Energy

Tesla is currently ‘aggressively ramping’ energy business, says CTO JB Straubel

Amid rising competition in the residential solar market from rivals such as SunRun, Tesla CTO JB Straubel stated that Tesla is ramping up its efforts to bolster its energy business. According to Straubel, the reception of the public to products like the Powerwall 2 and Solar Roof tiles has been similar to the Model 3. Thus, Tesla is now doing what it can to increase its capacity to produce its energy products as fast as it can.

Straubel’s update to Tesla’s energy business came as a statement to USA Today, which recently published an article about the residential solar market in the United States. While the Tesla CTO did not provide the actual figures of its Powerwall 2 and Solar Roof reservations, Straubel did state that for now, Tesla is unable to keep up with deposits being put down for the products. Straubel also emphasized that Tesla is not in any way stepping back from the residential energy business.

“No one should see us as stepping back from solar. In fact, it’s the opposite. It’s like with Model 3. People have come flooding in and are waiting on the product. So now we’re aggressively ramping our capacity,” he said.

To address the demand for its residential products, Straubel stated that production of the Powerwall 2 is set to pick up later this year, while output for Solar Roof tiles is expected to accelerate in 2019. The Tesla CTO expects these initiatives to reduce the wait times for these energy products.

The Tesla CTO’s latest statement comes as an encouraging update to the company’s residential energy business, much of which has been under the news radar for most of the year. The first consumer installations of the Solar Roof began earlier this year, and reports emerged that Gigafactory 2 in Buffalo, NY is ramping up hiring, but apart from these, Tesla’s energy initiatives appear to be focused on large-scale industrial projects, such as its upcoming Powerpack farm in Victoria, and its virtual power plant in South Australia.

Tesla’s residential energy business in the United States took a blow last month, as well, with the company closing a dozen of its solar facilities across nine states in the country as part of its restructuring. Apart from this, Tesla also announced that it would not renew its partnership with Home Depot to sell its solar solutions and Powerwall 2 home battery storage units.

Regardless of these, the progress of Tesla’s industrial energy projects is indicative of the potential of its residential initiatives. Over the past year, after all, Tesla had all but proved that its battery technology is a feasible alternative to conventional power solutions. The warm reception to its big battery in South Australia, which continues to support the region’s embattled energy grid, is a testament to this.

Considering the competition from its local competitors, Tesla would have to increase its push for its residential energy business in the United States. Solar analyst for GTM Research Allison Mond, for one, stated that Tesla could see its market share shrink in the coming quarters due to competitors and the company’s lack of focus on its solar products. Nevertheless, Straubel stated that market share is not really Tesla’s focus for its residential energy business.

“We’re focused intently on the customer experience, not on having a higher market share. We’re looking at the bigger picture,” he said.

During Tesla’s 2018 Annual Shareholder Meeting, Tesla CEO Elon Musk mentioned that the company is getting closer to a battery breakthrough. Addressing shareholders, Musk stated that Tesla is on pace to hit a battery cell cost of $100 per kWh by the end of 2018 depending on the stability of current commodity prices. Considering Straubel’s mention of a ramp in Powerwall 2 production later this year, it seems like Tesla’s push into residential solar could happen just as the company hits a breakthrough in its battery technology.

Energy

Tesla Megapack Megafactory in Texas advances with major property sale

Stream Realty Partners announced the sale of Buildings 9 and 10 at the Empire West industrial park, which total 1,655,523 square feet.

Tesla’s planned Megapack factory in Brookshire, Texas has taken a significant step forward, as two massive industrial buildings fully leased to the company were sold to an institutional investor.

In a press release, Stream Realty Partners announced the sale of Buildings 9 and 10 at the Empire West industrial park, which total 1,655,523 square feet. The properties are 100% leased to Tesla under a long-term agreement and were acquired by BGO on behalf of an institutional investor.

The two facilities, located at 100 Empire Boulevard in Brookshire, Texas, will serve as Tesla’s new Megafactory dedicated to manufacturing Megapack battery systems.

According to local filings previously reported, Tesla plans to invest nearly $200 million into the site. The investment includes approximately $44 million in facility upgrades such as electrical, utility, and HVAC improvements, along with roughly $150 million in manufacturing equipment.

