SpaceX

SpaceX’s Falcon 9 to launch new Starlink satellites from Florida this spring

NASASpaceflight.com reports that SpaceX is tentatively on target for the dedicated launch debut of its first (relatively) operational Starlink satellites as early as mid-May, indicating that the company might actually meet an extremely ambitious deadline set last year by CEO Elon Musk.

Although the CEO had briefly hinted that SpaceX would launch at least one additional round of prototype satellites – complementing the two launched in February 2018 – before moving to dedicated Starlink missions, all signs point to this mystery case being a dedicated Falcon 9 launch. Whether or not the aggressive mid-May schedule holds, the first launch of operational Starlink satellites would be a huge milestone for SpaceX’s low Earth orbit (LEO) internet constellation, meant to eventually provide high-quality, affordable broadband access to almost anyone on Earth.

Linking the stars in phases

In November 2018, SpaceX filed a modification to the license it been previously granted by the FCC (Federal Communications Commission) in March, requesting that it be allowed to dramatically change the first phase of its Starlink satellite constellation. In short, SpaceX wanted to find a faster and cheaper way to deploy its first Starlink satellites as quickly as possible.

“[SpaceX] will utilize key elements from its experimental satellites, such as its sophisticated phased-array antennas and its advanced Hall-effect thrusters, as the foundation of a more efficient and cost-effective architecture that can rapidly accelerate deployment for the overall constellation while optimizing space safety.” – Starlink FCC license modification request, SpaceX, 11/8/2018

This modification almost certainly arose as a direct result of CEO Elon Musk’s June 2018 ultimatum, in which he reportedly fired Starlink executives deemed uncooperative in order to rapidly speed up the constellation’s time-to-market. In fact, according to Reuters, Musk challenged the Starlink team to begin launching the constellation’s first operational satellites just one year later (June 2019), an extraordinary aspiration standing a handful of months after the group had launched its first two early satellite prototypes. According to a source

While both sides presumably have good reasons for their stubborn preferences, Musk may well be in the right at the end of the day, particularly given the sheer level of competition to complete LEO internet constellations and begin serving customers. An overly cautious approach could risk being so late to market that multiple competitors, ranging from relatively established entrants OneWeb and Telesat to more obscure companies like WorldVu and Space Norway. Barely a week ago, OneWeb completed the first successful launch of its constellation, placing six demonstration satellites in orbit to prove their technology and reduce risk prior to commencing operational launches with 30+ satellites apiece. Furthermore, both Tesla and SpaceX have more or less flourished while using the same approach, evidenced by a culture of continuous improvement where both electric cars and rocket engines are constantly upgraded and improved upon. Falcon 9 famously features a bevy of versions or “blocks”, culminating recently in Falcon 9 Block 5’s major reusability and reliability optimizations.

A little crazy, but it works

Whether or not Musk can be more than a little crazy, it’s nearly impossible to coherently deny the fact that his strategy of delivering a minimum viable product as quickly as possible and gradually improving it over time has a polished record of success. Once again, Falcon 9 is the best and most relevant example in the context of Starlink. SpaceX’s now-workhorse rocket began in a form (Falcon 9 V1.0) nearly unrecognizable compared to its most recent edition, featuring far less performance, no reusability, and an older and less capable version of Merlin. Falcon 9 V1.1 was a radical – almost clean-sheet –

In short, when Elon Musk and other SpaceX engineers originally conceived of Falcon 9 in the early 2000s, 2018’s Falcon 9 Block 5 was effectively the rocket they were imagining. Rather than spending countless hundreds of millions of dollars to privately design, test, and redesign multiple prototype iterations, Musk et al built a minimum viable product, began launching payloads for paying customers (both government and commercial), and used the company’s reputation, commercial success, and flight experience to shape Falcon 9 into the industry leader it is today.

Put simply, there is no reason to think that the same approach will not prove equally fruitful when applied to satellites instead of rockets. While SpaceX has yet to receive an FCC grant for its Starlink modification request, the company summarized its updated strategy in the November 2018 filing. The request effectively “relocates” the first phase of its 4,425 (now 4209) satellite LEO constellation, moving 1584 satellites from an 1100 km to 550 km orbit and simplifying the design of the first operational spacecraft by using just one spectrum segment (Ku-band) instead of two (Ku- and Ka-band). Hardware to exploit that additional spectrum will be developed and added to Starlink satellites and ground hardware down the road. As such, regardless of how unrefined SpaceX’s first operational Starlink satellites could be, the launch will be just as much of a milestone.

SpaceX will also be able to demonstrate a truly unique aspect of Starlink that helps bolsters its competitive advantage: vertically integrated production and launch of its satellites. Based on FCC permit requests filed last month, SpaceX plans to conduct the first dedicated launch from its Florida-based LC-40 pad, with the Falcon 9 booster landing more than 600 km (370 mi) offshore on drone ship

In other words, Starlink’s operational debut could very well be the heaviest payload SpaceX has yet to launch on a single mission. Weighing less than 500 kg apiece with a dispenser (per Iridium NEXT) around 10% of the total payload mass, SpaceX will likely launch anywhere from 20-40 Starlink satellites at once, depending on the final mass of these first spacecraft and their custom-built dispenser. While delays from the late-April to mid-May launch target are arguably quite likely, the fact that the first operational Starlink launch is tentatively scheduled even less than half a year away bodes very well for tangible constellation progress in 2019.

