SpaceX

SpaceX job posts hint at building satellite constellations for US military

Published within the last week, unusual SpaceX job postings have begun to combine a range of topics unusual for the company, indicating some level of internal interest in entering into an entirely new industry and mode of operations.

Judging from the job descriptions, SpaceX is looking to hire engineers familiar with integrating third-party payloads onto in-house satellite buses, and they are primarily interested in engineers with Top Secret security clearances.

https://twitter.com/collinkrum/status/1002425606401736704

Given the subtlety of the relevant job postings and the apparent need for high-level security clearances to become involved, it’s extremely difficult to figure out what exactly SpaceX’s goals are. Still, they contain just enough detail to point in the direction of several obvious explanations. These revolve around one industry in particular: satellite operations and sales to or for third parties.

To some extent, these job listings are to be expected: SpaceX has extensive experience building spacecraft (Falcon 9 upper stages and Dragon) explicitly intended for internal use and operations only. Instead, what is surprising about these job listings is the presence of repeated references to “customer payload[s]” in the context of “satellite mission design”, “SpaceX-developed satellite constellations and payload missions”, the “simulation of remote sensing payloads and constellations”, and a need for “on-orbit commissioning” or “activation”.

Put simply, there is no obvious explanation for why SpaceX would need any of those things, at least in the context of the company’s publicly-known activities and business interests. Taken individually, they might be explained by – as described in the same listings – “[SpaceX’s expanding] classified mission manifest”, as it’s well-known that SpaceX is in the process of certifying Falcon 9 and Falcon Heavy to launch all practicable Air Force (USAF) and National Reconnaissance Office (NRO) payloads. Those payloads often need to be placed in high-energy orbits that rely on extended upper stage coasts between orbit-raising maneuvers, essentially requiring modifications to Falcon 9’s upper stage such that it becomes a sort of ad-hoc, short-lived satellite.

