News

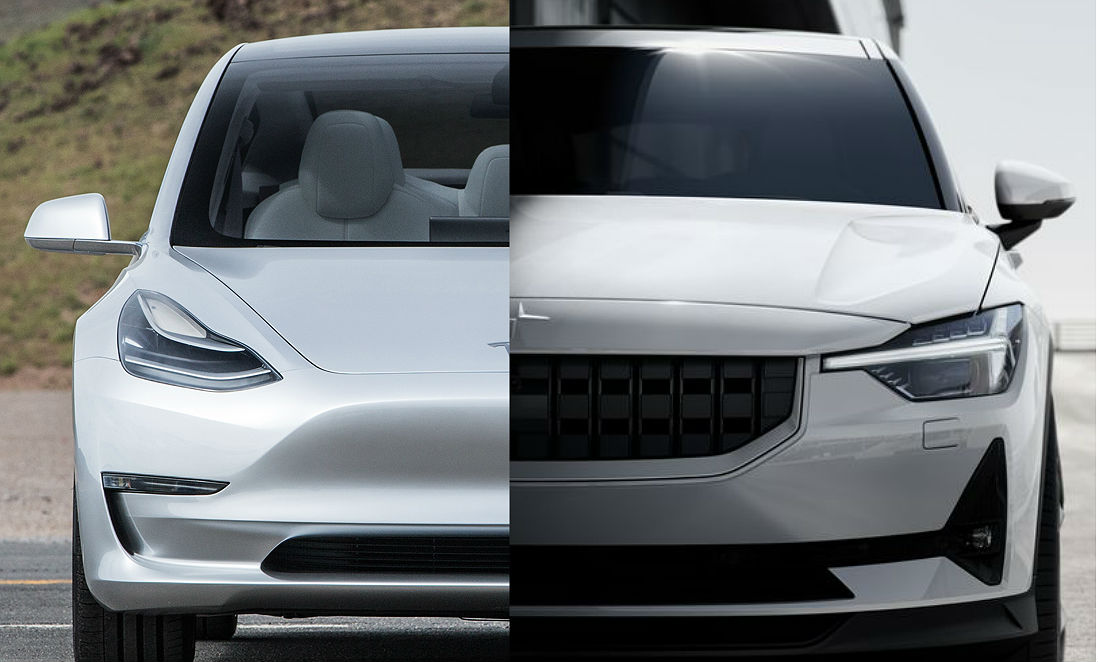

Tesla Model 3 vs Polestar 2: performance, features, batteries, and price

Volvo’s Polestar 2, which has been dubbed as a potential competitor to the best-selling Tesla Model 3, was recently unveiled. Here is a comparison of the vehicles in terms of their performance, features, batteries, and price.

Performance and Features

The Polestar 2 is equipped with dual motors that produce 408 hp, which allow the car to go from 0-60 mph in under 5 seconds. It is also an electric vehicle that features a deep integration with Google’s Android ecosystem, with its interior being dominated by an 11″ touchscreen that is loaded to the brim with familiar apps like Google Maps and Google Play Music. The Polestar 2 even has Google Assistant, which is arguably one of the most robust voice assistants in the market today, rivaling Apple’s Siri and Samsung’s Bixby.

The Model 3 features Tesla’s trademark performance and tech. The Model 3 Performance, which is in the same price category as the Polestar 2 Launch Edition (the first version of the car that will enter production), is equipped with dual motors that produce 450 hp, allowing the vehicle to sprint from 0-60 mph in 3.3 seconds. The Model 3 also features Tesla’s custom tech for its electric cars, which include features such as Autopilot. The vehicle also receives regular, free over-the-air software updates, which improve the vehicle and add features such as the recently-released Sentry Mode and Dog Mode.

Batteries and Range

The Polestar 2 is equipped with a sizable 78 kWh battery pack comprised of cells from LG Chem, which the company expects will give the fastback a range of 275 miles per charge. This figure is lower than the estimates of Polestar COO Jonathan Goodman last year, when he mentioned to Autocar at the 2018 Goodwood Festival of Speed that the Polestar 2 will have a range of around 350 miles per charge.

In comparison, the Long Range Tesla Model 3 is equipped with a ~75 kWh battery pack made of cells produced in Tesla’s Gigafactory 1 in Nevada. Despite having a smaller battery than the Polestar 2, the Long Range Model 3 features more range at 310 miles per charge. Tesla’s Mid Range Model 3, which is speculated to be equipped with a 62 kWh battery, features a range of 264 miles per charge.

