News

SpaceX’s next Falcon 9 launch delayed until November as lull drags on

For unknown reasons, SpaceX’s next Falcon 9 rocket launch has slipped from October to November, extending an already record-breaking lull in commercial US launch activity.

Depending on when SpaceX finally returns to flight, the company could have easily spent more than a quarter of 2019 between launches.

On August 7th, SpaceX successfully completed its most recent launch – orbiting Spacecom’s AMOS-17 communications satellite – and the company’s tenth orbital launch of 2019. Aside from two spectacular back-to-back Falcon Heavy launches in April and June and SpaceX’s first dedicated Starlink launch in May, 2019 has be a relatively normal year for SpaceX’s commercial launch business.

Shifting satellite sands

A comment made in September by SpaceX COO and President Gwynne Shotwell was nevertheless spot-on – 2019 has been a bit quieter than 2017 and 2018 and a large chunk of that slowdown can be reportedly explained by the lack of customer readiness. The satellites SpaceX’s paying customers have contracted launches for simply aren’t ready for flight.

In short, after finding its stride over the last two and a half years, SpaceX’s orbital launch capacity has grown to the point that it’s nearly outpacing the world’s commercial satellite manufacturing capabilities: SpaceX can launch them faster than the established industry can build them.

Although SpaceX’s unexpected 2019 launch lull is likely more of a perfect storm and coincidence than anything, it may still be a sign of things to come in the next decade and beyond. Annual orders for large geostationary communications satellites – representing a substantial share of the global launch market – reached their lowest levels ever in 2017 and 2018, a trend that appears likely to continue almost indefinitely.

Those often massive satellites tend to cost nine figures ($100M+), weigh at least several metric tons, and are designed with a failure-is-not-an-option attitude that has inflated their complexity and price tags to dysfunctional levels.

The Small-ening

SpaceX is undeniably aware of this trend, caused in large part by the growing commercial aversion (at least for new entrants) of putting all one’s eggs in an incredibly large and expensive satellite basket. Smaller satellites – be it in low Earth orbit, geostationary orbits, or even interplanetary space – are now largely viewed as the way forward for companies interested in commercializing spaceflight. Large spacecraft certainly still have their place and many industry stalwarts are extremely reluctant to part ways with the established standard of big communications satellites, but small is almost unequivocally the future.

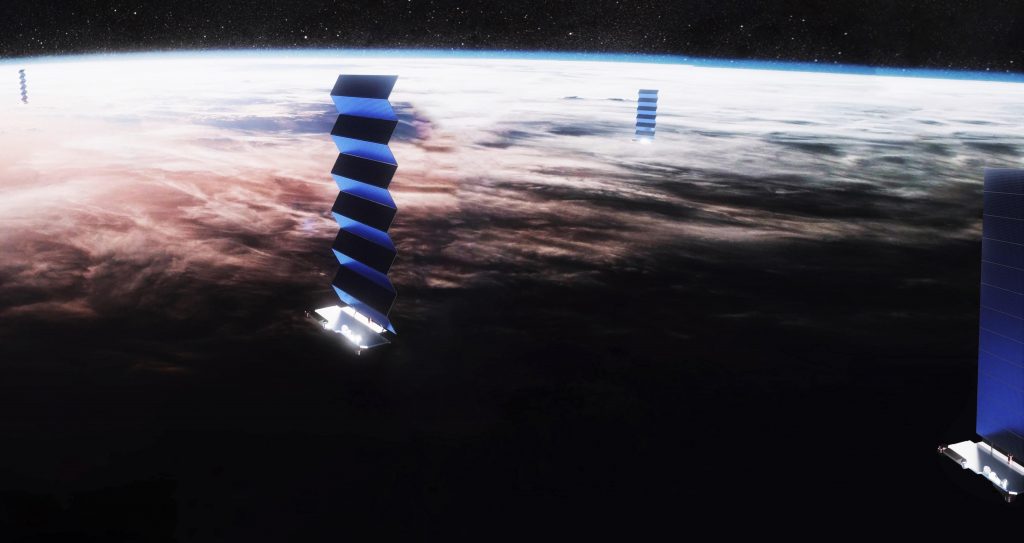

SpaceX is clearly onboard and has become the only launch services company in history to pursue plans to build, launch, and operate its own satellite constellation, known as Starlink. In a beta test at an unprecedented scale, SpaceX launched its first 60 Starlink satellite prototypes in May and has since been working to finalize designs and aggressively ramp up production.

