Investor's Corner

Tesla’s Impact Report gets nod of respect from corporate sustainability firm

Earlier this week, Tesla released its first Impact Report, outlining the effects of its operations on the environment and its respective communities. While around 80% of companies in the S&P 500 release similar reports to promote their corporate sustainability records, Tesla’s first effort was nonetheless enough to earn a nod of approval from a noted financial firm.

Trillium Asset Management, a firm that tracks corporate sustainability, stated that Tesla’s Impact Report went beyond superficial metrics. Allan Pearce, a shareholder advocate at Trillium, took particular notice of the company’s inclusion of its full greenhouse gas footprint, a metric that is rarely covered in first-time reports. “With any first report there’s always going to be room for improvement, though this is kind of a step above most first sustainability reports we see,” Pearce said.

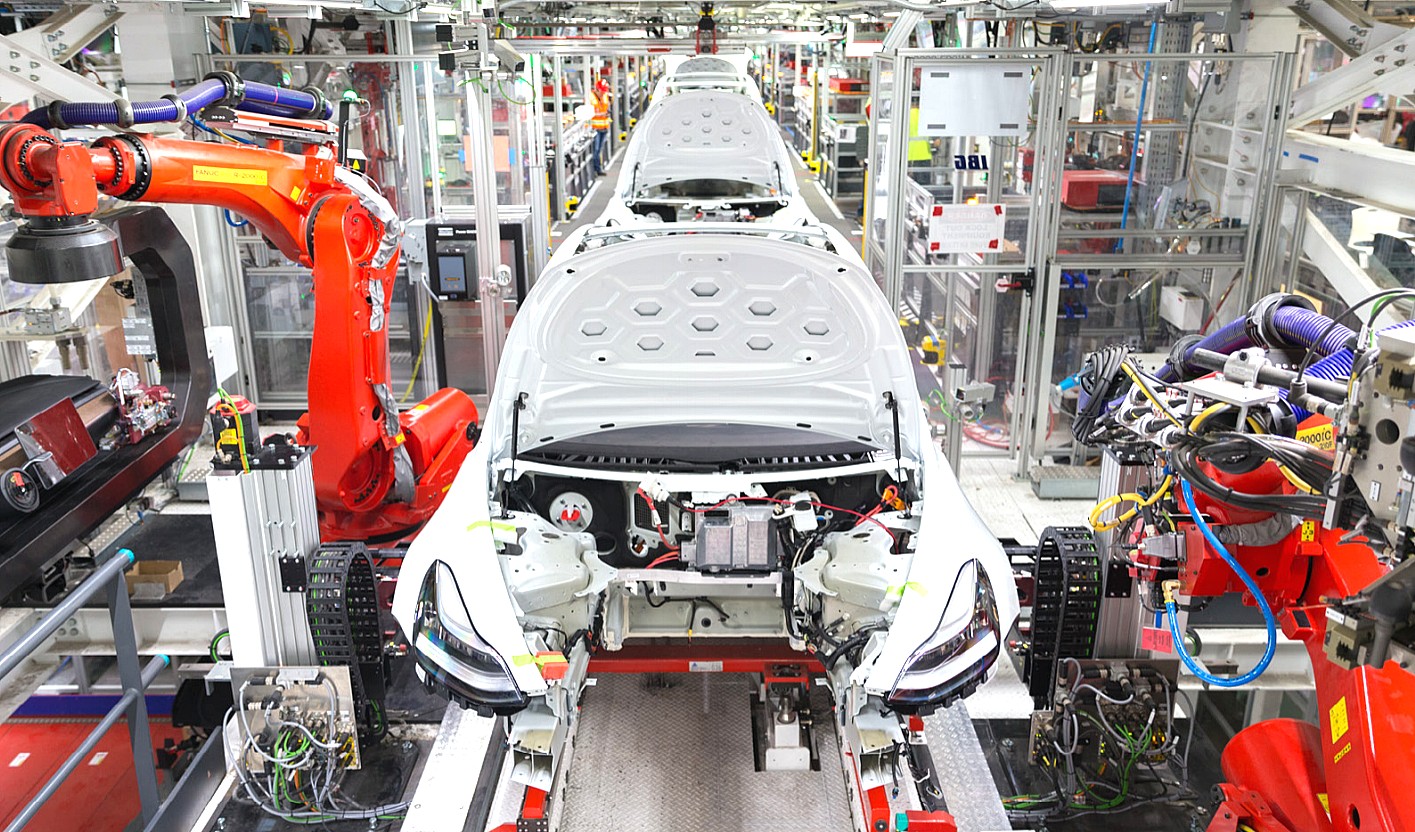

