News

Tesla gets boost from China’s regulations as Europe sees influx of Model 3 registrations

Tesla’s push into the international market with its Model 3 electric sedan could see a notable boost, thanks in part to some unexpected support from Chinese regulations and what appears to be widespread support for EVs in the European region. With the Model 3 about to saturate the right-hand-drive markets, it appears that Tesla’s ramp of the vehicle is entering its later stages.

A recent update from Beijing stands to benefit the countries’ largest local electric car companies and Tesla, which is currently building a wholly-owned factory in Shanghai. In an announcement on Friday, China’s Ministry of Finance announced that it would be extending a sales tax break for battery-powered and hybrid vehicles. A change was expected to go into effect on Monday, but with the update in place, battery-powered and hybrid vehicles will still be exempt from a 10% sales tax until the end of 2020.

With the extension of the tax break, analysts from China have noted that strong brands in the EV sector, such as Tesla and local companies like Geely Automobile Holdings, SAIC Motor, NIO, and Xpeng Motors, would likely see benefits from the government’s adjustment. Tax break or not, the China Association of Automobile Manufacturers expect New Energy Vehicle (NEV) sales in the country to increase by 27%, which would translate to around 1.6 million units over the course of 2019. If these forecasts prove accurate, China will set another sales record for its NEV initiative this year.

If Tesla starts producing the Model 3 at Gigafactory 3 later this year, the company could tap into the country’s growing NEV market. Tesla, after all, is considered a premium brand in the country, holding a reputation that is not too far from Apple. Tesla’s vehicles like the Model X have been considered as status symbols in the past, and this could ultimately benefit the Model 3, which offers a more affordable entry point into the Tesla ecosystem.

Apart from a potential boost thanks to China’s regulations, Tesla’s push into the European market also appears to be bearing fruit. Tesla conducted a massive end-of-quarter push in Europe last month, as part of its attempt to meet or even break its record in Q4 2018, when it delivered over 90,000 vehicles in one quarter. Data from Europe’s car sales in June 2019 show that Tesla’s delivery push might have paid off.

June’s sales from the European region are currently trickling in, and based on data from countries such as Norway and the Netherlands, where registrations surpassed 2,500 for the first time, Tesla appears to be increasing its reach. Denmark also saw 426 Tesla registrations, which is more than four times the total for all of 2018. In line with the company’s end-of-quarter push, almost a third of Denmark’s Tesla registrations were submitted in the last week of June. This influx of registrations is likely due to the Model 3, which is currently being shipped to the region.

Bloomberg Intelligence global autos analyst Kevin Tynan believes that Europe’s momentum could help the company, particularly as the company’s expansion in the US “stalls.” The analyst also expects Tesla to meet competition in Europe and China, as the company will have to challenge established local competitors. “Tesla’s global push will deliver expansion as the US stalls, but at great expense to margin. And dominance of the battery-electric vehicle market may not come as easily in China and Europe, as the company faces established hometown — and government — favorites there,” Tynan wrote.

Tesla’s Model 3 ramp has been the focus of the company for over a year. As Tesla starts its push into the RHD territories this quarter, and as the company prepares to manufacture the Model 3 in China, the later stages of Elon Musk’s play into the mass market could finally be at hand. Once the Model 3 ramp reaches its full fruition, Tesla could start its next, more ambitious push into the mainstream: the Model Y, which will compete in the competitive and lucrative crossover SUV market.

Elon Musk

Tesla Supercharger Diner food menu gets a sneak peek as construction closes out

What are you ordering at the Tesla Diner?

The Tesla Supercharger Diner in Los Angeles is nearing completion as construction appears to be winding down significantly. However, the more minor details, such as what the company will serve at its 50s-style diner for food, are starting to be revealed.

Tesla’s Supercharger Diner is set to open soon, seven years after CEO Elon Musk first drafted the idea in a post on X in 2018. Musk has largely come through on most of what he envisioned for the project: the diner, the massive movie screens, and the intended vibe are all present, thanks to the aerial and ground footage shared on social media.

