SpaceX

SpaceX CEO Elon Musk says that BFR could cost less to build than Falcon 9

SpaceX CEO Elon Musk believes that there may be a path for the company to ultimately build the massive Starship spacecraft and Super Heavy booster (formerly BFR) for less than Falcon 9/Falcon Heavy, a rocket 3-9 times smaller than BFR.

While it certainly ranks high on the list of wild and wacky things the CEO has said over the years, there may be a few ways – albeit with healthy qualifications – that Starship/Super Heavy production costs could ultimately compare favorably with SpaceX’s Falcon family of launch vehicles. Nevertheless, there are at least as many ways in which the next-gen rocket can (or should) never be able to beat the production cost of what is effectively a far simpler rocket.

This will sound implausible, but I think there’s a path to build Starship / Super Heavy for less than Falcon 9

— Elon Musk (@elonmusk) February 11, 2019

Dirty boosters done dirt cheap

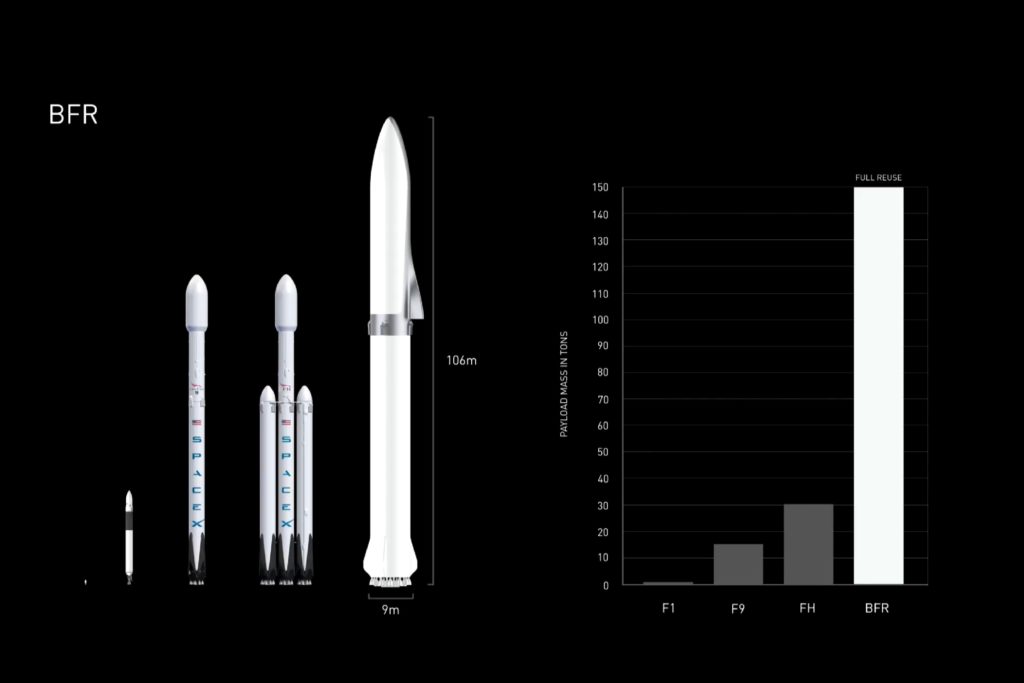

On the one hand, Musk might not necessarily be wrong, especially if one throws the CEO several bones in the interpretation of his brief tweet. BFR at its simplest is going to require a full 38 main rocket engines to achieve its nominal performance goals, 7 on Starship and 31 on Super Heavy. As a dramatically more advanced, larger, and far more complex engine, Raptor will (with very little doubt) cost far more per engine than the relatively simple Merlin 1D. BFR avionics (flight computers, electronics, wiring, harnesses) are likely to be more of a known quantity, meaning that costs will probably be comparable or even lower than Falcon 9’s when measured as a proportion of overall vehicle cost. Assuming that BFR can use the exact same cold gas thruster assemblies currently flying on Falcon 9, that cost should only grow proportionally with vehicle size. Finally, Starship will not require a deployable payload fairing (~10% of Falcon 9’s production cost).

All of those things mean that Starship/Super Heavy will probably be starting off with far better cost efficiency than Falcon 9 was able to, thanks to almost a decade of interim experience both building, flying, and refurbishing the rocket since its 2010 debut. Still, BFR will have to account for entirely new structures like six large tripod fins/wings and their actuators, wholly new thrust structures (akin to Falcon 9’s octaweb) for both stages, and more. Considering Starship on its own, the production of a human-rated spacecraft capable of safely housing dozens of people in space for weeks or months will almost without a doubt rival the cost of airliner production, where a 737 – with almost half a century of production and flight heritage – still holds a price tag of $100-130+ million.

