News

SpaceX Starlink Gen2 constellation weakened by “partial” FCC grant

More than two and a half years after SpaceX began the process of securing regulatory approval for its next-generation Starlink constellation, the US Federal Communications Commission (FCC) has finally granted the company a license – but only after drastically decreasing its scope.

In May 2020, SpaceX filed its first FCC license application for Starlink Gen2, an upgraded constellation of 30,000 satellites. In the second half of 2021, SpaceX amended its Starlink Gen2 application to take full advantage of the company’s more powerful Starship rocket and further improve the constellation’s potential utility. Only in December 2021 did the FCC finally accept SpaceX’s Gen2 application for filing, kicking off the final review process.

On November 29th, 2022, the FCC completed that review and granted SpaceX permission to launch just 7,500 of the ~30,000 Starlink Gen2 satellites it had requested permission for more than 30 months prior. The FCC offered no explanation of how it arrived at its arbitrary 75% reduction, nor why the resulting number is slightly lower than a different 7,518-satellite Starlink Gen1 constellation SpaceX had already received a license to deploy in late 2018. Adding insult to injury, the FCC repeatedly acknowledges that “the total number of satellites SpaceX is authorized to deploy is not increased by our action today, and in fact is slightly reduced.”

The update that's rolling out to the fleet makes full use of the front and rear steering travel to minimize turning circle. In this case a reduction of 1.6 feet just over the air— Wes (@wmorrill3) April 16, 2024

That claimed reduction is thanks to the fact that shortly before this decision, SpaceX told the FCC in good faith that it would voluntarily avoid launching the dedicated V-band Starlink constellation it already received a license for in order “to significantly reduce the total number of satellites ultimately on orbit.” Instead, once Starlink Gen2 was approved, it would request permission to add V-band payloads to a subset of the 29,988 planned Gen2 satellites, achieving a similar result without the need for another 7,518 satellites.

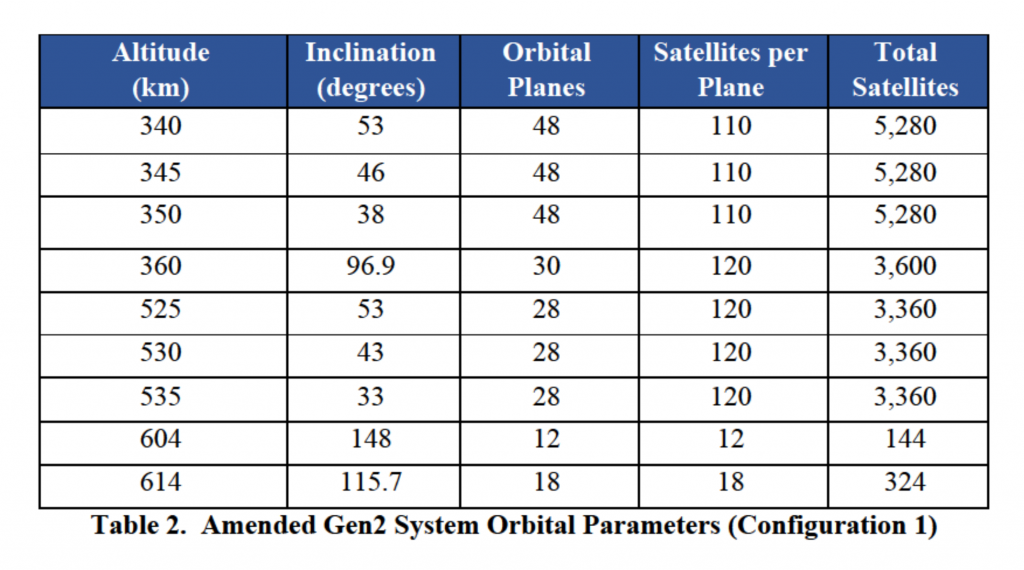

In response, the FCC slashed the total number of Starlink Gen2 satellites permitted to less than the number of satellites approved by the FCC’s November 2018 Starlink V-band authorization; limited those satellites to middle-ground orbits, entirely precluding Gen2 launches to higher or lower orbits; and didn’t even structure its compromise in a way that would at least allow SpaceX to fully complete three Starlink Gen2 ‘shells.’ Worse, the FCC’s partial grant barely mentioned SpaceX’s detailed plans to use new E-band antennas on Starlink Gen2 satellites and next-generation ground stations, simply stating that it will “defer acting on” the request until “further review and coordination with Federal users.”

