Elon Musk

Elon Musk argues lidar and radar make self driving cars more dangerous

The CEO is not just stating that using sensors like lidar is unnecessary to achieve self-driving.

Elon Musk is taking a firmer stance in the vision vs lidar debate for autonomous driving. In his more recent comments, the CEO is not just stating that using sensors like lidar is unnecessary to achieve self-driving.

Musk is stating that using lidar actually makes self-driving cars more dangerous.

Uber CEO’s comments

During a recent interview, Uber CEO Dara Khosrowshahi shared his thoughts on the autonomy race. As per the CEO, he is still inclined to believe that Waymo’s approach, which requires outfitting cars with equipment such as lidar and radar, is necessary to achieve superhuman levels of safety for self-driving cars.

“Solid state LiDAR is $500. Why not include lidar as well in order to achieve super human safety. All of our partners are using a combination of camera, radar and LiDAR, and I personally think that’s the right solution, but I could be proven wrong,” the Uber CEO noted.

Elon Musk’s rebuttal

In response to the Uber CEO’s comments, Elon Musk stated that lidar and radar, at least based on Tesla’s experience, actually reduce safety instead of improving it. As per the Tesla CEO, there are times when sensors such as lidar and radar disagree with cameras. This creates sensor ambiguity, which, in turn, creates more risk. Musk then noted that Tesla has seen an improvement in safety once the company focused on a vision only approach.

“Lidar and radar reduce safety due to sensor contention. If lidars/radars disagree with cameras, which one wins? This sensor ambiguity causes increased, not decreased, risk. That’s why Waymos can’t drive on highways. We turned off the radars in Teslas to increase safety. Cameras ftw,’ Musk wrote.

Musk’s comments are quite notable as Tesla was able to launch a dedicated Robotaxi pilot in Austin and the Bay Area using its vision-based autonomous systems. The same is true for FSD, which is quickly becoming notably better than humans in driving.

Elon Musk

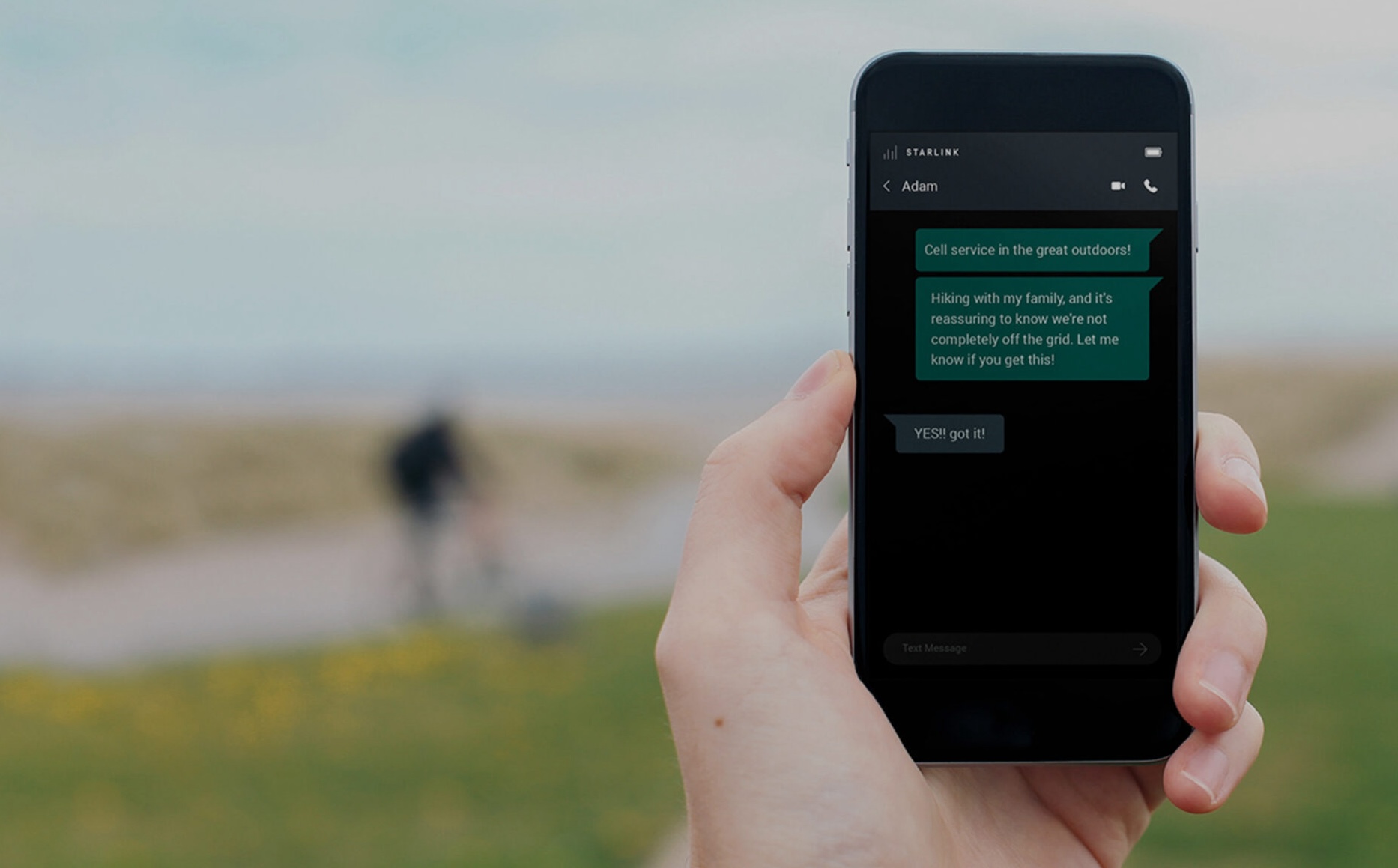

Starlink powers Europe’s first satellite-to-phone service with O2 partnership

The service initially supports text messaging along with apps such as WhatsApp, Facebook Messenger, Google Maps and weather tools.