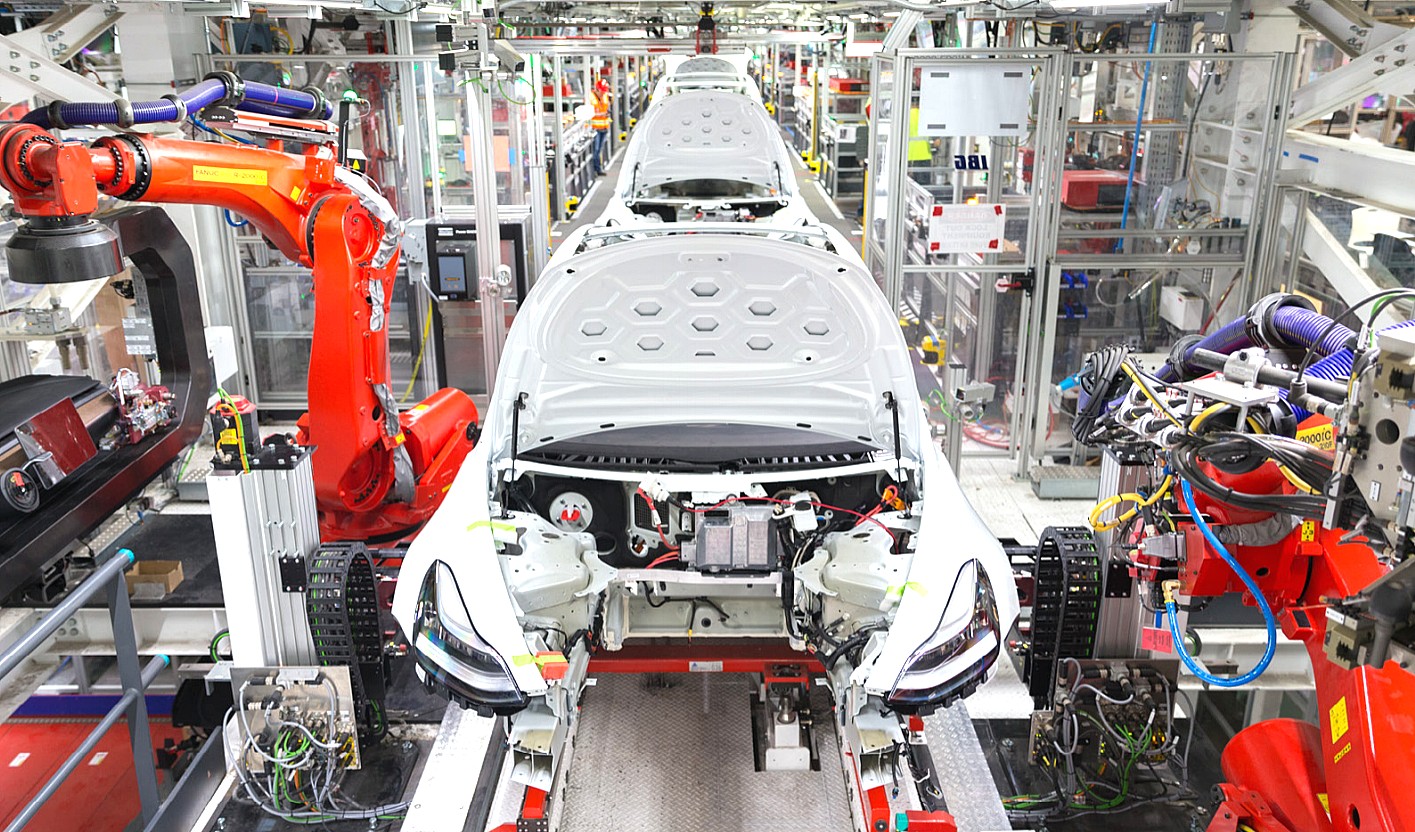

Trillium currently oversees around $2.5 billion for socially-conscious investors. The financial firm had actually been calling for Tesla to release an environmental impact report since 2017, which was around the same time when reports and allegations emerged about high injury rates in the Fremont factory. Trillium submitted a shareholder proposal requesting for an impact report as recent as last December. Upon Tesla’s publication of the report, the firm promptly withdrew its shareholder proposal.

This is not to say that Tesla’s environmental impact report is already perfect in its current state. Pearce noted that the electric car maker still has a lot of areas for improvement, such as a more in-depth analysis depicting how much greener Tesla’s electric cars are compared to vehicles equipped with an internal combustion engine. The shareholder advocate added that more discussions on Tesla’s concrete goals for the future would be appreciated by investors as well.