We already know the Diner will be open 24/7, based on decals placed on the front door of the restaurant that were shared earlier this week. We assume that Tesla Optimus will come into play for these long and uninterrupted hours.

The Tesla Diner is basically finished—here’s what it looks like

As far as the food, Tesla does have an email also printed on the front door of the Diner, but we did not receive any response back (yet) about what cuisine it will be offering. We figured it would be nothing fancy and it would be typical diner staples: burgers, fries, wings, milkshakes, etc.

According to pictures taken by @Tesla_lighting_, which were shared by Not a Tesla App, the food will be just that: quick and affordable meals that diners do well. It’s nothing crazy, just typical staples you’d find at any diner, just with a Tesla twist:

Tesla Diner food:

• Burgers

• Fries

• Chicken Wings

• Hot Dogs

• Hand-spun milkshakes

• And more https://t.co/kzFf20YZQq pic.twitter.com/aRv02TzouY— Sawyer Merritt (@SawyerMerritt) July 17, 2025

As the food menu is finalized, we will be sure to share any details Tesla provides, including a full list of what will be served and its prices.

Additionally, the entire property appears to be nearing its final construction stages, and it seems it may even be nearing completion. The movie screens are already up and showing videos of things like SpaceX launches.

There are many cars already using the Superchargers at the restaurant, and employees inside the facility look to be putting the finishing touches on the interior.

🚨 Boots on the ground at the Tesla Diner:

— TESLARATI (@Teslarati) July 17, 2025

It’s almost reminiscent of a Tesla version of a Buc-ee’s, a southern staple convenience store that offers much more than a traditional gas station. Of course, Tesla’s version is futuristic and more catered to the company’s image, but the idea is the same.

It’s a one-stop shop for anything you’d need to recharge as a Tesla owner. Los Angeles building permits have not yet revealed the date for the restaurant’s initial operation, but Tesla may have its eye on a target date that will likely be announced during next week’s Earnings Call.

News

Tesla’s longer Model Y did not scale back requests for this vehicle type from fans

Tesla fans are happy with the new Model Y, but they’re still vocal about the need for something else.

Tesla launched a slightly longer version of the Model Y all-electric crossover in China, and with it being extremely likely that the vehicle will make its way to other markets, including the United States, fans are still looking for something more.

The new Model Y L in China boasts a slightly larger wheelbase than its original version, giving slightly more interior room with a sixth seat, thanks to a third row.

Tesla exec hints at useful and potentially killer Model Y L feature

Tesla has said throughout the past year that it would focus on developing its affordable, compact models, which were set to begin production in the first half of the year. The company has not indicated whether it met that timeline or not, but many are hoping to see unveilings of those designs potentially during the Q3 earnings call.

However, the modifications to the Model Y, which have not yet been officially announced for any markets outside of China, still don’t seem to be what owners and fans are looking forward to. Instead, they are hoping for something larger.

A few months ago, I reported on the overall consensus within the Tesla community that the company needs a full-size SUV, minivan, or even a cargo van that would be ideal for camping or business use.

Tesla is missing one type of vehicle in its lineup and fans want it fast

That mentality still seems very present amongst fans and owners, who state that a full-size SUV with enough seating for a larger family, more capability in terms of cargo space for camping or business operation, and something to compete with gas cars like the Chevrolet Tahoe, Ford Expedition, or electric ones like the Volkswagen ID.BUZZ.

We asked the question on X, and Tesla fans were nearly unanimously in support of a larger SUV or minivan-type vehicle for the company’s lineup:

🚨 More and more people are *still* saying that, despite this new, longer Model Y, Tesla still needs a true three-row SUV

Do you agree? https://t.co/QmbRDcCE08 pic.twitter.com/p6m5zB4sDZ

— TESLARATI (@Teslarati) July 16, 2025

Here’s what some of the respondents said:

100% agree, we need a larger vehicle.

