Tesla has further reduced its cost per electric vehicle (EV) as it prepares to produce the new Model Y.

“Our journey on cost reduction continues, and we were able to get our overall cost per car down below $35,000, driven primarily by material costs,” said Tesla’s Chief Financial Officer, Vaibhav Taneja.

Three years ago, Tesla’s former Head of Investor Relations, Martin Viecha, shared that Tesla cost $84,000 to produce each car in 2017. By 2024, Tesla reduced that number to around $36,000 per vehicle.

Taneja hinted that reducing Tesla’s cost per vehicle was not easy. He explained that Tesla’s cost per car decreased despite increased depreciation. He also noted that some costs increased as Tesla prepared to produce the new Model Y.

“All our factories will start producing the new Model Y next month. While we feel confident in our team’s abilities to ramp production quickly, note that it is an unprecedented change, and we are not aware of anybody else taking the best-selling car on the planet and updating all factories at the same time,” noted Tesla’s CFO.

The Teslarati team would appreciate hearing from you. If you have any tips, contact me at maria@teslarati.com or via Twitter @Writer_01001101.

Elon Musk

Tesla to increase Full Self-Driving subscription price: here’s when

Tesla will increase its Full Self-Driving subscription price, meaning it will eventually be more than the current $99 per month price tag it has right now.

Already stating that the ability to purchase the suite outright will be removed, Tesla CEO Elon Musk said earlier this week that the Full Self-Driving subscription price would increase when its capabilities improve:

“I should also mention that the $99/month for supervised FSD will rise as FSD’s capabilities improve. The massive value jump is when you can be on your phone or sleeping for the entire ride (unsupervised FSD).”

This was an expected change, especially as Tesla has been hinting for some time that it is approaching a feature-complete version of Full Self-Driving that will no longer require driver supervision. However, with the increase, some are concerned that they may be priced out.

$99 per month is already a tough ask for some. While Full Self-Driving is definitely worth it just due to the capabilities, not every driver is ready to add potentially 50 percent to their car payment each month to have it.

While Tesla has not revealed any target price for FSD, it does seem that it will go up to at least $150.

I should also mention that the $99/month for supervised FSD will rise as FSD’s capabilities improve.

The massive value jump is when you can be on your phone or sleeping for the entire ride (unsupervised FSD). https://t.co/YDKhXN3aaG

— Elon Musk (@elonmusk) January 23, 2026

Additionally, the ability to purchase the suite outright is also being eliminated on February 14, which gives owners another reason to be slightly concerned about whether they will be able to afford to continue paying for Full Self-Driving in any capacity.

Some owners have requested a tiered program, which would allow people to pay for the capabilities they want at a discounted price.

Unsupervised FSD would be the most expensive, and although the company started removing Autopilot from some vehicles, it seems a Supervised FSD suite would still attract people to pay between $49 and $99 per month, as it is very useful.

Tesla will likely release pricing for the Unsupervised suite when it is available, but price increases could still come to the Supervised version as things improve.

This is not the first time Musk has hinted that the price would change with capability improvements, either. He’s been saying it for some time. In 2020, he even said the value of FSD would “probably be somewhere in excess of $100,000.”

The FSD price will continue to rise as the software gets closer to full self-driving capability with regulatory approval. It that point, the value of FSD is probably somewhere in excess of $100,000.

— Elon Musk (@elonmusk) May 18, 2020

Elon Musk

Tesla removes Autopilot as standard, receives criticism online

The move leaves only Traffic Aware Cruise Control as standard equipment on new Tesla orders.

Tesla removed its basic Autopilot package as a standard feature in the United States. The move leaves only Traffic Aware Cruise Control as standard equipment on new Tesla orders, and shifts the company’s strategy towards paid Full Self-Driving subscriptions.

Tesla removes Autopilot

As per observations from the electric vehicle community on social media, Tesla no longer lists Autopilot as standard in its vehicles in the U.S. This suggests that features such as lane-centering and Autosteer have been removed as standard equipment. Previously, most Tesla vehicles came with Autopilot by default, which offers Traffic-Aware Cruise Control and Autosteer.

The change resulted in backlash from some Tesla owners and EV observers, particularly as competing automakers, including mainstream players like Toyota, offer features like lane-centering as standard on many models, including budget vehicles.

That being said, the removal of Autopilot suggests that Tesla is concentrating its autonomy roadmap around FSD subscriptions rather than bundled driver-assistance features. It would be interesting to see how Tesla manages its vehicles’ standard safety features, as it seems out of character for Tesla to make its cars less safe over time.

Musk announces FSD price increases

Following the Autopilot changes, Elon Musk stated on X that Tesla is planning to raise subscription prices for FSD as its capabilities improve. In a post on X, Musk stated that the current $99-per-month price for supervised FSD would increase over time, especially as the system itself becomes more robust.

