News

SpaceX tracks towards first launch of 2019 with flight-proven Falcon 9 static fire

SpaceX has completed a Falcon 9 static fire test ahead of the company’s first launch of 2019, kicking off what is looking to be a truly jam-packed year for Falcon 9 and BFR. Most important, of course, is SpaceX’s primary business and main sources of revenue – safely and reliably launching customer satellites, payloads, and – soon – astronauts into orbit.

Previously tasked with launching heavy communications satellite Telstar 18V in September 2018, Falcon 9 B1049 is now set to launch an arguably historic mission for both SpaceX and customer Iridium, the eighth and final contracted launch of the upgraded Iridium NEXT satellite communications constellation.

Static fire test of Falcon 9 complete. Working with customer to determine best launch opportunity to complete the Iridium NEXT constellation; will announce targeted launch date once confirmed.

— SpaceX (@SpaceX) January 6, 2019

Struck all the way back in June 2010, Iridium’s decision to award the full NEXT constellation launch contract to SpaceX less than two weeks after Falcon 9’s first and only launch may well be the greatest calculated leap of faith in the history of commercial spaceflight. SpaceX did admittedly offer an unbeatable price ($492M for eight launches, $61.5M per launch) that may have allowed Iridium to afford a new constellation in the first place, but the risk Iridium took was truly immense at the time.

Originally launched between 1997 and 1998, the first Iridium constellation became and still remains the only satellite communications constellation in history to offer global and persistent coverage anywhere on Earth, allowing those with Iridium devices to guarantee connectivity no matter where they are. To some extent, the original constellation has become a subtle but omnipresent backbone of a huge variety of ventures, companies, and services, ranging from marine vessel tracking and emergency response to the go-to solution for those heading far off the beaten path. As just one small example, SpaceX’s large fleet of sea-going vessels and its cross-country transport infrastructure both rely on Iridium for streamlined company-wide movement tracking, making life considerably easier for logistics and planning teams.

@SpaceX #falcon9 vertical at SLC-4. Iridium NEXT-8 slated for 01/08 from #VandenbergAFB. #spacex #iridium pic.twitter.com/uJBIgG5Lrp

— Brian Sandoval (@sandovalphotos) January 6, 2019

Iridium’s decision to use SpaceX for its NEXT constellation likely also gave SpaceX a massive stature boost, taking it from the company with just a handful of commercial contracts that had failed three of its last five launches to the company that secured what was at the time the largest single commercial launch contract in history. Alongside NASA’s Commercial Orbital Transport Services (COTS) and Resupply Services (CRS) commitments (~14 launches as of 2010), Iridium NEXT raised SpaceX’s commercial manifest from perhaps 2 missions to ~10 while also taking the value of those contracts from an almost negligible sum to well over half a billion dollars.

Although SpaceX and Iridium originally planned for launches to take place over a roughly 24-month period stretch from 2015 to 2017, unplanned technical delays and a duo of catastrophic Falcon 9 failures (CRS-7 and Amos-6) in 2015 and 2016 ultimately pushed Iridium NEXT’s launch debut back several years. Despite those immense hurdles and a range of smaller issues, SpaceX and Iridium were finally able to begin launching satellites in January 2017 and have continued to consistently do so every 3-4 months since then. Aside from one partial NASA rideshare mission that featured five NEXT satellites in May 2018, all seven launches have placed ten NEXT satellites (weighing approx. 10,000 kg or 22,000 lb total) in a variety of low polar orbits without a single known hitch.

- A rare glimpse inside SpaceX’s SLC-4 rocket integration hangar, January 2017. (SpaceX)

- Iridium-7’s Falcon 9 payload fairing, July 2018. (Pauline Acalin)