Price

At a price between $45,000 for the base version and $68,000 for the fully-loaded top-tier variant, the Polestar 2 is a pretty solid option in the electric vehicle market. The Polestar 2 “Launch Edition,” which costs $63,000 and is expected to be produced first, is priced comparably with the Model 3 Performance, providing would-be electric car buyers who do not wish to purchase a Tesla a good alternative.

Tesla has been able to bring the price of the Model 3 down over the past few months. Currently, Tesla sells the vehicle’s most affordable variant, the Mid Range Model 3, for $42,900 before savings. The Long Range Dual Motor AWD Model 3 sells for $49,900 before savings, and the top-tier Model 3 Performance costs $60,900 before savings. Buyers who opt to purchase Enhanced Autopilot can order the driver-assist system for $5,000.

Conclusion

Ultimately, it should be noted that the Polestar 2 is something more than a competitor for the Model 3. It is a well-rounded vehicle produced by an experienced carmaker that is unashamedly electric; and thus, it is more of a threat to gasoline-powered cars than it is to other EVs on the market. With vehicles such as the Model 3 and the Polestar 2, it might be only a matter of time before the era of high-performance sedans such as the BMW M3 and the Mercedes-AMG C 63 S comes to an end.

Elon Musk

The Boring Company’s Vegas Loop moves 82k riders during CONEXPO

The Loop’s feat was highlighted by The Boring Company in a post on its official account on social media platform X.

The Boring Company said its Vegas Loop system transported roughly 82,000 passengers during the recent CONEXPO-CON/AGG construction trade show in Las Vegas. The event was held at the Las Vegas Convention Center (LVCC) from March 3-7, 2026.

The Loop’s feat was highlighted by The Boring Company in a post on its official account on social media platform X.

CONEXPO-CON/AGG 2026

CONEXPO-CON/AGG is one of the largest construction trade shows in North America. This year’s event was quite impressive, attracting more than 140,000 construction professionals from 128 countries across the world.

Considering the number of this year’s attendees, the LVCC Loop seemed to have proven itself to be a very useful transportation solution. A video posted by The Boring Company on its official X account featured attendees expressing their enthusiasm for the underground transport system, with some stating that they would like to see similar tunnels across Las Vegas.

The LVCC Loop is only part of the greater Vegas Loop network, which is actively under construction.

New Vegas Loop extensions

One of the newest additions is a station at the Fontainebleau Las Vegas resort on the Strip. The station is located on level V-1 of the resort’s south valet area, according to a report from the Las Vegas Review-Journal. From the Fontainebleau, passengers can travel free of charge to stations serving the Las Vegas Convention Center, as well as to Loop stations at Encore and Westgate.

The system is also expanding beyond the Strip corridor. In December, The Boring Company began offering Vegas Loop rides to and from Harry Reid International Airport. These trips include a limited above-ground segment after receiving approval from the Nevada Transportation Authority to allow surface street travel tied to Loop operations.

The Boring Company President Steve Davis previously told the Review-Journal that the University Center Loop segment, which is currently under construction, is expected to open in the first quarter of 2026. The extension would allow Loop vehicles to travel beneath Paradise Road between the convention center and the airport, with a planned station just north of Tropicana Avenue.

News

Tesla preps to build its most massive Supercharger yet: 400+ V4 stalls

The project will be an expansion of the current Eddie World Supercharger in Yermo, California, and will take place in several stages.

Tesla is preparing to build its most massive Supercharger yet, as it recently submitted plans for an over 400-stall Supercharging station in California, which would dwarf its massive 168-stall location in Lost Hills, California.

The project will be an expansion of the current Eddie World Supercharger in Yermo, California, and will take place in several stages.

The expansion, adjacent to the existing Eddie World Supercharger, which is currently comprised of 22 older V2 and V3 stalls limited to 150 kW, unfolds across six phases.

Construction on Phase 1 begins later this year with 72 V4 stalls. Subsequent stages will progressively add hundreds more, culminating in over 400 next-generation chargers. Site plans label expansive parking arrays across Phases 1–5 along Calico Boulevard, with Phase 6 design still to be determined.

Tesla is planning an absolutely massive Supercharger expansion in Yermo, California!!

Over the course of 6 phases, Tesla is set to add over 400 V4 stalls in a commercial development known as Eddie World 2.