- BFR shown to scale with Falcon 1, 9, and Heavy. (SpaceX)

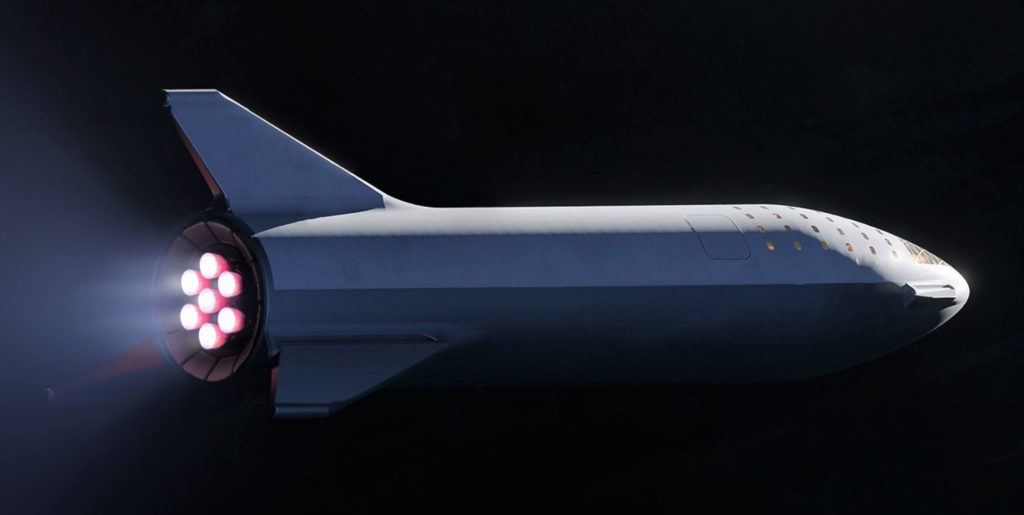

- A September 2018 render of Starship (then BFS) shows one of the vehicle’s two hinged wings/fins/legs. (SpaceX)

- BFR’s booster, now known as Super Heavy. (SpaceX)

- Sadly, this is a not a sight that will greet Falcon 9 booster B1046’s fourth launch – Crew Dragon’s critical In-Flight Abort test. (SpaceX)

Adding one more assumption, the most lenient interpretation of Musk’s tweet assumes that he is really only subjecting the overall structure (sans engines and any crew-relevant hardware) of BFR relative to Falcon 9. In other words, could a ~300-ton stainless steel rocket structure (BFR) cost the same amount or less to fabricate than a ~30-ton aluminum-lithium alloy rocket structure (Falcon 9/Heavy)? From the very roughest of numerical comparisons, Musk estimated the cost of the stainless steel alloys (300-series) to be used for BFR at around $3 per pound ($6.60/kg), while aluminum-lithium alloys used in aerospace (and on Falcon 9) are sold for around $20/lb ($44/kg)*. As such, simply buying the materials to build the basic structures of BFR and Falcon 9 would cost around and $7.5M and $5M, respectively.

Assuming that the process of assembling, welding, and integrating Starship and Super Heavy structures is somehow 5-10 times cheaper, easier, and less labor-intensive, it’s actually not inconceivable that the cost of building BFR’s structure could ultimately compete with Falcon 9 after production has stabilized after the new rocket’s prototyping phase is over and manufacturing processes are mature.

*Very rough estimate, difficult to find a public cost per unit mass from modern Al-Li suppliers

Costs vs. benefits

On the opposite hand, stainless steel rockets do not have a history of being uniquely cost-effective relative to vehicles using alternative materials. The only orbital-class launch vehicles to use stainless steel (and balloon) tanks are the Atlas booster and the Centaur upper stage, with Atlas dating back to the late 1950s and Centaur beginning launches in the early ’60s. Stainless steel Atlas launches ended in 2005 with the final Atlas III mission, while multiple forms of Centaur continue to fly regularly on ULA’s Atlas V and Delta IV.

