Investor's Corner

Tesla SolarCity merger may be delayed by shareholder lawsuits

A special stockholder meeting in connection with Tesla’s proposed SolarCity acquisition is coming soon.

Over the weekend, Tesla published two items related to the acquisition: a notice of an upcoming event, the Record Date for the Upcoming Tesla Special Stockholder Meeting in Connection with SolarCity Acquisition, and an update the the S-4 Registration Statement, a.k.a the Merger Proposal.

In the first announcement Tesla intends to inform Tesla investors that the “record date for the determination of Tesla stockholders entitled to […] vote at the Tesla special stockholders meeting in connection with the SolarCity acquisition will be sometime during the week of September 19, 2016.” In layman terms, this means that sometime this week, anyone that “settled” a TSLA stock purchase 3 days prior to this date will have the right to vote at the Tesla special stockholders meeting.

Because of the T+3 system of settlement presently used in North America whereby stock trades settle three business days after the transaction is carried out, anyone purchasing TSLA stock this week will likely be unable to vote at the Tesla special stockholders meeting.

The second filing is an update to the original S-4 Registration Statement of August 31, 2016. Comparing the two version of the Merger Proposal, shows that the documents are effectively identical, except for a section entitled “Litigation Relating to the Merger” (on page 23 of the latest PDF).

In this section of the Merger Proposal, Tesla discloses that “between September 1, 2016 and September 14, 2016, four lawsuits were filed in the Court of Chancery of the State of Delaware by purported stockholders of Tesla challenging the proposed Merger.” These lawsuits were filed by the City of Riviera Beach Police Pension Fund, Ellen Prasinos, the Arkansas Teacher Retirement System, and P. Evan Stephens.

In the lawsuits it is alleged “that the members of the Tesla Board breached their fiduciary duties in connection with the proposed Merger and, in some cases, that SolarCity and members of the SolarCity Board aided and abetted breaches of fiduciary duties and that certain individual defendants would be unjustly enriched by the proposed Merger.”

Additionally the lawsuits claim that “Member of the Tesla Board [..] [in the S-4 document] filed on August 31, 2016 allegedly failed to disclose material facts in connection with the proposed Merger.”

The main goal of the lawsuits is the rescission of the proposed Merger. Tesla of course believes that the actions are without merit.

What does this all means? Probably not too much. The record date will be announced this week, and soon after the Tesla special stockholders meeting in connection with the SolarCity acquisition will be held. Approval is expected, given that most of the large shareholders, Mutual Funds and major Hedge funds, have already announced their approval.

The lawsuits, unless thrown out by the appointed judge, will likely only delay the actual closing off the agreement. One thing to also note is that almost every merger agreement results in shareholders lawsuits, so the Tesla situation is fairly common.