Our model Y is quickly getting too small for our family of 5 as the kids grow. A slightly longer Y with an extra seat is nice but it’s not enough if you’re looking to take it on road trips/vacations/ kids sports gear etc.

Unfortunately we…

— Anthony Hunter (@_LiarsDice_) July 17, 2025

Had to buy a Kia Carnival Hybrid because Tesla doesn’t have a true 3 row vehicle with proper space and respectable range. pic.twitter.com/pzwFyHU8Gi

— Neil, like the astronaut (@Neileeyo) July 17, 2025

Agreed! I’m not sure who created this but I liked it enough to save it. pic.twitter.com/Sof5nMehjS

— 🦉Wise Words of Wisdom – Inspirational Quotes (IQ) (@WiseWordsIQ) July 16, 2025

Tesla is certainly aware that many of its owners would like the company to develop something larger that competes with the large SUVs on the market.

However, it has not stated that anything like that is in the current plans for future vehicles, as it has made a concerted effort to develop Robotaxi alongside the affordable, compact models that it claims are in development.

It has already unveiled the Robovan, a people-mover that can seat up to 20 passengers in a lounge-like interior.

The Robovan will be completely driverless, so it’s unlikely we will see it before the release of a fully autonomous Full Self-Driving suite from Tesla.

Energy

Tesla launches first Virtual Power Plant in UK – get paid to use solar

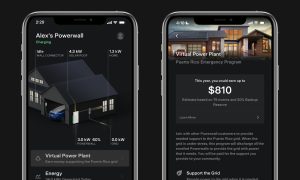

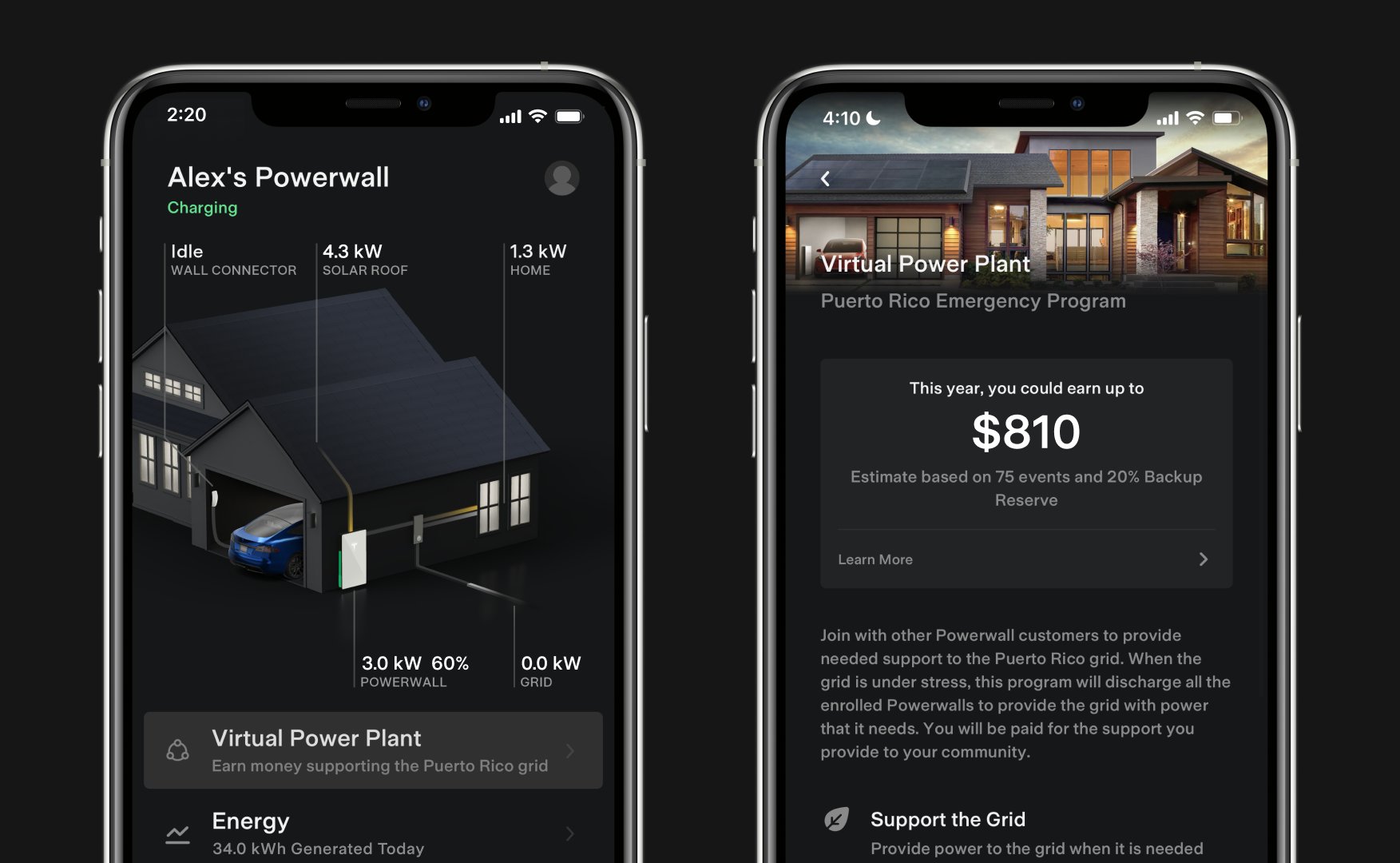

Tesla has launched its first-ever Virtual Power Plant program in the United Kingdom.

Tesla has launched its first-ever Virtual Power Plant program in the United Kingdom. This feature enables users of solar panels and energy storage systems to sell their excess energy back to the grid.

Tesla is utilizing Octopus Energy, a British renewable energy company that operates in multiple markets, including the UK, France, Germany, Italy, Spain, Australia, Japan, New Zealand, and the United States, as the provider for the VPP launch in the region.

The company states that those who enroll in the program can earn up to £300 per month.