Based on a 1966 contract between NASA and General Dynamics placed shortly after Centaur’s tortured development had largely been completed, Centaur upper stages were priced around $25M apiece (2018 USD). In 1980, the hardware for a dedicated Atlas-Centaur launch of a ~1500 kg Comstar I satellite to GTO cost the US the 2018 equivalent of a bit less than $40M ($71M including miscellaneous administrative costs) – $22.4M for Centaur and $17.6M for Atlas. For Atlas, the rocket’s airframe (tanks and general structure) was purchased for around $8.5M. That version of Atlas-Centaur (Atlas-SLV3D Centaur-D1A) was capable of lifting around 5100 kg (11,250 lb) into Low Earth Orbit (LEO) and 1800 kg (~4000 lb) to geostationary transfer orbit (GTO), while it stood around 40m (130 ft) tall, had a tank diameter of 3.05m (10 ft), and weighed ~150t (330,000 lb) fully fueled.

- Atlas shows off its shiny steel balloon tanks. (SDASM)

- The original space-faring Atlas, known as SM-65, seen here with a Mercury space capsule. (NASA)

- A Centaur upper stage is pictured here in 1964. (NASA)

- Atlas SLV3D is pictured here launching a Comstar I satellite.

- A Falcon 9 booster is seen here near the end of its tank welding, just prior to painting. (SpaceX)

- An overview of SpaceX’s Hawthorne factory floor in early 2018. (SpaceX)

In a very loose sense, that particular stainless steel Atlas variant was about half as large and half as capable as the first flight-worthy version of Falcon 9 at roughly the same price at launch ($60-70M). What does this jaunt through the history books tell us about the prospects of a stainless steel Starship and Super Heavy? Well, not much. The problem with trying to understand and pick apart official claims about SpaceX’s next-generation launch architecture is quite simple: only one family of rockets in the history of the industry (Atlas) regularly flew with stainless steel propellant tanks, a half-century lineage that completed its final launch in 2005.

Generally speaking, an industrial sample size of more or less one makes it far from easy to come to any particular conclusions about a given technology or practice, and SpaceX – according to CEO Elon Musk – fully intends to push past the state of the art of stainless steel rocket tankage with BFR. Ultimately, American Marietta/Martin Marietta/Lockheed Martin was never able to produce launch vehicle variants of the stainless steel Atlas family at a cost more than marginally competitive with Falcon 9, despite the latter rocket’s use of a far more expensive metal alloy throughout its primary tanks and structure.

At least 10X cheaper

— Elon Musk (@elonmusk) February 11, 2019

At some point, it’s even worth asking whether the per-unit cost of Starship and Super Heavy should be relevant at all to their design and construction, at least within reason. If the goal of BFR is to drastically lower the cost of launch by radically improving the ease of reuse, it would be truly bizarre (and utterly unintuitive) if those goals could somehow be achieved without dramatically raising the cost of initial hardware procurement. Perhaps the best close comparison to BFR’s goals, modern airliners are eyewateringly expensive ($100-500M apiece) as a consequence of the extraordinary reliability, performance, efficiency, and longevity customers and regulatory agencies demand from them, although those costs are admittedly not the absolute lowest they could be in a perfect manufacturing scenario.

At the end of the day, it appears that Musk is increasingly of the opinion that the pivot to stainless steel could ultimately make BFR simultaneously “better, faster, [&] cheaper”. However improbable that may be, if it does turn out to be the case, Starship and Super Heavy could be an unfathomable leap ahead for reliable and affordable access to space. It could also be another case of Musk’s excitement and optimism getting the better of him and hyping a given product well beyond what it ultimately is able to achieve. Time will tell!

Check out Teslarati’s newsletters for prompt updates, on-the-ground perspectives, and unique glimpses of SpaceX’s rocket launch and recovery processes!

Elon Musk

FCC chair criticizes Amazon over opposition to SpaceX satellite plan

Carr made the remarks in a post on social media platform X.

U.S. Federal Communications Commission (FCC) Chairman Brendan Carr criticized Amazon after the company opposed SpaceX’s proposal to launch a large satellite constellation that could function as an orbital data center network.

Carr made the remarks in a post on social media platform X.

Amazon recently urged the FCC to reject SpaceX’s application to deploy a constellation of up to 1 million low Earth orbit satellites that could serve as artificial intelligence data centers in space.

The company described the proposal as a “lofty ambition rather than a real plan,” arguing that SpaceX had not provided sufficient details about how the system would operate.

Carr responded by pointing to Amazon’s own satellite deployment progress.