“I should also mention that the $99/month for supervised FSD will rise as FSD’s capabilities improve. The massive value jump is when you can be on your phone or sleeping for the entire ride (Unsupervised FSD),” Musk wrote.

At the time of his recent post, Tesla still offers FSD as a one-time purchase for $8,000, but Elon Musk has confirmed that this option will be discontinued on February 14, leaving subscriptions as the only way to access the system.

Elon Musk

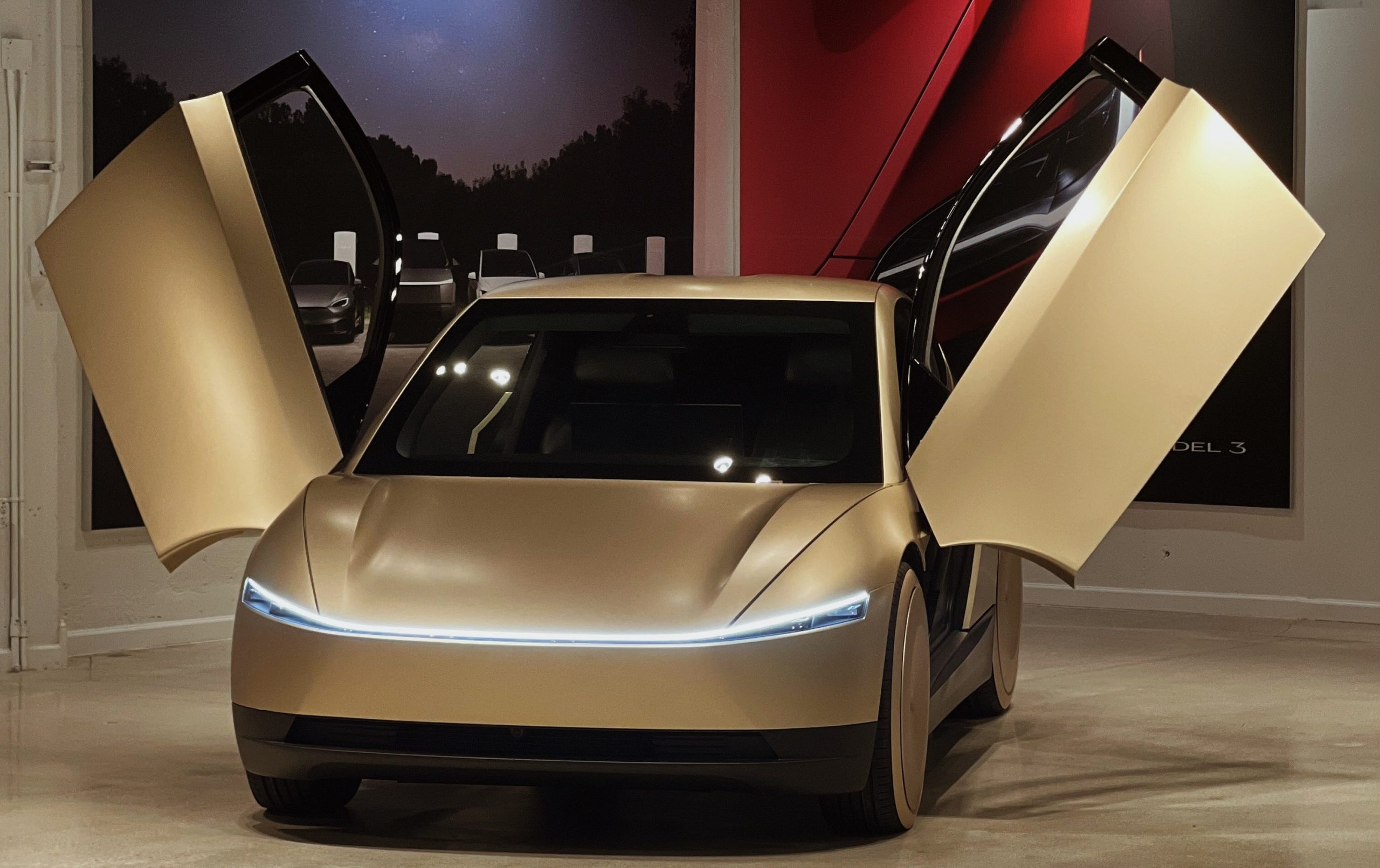

Elon Musk shares incredible detail about Tesla Cybercab efficiency

Elon Musk shared an incredible detail about Tesla Cybercab’s potential efficiency, as the company has hinted in the past that it could be one of the most affordable vehicles to operate from a per-mile basis.

