News

Fate of NASA’s Opportunity rover unknown as Martian dust storm reaches peak strength

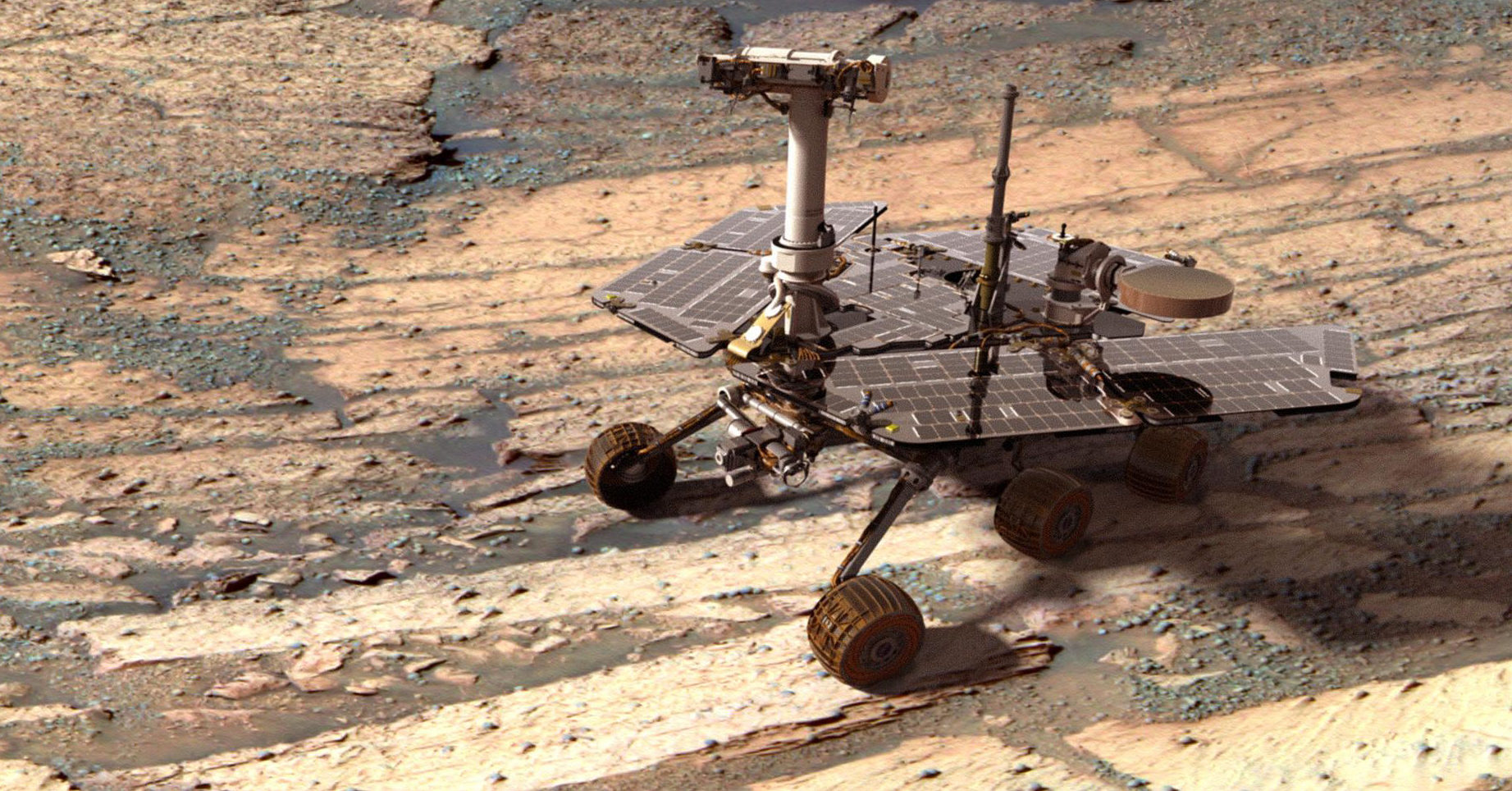

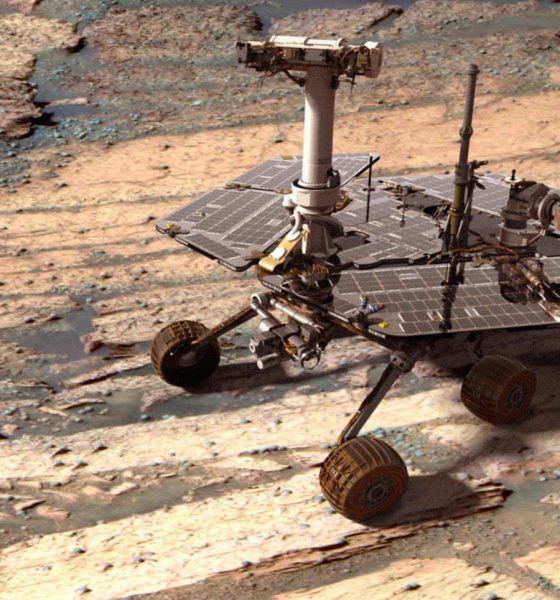

As NASA’s Opportunity Rover continues to weather the massive dust storm engulfing a quarter part of the Red Planet, the silence from the resilient rover has now stretched to three weeks. Despite this, however, Dr. James Rice, co-investigator and geology team leader on NASA projects including Opportunity, recently stated that it is far too early to speculate the rover’s demise, considering the grit and durability the machine has exhibited over the past 14 years.

In an article on Spaceflight Insider, Dr. Rice noted that NASA received the last power reading from Opportunity on Sol 5111 (June 10, 2018), when the rover collected a measly 22 Wh worth of solar power. Just ten days prior to the reading, Opportunity was still able to collect 645 Wh of energy from the Sun. Despite the lack of sunlight due to the dust storm, however, Dr. Rice noted that the timing of the storm could work in Opportunity’s favor, since the warm Martian Spring could help keep the rover’s electronics from becoming too cold during the night.

“We went from generating a healthy 645 watt-hours on June 1 to an unheard of, life-threatening, low just about one week later. Our last power reading on June 10 was only 22 watt hours the lowest we have ever seen. Our thermal experts think that we will stay above those low critical temperatures because we have a Warm Electronics Box (WEB) that is well insulated. So we are not expecting any thermal damage to the batteries or computer systems. Fortunately for us it is also the Martian Spring and the dust, while hindering our solar power in the day, helps keep us warmer at night,” Dr. Rice wrote.

Opportunity is currently weathering the Martian dust storm on the slopes of Perseverance Valley, where it is analyzing the planet’s geology. As the storm broke out, NASA opted to keep the rover’s robotic arm deployed on its rock target, La Joya. The dust storm, which covered 15.8 million square miles (41 million square kilometers) as of mid-June, started at a rather unusual time. Dust storms in the Red Planet, after all, usually form during the Martian Summer. Only one other dust event during the Martian Spring was recorded by NASA back in 2001, but it started significantly later than the current storm.

