreasing the weight listed in North America to match the global model. However, the Model Y RWD outside of North America still charges at 170kW, while its North American counterpart charges at 250kW. Tesla has not publically addressed this disparity.

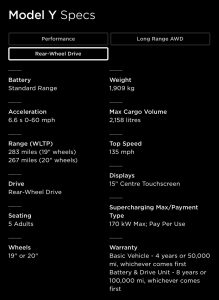

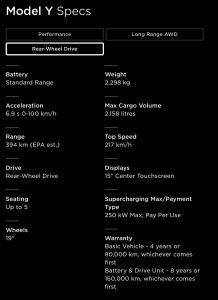

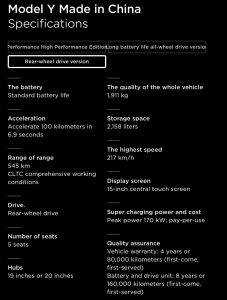

Looking at the spec sheets posted on Tesla websites worldwide, the heavier and faster charging Model Y RWD is only being sold in North America, including both Canada and Mexico, though the vehicle is not yet available in the States. In contrast, models sold in Australia, Europe, and Asia are lighter and charge significantly slower. Specifically, the North American model is 389kg (857.6 lbs) heavier than its global counterpart and charges almost twice as fast, 250kW vs. 170kW. The listed weight of the model sold in China is 2kg heavier than the one sold in Europe, but it has the same recorded charging speed.

The two models also seem to differ slightly in estimated range, though they aren’t precisely comparable considering they use entirely different testing schedules; EPA in North America, WLTP in Europe and Australia, and CLTC in China.

Strangely, this discrepancy continues when comparing the Model Y RWD with the Model Y Long-Range AWD sold in the same market. According to the Tesla Canada website, the RWD is 319kg (703.3 lbs) heavier than the LR AWD, though they charge at the same speed, 250kW.

While some have hypothesized that this weight difference has to do with how the weight is measured in each country, the more likely difference, which could also explain the dramatic difference in charging speed, is battery chemistry. Tesla does not list this difference on its website. Still, using lithium iron phosphate (LFP) batteries in North America would explain the incredible weight difference and the charging speed increase, that is, if the global model is using a lithium nickel manganese cobalt (NMC) battery.

Tesla CEO Elon Musk has previously noted that the automaker plans to switch all of its lower-priced offerings to the cheaper-to-produce LFP battery, further adding credence to the battery chemistry hypothesis.

With Tesla expected to continue to grow the reach of each of its product lines, many anticipate it will only be a matter of time before the RWD variant of the Model Y makes its way to Tesla’s home market, the United States. And with the rest of North America already using the heavier, faster charging model, Americans should expect access to this variant instead of the global version.

Along with the charging speed bump, the LFP battery would provide significantly improved durability and battery lifespan compared to those sold in Europe, Asia, and Australia.

What do you think of the article? Do you have any comments, questions, or concerns? Shoot me an email at william@teslarati.com. You can also reach me on Twitter @WilliamWritin. If you have news tips, email us at tips@teslarati.com!

News

Tesla opens first public Tesla Semi Megacharger site in Los Angeles

The development was highlighted in a post on social media platform X by the official Tesla Semi account.

Tesla has opened its first public Tesla Semi Megacharger site in Los Angeles. The station reportedly offers up to 750 kW charging speeds and is open to Tesla Semi customers.

The development was highlighted in a post on social media platform X by the official Tesla Semi account.

Tesla Semi Megachargers

The Los Angeles site seems to be the first public Tesla Semi Megacharger that is not located at a Tesla factory. It is also the third Megacharger site currently visible on Tesla’s map.

The Megacharger system is designed specifically for the Tesla Semi and is capable of delivering extremely high charging speeds to support long-haul trucking operations. Infrastructure such as this will likely play a key role in making the Semi competitive with diesel-powered transport trucks.

Tesla’s progress with the Semi has also drawn attention in recent days after Elon Musk biographer Ashlee Vance shared photos from inside the Tesla Semi factory near Giga Nevada. The images suggested that preparations for higher production volumes may be underway, hinting that a broader ramp of the Tesla Semi’s production indeed be approaching.

New deployment strategies

Tesla has continued expanding its broader charging network through several new strategies aimed at accelerating infrastructure deployment. One of these initiatives is the Supercharger for Business program, which allows third parties to purchase Tesla Supercharger equipment and deploy charging stations while still integrating with Tesla’s network.

The program recently marked a milestone in Alpharetta, Georgia, where the city deployed four 325 kW city-branded Superchargers near the Alpharetta Department of Public Safety on Old Milton Parkway. The chargers support the city’s Tesla Model Y police vehicles while also remaining accessible to the public.