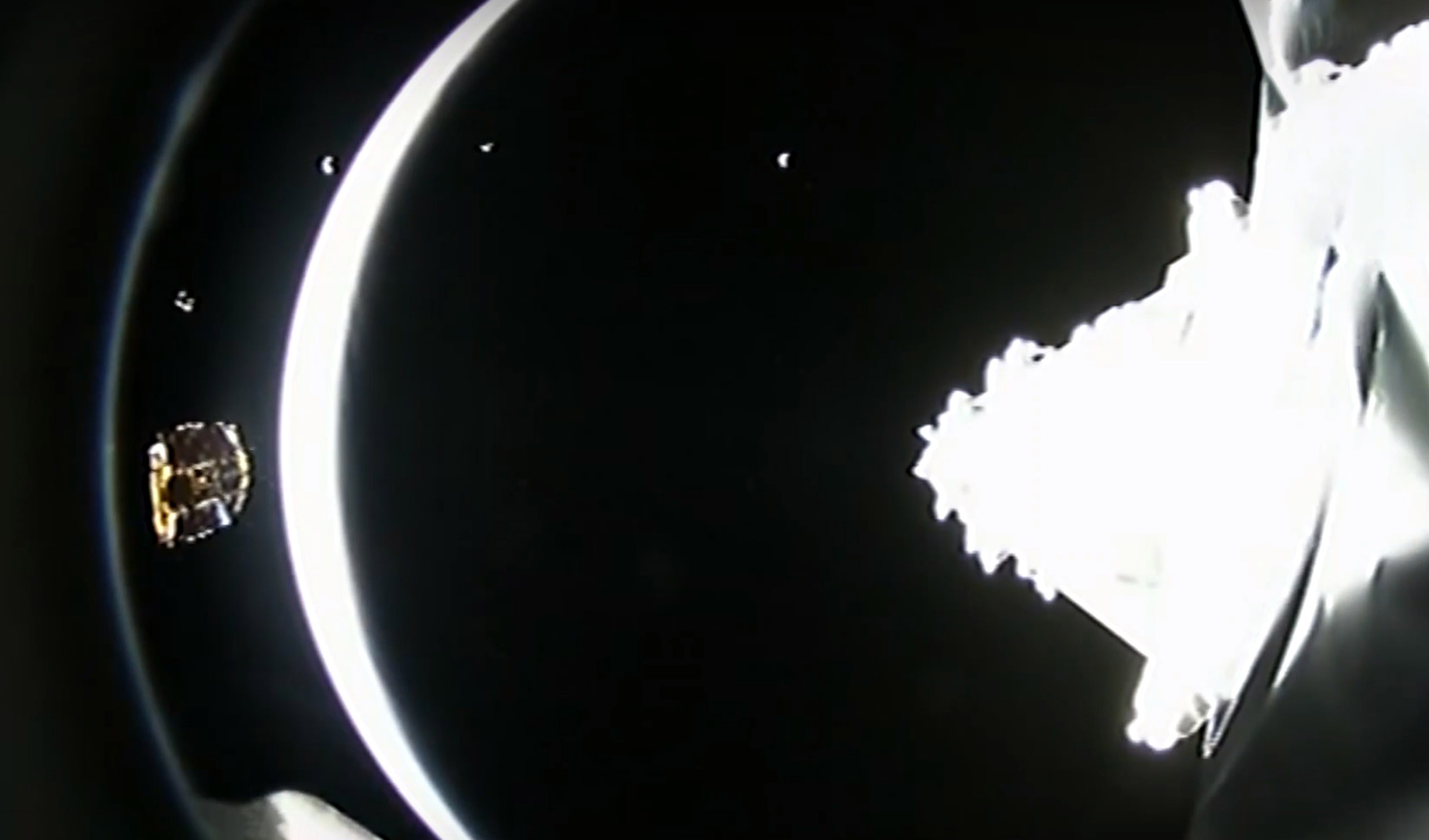

- SpaceX’s first Falcon Heavy launch also happened to be a strategic and successful test of Falcon upper stage coast capabilities. (SpaceX)

- SpaceX’s first two Starlink prototype satellites are pictured here before their inaugural launch, showing off a thoroughly utilitarian bus and several advanced components. (SpaceX)

Starlink spinoffs

However, in all (conceivable) cases where SpaceX might launch a highly-classified payload for a government customer, the dynamic is still precisely that – launch provider (SpaceX) and customer (NRO/USAF/etc). Just like FedEx or UPS have no ownership of or relationship with the goods they transport, satellite launch providers are simply delivering a (very expensive, fragile, and irreplaceable) payload from Point A (the ground) to Point B (orbit). When UPS ships a new smartphone from the manufacturer to the customer, they most certainly do not perform an “in-house commissioning” – if the customer needs help setting up their new phone, they go to the manufacturer or service provider (cell carrier).

In the same way, satellite commissioning is a generally necessary process where the satellite manufacturer – rarely the actual operator or service provider – raises or fine-tunes the expensive spacecraft’s orbit and verifies that all systems and payloads are functioning as intended – only after that process is complete does the manufacturer finally ‘hand off’ the satellite to the customer that paid for it. In some cases, the manufacturer continues to maintain or at least monitor the satellite in the background as the owner serves its own customers, much like how military airplane manufacturers are typically contracted to maintain or support those planes even after final delivery.

Judging from the need for top-secret security clearance in nearly all of these new job postings, SpaceX clearly has a very particular sort of customer in mind. Be it DARPA, NRO, the USAF, or some totally unknown government actor, one or several of the above entities have expressed explicit interest in coopting SpaceX’s newfound status as a prospective dirt-cheap-satellite manufacturer. If that were not the case, SpaceX would not be keen to publish 5+ engineering job postings with top-secret clearance as an explicit prerequisite.