Despite the very real danger Opportunity is facing, NASA remains optimistic about the resilient rover’s chances. Just recently, NASA’s Mars Exploration Program director Jim Watzin stated that the massive Martian dust storm silencing Opportunity might have already peaked. Considering that the storm took roughly a month to build up, however, Watzin noted that it could also be a “substantial” amount of time before the dust event settles enough for NASA to properly determine Opportunity’s fate, as noted in a Twitter update from Space News senior writer Jeff Foust.

Watzin: the Martian dust storm that silenced Opportunity may be peaking now, but it took a month to build up and thus could be a “substantial” amount of time before it subsides.

— Jeff Foust (@jeff_foust) July 2, 2018

Opportunity is currently the longest-serving rover on the Martian landscape. Launched back in 2004, Opportunity, together with its sister, Spirit, were designed to last for a 90-day mission. Both rovers proved far more durable than expected, however, with Spirit continuing its mission for six years before falling silent in 2010 and Opportunity still going strong well into 2018. Overall, the work done by Opportunity, Spirit, as well as the nuclear-powered Curiosity, have laid the groundwork for more ambitious missions to the Red Planet. Among these are Mars 2020, a machine based on Curiosity, as well as Europe’s ExoMars rover, both of which would be sent to Mars in order to find signs of life.

Elon Musk

Elon Musk shares updated Starship V3 maiden launch target date

The comment was posted on Musk’s official account on social media platform X.

SpaceX CEO Elon Musk shared a brief Starship V3 update in a post on social media platform X, stating the next launch attempt of the spacecraft could take place in about four weeks.

The comment was posted on Musk’s official account on social media platform X.

Musk’s update suggests that Starship Flight 12 could target a launch around early April, though the schedule will depend on several remaining milestones at SpaceX’s Starbase launch facility in Texas.

Among the key steps is testing and certification of the site’s new launch tower, launch mount, and tank farm systems. These upgrades will support the next generation of Starship vehicles.

Booster 19 is expected to roll to the launch site and be placed on the launch mount before returning to the production facility to receive its 33 Raptor engines. The booster would then return for a static fire test, which could mark the first time a Super Heavy booster equipped with Raptor V3 engines is fired on the pad.

Ship 39 is expected to undergo a similar preparation process. The vehicle will likely return to the production site to receive its six engines before heading to Massey’s test site for static fire testing.