SpaceX’s current plans for Starlink involve a constellation of nearly 12,000 satellites, potentially growing to 40,000+ well down the road. SpaceX much launch approximately half of those satellites by November 2023 and all of them by November 2027, a feat that will require the company to build and launch spacecraft at a rate unprecedented in the history of commercial space.

Shotwell indicated at the same September 2019 conference that SpaceX’s goal was to launch as many Starlink missions as possible while attempting to avoid disrupting the schedules of its commercial launch customers. In fact, the launch expected to end SpaceX’s 2019 launch lull was and still is a Starlink mission, the first flight of 60 finalized ‘v1.0’ satellites.

For unknown reasons probably related SpaceX’s relatively recent entrance into satellite manufacturing, that ‘Starlink-1’ launch (and 1-3 more expected to occur in quick succession) has slipped from a relatively firm October 17th planning date to late-October, and now has a tentative launch target sometime in November. Pending mission success, a second launch (‘Starlink-2’) could follow as early as November or December, while SpaceX also plans to launch Crew Dragon’s In-Flight Abort (IFA) as early as late-November, Cargo Dragon’s CRS-19 mission NET December 4th, and the Kacific-1 communications satellite in mid-December.

Check out Teslarati’s Marketplace! We offer Tesla accessories, including for the Tesla Cybertruck and Tesla Model 3.

News

Tesla begins Robotaxi certification push in Arizona: report

Tesla seems serious about expanding its Robotaxi service to several states in the coming months.

Tesla has initiated discussions with Arizona transportation regulators to certify its driverless Robotaxi service in the state, as per a recent report from Bloomberg News. The move follows Tesla’s launch of its Robotaxi pilot program in Austin, Texas, as well as CEO Elon Musk’s recent comments about the service’s expansion in the Bay Area.

The Arizona Department of Transportation confirmed to Bloomberg that Tesla has reached out to begin the certification process for autonomous ride-sharing operations in the state. While details remain limited, the outreach suggests that Tesla is serious about expanding its driverless Robotaxi service to several territories in the coming months.

The Arizona development comes as Tesla prepares to expand its service area in Austin this weekend, as per CEO Elon Musk in a post on X. Musk also stated that Tesla is targeting the San Francisco Bay Area as its next major market, with a potential launch “in a month or two,” pending regulatory approvals.

Tesla first launched its autonomous ride-hailing program on June 22 in Austin with a small fleet of Model Y vehicles, accompanied by a Tesla employee in the passenger seat to monitor safety. While still classified as a test, Musk has said the program will expand to about 1,000 vehicles in the coming months. Tesla will later upgrade its Robotaxi fleet with the Cyercab, a two-seater that is designed without a steering wheel.

Sightings of Cybercab castings around the Giga Texas complex suggests that Tesla may be ramping the initial trial production of the self-driving two-seater. Tesla, for its part, has noted in the past that volume production of the Cybercab is expected to start sometime next year.

In California, Tesla has already applied for a transportation charter-party carrier permit from the state’s Public Utilities Commission. The company is reportedly taking a phased approach to operating in California, with the Robotaxi service starting with pre-arranged rides for employees in vehicles with safety drivers.

News

Tesla sets November 6 date for 2025 Annual Shareholder Meeting

The automaker announced the date on Thursday in a Form 8-K.

Tesla has scheduled its 2025 annual shareholder meeting for November 6, addressing investor concerns that the company was nearing a legal deadline to hold the event.

The automaker announced the date on Thursday in a Form 8-K submitted to the United States Securities and Exchange Commission (SEC). The company also listed a new proposal submission deadline of July 31 for items to be included in the proxy statement.