As per a report from EVwire, the project was designed not only to support fleet charging but also to generate economic returns that could offset the city’s investment. Tesla’s Supercharger for Business program has already attracted several participants, including businesses and charging providers such as Suncoast Charging, Pie Safe bakery in Idaho, Francis Energy in Oklahoma, and Wawa convenience stores.

Elon Musk

The Boring Company’s Vegas Loop moves 82k riders during CONEXPO

The Loop’s feat was highlighted by The Boring Company in a post on its official account on social media platform X.

The Boring Company said its Vegas Loop system transported roughly 82,000 passengers during the recent CONEXPO-CON/AGG construction trade show in Las Vegas. The event was held at the Las Vegas Convention Center (LVCC) from March 3-7, 2026.

The Loop’s feat was highlighted by The Boring Company in a post on its official account on social media platform X.

CONEXPO-CON/AGG 2026

CONEXPO-CON/AGG is one of the largest construction trade shows in North America. This year’s event was quite impressive, attracting more than 140,000 construction professionals from 128 countries across the world.

Considering the number of this year’s attendees, the LVCC Loop seemed to have proven itself to be a very useful transportation solution. A video posted by The Boring Company on its official X account featured attendees expressing their enthusiasm for the underground transport system, with some stating that they would like to see similar tunnels across Las Vegas.

The LVCC Loop is only part of the greater Vegas Loop network, which is actively under construction.

New Vegas Loop extensions

One of the newest additions is a station at the Fontainebleau Las Vegas resort on the Strip. The station is located on level V-1 of the resort’s south valet area, according to a report from the Las Vegas Review-Journal. From the Fontainebleau, passengers can travel free of charge to stations serving the Las Vegas Convention Center, as well as to Loop stations at Encore and Westgate.

The system is also expanding beyond the Strip corridor. In December, The Boring Company began offering Vegas Loop rides to and from Harry Reid International Airport. These trips include a limited above-ground segment after receiving approval from the Nevada Transportation Authority to allow surface street travel tied to Loop operations.

The Boring Company President Steve Davis previously told the Review-Journal that the University Center Loop segment, which is currently under construction, is expected to open in the first quarter of 2026. The extension would allow Loop vehicles to travel beneath Paradise Road between the convention center and the airport, with a planned station just north of Tropicana Avenue.

News

Tesla preps to build its most massive Supercharger yet: 400+ V4 stalls

The project will be an expansion of the current Eddie World Supercharger in Yermo, California, and will take place in several stages.

Tesla is preparing to build its most massive Supercharger yet, as it recently submitted plans for an over 400-stall Supercharging station in California, which would dwarf its massive 168-stall location in Lost Hills, California.

The project will be an expansion of the current Eddie World Supercharger in Yermo, California, and will take place in several stages.

The expansion, adjacent to the existing Eddie World Supercharger, which is currently comprised of 22 older V2 and V3 stalls limited to 150 kW, unfolds across six phases.

Construction on Phase 1 begins later this year with 72 V4 stalls. Subsequent stages will progressively add hundreds more, culminating in over 400 next-generation chargers. Site plans label expansive parking arrays across Phases 1–5 along Calico Boulevard, with Phase 6 design still to be determined.

Tesla is planning an absolutely massive Supercharger expansion in Yermo, California!!

Over the course of 6 phases, Tesla is set to add over 400 V4 stalls in a commercial development known as Eddie World 2.

The first phase, which should begin construction sometime this year,… pic.twitter.com/ks5Y5dE8lR

— MarcoRP (@MarcoRPi1) March 6, 2026

The project was first flagged by MarcoRP, a notable Tesla Supercharger watcher.

Strategically located midway on I-15 between Los Angeles and Las Vegas, the station targets heavy EV traffic on this high-demand corridor.

The surrounding 20-mile stretch already hosts over 200 high-power stalls (including 40 at 250 kW, 120 at 325 kW, and more), plus 96 in nearby Baker—yet bottlenecks persist during peak travel.

In scale, it eclipses all existing Tesla Superchargers. The current record holder, the solar- and Megapack-powered “Project Oasis” in Lost Hills, California, offers 164 stalls. Barstow’s former leader had 120. Eddie World 2 will be more than double that size, cementing Tesla’s dominance in ultra-high-capacity charging.

Tesla finishes its biggest Supercharger ever with 168 stalls

Development blends charging with convenience. Architectural drawings show integrated retail: a 10,100 square foot Cracker Barrel, a 4,300 square foot McDonald’s, a 3,800 square foot convenience store, additional restaurants, drive-thrus, outdoor dining, and lease space.

EV-centric features include pull-through bays for Cybertrucks and trailers, ensuring accessibility for larger vehicles and future Semi trucks.