Starlink is now powering Europe’s first commercial satellite-to-smartphone service, as Virgin Media O2 launches a space-based mobile data offering across the UK.

The new O2 Satellite service uses Starlink’s low-Earth orbit network to connect regular smartphones in areas without terrestrial coverage, expanding O2’s reach from 89% to 95% of Britain’s landmass.

Under the rollout, compatible Samsung devices automatically connect to Starlink satellites when users move beyond traditional mobile coverage, according to Reuters.

The service initially supports text messaging along with apps such as WhatsApp, Facebook Messenger, Google Maps and weather tools. O2 is pricing the add-on at £3 per month.

By leveraging Starlink’s satellite infrastructure, O2 can deliver connectivity in remote and rural regions without building additional ground towers. The move represents another step in Starlink’s push beyond fixed broadband and into direct-to-device mobile services.

Virgin Media O2 chief executive Lutz Schuler shared his thoughts about the Starlink partnership. “By launching O2 Satellite, we’ve become the first operator in Europe to launch a space-based mobile data service that, overnight, has brought new mobile coverage to an area around two-thirds the size of Wales for the first time,” he said.

Satellite-based mobile connectivity is gaining traction globally. In the U.S., T-Mobile has launched a similar satellite-to-cell offering. Meanwhile, Vodafone has conducted satellite video call tests through its partnership with AST SpaceMobile last year.

For Starlink, the O2 agreement highlights how its network is increasingly being integrated into national telecom systems, enabling standard smartphones to connect directly to satellites without specialized hardware.

Elon Musk

Elon Musk’s Starbase, TX included in $84.6 million coastal funding round

The funds mark another step in the state’s ongoing beach restoration and resilience efforts along the Gulf Coast.

Elon Musk’s Starbase, Texas has been included in an $84.6 million coastal funding round announced by the Texas General Land Office (GLO). The funds mark another step in the state’s ongoing beach restoration and resilience efforts along the Gulf Coast.

Texas Land Commissioner Dawn Buckingham confirmed that 14 coastal counties will receive funding through the Coastal Management Program (CMP) Grant Cycle 31 and Coastal Erosion Planning and Response Act (CEPRA) program Cycle 14. Among the Brownsville-area recipients listed was the City of Starbase, which is home to SpaceX’s Starship factory.

“As someone who spent more than a decade living on the Texas coast, ensuring our communities, wildlife, and their habitats are safe and thriving is of utmost importance. I am honored to bring this much-needed funding to our coastal communities for these beneficial projects,” Commissioner Buckingham said in a press release.

“By dedicating this crucial assistance to these impactful projects, the GLO is ensuring our Texas coast will continue to thrive and remain resilient for generations to come.”

The official Starbase account acknowledged the support in a post on X, writing: “Coastal resilience takes teamwork. We appreciate @TXGLO and Commissioner Dawn Buckingham for their continued support of beach restoration projects in Starbase.”

The funding will support a range of coastal initiatives, including beach nourishment, dune restoration, shoreline stabilization, habitat restoration, and water quality improvements.

CMP projects are backed by funding from the National Oceanic and Atmospheric Administration and the Gulf of Mexico Energy Security Act, alongside local partner matches. CEPRA projects focus specifically on reducing coastal erosion and are funded through allocations from the Texas Legislature, the Texas Hotel Occupancy Tax, and GOMESA.

Checks were presented in Corpus Christi and Brownsville to counties, municipalities, universities, and conservation groups. In addition to Starbase, Brownsville-area recipients included Cameron County, the City of South Padre Island, Willacy County, and the Willacy County Navigation District.

Elon Musk

The Boring Company wins key approval for Nashville Music City Loop

The approval allows The Boring Company to use state-owned right-of-way along Tennessee’s highway system.

Tennessee Gov. Bill Lee announced that the Tennessee Department of Transportation (TDOT) and the Federal Highway Administration (FHWA) have jointly approved The Boring Company’s lease application and enhanced grading permit for the Music City Loop.

The approval allows The Boring Company to use state-owned right-of-way along Tennessee’s highway system, clearing a key hurdle for the privately funded tunnel project that aims to connect downtown Nashville to Nashville International Airport in approximately eight minutes, the Office of the TN Governor wrote in a press release.

“Tennessee continues to lead the nation in finding innovative solutions to accommodate growth, and in partnership with The Boring Company, we are exploring possibilities we couldn’t achieve on our own,” Gov. Lee said in a statement.

“The Boring Company is grateful for the leadership and hard work of federal, state, and local agencies in bringing this project to a shovel-ready point,” The Boring Company President Steve Davis said. “Music City Loop will be a safe, fast, and fun public transportation system, and we are excited to build it in Nashville.”

With lease and permitting approvals secured, The Boring Company will move forward with the Loop system’s construction immediately. The first segment of the Loop system is expected to be operational by the end of the year.

The Music City Loop will run beneath state-owned roadways and is designed to connect downtown Nashville to the airport, as well as lower Broadway to West End. The project will be 100% privately funded.

“The Music City Loop shows what’s possible when we leverage private-sector innovation and American ingenuity to solve transportation challenges,” said U.S. Transportation Secretary Sean Duffy. “TDOT’s lease approval will help advance this ambitious project as we work to reduce congestion and make travel more seamless for the American people.”

The Boring Company described the Loop as an all-electric, zero-emissions, high-speed underground transportation system that will meet or exceed safety standards. The Vegas Loop, for one, earned a 99.57% safety and security rating from the DHS and the TSA, the highest score ever awarded to any transportation system.