Check out Teslarati’s Marketplace! We offer Tesla accessories, including for the Tesla Cybertruck and Tesla Model 3.

Elon Musk

Elon Musk outlines plan for first Starship tower catch attempt

Musk confirmed that Starship V3 Ship 1 (SN1) is headed for ground tests and expressed strong confidence in the updated vehicle design.

Elon Musk has clarified when SpaceX will first attempt to catch Starship’s upper stage with its launch tower. The CEO’s update provides the clearest teaser yet for the spacecraft’s recovery roadmap.

Musk shared the details in recent posts on X. In his initial post, Musk confirmed that Starship V3 Ship 1 (SN1) is headed for ground tests and expressed strong confidence in the updated vehicle design.

“Starship V3 SN1 headed for ground tests. I am highly confident that the V3 design will achieve full reusability,” Musk wrote.

In a follow-up post, Musk addressed when SpaceX would attempt to catch the upper stage using the launch tower’s robotic arms.

“Should note that SpaceX will only try to catch the ship with the tower after two perfect soft landings in the ocean. The risk of the ship breaking up over land needs to be very low,” Musk clarified.

His remarks suggest that SpaceX is deliberately reducing risk before attempting a tower catch of Starship’s upper stage. Such a milestone would mark a major step towards the full reuse of the Starship system.

SpaceX is currently targeting the first Starship V3 flight of 2026 this coming March. The spacecraft’s V3 iteration is widely viewed as a key milestone in SpaceX’s long-term strategy to make Starship fully reusable.

Starship V3 features a number of key upgrades over its previous iterations. The vehicle is equipped with SpaceX’s Raptor V3 engines, which are designed to deliver significantly higher thrust than earlier versions while reducing cost and weight.

The V3 design is also expected to be optimized for manufacturability, a critical step if SpaceX intends to scale the spacecraft’s production toward frequent launches for Starlink, lunar missions, and eventually Mars.