Project Blackjack

Ultimately, it’s undeniable that the prospect of a completed vertically-integrated launch and satellite service provider could be so alluring that entities like the NRO, USAF, or DARPA simply could not pass up the opportunity to at least give it a try. From a purely speculative perspective, the services and processes SpaceX seems to be in the middle of developing are an almost perfect fit with DARPA’s (Defense Advanced Research Projects Agency) brand new Blackjack program. Perfectly summarized in September by Space News reporter Sandra Erwin,

“[DARPA] wants to buy small satellites from commercial vendors, equip them with military sensor payloads and deploy a small constellation in low-Earth orbit to see how they perform in real military operations.”

DARPA awarded a $1.5M contract to smallsat manufacturer and operator Blue Canyon on in October 2018, small relative to the program’s roughly $118M budget. DARPA has made clear that it plans to finalize multiple contracts with different prospective satellite designers and operators in order to ensure a competitive environment, fuel growth in a fairly new industry, and pave the way for the final procurement of an experimental constellation of 20 satellites by 2021. If successful, it could completely change the way the entire US government procures national security-related satellites, offering a far faster, cheaper, and more flexible route to set up unique capabilities.

For prompt updates, on-the-ground perspectives, and unique glimpses of SpaceX’s rocket recovery fleet check out our brand new LaunchPad and LandingZone newsletters!

Elon Musk

Starlink V2 to bring satellite-to-phone service to Deutsche Telekom in Europe

Starlink stated that the system is designed to deliver 5G speeds directly to compatible smartphones in remote areas.

Starlink is partnering with Deutsche Telekom to roll out satellite-to-mobile connectivity across Europe, extending coverage to more than 140 million subscribers across 10 countries.

The service, planned for launch in 2028 in several Telekom markets, including Germany, will use Starlink’s next-generation V2 satellites and Mobile Satellite Service (MSS) spectrum to enable direct-to-device connectivity.

In a post on X, the official Starlink account stated that the agreement will be the first in Europe to deploy its V2 next-generation satellite-to-mobile technology using new MSS spectrum. The company added that the system is designed to deliver 5G speeds directly to compatible smartphones in remote areas.

Abdu Mudesir, Board Member for Product and Technology at Deutsche Telekom, shared his excitement for the partnership in a press release. “We provide our customers with the best mobile network. And we continue to invest heavily in expanding our infrastructure. At the same time, there are regions where expansion is especially complex due to topographical conditions or official constraints,” he said.

“We want to ensure reliable connectivity for our customers in those areas as well. That is why we are strategically complementing our network with satellite-to-mobile connectivity. For us, it is clear: connectivity creates security and trust. And we deliver. Everywhere.”

Under the partnership, compatible smartphones will automatically switch to Starlink’s satellite network when terrestrial coverage is unavailable, enabling access to data, voice, video, and messaging services.

Telekom reports 5G geographic coverage approaching 90% in Germany, with LTE exceeding 92% and voice coverage reaching up to 99%. Starlink’s satellite layer is intended to extend connectivity beyond those terrestrial limits, particularly in topographically challenging or infrastructure-constrained areas.

Stephanie Bednarek, VP of Starlink Sales, also shared her thoughts on the partnership. “We’re so pleased to bring reliable satellite-to-mobile connectivity to millions of people across 10 countries in partnership with Deutsche Telekom. This agreement will be the first-of-its-kind in Europe to launch Starlink’s V2 next-generation technology that will expand on data, voice and messaging by providing broadband directly to mobile phones,” she said.

Starlink’s V2 constellation is designed to expand bandwidth and capacity compared to its predecessor. If implemented as outlined, the 2028 launch would mark one of the first large-scale European deployments of integrated satellite-to-phone connectivity by a major telecom operator.

Elon Musk

SpaceX pursues 5G-level connectivity with Starlink Mobile V2 expansion

SpaceX noted that the upcoming Starlink V2 satellites will deliver up to 100 times the data density of the current first-generation system.

SpaceX has previewed a major upgrade to Starlink Mobile, outlining next-generation satellites that aim to deliver significantly higher capacity and full 5G-level connectivity directly to mobile phones.