Throughout the partial grant, the FCC couches its decision to drastically downscale SpaceX’s Starlink Gen2 constellation in terms of needing more time “to evaluate the complex and novel issues on the record before [the Commission],” raising the question of what exactly the Commission was doing instead in the 30 months since SpaceX’s first Gen2 application and 15 months since its Gen2 modification. In comparison, SpaceX received a full license for its 7,518-satellite V-band constellation less than five months after applying. SpaceX’s 4,408-satellite Starlink Gen1 constellation – the first megaconstellation ever reviewed by the modern FCC – was licensed 16 months after its first application and eight months after a modified application was submitted.

Adding to the oddity of the unusual and inconsistent decision-making in this FCC ruling, the Commission openly acknowledges that the idea to grant SpaceX permission to launch a fraction of its Starlink Gen2 constellation came from Amazon’s Project Kuiper [PDF], a major prospective Starlink competitor. The FCC says it agreed with Amazon’s argument, stating that “the public interest would be served by taking this approach in order to permit monitoring of developments involving this large-scale deployment and permit additional consideration of issues unique to the other orbits SpaceX requests.”

The V-band Starlink constellation already approved by the FCC was for 7,518 satellites in very low Earth orbits (~340 km). In the first 4,425-satellite Starlink constellation licensed by the FCC, the Commission gave SpaceX permission to operate 2,814 satellites at orbits between 1100 and 1300 kilometers. Increasingly conscious of the consequences of space debris, which would last hundreds of years at 1000+ kilometers, SpaceX later requested permission in 2019 and 2020 to launch those 2,814 satellites to around 550 kilometers, where failed satellites would reenter in just five years. For unknown reasons, the FCC only fully approved the change two years later, in April 2021.

The “other orbits [requested by SpaceX]” that the FCC says create unique issues that demand “additional consideration” of Starlink Gen2 are for 19,400 satellites between 340 and 360 kilometers and 468 satellites between 604 and 614 kilometers. Starlink satellites are expected to be around four times heavier and feature a magnitude more surface area, but the fact remains that the FCC has already granted SpaceX permission to launch almost 3000 smaller satellites to orbits much higher than 604 kilometers and more than 7500 satellites to orbits lower than 360 kilometers. It’s thus hard not to conclude that the Commission’s claims that a partial license denial was warranted by “concerns about orbital debris and space safety,” and “issues unique to…other orbits” are incoherent at best.

Perhaps the strangest inclusion in the partial grant is a decision by the FCC to subject SpaceX to an arbitrary metric devised by another third-party, for-profit company LeoLabs. In a March 2022 letter, LeoLabs reportedly proposed that “SpaceX’s authorization to continue deploying satellites” be directly linked to an arbitrary metric measuring “the number of years each failed satellite remains in orbit, summed across all failed satellites.” The FCC apparently loved the suggestion and made it an explicit condition of its already harsh Starlink Gen2 authorization, even adopting the arbitrary limit of “100 object years” proposed by LeoLabs.

In other words, once the sum of the time required for all failed Starlink Gen2 satellites to naturally deorbit reaches 100 years, the FCC will force SpaceX to “cease satellite deployment” while it “[reviews] sources of satellite failure” and “determine[s] whether there are any adequate and reliable mitigation measures going forward.” The FCC acknowledges that the arbitrary 100-year limit means that the failure of just 20 Starlink satellites at operational orbits would force the company to halt launches. The Commission does not explain how it will decide when SpaceX can restart Starlink launches after a launch halt. SpaceX must simultaneously follow the FCC’s deployment schedule, which could see the company’s license revoked if it doesn’t deploy 3,750 Starlink Gen2 satellites by November 2028 and all 7,500 satellites by November 2031.

Based on the unofficial observations of astrophysicist Jonathan McDowell, SpaceX currently has more 30 failed Starlink Gen1 satellites at or close to their operational altitudes of 500+ kilometers, meaning that SpaceX would almost certainly be forced to stop launching Gen1 satellites if this arbitrary new rule were applied to other constellations. The same is true for competitor OneWeb, which had a single satellite fail at around 1200 kilometers in 2021. At that altitude, it will likely take hundreds of “object years” to naturally deorbit, easily surpassing LeoLabs’ draconian 100-year limit.