Building 9, spanning roughly 1 million square feet, will function as the primary manufacturing floor where Megapacks are assembled. Building 10, covering approximately 600,000 square feet, will be dedicated to warehousing and logistics operations, supporting storage and distribution of completed battery systems.

Waller County Commissioners have approved a 10-year tax abatement agreement with Tesla, offering up to a 60% property-tax reduction if the company meets hiring and investment targets. Tesla has committed to employing at least 375 people by the end of 2026, increasing to 1,500 by the end of 2028, as noted in an Austin County News Online report.

The Brookshire Megafactory will complement Tesla’s Lathrop Megafactory in California and expand U.S. production capacity for the utility-scale energy storage unit. Megapacks are designed to support grid stabilization and renewable-energy integration, a segment that has become one of Tesla’s fastest-growing businesses.

Energy

Tesla meets Giga New York’s Buffalo job target amid political pressures

Giga New York reported more than 3,460 statewide jobs at the end of 2025, meeting the benchmark tied to its dollar-a-year lease.

Tesla has surpassed its job commitments at Giga New York in Buffalo, easing pressure from lawmakers who threatened the company with fines, subsidy clawbacks, and dealership license revocations last year.

The company reported more than 3,460 statewide jobs at the end of 2025, meeting the benchmark tied to its dollar-a-year lease at the state-built facility.

As per an employment report reviewed by local media, Tesla employed 2,399 full-time workers at Gigafactory New York and 1,060 additional employees across the state at the end of 2025. Part-time roles pushed the total headcount of Tesla’s New York staff above the 3,460-job target.

The gains stemmed in part from a new Long Island service center, a Buffalo warehouse, and additional showrooms in White Plains and Staten Island. Tesla also said it has invested $350 million in supercomputing infrastructure at the site and has begun manufacturing solar panels.

Empire State Development CEO Hope Knight said the agency was “very happy” with Giga New York’s progress, as noted in a WXXI report. The current lease runs through 2029, and negotiations over updated terms have included potential adjustments to job requirements and future rent payments.

Some lawmakers remain skeptical, however. Assemblymember Pat Burke questioned whether the reported job figures have been fully verified. State Sen. Patricia Fahy has also continued to sponsor legislation that would revoke Tesla’s company-owned dealership licenses in New York. John Kaehny of Reinvent Albany has argued that the project has not delivered the manufacturing impact originally promised as well.

Knight, for her part, maintained that Empire State Development has been making the best of a difficult situation.

“(Empire State Development) has tried to make the best of a very difficult situation. There hasn’t been another use that has come forward that would replace this one, and so to the extent that we’re in this place, the fact that 2,000 families at (Giga New York) are being supported through the activity of this employer. It’s the best that we can have happen,” the CEO noted.

Energy

Tesla launches Cybertruck vehicle-to-grid program in Texas

The initiative was announced by the official Tesla Energy account on social media platform X.