Tesla has operated several VPP programs worldwide, most notably in California, Texas, Connecticut, and the U.S. territory of Puerto Rico. This is not the first time Tesla has operated a VPP outside the United States, as there are programs in Australia, Japan, and New Zealand.

This is its first in the UK:

Our first VPP in the UK

You can get paid to share your energy – store excess energy in your Powerwall & sell it back to the grid

You’re making £££ and the community is powered by clean energy

Win-win pic.twitter.com/evhMtJpgy1

— Tesla UK (@tesla_uk) July 17, 2025

Tesla is not the only company that is working with Octopus Energy in the UK for the VPP, as it joins SolarEdge, GivEnergy, and Enphase as other companies that utilize the Octopus platform for their project operations.

It has been six years since Tesla launched its first VPP, as it started its first in Australia back in 2019. In 2024, Tesla paid out over $10 million to those participating in the program.

Participating in the VPP program that Tesla offers not only provides enrolled individuals with the opportunity to earn money, but it also contributes to grid stabilization by supporting local energy grids.

-

Elon Musk1 day ago

Elon Musk1 day agoWaymo responds to Tesla’s Robotaxi expansion in Austin with bold statement

-

News1 day ago

News1 day agoTesla exec hints at useful and potentially killer Model Y L feature

-

Elon Musk2 days ago

Elon Musk2 days agoElon Musk reveals SpaceX’s target for Starship’s 10th launch

-

Elon Musk3 days ago

Elon Musk3 days agoTesla ups Robotaxi fare price to another comical figure with service area expansion

-

News1 day ago

News1 day agoTesla’s longer Model Y did not scale back requests for this vehicle type from fans

-

News1 day ago

News1 day ago“Worthy of respect:” Six-seat Model Y L acknowledged by Tesla China’s biggest rivals

-

News2 days ago

News2 days agoFirst glimpse of Tesla Model Y with six seats and extended wheelbase

-

Elon Musk2 days ago

Elon Musk2 days agoElon Musk confirms Tesla is already rolling out a new feature for in-car Grok