Elon Musk

Tesla’s Elon Musk confirms he’ll stay CEO for at least five more years

Tesla CEO Elon Musk eased any speculation about his role with the company as he confirmed he would be with the automaker for at least five more years.

Tesla’s Elon Musk said that he will still be CEO of the automaker in five years’ time, dispelling any potential skepticism regarding his commitment or plans with the company.

In the past, there was some speculation that Musk would leave Tesla if he was not adequately compensated for his work. He had a massive pay package taken from him by Delaware Judge Kathaleen McCormick in a move that caused Tesla to reincorporate its company in Texas.

Tesla Chair of the Board letter urges stockholders to approve Texas reincorporation

However, Musk confirmed today with a simple “Yes” that he would still be Tesla’s frontman in five years during an interview with Bloomberg at the Qatar Economic Forum:

“Do you see yourself and are you committed to still being the chief executive of Tesla in five years’ time?”

“Yes.”

Musk has had the massive $56 billion pay package declined twice by Chancellor McCormick, who has ruled that the pay was an “unfathomable sum.” Shareholders have voted twice in overwhelming fashion to award Musk with the pay package, but she has overruled it twice. This seemed to be one reason Musk might minimize his role or even step away from Tesla.

He said (via Bloomberg):

“The compensation should match that something incredible was done. But I’m confident that whatever some activist posing as a judge in Delaware happens to do will not affect the future compensation.”

Musk’s commitment to Tesla for the next five years will help steer the company in a more stable direction as it begins to expand its market well past automotive and sustainable energy. Although Tesla has been labeled as an AI company, it is also starting to push more into the robotics industry with the future release of the Optimus robot.

Now that Musk is on board for at least five more years, Tesla investors have their frontman, who has remained firm on the company’s vision to be a true disruptor in all things tech. The company’s stock is trading up just over 1 percent at the time of publication.

Elon Musk

Elon Musk fires back after Wikipedia co-founder claims neutrality and dubs Grokipedia “ridiculous”

Musk’s response to Wales’ comments, which were posted on social media platform X, was short and direct: “Famous last words.”

Elon Musk fired back at Wikipedia co-founder Jimmy Wales after the longtime online encyclopedia leader dismissed xAI’s new AI-powered alternative, Grokipedia, as a “ridiculous” idea that is bound to fail.

Musk’s response to Wales’ comments, which were posted on social media platform X, was short and direct: “Famous last words.”

Wales made the comments while answering questions about Wikipedia’s neutrality. According to Wales, Wikipedia prides itself on neutrality.

“One of our core values at Wikipedia is neutrality. A neutral point of view is non-negotiable. It’s in the community, unquestioned… The idea that we’ve become somehow ‘Wokepidea’ is just not true,” Wales said.

When asked about potential competition from Grokipedia, Wales downplayed the situation. “There is no competition. I don’t know if anyone uses Grokipedia. I think it is a ridiculous idea that will never work,” Wales wrote.

After Grokipedia went live, Larry Sanger, also a co-founder of Wikipedia, wrote on X that his initial impression of the AI-powered Wikipedia alternative was “very OK.”

“My initial impression, looking at my own article and poking around here and there, is that Grokipedia is very OK. The jury’s still out as to whether it’s actually better than Wikipedia. But at this point I would have to say ‘maybe!’” Sanger stated.

Musk responded to Sanger’s assessment by saying it was “accurate.” In a separate post, he added that even in its V0.1 form, Grokipedia was already better than Wikipedia.

During a past appearance on the Tucker Carlson Show, Sanger argued that Wikipedia has drifted from its original vision, citing concerns about how its “Reliable sources/Perennial sources” framework categorizes publications by perceived credibility. As per Sanger, Wikipedia’s “Reliable sources/Perennial sources” list leans heavily left, with conservative publications getting effectively blacklisted in favor of their more liberal counterparts.

As of writing, Grokipedia has reportedly surpassed 80% of English Wikipedia’s article count.