Elon Musk

Starlink powers Europe’s first satellite-to-phone service with O2 partnership

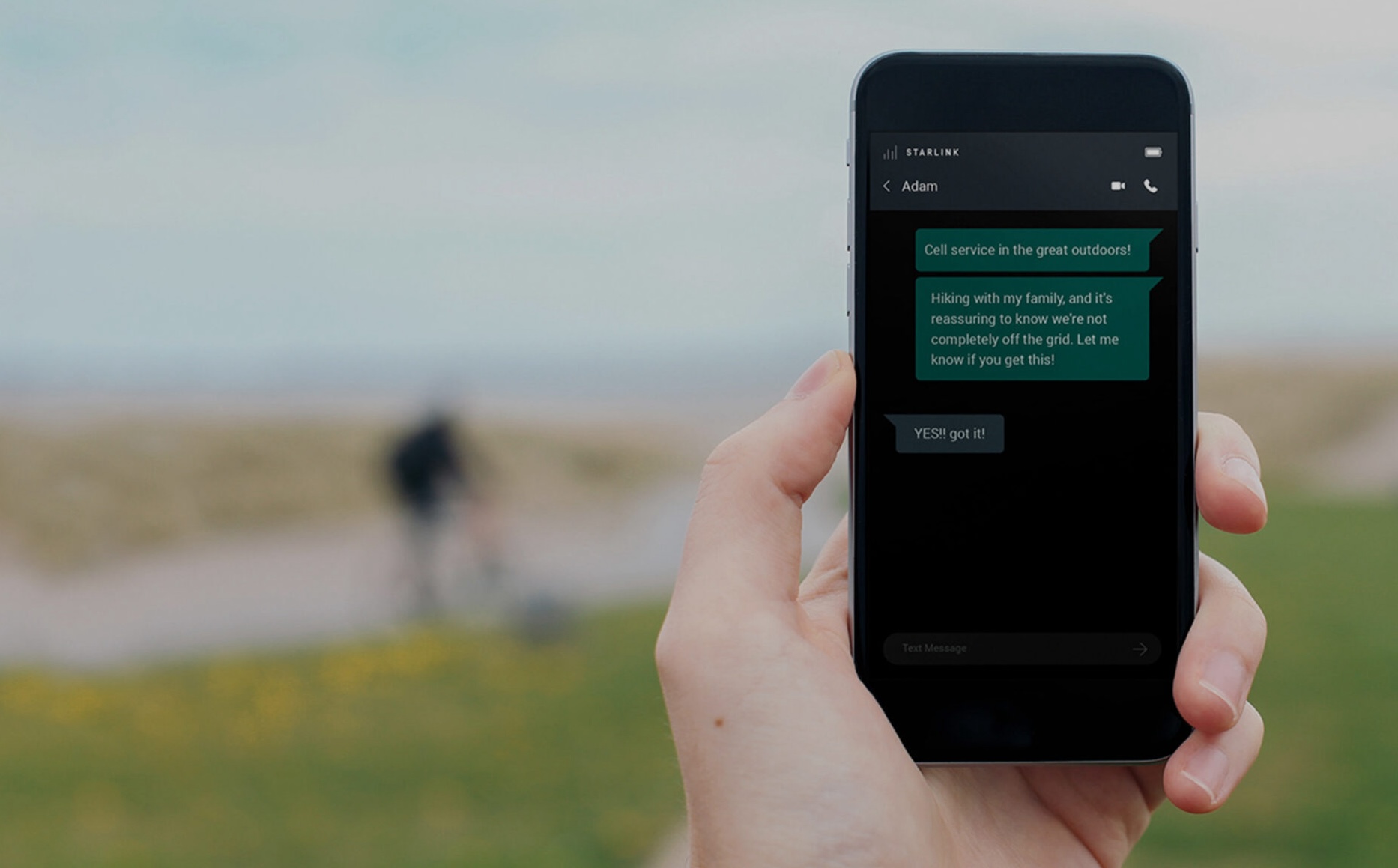

The service initially supports text messaging along with apps such as WhatsApp, Facebook Messenger, Google Maps and weather tools.

Starlink is now powering Europe’s first commercial satellite-to-smartphone service, as Virgin Media O2 launches a space-based mobile data offering across the UK.

The new O2 Satellite service uses Starlink’s low-Earth orbit network to connect regular smartphones in areas without terrestrial coverage, expanding O2’s reach from 89% to 95% of Britain’s landmass.

Under the rollout, compatible Samsung devices automatically connect to Starlink satellites when users move beyond traditional mobile coverage, according to Reuters.

The service initially supports text messaging along with apps such as WhatsApp, Facebook Messenger, Google Maps and weather tools. O2 is pricing the add-on at £3 per month.

By leveraging Starlink’s satellite infrastructure, O2 can deliver connectivity in remote and rural regions without building additional ground towers. The move represents another step in Starlink’s push beyond fixed broadband and into direct-to-device mobile services.

Virgin Media O2 chief executive Lutz Schuler shared his thoughts about the Starlink partnership. “By launching O2 Satellite, we’ve become the first operator in Europe to launch a space-based mobile data service that, overnight, has brought new mobile coverage to an area around two-thirds the size of Wales for the first time,” he said.

Satellite-based mobile connectivity is gaining traction globally. In the U.S., T-Mobile has launched a similar satellite-to-cell offering. Meanwhile, Vodafone has conducted satellite video call tests through its partnership with AST SpaceMobile last year.

For Starlink, the O2 agreement highlights how its network is increasingly being integrated into national telecom systems, enabling standard smartphones to connect directly to satellites without specialized hardware.

Elon Musk

Elon Musk’s Starbase, TX included in $84.6 million coastal funding round

The funds mark another step in the state’s ongoing beach restoration and resilience efforts along the Gulf Coast.

Elon Musk’s Starbase, Texas has been included in an $84.6 million coastal funding round announced by the Texas General Land Office (GLO). The funds mark another step in the state’s ongoing beach restoration and resilience efforts along the Gulf Coast.

Texas Land Commissioner Dawn Buckingham confirmed that 14 coastal counties will receive funding through the Coastal Management Program (CMP) Grant Cycle 31 and Coastal Erosion Planning and Response Act (CEPRA) program Cycle 14. Among the Brownsville-area recipients listed was the City of Starbase, which is home to SpaceX’s Starship factory.

“As someone who spent more than a decade living on the Texas coast, ensuring our communities, wildlife, and their habitats are safe and thriving is of utmost importance. I am honored to bring this much-needed funding to our coastal communities for these beneficial projects,” Commissioner Buckingham said in a press release.

“By dedicating this crucial assistance to these impactful projects, the GLO is ensuring our Texas coast will continue to thrive and remain resilient for generations to come.”

The official Starbase account acknowledged the support in a post on X, writing: “Coastal resilience takes teamwork. We appreciate @TXGLO and Commissioner Dawn Buckingham for their continued support of beach restoration projects in Starbase.”

The funding will support a range of coastal initiatives, including beach nourishment, dune restoration, shoreline stabilization, habitat restoration, and water quality improvements.

CMP projects are backed by funding from the National Oceanic and Atmospheric Administration and the Gulf of Mexico Energy Security Act, alongside local partner matches. CEPRA projects focus specifically on reducing coastal erosion and are funded through allocations from the Texas Legislature, the Texas Hotel Occupancy Tax, and GOMESA.

Checks were presented in Corpus Christi and Brownsville to counties, municipalities, universities, and conservation groups. In addition to Starbase, Brownsville-area recipients included Cameron County, the City of South Padre Island, Willacy County, and the Willacy County Navigation District.