“Amazon should focus on the fact that it will fall roughly 1,000 satellites short of meeting its upcoming deployment milestone, rather than spending their time and resources filing petitions against companies that are putting thousands of satellites in orbit,” Carr wrote on X.

Amazon has declined to comment on the statement.

Amazon has been working to deploy its Project Kuiper satellite network, which is intended to compete with SpaceX’s Starlink service. The company has invested more than $10 billion in the program and has launched more than 200 satellites since April of last year.

Amazon has also asked the FCC for a 24-month extension, until July 2028, to meet a requirement to deploy roughly 1,600 satellites by July 2026, as noted in a CNBC report.

SpaceX’s Starlink network currently has nearly 10,000 satellites in orbit and serves roughly 10 million customers. The FCC has also authorized SpaceX to deploy 7,500 additional satellites as the company continues expanding its global satellite internet network.

Elon Musk

NASA watchdog says Starship development delays could affect Artemis timeline

The report noted that several technical milestones still need to be completed before Starship can serve as a crewed lunar lander.

A NASA watchdog report stated that continued development work on SpaceX’s Starship could affect the timeline for the agency’s planned Artemis moon missions. The report noted that several technical milestones still need to be completed before the spacecraft can serve as a crewed lunar lander.

The findings were detailed in a report from NASA’s Office of Inspector General, as noted in a report from Reuters.

NASA selected SpaceX’s Starship in 2021 to serve as the Human Landing System (HLS) for its Artemis lunar program. The vehicle is intended to transport astronauts from lunar orbit to the surface of the Moon and back as part of future Artemis missions.

According to the watchdog report, Starship’s development has experienced roughly two years of schedule delays compared to earlier expectations. Still, NASA is targeting 2028 for the first crewed lunar landing using the Starship lander.

One of the most significant technical milestones for Starship’s lunar missions is in-space refueling.

To support a crewed lunar landing, multiple Starship launches will be required to deliver propellant to orbit. Tanker versions of Starship will transfer fuel to a storage depot spacecraft, which will then refuel the lunar lander.

The report noted that this approach could require more than 10 Starship launches to fully refuel the spacecraft needed for a single lunar landing mission.

NASA officials indicated that demonstrating cryogenic propellant transfer in orbit remains one of the most important technical steps before Starship can be certified for lunar missions.

SpaceX has conducted 11 Starship test flights since 2023 as the company continues developing the fully reusable launch system. A 12th test flight, this time featuring Starship V3, is expected to be held in early April.

Elon Musk

SpaceX weighs Nasdaq listing as company explores early index entry: report

The company is reportedly seeking early inclusion in the Nasdaq-100 index.

Elon Musk’s SpaceX is reportedly leaning toward listing its shares on the Nasdaq for a potential initial public offering (IPO) that could become the largest in history.

As per a recent report, the company is reportedly seeking early inclusion in the Nasdaq-100 index. The update was reported by Reuters, citing people familiar with the matter.

According to the publication, SpaceX is considering Nasdaq as the venue for its eventual IPO, though the New York Stock Exchange is also competing for the listing. Neither exchange has reportedly been informed of a final decision.

Reuters has previously reported that SpaceX could pursue an IPO as early as June, though the company’s plans could still change.

One of the publication’s sources also suggested that SpaceX is targeting a valuation of about $1.75 trillion for its IPO. At that level, the company would rank among the largest publicly traded firms in the United States by market capitalization.

Nasdaq has proposed a rule change that could accelerate the inclusion of newly listed megacap companies into the Nasdaq-100 index.

Under the proposed “Fast Entry” rule, a newly listed company could qualify for the index in less than a month if its market capitalization ranks among the top 40 companies already included in the Nasdaq-100.

If SpaceX is successful in achieving its target valuation of $1.75 trillion, it would become the sixth-largest company by market value in the United States, at least based on recent share prices.

Newly listed companies typically have to wait up to a year before becoming eligible for major indexes such as the Nasdaq-100 or S&P 500.

Inclusion in a major index can significantly broaden a company’s shareholder base because many institutional investors purchase shares through index-tracking funds.

According to Reuters, Nasdaq’s proposed fast-track rule is partly intended to attract highly valued private companies such as SpaceX, OpenAI, and Anthropic to list on the exchange.

![Lucid Lunar robotaxi concept [Credit: Rendering by TESLARATI]](https://www.teslarati.com/wp-content/uploads/2026/03/lucid-lunar-robotaxi-concept-teslarati-rendering-80x80.jpg)