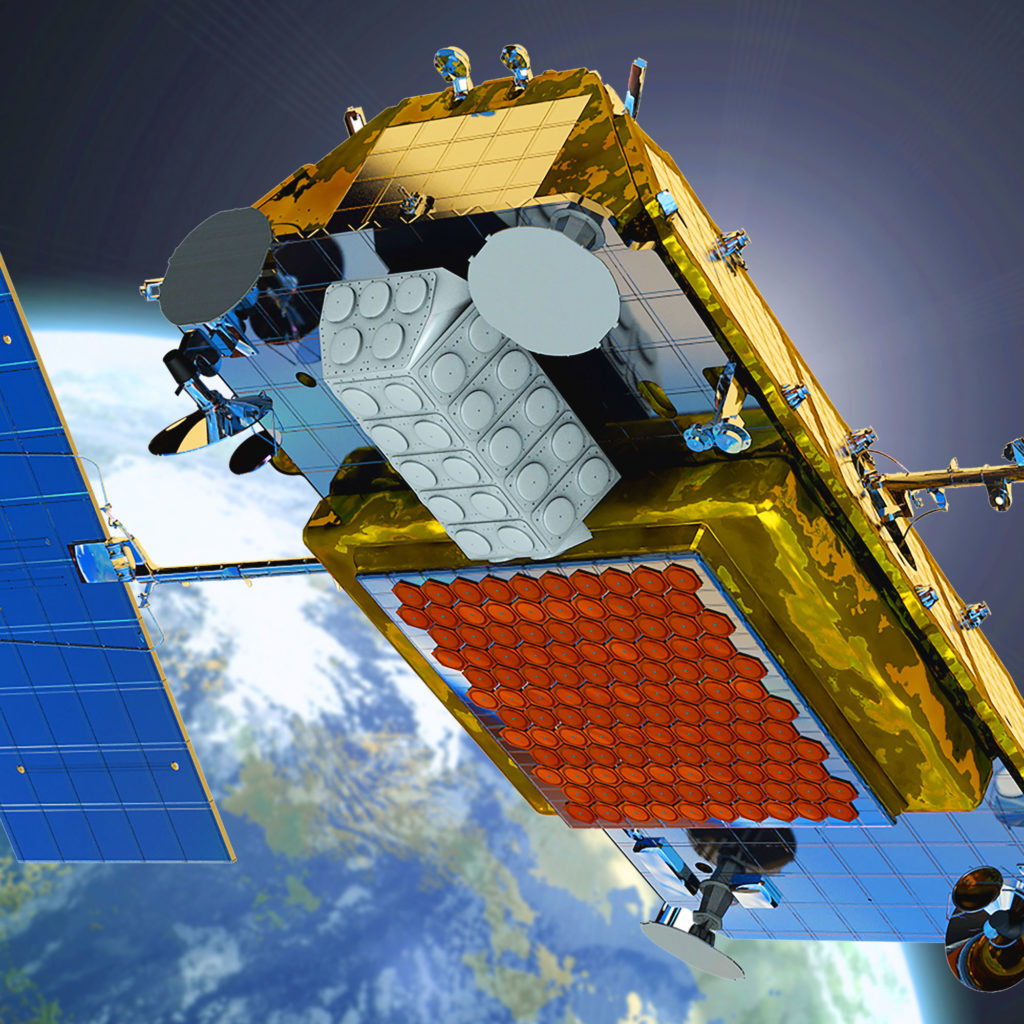

- LEO communications satellites like Iridium’s NEXT constellation feature totally flat panels of phased array antennas, capable of forming beams digitally. (Harris)

Falcon 9 enters the era of reusability

Closely following SES, NASA, and SSL (BulgariaSat), Iridium also became the fourth commercial entity to launch on a flight-proven Falcon 9 rocket for the launch vehicle’s fourth flight-proven mission ever. Iridium-8 will become the fourth constellation launch to fly aboard a sooty Falcon 9 rocket, meaning that a full 50% of the next-gen satellites will have launched on reused rockets, easily one of the coolest bragging rights ever. Currently standing at 65 NEXT satellites in orbit and rapidly nearing operational status, Falcon 9 B1049 and a fresh upper stage will (fingers crossed) place the last ten satellites in orbit to complete the constellation’s last plane and seal the last gap in its perfect global coverage.

Although NEXT would have been valuable for the sole reason that its predecessor satellites are now 5-10 years past their designed lifespans, NEXT will also serve to dramatically increase Iridium’s overall bandwidth, slash concurrent user bottlenecks, and provide a platform for new services like Aireon, which hopes to become the first operator of a truly commercial aircraft tracking service with global satellite-based coverage.

- Falcon 9 B1041.2 seen before launching Iridium-5. (Pauline Acalin)

- Iridium-1’s successful and scenic landing on Pacific drone ship JRTI, January 2017. This could be an increasingly rare occurrence in the Pacific, thanks to SpaceX’s new land-based landing zone. (SpaceX)

- 2017 saw SpaceX recovery 10 Falcon 9 first stages, 5 by sea. (SpaceX)

All things considered, it will be hugely bittersweet to watch Iridium and SpaceX’s direct relationship come to a close with the launch of Iridium-8. Aside from nine additional on-orbit spares once all 75 are launched, Iridium will also have a complement of six more spares that will be kept in storage on the ground until they are required in orbit. If or when those times come, SpaceX will be able to compete with other launch providers for the opportunity to carry maybe one or two Iridium satellites – likely as rideshare payloads – into orbit sometime in the future.

Iridium open to rideshares for spare satellite launches https://t.co/ino39oWCHw pic.twitter.com/56PTcaEMW3

— SpaceNews (@SpaceNews_Inc) January 4, 2019

In the meantime, stay tuned for Iridium-8’s official launch time and date, likely to be announced by SpaceX sometime within the next 24-48 hours.

For prompt updates, on-the-ground perspectives, and unique glimpses of SpaceX’s rocket recovery fleet check out our brand new LaunchPad and LandingZone newsletters!

Elon Musk

Brazil Supreme Court orders Elon Musk and X investigation closed

The decision was issued by Supreme Court Justice Alexandre de Moraes following a recommendation from Brazil’s Prosecutor-General Paulo Gonet.

