News

BMW CFO downbeat about electric cars and their ability to generate profit

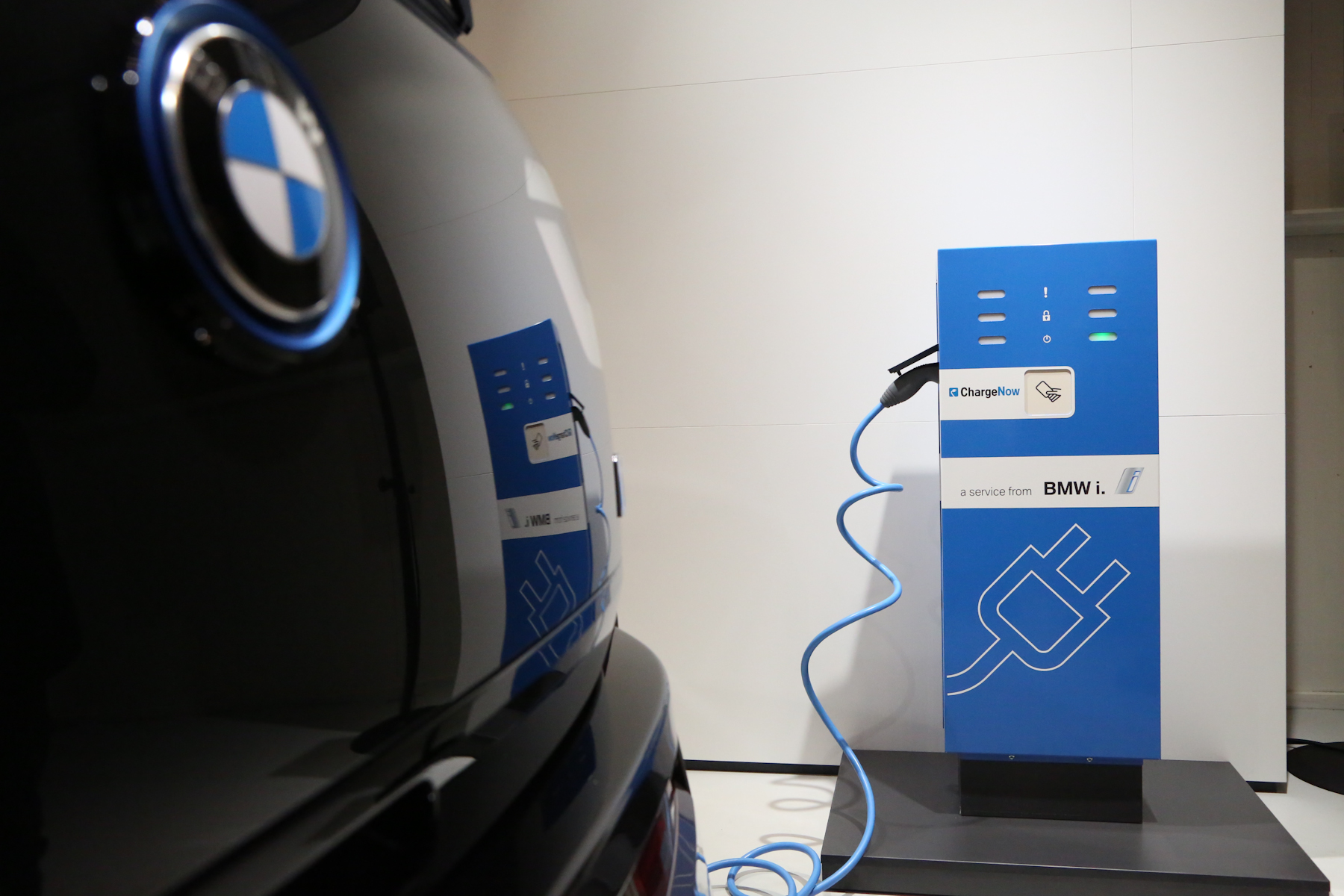

BMW chief financial officer Friedrich Eichiner was downbeat about electric cars when he spoke to reporters in Lisbon last week. “We’ve learned that people aren’t prepared to pay a higher price for an electric vehicle. I don’t see some kind of disruptive element coming from electric cars that would prompt sales to go up quickly in the next five to six years.” This is in spite of recent reports that German Minister of Economic Affairs has called for a joint effort by European car makers to produce batteries for electric vehicles in Germany and Europe.

Eichiner says it will take seven years to double the energy density of batteries for electric cars. Until then, “We simply have to walk through the valley of tears,” Stefan Juraschek, vice president of electric powertrain development, told reporters at a briefing at a BMW testing facility in Munich recently. That’s what he says it will take before his company will be able to make money selling battery powered cars.

The conundrum, Juraschek says, is that buyers expect EVs to have longer range and sell for less money. He thinks electric cars will not go mainstream until battery technology improves significantly. “There’s a clear trend to bigger electric cars and longer driving ranges,” Juraschek told the press. The statement is in line with a recent poll suggesting that would-be EV buyers prefer longer battery range over short range but with ultra-fast charging times.

One way around the limitations of current battery technology is to make plug-in hybrid cars. BMW presented a plug-in hybrid MINI Countryman at the Los Angeles auto show last month. It also has added plug-in powertrains to its 3 Series sedan, X5 SUV, and 7 Series sedans. It has plans for a battery electric version of the MINI and the X3 compact crossover SUV but not until 2019.

Plug-ins do not have the same green car credentials as battery electrics, but BMW is hoping they will allow it to cap spending while it pushes the boundaries of autonomous and connected cars. It’s iNext self-driving car is scheduled to come to market in 2021.