In theory, the FCC does make it clear that it will consider changing those restrictions and allowing SpaceX to launch more of its proposed Starlink Gen2 constellation in the future. But the Commission has also repeatedly demonstrated to SpaceX that it will happily take years to modify existing licenses or approve new ones – not a particularly reassuring foundation for investments as large and precarious as megaconstellations.

Ultimately, short of shady handshake deals in back rooms, the FCC’s partial grant leaves SpaceX’s Starlink Gen2 constellation in an undesirable position. For the company to proceed under the current license, it could be forced to redesign its satellites and ground stations to avoid the E-band, or gamble by continuing to build and deploy satellites and ground stations with E-band antennas without a guarantee that it’ll ever be able to use that hardware. There is also no guarantee that the FCC will permit SpaceX to launch any of the ~22,500 satellites left on the table by the partial grant, which will drastically change the financial calculus that determines whether the constellation is economically viable and how expansive associated infrastructure needs to be.

Additionally, if SpaceX accepts the gambit and launches all 7,500 approved Gen2 satellites only for the FCC to fail to approve expansions, Starlink Gen2 would be stuck with zero polar coverage, significantly reducing the constellation’s overall utility. Starlink Gen2 likely represents an investment of at least $30-60 billion (assuming an unprecedentedly low $1-2M to build and launch each 50-150 Gbps satellite). With its partial license denial and the addition of several new and arbitrary conditions, the FCC is effectively forcing SpaceX to take an even riskier gamble with the billions of dollars of brand new infrastructure it will need to build to manufacture, launch, operate, and utilize its Starlink Gen2 constellation.

News

Tesla launches in India with Model Y, showing pricing will be biggest challenge

Tesla finally got its Model Y launched in India, but it will surely come at a price for consumers.

Tesla has officially launched in India following years of delays, as it brought its Model Y to the market for the first time on Tuesday.

However, the launch showed that pricing is going to be its biggest challenge. The all-electric Model Y is priced significantly higher than in other major markets in which Tesla operates.

On Tuesday, Tesla’s Model Y went up for sale for 59,89,000 rupees for the Rear-Wheel Drive configuration, while the Long Range Rear-Wheel Drive was priced at 67,89,000.

This equates to $69,686 for the RWD and $78,994 for the Long Range RWD, a substantial markup compared to what these cars sell for in the United States.

🚨 Here’s the difference in price for the Tesla Model Y in the U.S. compared to India.

🚨 59,89,000 is $69,686

🚨 67,89,000 is $78,994 pic.twitter.com/7EUzyWLcED— TESLARATI (@Teslarati) July 15, 2025

Deliveries are currently scheduled for the third quarter, and it will be interesting to see how many units they can sell in the market at this price point.

The price includes tariffs and additional fees that are applied by the Indian government, which has aimed to work with foreign automakers to come to terms on lower duties that increase vehicle cost.

Tesla Model Y seen testing under wraps in India ahead of launch

There is a chance that these duties will be removed, which would create a more stable and affordable pricing model for Tesla in the future. President Trump and Indian Prime Minister Narendra Modi continue to iron out those details.

Maharashtra Chief Minister Devendra Fadnavis said to reporters outside the company’s new outlet in the region (via Reuters):

“In the future, we wish to see R&D and manufacturing done in India, and I am sure at an appropriate stage, Tesla will think about it.”

It appears to be eerily similar to the same “game of chicken” Tesla played with Indian government officials for the past few years. Tesla has always wanted to enter India, but was unable to do so due to these import duties.

India wanted Tesla to commit to building a Gigafactory in the country, but Tesla wanted to test demand first.

It seems this could be that demand test, and the duties are going to have a significant impact on what demand will actually be.

Elon Musk

Tesla ups Robotaxi fare price to another comical figure with service area expansion

Tesla upped its fare price for a Robotaxi ride from $4.20 to, you guessed it, $6.90.

Tesla has upped its fare price for the Robotaxi platform in Austin for the first time since its launch on June 22. The increase came on the same day that Tesla expanded its Service Area for the Robotaxi ride-hailing service, offering rides to a broader portion of the city.

The price is up from $4.20, a figure that many Tesla fans will find amusing, considering CEO Elon Musk has used that number, as well as ’69,’ as a light-hearted attempt at comedy over the past several years.