The update comes as Starlink rebrands its Direct-to-Cell service to Starlink Mobile, positioning the platform as a scalable satellite-to-mobile solution that’s integrated with global telecom partners.

SpaceX noted that the upcoming Starlink V2 satellites will deliver up to 100 times the data density of the current first-generation system. The company also noted that the new V2 satellites are designed to provide significantly higher throughput capability compared to its current iteration.

“The next generation of Starlink Mobile satellites – V2 – will deliver full cellular coverage to places never thought possible via the highest performing satellite-to-mobile network ever built.

“Driven by custom SpaceX-designed silicon and phased array antennas, the satellites will support thousands of spatial beams and higher bandwidth capability, enabling around 20x the throughput capability as compared to a first-generation satellite,” SpaceX wrote in its official Starlink Mobile page.

Thanks to the higher bandwidth of Starlink Mobile, users should be able to stream, browse the internet, use high-speed apps, and enjoy voice services comparable to terrestrial cellular networks.

In most environments, Starlink says the upgraded system will enable full 5G cellular connectivity with a user experience similar to existing ground-based networks.

The satellites function as “cell towers in space,” using advanced phased-array antennas and laser interlinks to integrate with terrestrial infrastructure in a roaming-like architecture.

“Starlink Mobile works with existing LTE phones wherever you can see the sky. The satellites have an antenna that acts like a cellphone tower in space, the most advanced phased array antennas in the world that connect seamlessly over lasers to any point in the globe, allowing network integration similar to a standard roaming partner,” SpaceX wrote.

Starlink Mobile currently operates with approximately 650 satellites in low-Earth orbit and is active across more than 32 countries, representing over 1.7 billion people through partnerships with mobile network operators. Starlink Mobile’s current partnerships span North America, Europe, Asia, Africa, and Oceania, allowing reciprocal access across participating nations.

Elon Musk

SpaceX IPO could push Elon Musk’s net worth past $1 trillion: Polymarket

The estimates were shared by the official Polymarket Money account on social media platform X.

Recent projections have outlined how a potential $1.75 trillion SpaceX IPO could generate historic returns for early investors. The projections suggest the offering would not only become the largest IPO in history but could also result in unprecedented windfalls for some of the company’s key investors.

The estimates were shared by the official Polymarket Money account on social media platform X.

As noted in a Polymarket Money analysis, Elon Musk invested $100 million into SpaceX in 2002 and currently owns approximately 42% of the company. At a $1.75 trillion valuation following SpaceX’s potential $1.75 trillion IPO, that stake would be worth roughly $735 billion.

Such a figure would dramatically expand Musk’s net worth. When combined with his holdings in Tesla Inc. and other ventures, a public debut at that level could position him as the world’s first trillionaire, depending on market conditions at the time of listing.

The Bloomberg Billionaires Index currently lists Elon Musk with a net worth of $666 billion, though a notable portion of this is tied to his TSLA stock. Tesla currently holds a market cap of $1.51 trillion, and Elon Musk’s currently holds about 13% to 15% of the company’s outstanding common stock.

Founders Fund, co-founded by Peter Thiel, invested $20 million in SpaceX in 2008. Polymarket Money estimates the firm owns between 1.5% and 3% of the private space company. At a $1.75 trillion valuation, that range would translate to approximately $26.25 billion to $52.5 billion in value.

That return would represent one of the most significant venture capital outcomes in modern Silicon Valley history, with a growth of 131,150% to 262,400%.

Alphabet Inc., Google’s parent company, invested $900 million into SpaceX in 2015 and is estimated to hold between 6% and 7% of the private space firm. At the projected IPO valuation, that stake could be worth between $105 billion and $122.5 billion. That’s a growth of 11,566% to 14,455%.

Other major backers highlighted in the post include Fidelity Investments, Baillie Gifford, Valor Equity Partners, Bank of America, and Andreessen Horowitz, each potentially sitting on multibillion-dollar gains.