The results of Tesla’s first impact report revealed an encouraging picture of a young company that is working hard to achieve the very ambitious goal of accelerating the world’s transition to sustainable energy. The report covered several important points, including the amount of C02 saved by the company’s fleet of all-electric cars. With around 550,000 vehicles on the road since the days of the original Tesla Roadster, the company noted that its zero-emissions fleet has driven over 10 billion miles to date, helping prevent more than 4 million tons of C02 from polluting the environment,

Tesla also revealed that its Energy business, which is comprised of products like solar panels, the Solar Roof, the Powerwall 2, and the Powerpack, have generated a total of 13.25 TWh worth energy to date. This figure is far above the energy consumption of the company’s fleet of Model S, Model 3, and Model X, which have consumed a total of 5.26 TWh worth of energy to date.

Within its discussions on the recently released Impact Report, Tesla also revealed that it is working on its own unique battery recycling system that is estimated to result in significant savings in the future. “At Gigafactory 1, Tesla is developing a unique battery recycling system that will process both battery manufacturing scrap and end-of-life batteries. Through this system, the recovery of critical minerals such as lithium and cobalt will be maximized along with the recovery of all metals used in the battery cell, such as copper, aluminum and steel. All of these materials will be recovered in forms optimized for new battery material production,” Tesla wrote.

Investor's Corner

Tesla could save $2.5B by replacing 10% of staff with Optimus: Morgan Stanley

Jonas assigned each robot a net present value (NPV) of $200,000.

Tesla’s (NASDAQ:TSLA) near-term outlook may be clouded by political controversies and regulatory headwinds, but Morgan Stanley analyst Adam Jonas sees a glimmer of opportunity for the electric vehicle maker.

In a new note, the Morgan Stanley analyst estimated that Tesla could save $2.5 billion by replacing just 10% of its workforce with its Optimus robots, assigning each robot a net present value (NPV) of $200,000.

Morgan Stanley highlights Optimus’ savings potential

Jonas highlighted the potential savings on Tesla’s workforce of 125,665 employees in his note, suggesting that the utilization of Optimus robots could significantly reduce labor costs. The analyst’s note arrived shortly after Tesla reported Q2 2025 deliveries of 384,122 vehicles, which came close to Morgan Stanley’s estimate and slightly under the consensus of 385,086.

“Tesla has 125,665 employees worldwide (year-end 2024). On our calculations, a 10% substitution to humanoid at approximately ($200k NPV/humanoid) could be worth approximately $2.5bn,” Jonas wrote, as noted by Street Insider.

Jonas also issued some caution on Tesla Energy, whose battery storage deployments were flat year over year at 9.6 GWh. Morgan Stanley had expected Tesla Energy to post battery storage deployments of 14 GWh in the second quarter.

Musk’s political ambitions

The backdrop to Jonas’ note included Elon Musk’s involvement in U.S. politics. The Tesla CEO recently floated the idea of launching a new political party, following a poll on X that showed support for the idea. Though a widely circulated FEC filing was labeled false by Musk, the CEO does seem intent on establishing a third political party in the United States.

Jonas cautioned that Musk’s political efforts could divert attention and resources from Tesla’s core operations, adding near-term pressure on TSLA stock. “We believe investors should be prepared for further devotion of resources (financial, time/attention) in the direction of Mr. Musk’s political priorities which may add further near-term pressure to TSLA shares,” Jonas stated.

Investor's Corner

Two Tesla bulls share differing insights on Elon Musk, the Board, and politics

Two noted Tesla bulls have shared differing views on the recent activities of CEO Elon Musk and the company’s leadership.

Two noted Tesla (NASDAQ:TSLA) bulls have shared differing views on the recent activities of CEO Elon Musk and the company’s leadership.

While Wedbush analyst Dan Ives called on Tesla’s board to take concrete steps to ensure Musk remains focused on the EV maker, longtime Tesla supporter Cathie Wood of Ark Invest reaffirmed her confidence in the CEO and the company’s leadership.

Ives warns of distraction risk amid crucial growth phase

In a recent note, Ives stated that Tesla is at a critical point in its history, as the company is transitioning from an EV maker towards an entity that is more focused on autonomous driving and robotics. He then noted that the Board of Directors should “act now” and establish formal boundaries around Musk’s political activities, which could be a headwind on TSLA stock.