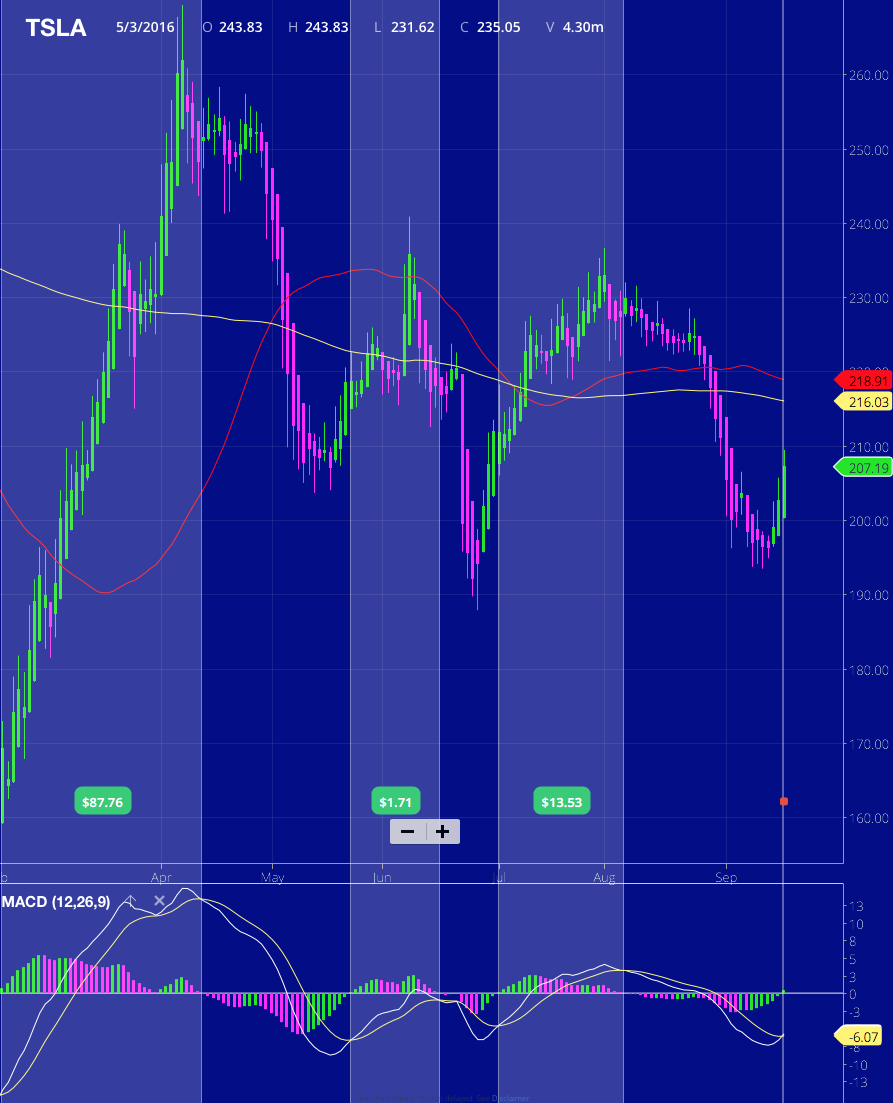

TSLA Stock Action

TSLA stock is now officially back on the run. Looking at today’s chart, most of the technical indicators have now turned positive: we have 3 green bars of the Heikin-Ashi chart (the pay-day-cycle, showing the momentum is on the upside), the MACD has turned positive and the MACD averages are “pinching”. This was enough for me to initiate a buy on Friday of TSLA January 2017 $200 calls.

Source: Wall Street I/O

Elon Musk

Tesla locks in Elon Musk’s top problem solver as it enters its most ambitious era

The generous equity award was disclosed by the electric vehicle maker in a recent regulatory filing.

Tesla has granted Senior Vice President of Automotive Tom Zhu more than 520,000 stock options, tying a significant portion of his compensation to the company’s long-term performance.

The generous equity award was disclosed by the electric vehicle maker in a recent regulatory filing.

Tesla secures top talent

According to a Form 4 filing with the U.S. Securities and Exchange Commission, Tom Zhu received 520,021 stock options with an exercise price of $435.80 per share. Since the award will not fully vest until March 5, 2031, Zhu must remain at Tesla for more than five years to realize the award’s full benefit.

Considering that Tesla shares are currently trading at around the $445 to $450 per share level, Zhu will really only see gains in his equity award if Tesla’s stock price sees a notable rise over the years, as noted in a Sina Finance report.

Still, even at today’s prices, Zhu’s stock award is already worth over $230 million. If Tesla reaches the market cap targets set forth in Elon Musk’s 2025 CEO Performance Award, Zhu would become a billionaire from this equity award alone.

Tesla’s problem solver

Zhu joined Tesla in April 2014 and initially led the company’s Supercharger rollout in China. Later that year, he assumed the leadership of Tesla’s China business, where he played a central role in Tesla’s localization efforts, including expanding retail and service networks, and later, overseeing the development of Gigafactory Shanghai.

Zhu’s efforts helped transform China into one of Tesla’s most important markets and production hubs. In 2023, Tesla promoted Zhu to Senior Vice President of Automotive, placing him among the company’s core global executives and expanding his influence beyond China. He has since garnered a reputation as the company’s problem solver, being tapped by Elon Musk to help ramp Giga Texas’s vehicle production.

With this in mind, Tesla’s recent filing seems to suggest that the company is locking in its top talent as it enters its newest, most ambitious era to date. As could be seen in the targets of Elon Musk’s 2025 pay package, Tesla is now aiming to be the world’s largest company by market cap, and it is aiming to achieve production levels that are unheard of. Zhu’s talents would definitely be of use in this stage of the company’s growth.