BMW’s complaint about the slow pace of battery development seems to run counter to Tesla’s experience. In one year, it doubled the storage capacity of its Powerwall residential battery, added an integrated inverter and lowered the price. It has also consistently pushed the limits of its batteries for the Model S and Model X, finding ways to increase energy density while keeping the size of the overall battery pack the same. Its latest product, the company’s newest 100 kWh battery pack with upgraded liquid cooling seems to prove that advances in battery technology are not quite the “valley of tears” BMW suggests.

Source: Bloomberg

Elon Musk

The Boring Company wins key approval for Nashville Music City Loop

The approval allows The Boring Company to use state-owned right-of-way along Tennessee’s highway system.

Tennessee Gov. Bill Lee announced that the Tennessee Department of Transportation (TDOT) and the Federal Highway Administration (FHWA) have jointly approved The Boring Company’s lease application and enhanced grading permit for the Music City Loop.

The approval allows The Boring Company to use state-owned right-of-way along Tennessee’s highway system, clearing a key hurdle for the privately funded tunnel project that aims to connect downtown Nashville to Nashville International Airport in approximately eight minutes, the Office of the TN Governor wrote in a press release.

“Tennessee continues to lead the nation in finding innovative solutions to accommodate growth, and in partnership with The Boring Company, we are exploring possibilities we couldn’t achieve on our own,” Gov. Lee said in a statement.

“The Boring Company is grateful for the leadership and hard work of federal, state, and local agencies in bringing this project to a shovel-ready point,” The Boring Company President Steve Davis said. “Music City Loop will be a safe, fast, and fun public transportation system, and we are excited to build it in Nashville.”

With lease and permitting approvals secured, The Boring Company will move forward with the Loop system’s construction immediately. The first segment of the Loop system is expected to be operational by the end of the year.

The Music City Loop will run beneath state-owned roadways and is designed to connect downtown Nashville to the airport, as well as lower Broadway to West End. The project will be 100% privately funded.

“The Music City Loop shows what’s possible when we leverage private-sector innovation and American ingenuity to solve transportation challenges,” said U.S. Transportation Secretary Sean Duffy. “TDOT’s lease approval will help advance this ambitious project as we work to reduce congestion and make travel more seamless for the American people.”

The Boring Company described the Loop as an all-electric, zero-emissions, high-speed underground transportation system that will meet or exceed safety standards. The Vegas Loop, for one, earned a 99.57% safety and security rating from the DHS and the TSA, the highest score ever awarded to any transportation system.

News

Tesla China extends its 7-year financing promotion once more

The move marks Tesla’s second extension of the program this year.

Tesla has extended its seven-year ultra-low-interest and five-year interest-free financing programs in China once more, pushing the offers through March 31, the end of the first quarter.

The move marks Tesla’s second extension of the program this year. The financing plan was first introduced on January 6 as a strategy aimed at offsetting higher ownership costs ahead of China’s planned 5% NEV purchase tax in 2026.

The original promotion was set to expire at the end of January but was extended to the end of February. This has now been extended again through March.

The repeated extensions reflect growing competitive pressure. Tesla’s 2025 retail sales in China totaled 625,698 units, representing a 4.78% year-on-year decline, as per data compiled by CNEV Post. That being said, this decline is partly caused by the Model Y’s changeover to its new variant in Q1 2025, which resulted in lower sales during the quarter.

In early 2026, the Model Y also lost its position as China’s top-selling EV in January to Xiaomi’s YU7, though this was also a month when Tesla primarily exported vehicles to foreign territories, which pushed local delivery numbers lower.

During January 2026, Tesla China exported 50,644 vehicles, roughly 1.7 times higher than the same month a year ago and more than 15 times higher than December’s level.

Tesla’s financing push has not gone unanswered. BYD this week introduced its own seven-year low-interest plan across its Ocean lineup and Fang Cheng Bao sub-brand, also valid through March 31. Other competitors including NIO, XPeng, Li Auto, and Geely Auto have already rolled out extended-term loan programs as well.

News

Tesla China focuses on local deliveries as Q1 enters final month

Tesla’s estimated delivery times for all variants of the Model 3 and Model Y in China were listed at just one to three weeks.

Tesla’s delivery wait times in China have dropped to some of their shortest levels in years, an apparent hint that Giga Shanghai has largely cleared its order backlog and currently has strong production capacity.

As of February 26, estimated delivery times for all variants of the Model 3 and Model Y in China were listed at just one to three weeks, as per observations of Tesla China’s official webpages by CNEV Post.

That marks a notable shift from the several-week or even two-month waits seen late last year.

The one-to-three-week delivery window suggests that Giga Shanghai is likely focusing on the local market, at least for now as the company enters the final month of the first quarter. Tesla China typically spends the first half of the quarter catering to markets that import vehicles from Giga Shanghai.

Historically, when Tesla’s wait times in China compress to their shortest levels, the company often follows with fresh market actions.

In past cycles, shortened delivery timelines were followed by promotional activity. After delivery windows narrowed to one to three weeks in early 2024, for example, Tesla later introduced an RMB 10,000 instant discount on Model Y final payments that year.

To spur local demand, Tesla recently extended its seven-year ultra-low-interest and five-year interest-free financing offers through March 31. This marks the second extension of the policy this year.

So far, posts from the Tesla community suggest that interest in the company’s vehicles among consumers in China is still strong. Videos of busy delivery centers across China have been shared on social media.

China’s competitive EV landscape has evolved as of late. With regulators discouraging aggressive price wars, automakers are increasingly leaning on financing incentives instead of direct price cuts. Major players including BYD, NIO, XPeng, and Li Auto have introduced similar loan extensions and promotional financing packages.