Ives laid out a three-point plan that he believes could ensure that the electric vehicle maker is led with proper leadership until the end of the decade. First off, the analyst noted that a new “incentive-driven pay package for Musk as CEO that increases his ownership of Tesla up to ~25% voting power” is necessary. He also stated that the Board should establish clear guidelines for how much time Musk must devote to Tesla operations in order to receive his compensation, and a dedicated oversight committee must be formed to monitor the CEO’s political activities.

Ives, however, highlighted that Tesla should move forward with Musk at its helm. “We urge the Board to act now and move the Tesla story forward with Musk as CEO,” he wrote, reiterating its Outperform rating on Tesla stock and $500 per share price target.

Tesla CEO Elon Musk has responded to Ives’ suggestions with a brief comment on X. “Shut up, Dan,” Musk wrote.

Cathie Wood reiterates trust in Musk and Tesla board

Meanwhile, Ark Investment Management founder Cathie Wood expressed little concern over Musk’s latest controversies. In an interview with Bloomberg Television, Wood said, “We do trust the board and the board’s instincts here and we stay out of politics.” She also noted that Ark has navigated Musk-related headlines since it first invested in Tesla.

Wood also pointed to Musk’s recent move to oversee Tesla’s sales operations in the U.S. and Europe as evidence of his renewed focus in the electric vehicle maker. “When he puts his mind on something, he usually gets the job done,” she said. “So I think he’s much less distracted now than he was, let’s say, in the White House 24/7,” she said.

TSLA stock is down roughly 25% year-to-date but has gained about 19% over the past 12 months, as noted in a StocksTwits report.

Investor's Corner

Cantor Fitzgerald maintains Tesla (TSLA) ‘Overweight’ rating amid Q2 2025 deliveries

Cantor Fitzgerald is holding firm on its bullish stance for the electric vehicle maker.

Cantor Fitzgerald is holding firm on its bullish stance for Tesla (NASDAQ: TSLA), reiterating its “Overweight” rating and $355 price target amidst the company’s release of its Q2 2025 vehicle delivery and production report.

Tesla delivered 384,122 vehicles in Q2 2025, falling below last year’s Q2 figure of 443,956 units. Despite softer demand in some countries in Europe and ongoing controversies surrounding CEO Elon Musk, the firm maintained its view that Tesla is a long-term growth story in the EV sector.

Tesla’s Q2 results

Among the 384,122 vehicles that Tesla delivered in the second quarter, 373,728 were Model 3 and Model Y. The remaining 10,394 units were attributed to the Model S, Model X, and Cybertruck. Production was largely flat year-over-year at 410,244 units.

In the energy division, Tesla deployed 9.6 GWh of energy storage in Q2, which was above last year’s 9.4 GWh. Overall, Tesla continues to hold a strong position with $95.7 billion in trailing twelve-month revenue and a 17.7% gross margin, as noted in a report from Investing.com.

Tesla’s stock is still volatile

Tesla’s market cap fell to $941 billion on Monday amid volatility that was likely caused in no small part by CEO Elon Musk’s political posts on X over the weekend. Musk has announced that he is forming the America Party to serve as a third option for voters in the United States, a decision that has earned the ire of U.S. President Donald Trump.

Despite Musk’s controversial nature, some analysts remain bullish on TSLA stock. Apart from Cantor Fitzgerald, Canaccord Genuity also reiterated its “Buy” rating on Tesla shares, with the firm highlighting the company’s positive Q2 vehicle deliveries, which exceeded its expectations by 24,000 units. Cannacord also noted that Tesla remains strong in several markets despite its year-over-year decline in deliveries.

-

Elon Musk1 day ago

Elon Musk1 day agoWaymo responds to Tesla’s Robotaxi expansion in Austin with bold statement

-

News1 day ago

News1 day agoTesla exec hints at useful and potentially killer Model Y L feature

-

Elon Musk2 days ago

Elon Musk2 days agoElon Musk reveals SpaceX’s target for Starship’s 10th launch

-

Elon Musk3 days ago

Elon Musk3 days agoTesla ups Robotaxi fare price to another comical figure with service area expansion

-

News1 day ago

News1 day agoTesla’s longer Model Y did not scale back requests for this vehicle type from fans

-

News1 day ago

News1 day ago“Worthy of respect:” Six-seat Model Y L acknowledged by Tesla China’s biggest rivals

-

News2 days ago

News2 days agoFirst glimpse of Tesla Model Y with six seats and extended wheelbase

-

Elon Musk2 days ago

Elon Musk2 days agoElon Musk confirms Tesla is already rolling out a new feature for in-car Grok