Elon Musk

Music City Loop could highlight The Boring Company’s real disruption

The real story behind the tunneling startup’s Nashville tunnel project is the company’s targeted $25 million per mile construction cost.

Recent commentary on social media has highlighted what could very well prove to be The Boring Company’s real disruption.

The analysis was shared by tech watcher Aakash Gupta on social media platform X, where he argued that the real story behind the tunneling startup’s Nashville tunnel project is the company’s targeted $25 million per mile construction cost.

According to Gupta’s breakdown, Nashville’s 2018 light rail proposal was priced at roughly $200 million per mile. New York’s East Side Access project reportedly cost about $3.5 billion per mile, while Los Angeles Metro expansion projects have approached $1 billion per mile.

By comparison, The Boring Company has stated it can construct 13 miles of twin tunnels in the Music City Loop for between $240 million and $300 million total. That implies a cost near $25 million per mile, or roughly a 95% reduction from industry averages cited in the post.

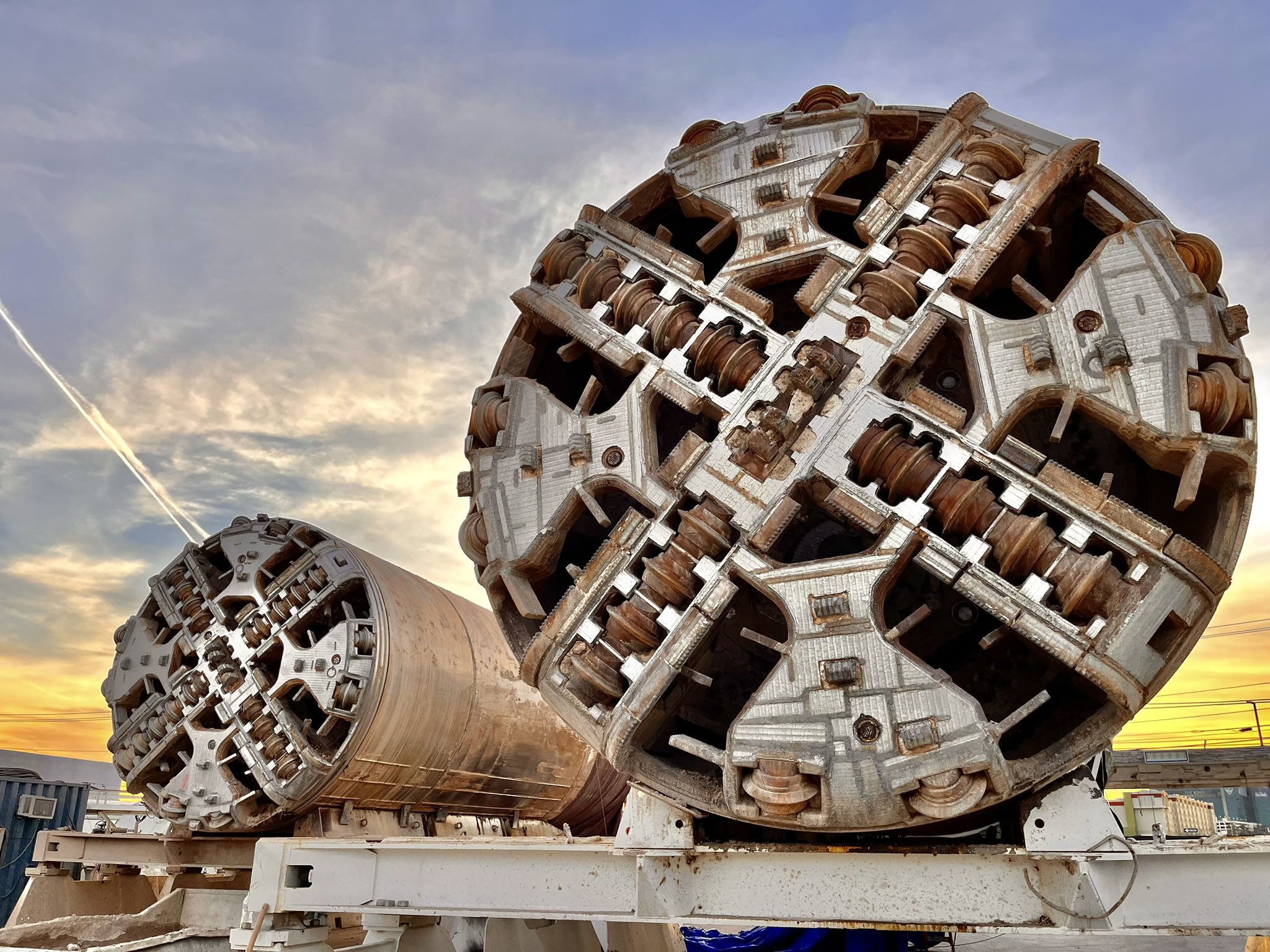

Several technical departures from conventional tunneling allow the Boring Company to lower its costs, from its smaller 12-foot diameter tunnels to its fully electric Prufrock machines that are designed to mine continuously with no personnel inside the tunnel and their capability to “porpoise” for easy launch and retrieval.

Tesla and Space CEO Elon Musk responded to the post on X, stating simply that “Tunnels are so underrated.”

The Boring Company has seen some momentum as of late, with the company recently signing a construction contract in Dubai and the Universal Orlando Loop progressing. Recent reports have also pointed to tunnels potentially being constructed to solve traffic congestion issues near the Giga Nevada area.

While The Boring Company’s tunnels have so far been used for Loop systems publicly for now, Elon Musk recently noted that the tunneling startup’s underground passages would not be limited only to ride-hailing vehicles.

In a reply to a post on X which discussed the specifications of the Music City Loop, Musk clarified that “any fully autonomous electric cars can use the tunnels.” This suggests that vehicles potentially running systems like FSD Supervised, even if they are not Teslas, could be used in systems like the Music City Loop in the future.