Investor's Corner

Tesla analyst teases self-driving dominance in new note: ‘It’s not even close’

Tesla analyst Andrew Percoco of Morgan Stanley teased the company’s dominance in its self-driving initiative, stating that its lead over competitors is “not even close.”

Percoco recently overtook coverage of Tesla stock from Adam Jonas, who had covered the company at Morgan Stanley for years. Percoco is handling Tesla now that Jonas is covering embodied AI stocks and no longer automotive.

His first move after grabbing coverage was to adjust the price target from $410 to $425, as well as the rating from ‘Overweight’ to ‘Equal Weight.’

Percoco’s new note regarding Tesla highlights the company’s extensive lead in self-driving and autonomy projects, something that it has plenty of competition in, but has established its prowess over the past few years.

He writes:

“It’s not even close. Tesla continues to lead in autonomous driving, even as Nvidia rolls out new technology aimed at helping other automakers build driverless systems.”

Percoco’s main point regarding Tesla’s advantage is the company’s ability to collect large amounts of training data through its massive fleet, as millions of cars are driving throughout the world and gathering millions of miles of vehicle behavior on the road.

This is the main point that Percoco makes regarding Tesla’s lead in the entire autonomy sector: data is King, and Tesla has the most of it.

One big story that has hit the news over the past week is that of NVIDIA and its own self-driving suite, called Alpamayo. NVIDIA launched this open-source AI program last week, but it differs from Tesla’s in a significant fashion, especially from a hardware perspective, as it plans to use a combination of LiDAR, Radar, and Vision (Cameras) to operate.

Percoco said that NVIDIA’s announcement does not impact Morgan Stanley’s long-term opinions on Tesla and its strength or prowess in self-driving.

NVIDIA CEO Jensen Huang commends Tesla’s Elon Musk for early belief

And, for what it’s worth, NVIDIA CEO Jensen Huang even said some remarkable things about Tesla following the launch of Alpamayo:

“I think the Tesla stack is the most advanced autonomous vehicle stack in the world. I’m fairly certain they were already using end-to-end AI. Whether their AI did reasoning or not is somewhat secondary to that first part.”

Percoco reiterated both the $425 price target and the ‘Equal Weight’ rating on Tesla shares.

Investor's Corner

Tesla price target boost from its biggest bear is 95% below its current level

Tesla stock (NASDAQ: TSLA) just got a price target boost from its biggest bear, Gordon Johnson of GLJ Research, who raised his expected trading level to one that is 95 percent lower than its current trading level.

Johnson pushed his Tesla price target from $19.05 to $25.28 on Wednesday, while maintaining the ‘Sell’ rating that has been present on the stock for a long time. GLJ has largely been recognized as the biggest skeptic of Elon Musk’s company, being particularly critical of the automotive side of things.

Tesla has routinely been called out by Johnson for negative delivery growth, what he calls “weakening demand,” and price cuts that have occurred in past years, all pointing to them as desperate measures to sell its cars.

Johnson has also said that Tesla is extremely overvalued and is too reliant on regulatory credits for profitability. Other analysts on the bullish side recognize Tesla as a company that is bigger than just its automotive side.

Many believe it is a leader in autonomous driving, like Dan Ives of Wedbush, who believes Tesla will have a widely successful 2026, especially if it can come through on its targets and schedules for Robotaxi and Cybercab.

Justifying the price target this week, Johnson said that the revised valuation is based on “reality rather than narrative.” Tesla has been noted by other analysts and financial experts as a stock that trades on narrative, something Johnson obviously disagrees with.

Dan Nathan, a notorious skeptic of the stock, turned bullish late last year, recognizing the company’s shares trade on “technicals and sentiment.” He said, “From a trading perspective, it looks very interesting.”

Tesla bear turns bullish for two reasons as stock continues boost

Johnson has remained very consistent with this sentiment regarding Tesla and his beliefs regarding its true valuation, and has never shied away from putting his true thoughts out there.

Tesla shares closed at $431.40 today, about 95 percent above where Johnson’s new price target lies.