Investor's Corner

HyperLoop Test Track Coming To California

HyperLoop Transportation Technologies has purchased land in central California to build HyperLoop test track to see if the this nutty idea actually works.

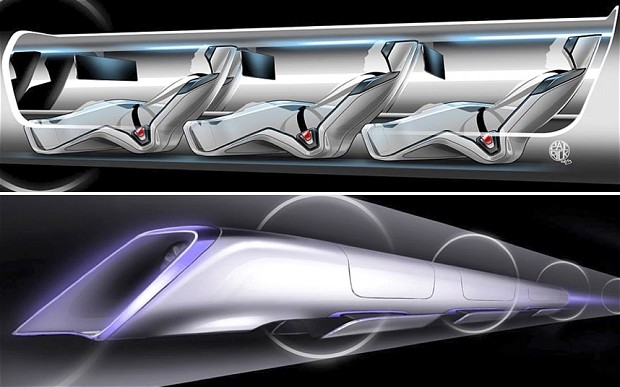

HyperLoop Transportation Technologies has struck a deal to buy enough land near Interstate 5 in central California to build a 5 mile long HyperLoop test track, reports Navigant Research. It will cost about $100,000,000 and serve as a “proof of concept” facility for the HyperLoop idea proposed by Elon Musk in 2013. The money to pay for it is expected to come from an IPO later this year, with construction beginning in 2016.

If you’re not familiar with the HyperLoop, think of it as one of those pneumatic tubes that connect drivers and tellers at drive-thru banks, only hundreds of miles long and big enough to carry people. Musk thinks such a system could whisk passengers from LA to San Francisco in about 35 minutes at speeds up to 800 mph.

If that seems a little fantastic to you, remember this is the man who thought it was possible to build a rocket ship for a fraction of what it costs other companies — and then did it. Today, his SpaceX company has years of business worth billions of dollars booked, while those others are crying for customers. Saying “It can’t be done,” to Musk is like telling Congress to stop spending your money.

For all his genius, not even Elon Musk can overturn the laws of physics. All transportation devices have to deal with friction losses and wind resistance. As speeds increase, so does friction, but the real enemy of high speed travel is wind resistance. Aerodynamic loads increase with the square of speed. That’s why it takes 4 times as much power to punch a hole in the air at 100 mph than it does at 50 mph.

The HyperLoop doesn’t repeal the laws of physics; it finds new ways to minimize their effects. It’s one of those “Don’t raise the bridge, lower the river,” kind of things and it’s brilliant. Let’s start with wind resistance. The HyperLoop will consist of a steel tube hundreds of miles long that has a partial vacuum inside. Less air means less wind resistance. Less wind resistance means higher speeds with less power.

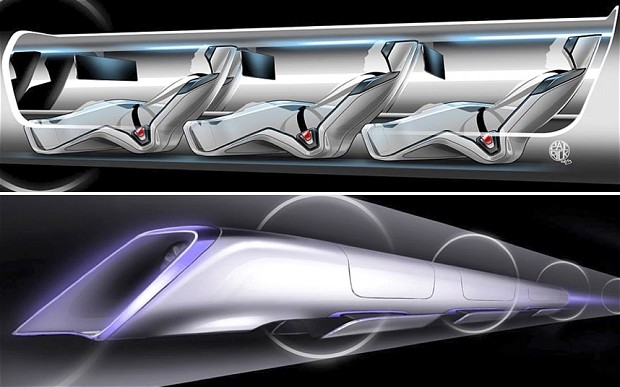

Part two of the plan eliminates all the wheels, axles and motors that cause friction in regular vehicles. Instead, the transportation modules inside the HyperLoop tube will “float” on a thin layer of air, slashing friction to nearly zero. Instead of motors, the train will be propelled by electrically powered linear accelerators installed along its entire length. Once again, the idea is brilliant. But will it work?

Musk says passengers in his HyperLoop will be whisked along in complete comfort. But skeptics point out that they will be sealed inside windowless pods during the journey. Those who suffer from claustrophobia shouldn’t buy a ticket. There will be no beverage service, no restrooms and no possibility of moving around during the journey. Furthermore, they will be bombarded by the sound of what little air is left inside the tube rushing by at near supersonic speeds.

While Musk assumes the ride will be serenely smooth, in reality the alignment of the tube will have to be virtually perfect over its entire length for that to happen. Hello? We are talking about California here, a state known for its frequent seismic activity. Then there are considerations like how to keep the HyperLink tube sealed against air leaks and safe from vandalism.

The test track is designed to answer all those questions and win over the doubters. If the idea is validated, Musk says a Hyperloop along the heavily traveled I 5 corridor could be built for about $8 billion. Contrast that with the $64 billion the Amtrak high speed rail line scheduled to begin construction soon is supposed to cost. When was the last time a government project came in on time and under budget? Of course, Musk’s numbers don’t include the costs of developing his idea and making it a reality.

Elon Musk’s greatest gift is spinning wondrous tales about what could be and convincing people to invest today in his promise of tomorrow. Then he uses the funds raised to make tomorrow happen. So far, more people have made money investing in Musk and his dreams than have lost it. When the HyperLoop Transportation Technologies IPO takes place, will you be on the phone to your broker, placing a “buy” order? Or do you think the HyperLoop is mostly hype and hyperbole?

The problem with predicting the future is the future is so stubbornly unpredictable.

Investor's Corner

Tesla stock closes at all-time high on heels of Robotaxi progress

Tesla stock (NASDAQ: TSLA) closed at an all-time high on Tuesday, jumping over 3 percent during the day and finishing at $489.88.

The price beats the previous record close, which was $479.86.