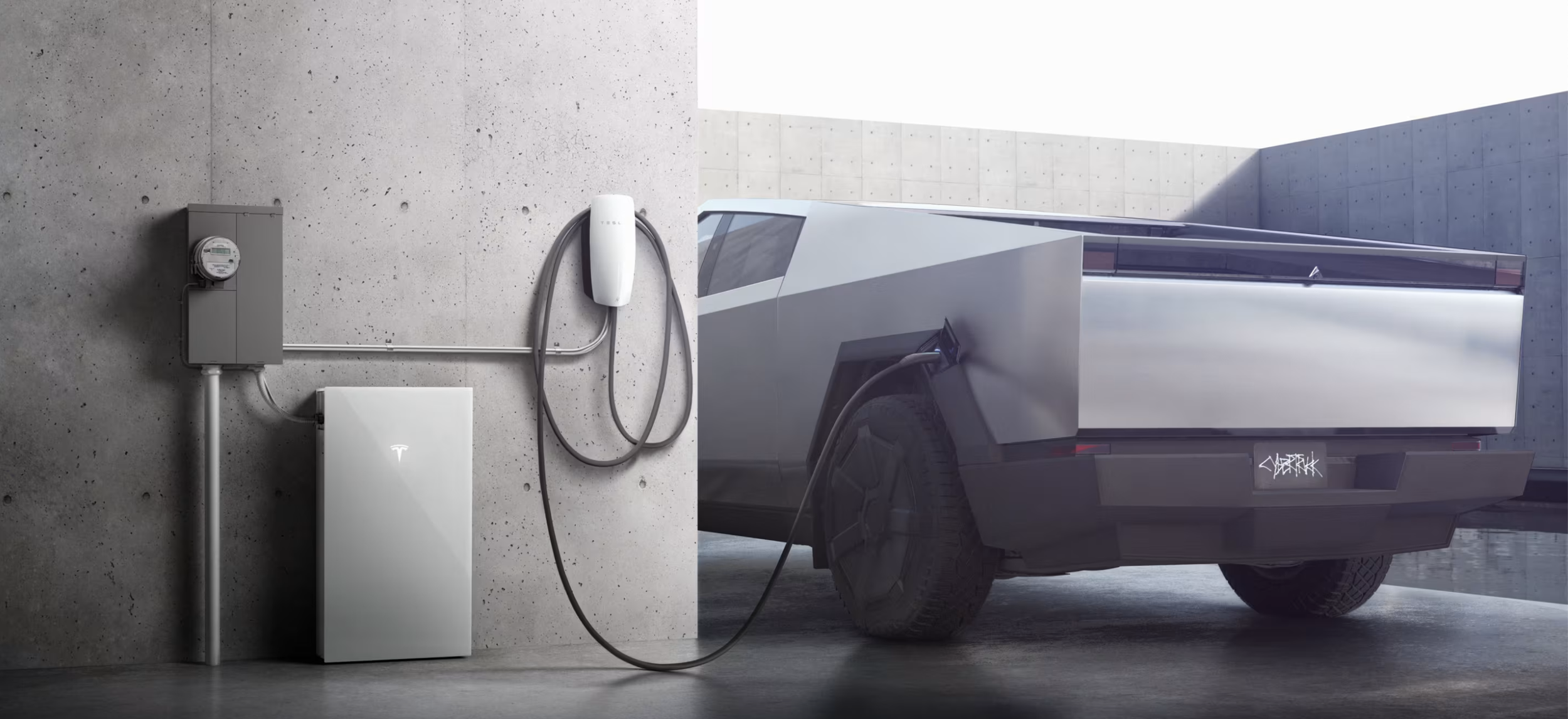

Tesla has launched a vehicle-to-grid (V2G) program in Texas, allowing eligible Cybertruck owners to send energy back to the grid during high-demand events and receive compensation on their utility bills.

The initiative, dubbed Powershare Grid Support, was announced by the official Tesla Energy account on social media platform X.

Texas’ Cybertruck V2G program

In its post on X, Tesla Energy confirmed that vehicle-to-grid functionality is “coming soon,” starting with select Texas markets. Under the new Powershare Grid Support program, owners of the Cybertruck equipped with Powershare home backup hardware can opt in through the Tesla app and participate in short-notice grid stress events.

During these events, the Cybertruck automatically discharges excess energy back to the grid, supporting local utilities such as CenterPoint Energy and Oncor. In return, participants receive compensation in the form of bill credits. Tesla noted that the program is currently invitation-only as part of an early adopter rollout.

The launch builds on the Cybertruck’s existing Powershare capability, which allows the vehicle to provide up to 11.5 kW of power for home backup. Tesla added that the program is expected to expand to California next, with eligibility tied to utilities such as PG&E, SCE, and SDG&E.

Powershare Grid Support

To participate in Texas, Cybertruck owners must live in areas served by CenterPoint Energy or Oncor, have Powershare equipment installed, enroll in the Tesla Electric Drive plan, and opt in through the Tesla app. Once enrolled, vehicles would be able to contribute power during high-demand events, helping stabilize the grid.

Tesla noted that events may occur with little notice, so participants are encouraged to keep their Cybertrucks plugged in when at home and to manage their discharge limits based on personal needs. Compensation varies depending on the electricity plan, similar to how Powerwall owners in some regions have earned substantial credits by participating in Virtual Power Plant (VPP) programs.