Once both stages are prepared, the booster and ship will roll out to the launch site for the first full stack of a V3 Super Heavy and V3 Starship. A full wet dress rehearsal is expected to follow before any launch attempt.

Elon Musk has previously shared how SpaceX plans to eventually recover Starship’s upper stage using the launch tower’s robotic arms. Musk noted that the company will only attempt to catch the Starship spacecraft after two successful soft landings in the ocean. The approach is intended to reduce risk before attempting a recovery over land.

“Should note that SpaceX will only try to catch the ship with the tower after two perfect soft landings in the ocean. The risk of the ship breaking up over land needs to be very low,” Musk wrote in a post on X.

Such a milestone would represent a major step toward the full reuse of the Starship system, which remains a central goal for SpaceX’s long-term launch strategy.

News

Tesla opens first public Tesla Semi Megacharger site in Los Angeles

The development was highlighted in a post on social media platform X by the official Tesla Semi account.

Tesla has opened its first public Tesla Semi Megacharger site in Los Angeles. The station reportedly offers up to 750 kW charging speeds and is open to Tesla Semi customers.

The development was highlighted in a post on social media platform X by the official Tesla Semi account.

Tesla Semi Megachargers

The Los Angeles site seems to be the first public Tesla Semi Megacharger that is not located at a Tesla factory. It is also the third Megacharger site currently visible on Tesla’s map.

The Megacharger system is designed specifically for the Tesla Semi and is capable of delivering extremely high charging speeds to support long-haul trucking operations. Infrastructure such as this will likely play a key role in making the Semi competitive with diesel-powered transport trucks.

Tesla’s progress with the Semi has also drawn attention in recent days after Elon Musk biographer Ashlee Vance shared photos from inside the Tesla Semi factory near Giga Nevada. The images suggested that preparations for higher production volumes may be underway, hinting that a broader ramp of the Tesla Semi’s production indeed be approaching.

New deployment strategies

Tesla has continued expanding its broader charging network through several new strategies aimed at accelerating infrastructure deployment. One of these initiatives is the Supercharger for Business program, which allows third parties to purchase Tesla Supercharger equipment and deploy charging stations while still integrating with Tesla’s network.

The program recently marked a milestone in Alpharetta, Georgia, where the city deployed four 325 kW city-branded Superchargers near the Alpharetta Department of Public Safety on Old Milton Parkway. The chargers support the city’s Tesla Model Y police vehicles while also remaining accessible to the public.

As per a report from EVwire, the project was designed not only to support fleet charging but also to generate economic returns that could offset the city’s investment. Tesla’s Supercharger for Business program has already attracted several participants, including businesses and charging providers such as Suncoast Charging, Pie Safe bakery in Idaho, Francis Energy in Oklahoma, and Wawa convenience stores.

Elon Musk

The Boring Company’s Vegas Loop moves 82k riders during CONEXPO

The Loop’s feat was highlighted by The Boring Company in a post on its official account on social media platform X.

The Boring Company said its Vegas Loop system transported roughly 82,000 passengers during the recent CONEXPO-CON/AGG construction trade show in Las Vegas. The event was held at the Las Vegas Convention Center (LVCC) from March 3-7, 2026.

The Loop’s feat was highlighted by The Boring Company in a post on its official account on social media platform X.

CONEXPO-CON/AGG 2026

CONEXPO-CON/AGG is one of the largest construction trade shows in North America. This year’s event was quite impressive, attracting more than 140,000 construction professionals from 128 countries across the world.

Considering the number of this year’s attendees, the LVCC Loop seemed to have proven itself to be a very useful transportation solution. A video posted by The Boring Company on its official X account featured attendees expressing their enthusiasm for the underground transport system, with some stating that they would like to see similar tunnels across Las Vegas.

The LVCC Loop is only part of the greater Vegas Loop network, which is actively under construction.

New Vegas Loop extensions

One of the newest additions is a station at the Fontainebleau Las Vegas resort on the Strip. The station is located on level V-1 of the resort’s south valet area, according to a report from the Las Vegas Review-Journal. From the Fontainebleau, passengers can travel free of charge to stations serving the Las Vegas Convention Center, as well as to Loop stations at Encore and Westgate.

The system is also expanding beyond the Strip corridor. In December, The Boring Company began offering Vegas Loop rides to and from Harry Reid International Airport. These trips include a limited above-ground segment after receiving approval from the Nevada Transportation Authority to allow surface street travel tied to Loop operations.

The Boring Company President Steve Davis previously told the Review-Journal that the University Center Loop segment, which is currently under construction, is expected to open in the first quarter of 2026. The extension would allow Loop vehicles to travel beneath Paradise Road between the convention center and the airport, with a planned station just north of Tropicana Avenue.