Musk confirmed yesterday that Tesla would up the price per ride from that $4.20 point to $6.90. Are we really surprised that is what the company decided on, as the expansion of the Service Area also took effect on Monday?

But the price is now a princely $6.90, as foretold in the prophecy 😂

— Elon Musk (@elonmusk) July 14, 2025

The Service Area expansion was also somewhat of a joke too, especially considering the shape of the new region where the driverless service can travel.

I wrote yesterday about how it might be funny, but in reality, it is more of a message to competitors that Tesla can expand in Austin wherever it wants at any time.

Tesla’s Robotaxi expansion wasn’t a joke, it was a warning to competitors

It was only a matter of time before the Robotaxi platform would subject riders to a higher, flat fee for a ride. This is primarily due to two reasons: the size of the access program is increasing, and, more importantly, the service area is expanding in size.

Tesla has already surpassed Waymo in Austin in terms of its service area, which is roughly five square miles larger. Waymo launched driverless rides to the public back in March, while Tesla’s just became available to a small group in June. Tesla has already expanded it, allowing new members to hail a ride from a driverless Model Y nearly every day.

The Robotaxi app is also becoming more robust as Tesla is adding new features with updates. It has already been updated on two occasions, with the most recent improvements being rolled out yesterday.

Tesla updates Robotaxi app with several big changes, including wider service area

News

Tesla Model Y and Model 3 dominate U.S. EV sales despite headwinds

Tesla’s two mainstream vehicles accounted for more than 40% of all EVs sold in the United States in Q2 2025.

Tesla’s Model Y and Model 3 remained the top-selling electric vehicles in the U.S. during Q2 2025, even as the broader EV market dipped 6.3% year-over-year.

The Model Y logged 86,120 units sold, followed by the Model 3 at 48,803. This means that Tesla’s two mainstream vehicles accounted for 43% of all EVs sold in the United States during the second quarter, as per data from Cox Automotive.

Tesla leads amid tax credit uncertainty and a tough first half

Tesla’s performance in Q2 is notable given a series of hurdles earlier in the year. The company temporarily paused Model Y deliveries in Q1 as it transitioned to the production of the new Model Y, and its retail presence was hit by protests and vandalism tied to political backlash against CEO Elon Musk. The fallout carried into Q2, yet Tesla’s two mass-market vehicles still outsold the next eight EVs combined.

Q2 marked just the third-ever YoY decline in quarterly EV sales, totaling 310,839 units. Electric vehicle sales, however, were still up 4.9% from Q1 and reached a record 607,089 units in the first half of 2025. Analysts also expect a surge in Q3 as buyers rush to qualify for federal EV tax credits before they expire on October 1, Cox Automotive noted in a post.

Legacy rivals gain ground, but Tesla holds its commanding lead

General Motors more than doubled its EV volume in the first half of 2025, selling over 78,000 units and boosting its EV market share to 12.9%. Chevrolet became the second-best-selling EV brand, pushing GM past Ford and Hyundai. Tesla, however, still retained a commanding 44.7% electric vehicle market share despite a 12% drop in in Q2 revenue, following a decline of almost 9% in Q1.

Incentives reached record highs in Q2, averaging 14.8% of transaction prices, roughly $8,500 per vehicle. As government support winds down, the used EV market is also gaining momentum, with over 100,000 used EVs sold in Q2.

Q2 2025 Kelley Blue Book EV Sales Report by Simon Alvarez on Scribd

-

News3 days ago

News3 days agoTesla debuts hands-free Grok AI with update 2025.26: What you need to know

-

Elon Musk1 week ago

Elon Musk1 week agoElon Musk confirms Grok 4 launch on July 9 with livestream event

-

Elon Musk5 days ago

Elon Musk5 days agoxAI launches Grok 4 with new $300/month SuperGrok Heavy subscription

-

News2 weeks ago

News2 weeks agoTesla Model 3 ranks as the safest new car in Europe for 2025, per Euro NCAP tests

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoxAI’s Memphis data center receives air permit despite community criticism

-

News5 days ago

News5 days agoTesla begins Robotaxi certification push in Arizona: report

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla reveals it is using AI to make factories more sustainable: here’s how

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla scrambles after Musk sidekick exit, CEO takes over sales