Brazil’s Supreme Federal Court has ordered the closure of an investigation involving Elon Musk and social media platform X. The inquiry had been pending for about two years and examined whether the platform was used to coordinate attacks against members of the judiciary.

The decision was issued by Supreme Court Justice Alexandre de Moraes following a recommendation from Brazil’s Prosecutor-General Paulo Gonet.

According to a report from Agencia Brasil, the investigation conducted by the Federal Police did not find evidence that X deliberately attempted to attack the judiciary or circumvent court orders.

Prosecutor-General Paulo Gonet concluded that the irregularities identified during the probe did not indicate fraudulent intent.

Justice Moraes accepted the prosecutor’s recommendation and ruled that the investigation should be closed. Under the ruling, the case will remain closed unless new evidence emerges.

The inquiry stemmed from concerns that content on X may have enabled online attacks against Supreme Court justices or violated rulings requiring the suspension of certain accounts under investigation.

Justice Moraes had previously taken several enforcement actions related to the platform during the broader dispute involving social media regulation in Brazil.

These included ordering a nationwide block of the platform, freezing Starlink accounts, and imposing fines on X totaling about $5.2 million. Authorities also froze financial assets linked to X and SpaceX through Starlink to collect unpaid penalties and seized roughly $3.3 million from the companies’ accounts.

Moraes also imposed daily fines of up to R$5 million, about $920,000, for alleged evasion of the X ban and established penalties of R$50,000 per day for VPN users who attempted to bypass the restriction.

Brazil remains an important market for X, with roughly 17 million users, making it one of the platform’s larger user bases globally.

The country is also a major market for Starlink, SpaceX’s satellite internet service, which has surpassed one million subscribers in Brazil.

Elon Musk

FCC chair criticizes Amazon over opposition to SpaceX satellite plan

Carr made the remarks in a post on social media platform X.

U.S. Federal Communications Commission (FCC) Chairman Brendan Carr criticized Amazon after the company opposed SpaceX’s proposal to launch a large satellite constellation that could function as an orbital data center network.

Carr made the remarks in a post on social media platform X.

Amazon recently urged the FCC to reject SpaceX’s application to deploy a constellation of up to 1 million low Earth orbit satellites that could serve as artificial intelligence data centers in space.

The company described the proposal as a “lofty ambition rather than a real plan,” arguing that SpaceX had not provided sufficient details about how the system would operate.

Carr responded by pointing to Amazon’s own satellite deployment progress.

“Amazon should focus on the fact that it will fall roughly 1,000 satellites short of meeting its upcoming deployment milestone, rather than spending their time and resources filing petitions against companies that are putting thousands of satellites in orbit,” Carr wrote on X.

Amazon has declined to comment on the statement.

Amazon has been working to deploy its Project Kuiper satellite network, which is intended to compete with SpaceX’s Starlink service. The company has invested more than $10 billion in the program and has launched more than 200 satellites since April of last year.

Amazon has also asked the FCC for a 24-month extension, until July 2028, to meet a requirement to deploy roughly 1,600 satellites by July 2026, as noted in a CNBC report.

SpaceX’s Starlink network currently has nearly 10,000 satellites in orbit and serves roughly 10 million customers. The FCC has also authorized SpaceX to deploy 7,500 additional satellites as the company continues expanding its global satellite internet network.

Energy

Tesla Energy gains UK license to sell electricity to homes and businesses

The license was granted to Tesla Energy Ventures Ltd. by UK energy regulator Ofgem after a seven-month review process.

Tesla Energy has received a license to supply electricity in the United Kingdom, opening the door for the company to serve homes and businesses in the country.

The license was granted to Tesla Energy Ventures Ltd. by UK energy regulator Ofgem after a seven-month review process.

According to Ofgem, the license took effect at 6 p.m. local time on Wednesday and applies to Great Britain.

The approval allows Tesla’s energy business to sell electricity directly to customers in the region, as noted in a Bloomberg News report.

Tesla has already expanded similar services in the United States. In Texas, the company offers electricity plans that allow Tesla owners to charge their vehicles at a lower cost while also feeding excess electricity back into the grid.

Tesla already has a sizable presence in the UK market. According to price comparison website U-switch, there are more than 250,000 Tesla electric vehicles in the country and thousands of Tesla home energy storage systems.

Ofgem also noted that Tesla Motors Ltd., a separate entity incorporated in England and Wales, received an electricity generation license in June 2020.

The new UK license arrives as Tesla continues expanding its global energy business.

Last year, Tesla Energy retained the top position in the global battery energy storage system (BESS) integrator market for the second consecutive year. According to Wood Mackenzie’s latest rankings, Tesla held about 15% of global market share in 2024.

The company also maintained a dominant position in North America, where it captured roughly 39% market share in the region.

At the same time, competition in the energy storage sector is increasing. Chinese companies such as Sungrow have been expanding their presence globally, particularly in Europe.