Shares have had a crazy year, dipping more than 40 percent from the start of the year. The stock then started to recover once again around late April, when its price started to climb back up from the low $200 level.

This week, Tesla started to climb toward its highest levels ever, as it was revealed on Sunday that the company was testing driverless Robotaxis in Austin. The spike in value pushed the company’s valuation to $1.63 trillion.

Tesla Robotaxi goes driverless as Musk confirms Safety Monitor removal testing

It is the seventh-most valuable company on the market currently, trailing Nvidia, Apple, Alphabet (Google), Microsoft, Amazon, and Meta.

Shares closed up $14.57 today, up over 3 percent.

The stock has gone through a lot this year, as previously mentioned. Shares tumbled in Q1 due to CEO Elon Musk’s involvement with the Department of Government Efficiency (DOGE), which pulled his attention away from his companies and left a major overhang on their valuations.

However, things started to rebound halfway through the year, and as the government started to phase out the $7,500 tax credit, demand spiked as consumers tried to take advantage of it.

Q3 deliveries were the highest in company history, and Tesla responded to the loss of the tax credit with the launch of the Model 3 and Model Y Standard.

Additionally, analysts have announced high expectations this week for the company on Wall Street as Robotaxi continues to be the focus. With autonomy within Tesla’s sights, things are moving in the direction of Robotaxi being a major catalyst for growth on the Street in the coming year.

Elon Musk

Tesla needs to come through on this one Robotaxi metric, analyst says

“We think the key focus from here will be how fast Tesla can scale driverless operations (including if Tesla’s approach to software/hardware allows it to scale significantly faster than competitors, as the company has argued), and on profitability.”

Tesla needs to come through on this one Robotaxi metric, Mark Delaney of Goldman Sachs says.

Tesla is in the process of rolling out its Robotaxi platform to areas outside of Austin and the California Bay Area. It has plans to launch in five additional cities, including Houston, Dallas, Miami, Las Vegas, and Phoenix.

However, the company’s expansion is not what the focus needs to be, according to Delaney. It’s the speed of deployment.

The analyst said:

“We think the key focus from here will be how fast Tesla can scale driverless operations (including if Tesla’s approach to software/hardware allows it to scale significantly faster than competitors, as the company has argued), and on profitability.”

Profitability will come as the Robotaxi fleet expands. Making that money will be dependent on when Tesla can initiate rides in more areas, giving more customers access to the program.

There are some additional things that the company needs to make happen ahead of the major Robotaxi expansion, one of those things is launching driverless rides in Austin, the first city in which it launched the program.

This week, Tesla started testing driverless Robotaxi rides in Austin, as two different Model Y units were spotted with no occupants, a huge step in the company’s plans for the ride-sharing platform.

Tesla Robotaxi goes driverless as Musk confirms Safety Monitor removal testing

CEO Elon Musk has been hoping to remove Safety Monitors from Robotaxis in Austin for several months, first mentioning the plan to have them out by the end of 2025 in September. He confirmed on Sunday that Tesla had officially removed vehicle occupants and started testing truly unsupervised rides.

Although Safety Monitors in Austin have been sitting in the passenger’s seat, they have still had the ability to override things in case of an emergency. After all, the ultimate goal was safety and avoiding any accidents or injuries.

Goldman Sachs reiterated its ‘Neutral’ rating and its $400 price target. Delaney said, “Tesla is making progress with its autonomous technology,” and recent developments make it evident that this is true.

Investor's Corner

Tesla gets bold Robotaxi prediction from Wall Street firm

Last week, Andrew Percoco took over Tesla analysis for Morgan Stanley from Adam Jonas, who covered the stock for years. Percoco seems to be less optimistic and bullish on Tesla shares, while still being fair and balanced in his analysis.

Tesla (NASDAQ: TSLA) received a bold Robotaxi prediction from Morgan Stanley, which anticipates a dramatic increase in the size of the company’s autonomous ride-hailing suite in the coming years.

Last week, Andrew Percoco took over Tesla analysis for Morgan Stanley from Adam Jonas, who covered the stock for years. Percoco seems to be less optimistic and bullish on Tesla shares, while still being fair and balanced in his analysis.

Percoco dug into the Robotaxi fleet and its expansion in the coming years in his latest note, released on Tuesday. The firm expects Tesla to increase the Robotaxi fleet size to 1,000 vehicles in 2026. However, that’s small-scale compared to what they expect from Tesla in a decade.

Tesla expands Robotaxi app access once again, this time on a global scale

By 2035, Morgan Stanley believes there will be one million Robotaxis on the road across multiple cities, a major jump and a considerable fleet size. We assume this means the fleet of vehicles Tesla will operate internally, and not including passenger-owned vehicles that could be added through software updates.

He also listed three specific catalysts that investors should pay attention to, as these will represent the company being on track to achieve its Robotaxi dreams:

- Opening Robotaxi to the public without a Safety Monitor. Timing is unclear, but it appears that Tesla is getting closer by the day.

- Improvement in safety metrics without the Safety Monitor. Tesla’s ability to improve its safety metrics as it scales miles driven without the Safety Monitor is imperative as it looks to scale in new states and cities in 2026.

- Cybercab start of production, targeted for April 2026. Tesla’s Cybercab is a purpose-built vehicle (no steering wheel or pedals, only two seats) that is expected to be produced through its state-of-the-art unboxed manufacturing process, offering further cost reductions and thus accelerating adoption over time.

Robotaxi stands to be one of Tesla’s most significant revenue contributors, especially as the company plans to continue expanding its ride-hailing service across the world in the coming years.

Its current deployment strategy is controlled and conservative to avoid any drastic and potentially program-ruining incidents.

So far, the program, which is active in Austin and the California Bay Area, has been widely successful.