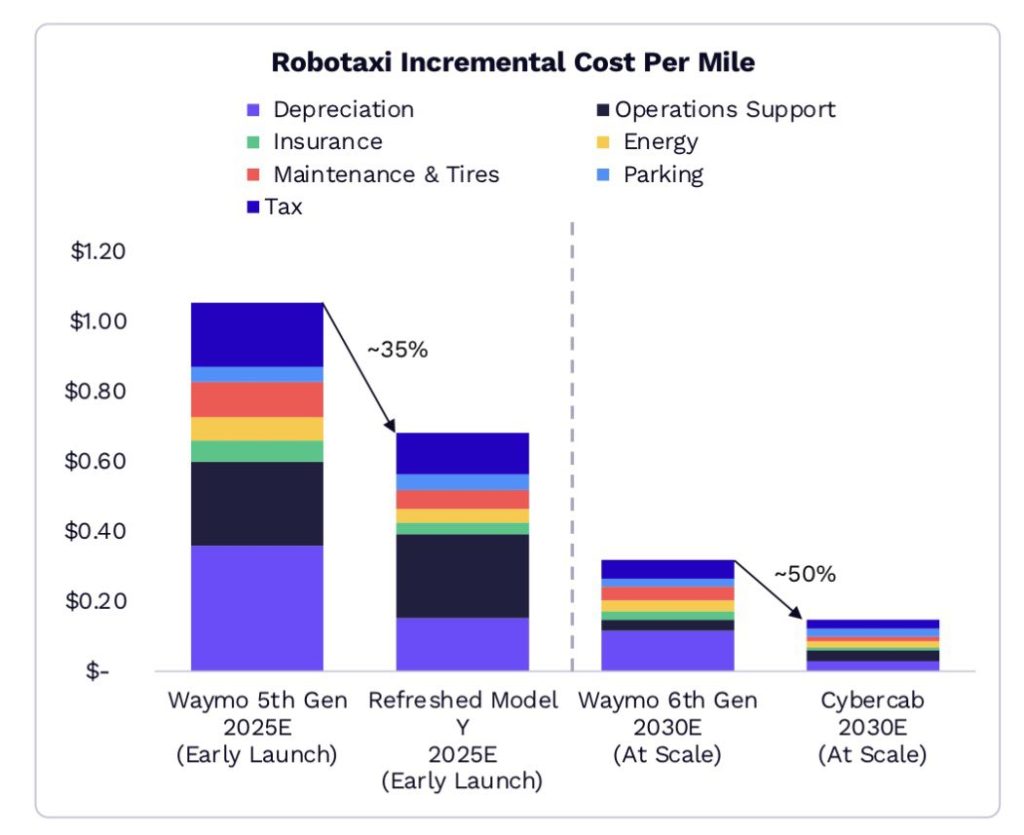

ARK Invest released a report recently that shed some light on the potential incremental cost per mile of various Robotaxis that will be available on the market in the coming years.

The Cybercab, which is detailed for the year 2030, has an exceptionally low cost of operation, which is something Tesla revealed when it unveiled the vehicle a year and a half ago at the “We, Robot” event in Los Angeles.

Musk said on numerous occasions that Tesla plans to hit the $0.20 cents per mile mark with the Cybercab, describing a “clear path” to achieving that figure and emphasizing it is the “full considered” cost, which would include energy, maintenance, cleaning, depreciation, and insurance.

Probably true

— Elon Musk (@elonmusk) January 22, 2026

ARK’s report showed that the Cybercab would be roughly half the cost of the Waymo 6th Gen Robotaxi in 2030, as that would come in at around $0.40 per mile all in. Cybercab, at scale, would be at $0.20.

Credit: ARK Invest

This would be a dramatic decrease in the cost of operation for Tesla, and the savings would then be passed on to customers who choose to utilize the ride-sharing service for their own transportation needs.

The U.S. average cost of new vehicle ownership is about $0.77 per mile, according to AAA. Meanwhile, Uber and Lyft rideshares often cost between $1 and $4 per mile, while Waymo can cost between $0.60 and $1 or more per mile, according to some estimates.

Tesla’s engineering has been the true driver of these cost efficiencies, and its focus on creating a vehicle that is as cost-effective to operate as possible is truly going to pay off as the vehicle begins to scale. Tesla wants to get the Cybercab to about 5.5-6 miles per kWh, which has been discussed with prototypes.

Additionally, fewer parts due to the umboxed manufacturing process, a lower initial cost, and eliminating the need to pay humans for their labor would also contribute to a cheaper operational cost overall. While aspirational, all of the ingredients for this to be a real goal are there.

It may take some time as Tesla needs to hammer the manufacturing processes, and Musk has said there will be growing pains early. This week, he said regarding the early production efforts:

“…initial production is always very slow and follows an S-curve. The speed of production ramp is inversely proportionate to how many new parts and steps there are. For Cybercab and Optimus, almost everything is new, so the early production rate will be agonizingly slow, but eventually end up being insanely fast.”