Elon Musk

SpaceX IPO could push Elon Musk’s net worth past $1 trillion: Polymarket

The estimates were shared by the official Polymarket Money account on social media platform X.

Recent projections have outlined how a potential $1.75 trillion SpaceX IPO could generate historic returns for early investors. The projections suggest the offering would not only become the largest IPO in history but could also result in unprecedented windfalls for some of the company’s key investors.

The estimates were shared by the official Polymarket Money account on social media platform X.

As noted in a Polymarket Money analysis, Elon Musk invested $100 million into SpaceX in 2002 and currently owns approximately 42% of the company. At a $1.75 trillion valuation following SpaceX’s potential $1.75 trillion IPO, that stake would be worth roughly $735 billion.

Such a figure would dramatically expand Musk’s net worth. When combined with his holdings in Tesla Inc. and other ventures, a public debut at that level could position him as the world’s first trillionaire, depending on market conditions at the time of listing.

The Bloomberg Billionaires Index currently lists Elon Musk with a net worth of $666 billion, though a notable portion of this is tied to his TSLA stock. Tesla currently holds a market cap of $1.51 trillion, and Elon Musk’s currently holds about 13% to 15% of the company’s outstanding common stock.

Founders Fund, co-founded by Peter Thiel, invested $20 million in SpaceX in 2008. Polymarket Money estimates the firm owns between 1.5% and 3% of the private space company. At a $1.75 trillion valuation, that range would translate to approximately $26.25 billion to $52.5 billion in value.

That return would represent one of the most significant venture capital outcomes in modern Silicon Valley history, with a growth of 131,150% to 262,400%.

Alphabet Inc., Google’s parent company, invested $900 million into SpaceX in 2015 and is estimated to hold between 6% and 7% of the private space firm. At the projected IPO valuation, that stake could be worth between $105 billion and $122.5 billion. That’s a growth of 11,566% to 14,455%.

Other major backers highlighted in the post include Fidelity Investments, Baillie Gifford, Valor Equity Partners, Bank of America, and Andreessen Horowitz, each potentially sitting on multibillion-dollar gains.