The first phase, which should begin construction sometime this year,… pic.twitter.com/ks5Y5dE8lR

— MarcoRP (@MarcoRPi1) March 6, 2026

The project was first flagged by MarcoRP, a notable Tesla Supercharger watcher.

Strategically located midway on I-15 between Los Angeles and Las Vegas, the station targets heavy EV traffic on this high-demand corridor.

The surrounding 20-mile stretch already hosts over 200 high-power stalls (including 40 at 250 kW, 120 at 325 kW, and more), plus 96 in nearby Baker—yet bottlenecks persist during peak travel.

In scale, it eclipses all existing Tesla Superchargers. The current record holder, the solar- and Megapack-powered “Project Oasis” in Lost Hills, California, offers 164 stalls. Barstow’s former leader had 120. Eddie World 2 will be more than double that size, cementing Tesla’s dominance in ultra-high-capacity charging.

Tesla finishes its biggest Supercharger ever with 168 stalls

Development blends charging with convenience. Architectural drawings show integrated retail: a 10,100 square foot Cracker Barrel, a 4,300 square foot McDonald’s, a 3,800 square foot convenience store, additional restaurants, drive-thrus, outdoor dining, and lease space.

EV-centric features include pull-through bays for Cybertrucks and trailers, ensuring accessibility for larger vehicles and future Semi trucks.

News

Tesla makes latest move to remove Model S and Model X from its lineup

Tesla’s latest decisive step toward phasing out its flagship sedan and SUV was quietly removing the Model S and Model X from its U.S. referral program earlier this week.

Tesla has made its latest move that indicates the Model S and Model X are being removed from the company’s lineup, an action that was confirmed by the company earlier this quarter, that the two flagship vehicles would no longer be produced.

Tesla has ultimately started phasing out the Model S and Model X in several ways, as it recently indicated it had sold out of a paint color for the two vehicles.

Now, the company is making even more moves that show its plans for the two vehicles are being eliminated slowly but surely.

Tesla’s latest decisive step toward phasing out its flagship sedan and SUV was quietly removing the Model S and Model X from its U.S. referral program earlier this week.

The change eliminates the $1,000 referral discount previously available to new buyers of these vehicles. Existing Tesla owners purchasing a new Model S or Model X will now only receive a halved loyalty discount of $500, down from $1,000.

The updates extend beyond the two flagship vehicles. New Cybertruck buyers using a referral code on Premium AWD or Cyberbeast configurations will no longer get $1,000 off. Instead, both referrer and buyer receive three months of Full Self-Driving (Supervised).

The loyalty discount for Cybertruck purchases, excluding the new Dual Motor AWD trim level, has also been cut to $500.

NEWS: Tesla has removed the Model S and Model X from the referral program.

New owners also no longer get a $1,000 referral discount on a new Cybertruck Premium AWD or Cyberbeast. Instead, you now get 3 months of FSD (Supervised).

Additionally, Tesla has reduced the loyalty… pic.twitter.com/IgIY8Hi2WJ

— Sawyer Merritt (@SawyerMerritt) March 6, 2026

These adjustments apply only in the United States, and reflect Tesla’s broader strategy to optimize margins while boosting adoption of its autonomous driving software.

The timing is no coincidence. Tesla confirmed earlier this year that Model S and Model X production will end in the second quarter of 2026, roughly June, as the company reallocates factory capacity toward its Optimus humanoid robot and next-generation vehicles.

With annual sales of the low-volume flagships already declining (just 53,900 units in 2025), incentives are no longer needed to drive demand. Production is winding down, and Tesla expects strong remaining interest without subsidies.

Industry observers see this as the clearest sign yet of an “end-of-life” phase for the vehicles that once defined Tesla’s luxury segment. Community reactions on X range from nostalgia, “Rest in power S and X”, to frustration among long-time owners who feel perks are eroding just as the models approach discontinuation.

Some buyers are rushing orders to lock in final discounts before they vanish entirely.

Doug DeMuro names Tesla Model S the Most Important Car of the last 30 years

For Tesla, the move prioritizes efficiency: fewer discounts on outgoing models, a stronger push for FSD subscriptions, and a focus on high-margin Cybertruck trims amid surging orders.

Loyalists still have a narrow window to purchase a refreshed Plaid or Long Range model with remaining incentives, but the message is clear: Tesla’s lineup is evolving, and the era of the original flagships is drawing to a close.