Tesla’s announcement followed calls from a group of 27 shareholders, including the leaders of large public pension funds, which urged Tesla’s board to formally set the meeting date, as noted in a report from The Wall Street Journal.

The group noted that under Texas law, where Tesla is now incorporated, companies must hold annual meetings within 13 months of the last one if requested by shareholders. Tesla’s previous annual shareholder meeting was held on June 13, 2024, which placed the July 13 deadline in focus.

Tesla originally stated in its 2024 annual report that it would file its proxy statement by the end of April. However, an amended filing on April 30 indicated that the Board of Directors had not yet finalized a meeting date, at least at the time.

The April filing also confirmed that Tesla’s board had formed a special committee to evaluate certain matters related to CEO Elon Musk’s compensation plan. Musk’s CEO performance award remains at the center of a lengthy legal dispute in Delaware, Tesla’s former state of incorporation.

Due to the aftermath of Musk’s legal dispute about his compensation plan in Delaware, he has not been paid for his work at Tesla for several years. Musk, for his part, has noted that he is more concerned about his voting stake in Tesla than his actual salary.

At last year’s annual meeting, TSLA shareholders voted to reapprove Elon Musk’s compensation plan and ratified Tesla’s decision to relocate its legal domicile from Delaware to Texas.

Elon Musk

Grok coming to Tesla vehicles next week “at the latest:” Elon Musk

Grok’s rollout to Tesla vehicles is expected to begin next week at the latest.

Elon Musk announced on Thursday that Grok, the large language model developed by his startup xAI, will soon be available in Tesla vehicles. Grok’s rollout to Tesla vehicles is expected to begin next week at the latest, further deepening the ties between the two Elon Musk-led companies.

Tesla–xAI synergy

Musk confirmed the news on X shortly after livestreaming the release of Grok 4, xAI’s latest large language model. “Grok is coming to Tesla vehicles very soon. Next week at the latest,” Musk wrote in a post on social media platform X.

During the livestream, Musk and several members of the xAI team highlighted several upgrades to Grok 4’s voice capabilities and performance metrics, positioning the LLM as competitive with top-tier models from OpenAI and Google.

The in-vehicle integration of Grok marks a new chapter in Tesla’s AI development. While Tesla has long relied on in-house systems for autonomous driving and energy optimization, Grok’s integration would introduce conversational AI directly into its vehicles’ user experience. This integration could potentially improve customer interaction inside Tesla vehicles.

xAI and Tesla’s collaborative footprint

Grok’s upcoming rollout to Tesla vehicles adds to a growing business relationship between Tesla and xAI. Earlier this year, Tesla disclosed that it generated $198.3 million in revenue from commercial, consulting, and support agreements with xAI, as noted in a report from Bloomberg News. A large portion of that amount, however, came from the sale of Megapack energy storage systems to the artificial intelligence startup.

In July 2023, Musk polled X users about whether Tesla should invest $5 billion in xAI. While no formal investment has been made so far, 68% of poll participants voted yes, and Musk has since stated that the idea would be discussed with Tesla’s board.

-

Elon Musk1 week ago

Elon Musk1 week agoTesla investors will be shocked by Jim Cramer’s latest assessment

-

Elon Musk3 days ago

Elon Musk3 days agoElon Musk confirms Grok 4 launch on July 9 with livestream event

-

Elon Musk14 hours ago

Elon Musk14 hours agoxAI launches Grok 4 with new $300/month SuperGrok Heavy subscription

-

News7 days ago

News7 days agoTesla Model 3 ranks as the safest new car in Europe for 2025, per Euro NCAP tests

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoA Tesla just delivered itself to a customer autonomously, Elon Musk confirms

-

Elon Musk1 week ago

Elon Musk1 week agoxAI’s Memphis data center receives air permit despite community criticism

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla’s Omead Afshar, known as Elon Musk’s right-hand man, leaves company: reports

-

News2 weeks ago

News2 weeks agoXiaomi CEO congratulates Tesla on first FSD delivery: “We have to continue learning!”