Customers who bought Tesla’s Full Self-Driving will get a free upgrade from Hardware 3 to Hardware 4. Elon Musk reiterated the free upgrades at a recent earnings call.

A retail investor submitted a question to Tesla about Hardware 3 in the company’s Q4 and Full Year 2024 earnings call.

Question: Is it expected that Tesla will need to upgrade Hardware 3 vehicles? And if so, what is the timeline and expected impact on Tesla’s capex? I think they’re referring to the cost there.

Elon Musk responded to the questions honestly, and reiterated that Tesla will provide free upgrades to FSD users.

“I mean, I think the honest answer is that we’re going to have to upgrade people’s Hardware 3 computers for those that have bought Full Self-Driving, and that is the honest answer, and that’s going to be painful and difficult, but we’ll get it done. Now I’m kind of glad that not that many people bought the FSD package,” Musk replied.

Tesla’s Chief Financial Officer Viahbhav Taneja added that the company hasn’t stopped working on Hardware 3. He commented that Tesla still releases software for Hardware 3.

“We released the 12.6 release recently, which was like a baby V13, but it’s a significant improvement compared to what they had previously. People are still finding ways to distill larger models in the smaller models. So, we’re not giving up on Hardware. We’re still working on it. Just will trail the Hardware 4 releases,” said Tesla’s CFO.

The Teslarati team would appreciate hearing from you. If you have any tips, contact me at maria@teslarati.com or via Twitter @Writer_01001101.

Elon Musk

Elon Musk explains why Tesla’s 4680 battery breakthrough is a big deal

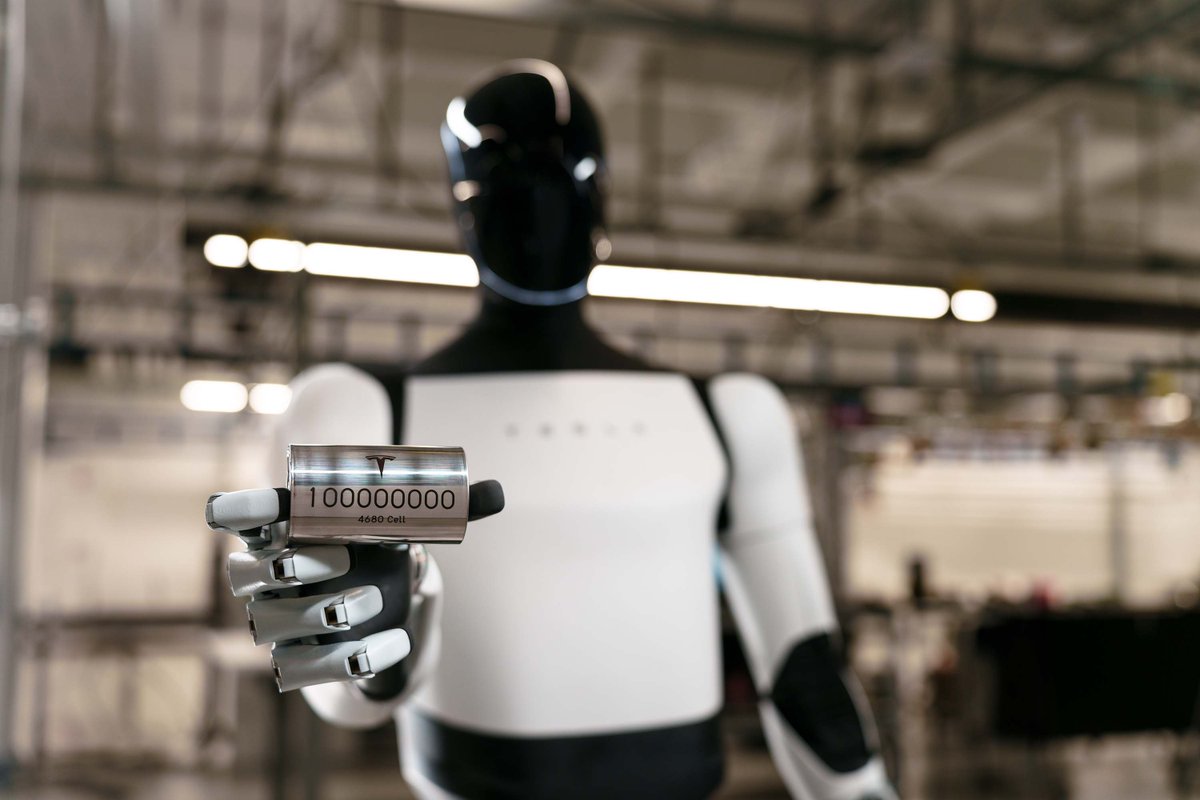

Tesla confirmed in its Q4 and FY 2025 update letter that it is now producing 4680 cells whose anode and cathode were produced during the dry electrode process.

Tesla’s breakthroughs with its 4680 battery cell program mark a significant milestone for the electric vehicle maker. This was, at least, as per Elon Musk in a recent post on social media platform X.

Tesla confirmed in its Q4 and FY 2025 update letter that it is now producing 4680 cells whose anode and cathode were produced during the dry electrode process.

Why dry-electrode matters

In a post on X, Elon Musk stated that making the dry-electrode process work at scale was “incredibly difficult,” calling it a major achievement for Tesla’s engineering, production, and supply chain teams, as well as its partner suppliers. He also shared his praise for the Tesla team for overcoming such a difficult task.

“Making the dry electrode process work at scale, which is a major breakthrough in lithium battery production technology, was incredibly difficult. Congratulations to the @Tesla engineering, production and supply chain teams and our strategic partner suppliers for this excellent achievement!” Musk wrote in his post.

Tesla’s official X account expanded on Musk’s remarks, stating that dry-electrode manufacturing “cuts cost, energy use & factory complexity while dramatically increasing scalability.” Bonne Eggleston, Tesla’s Vice President of 4680 batteries, also stated that “Getting dry electrode technology to scale is just the beginning.”

Tesla’s 4680 battery program

Tesla first introduced the dry-electrode concept at Battery Day in 2020, positioning it as a way to eliminate solvent-based electrode drying, shrink factory footprints, and lower capital expenditures. While Tesla has produced 4680 cells for some time, the dry cathode portion of the process proved far more difficult to industrialize than expected.

Together with its confirmation that it is producing 4680 cells in Austin with both electrodes manufactured using the dry process, Tesla has also stated that it has begun producing Model Y vehicles with 4680 battery packs. As per Tesla, this strategy was adopted as a safety layer against trade barriers and tariff risks.

“We have begun to produce battery packs for certain Model Ys with our 4680 cells, unlocking an additional vector of supply to help navigate increasingly complex supply chain challenges caused by trade barriers and tariff risks,” Tesla wrote in its Q4 and FY 2025 update letter.

Elon Musk

Tesla director pay lawsuit sees lawyer fees slashed by $100 million

The ruling leaves the case’s underlying settlement intact while significantly reducing what the plaintiffs’ attorneys will receive.

The Delaware Supreme Court has cut more than $100 million from a legal fee award tied to a shareholder lawsuit challenging compensation paid to Tesla directors between 2017 and 2020.

The ruling leaves the case’s underlying settlement intact while significantly reducing what the plaintiffs’ attorneys will receive.

Delaware Supreme Court trims legal fees

As noted in a Bloomberg Law report, the case targeted pay granted to Tesla directors, including CEO Elon Musk, Oracle founder Larry Ellison, Kimbal Musk, and Rupert Murdoch. The Delaware Chancery Court had awarded $176 million to the plaintiffs. Tesla’s board must also return stock options and forego years worth of pay.

As per Chief Justice Collins J. Seitz Jr. in an opinion for the Delaware Supreme Court’s full five-member panel, however, the decision of the Delaware Chancery Court to award $176 million to a pension fund’s law firm “erred by including in its financial benefit analysis the intrinsic value” of options being returned by Tesla’s board.

The justices then reduced the fee award from $176 million to $70.9 million. “As we measure it, $71 million reflects a reasonable fee for counsel’s efforts and does not result in a windfall,” Chief Justice Seitz wrote.

Other settlement terms still intact

The Supreme Court upheld the settlement itself, which requires Tesla’s board to return stock and options valued at up to $735 million and to forgo three years of additional compensation worth about $184 million.

Tesla argued during oral arguments that a fee award closer to $70 million would be appropriate. Interestingly enough, back in October, Justice Karen L. Valihura noted that the $176 award was $60 million more than the Delaware judiciary’s budget from the previous year. This was quite interesting as the case was “settled midstream.”

The lawsuit was brought by a pension fund on behalf of Tesla shareholders and focused exclusively on director pay during the 2017–2020 period. The case is separate from other high-profile compensation disputes involving Elon Musk.

Elon Musk

SpaceX-xAI merger discussions in advanced stage: report

The update was initially reported by Bloomberg News, which cited people reportedly familiar with the matter.

SpaceX is reportedly in advanced discussions to merge with artificial intelligence startup xAI. The talks could reportedly result in an agreement as soon as this week, though discussions remain ongoing.

The update was initially reported by Bloomberg News, which cited people reportedly familiar with the matter.

SpaceX and xAI advanced merger talks

SpaceX and xAI have reportedly informed some investors about plans to potentially combine the two privately held companies, Bloomberg’s sources claimed. Representatives for both companies did not immediately respond to requests for comment.

A merger would unite two of the world’s largest private firms. xAI raised capital at a valuation of about $200 billion in September, while SpaceX was preparing a share sale late last year that valued the rocket company at roughly $800 billion.

If completed, the merger would bring together SpaceX’s launch and satellite infrastructure with xAI’s computing and model development. This could pave the way for Musk’s vision of deploying data centers in orbit to support large-scale AI workloads.

Musk’s broader consolidation efforts

Elon Musk has increasingly linked his companies around autonomy, AI, and space-based infrastructure. SpaceX is seeking regulatory approval to launch up to one million satellites as part of its long-term plans, as per a recent filing. Such a scale could support space-based computing concepts.

SpaceX has also discussed the feasibility of a potential tie-up with electric vehicle maker Tesla, Bloomberg previously reported. SpaceX has reportedly been preparing for a possible initial public offering (IPO) as well, which could value the company at up to $1.5 trillion. No timeline for SpaceX’s reported IPO plans have been announced yet, however.