Tesla China’s order page for the Model 3 has been updated, and delivery estimates for the all-electric sedan have been pushed back. The adjusted delivery estimates for the Giga Shanghai-made Model 3 were true for both the vehicle’s Rear Wheel Drive (RWD) and Long Range Dual Motor All Wheel Drive (AWD) version.

As could be seen in Tesla China’s order page for the Giga Shanghai-made Model 3, the estimated delivery dates of the Model 3 RWD and Model 3 Long Range Dual Motor AWD are now listed as 3-6 weeks. Prior to the update, both vehicles were listed with an estimated delivery timeframe of 2-6 weeks.

Interestingly enough, this update is only true for the Model 3. The Giga Shanghai-made Model Y is still listed with an estimated delivery date of 2-6 weeks. This is true for the Model Y RWD, Model Y Long Range Dual Motor AWD, and Model Y Performance.

$TSLA ??

NEWS: Tesla China's Model 3 delivery estimated period has increased by a week.

They are currently 3-6 weeks.

(Previously 2-6 weeks.)

– No Change in Model Y pic.twitter.com/Ya0ZHH5elm— Tsla Chan (@Tslachan) April 19, 2024

Tesla China has not provided an explanation for the upgraded Model 3’s longer wait times, though previous reports have claimed that Giga Shanghai has scaled back some of its production last month. Earlier this month, Tesla China also rolled out a new incentive program in the form of limited-time finance policies such as low downpayment offers and zero-interest loans.

In its promotional materials, Tesla China highlighted the affordability of the Giga Shnaghai-made Model 3 and Model Y. “Can you believe that you can drive away a new Tesla with RMB 80,000 without any interest? The best-selling Model 3/Y has a daily payment of only RMB 154 at most, which is equivalent to the price of a hot pot meal. Change the car into a Tesla. The gas money can be spent on the monthly payment,” Tesla China wrote in its post.

The Tesla Model 3 RWD starts at RMB 245,900 ($34,000) in China, while the Model 3 Long Range Dual Motor AWD starts at RMB 285,900 ($39,400).

Don’t hesitate to contact us with news tips. Just send a message to simon@teslarati.com to give us a heads up.

News

Tesla already has a complete Robotaxi model, and it doesn’t depend on passenger count

That scenario was discussed during the company’s Q4 and FY 2025 earnings call, when executives explained why the majority of Robotaxi rides will only involve one or two people.

Tesla already has the pieces in place for a full Robotaxi service that works regardless of passenger count, even if the backbone of the program is a small autonomous two-seater.

That scenario was discussed during the company’s Q4 and FY 2025 earnings call, when executives explained why the majority of Robotaxi rides will only involve one or two people.

Two-seat Cybercabs make perfect sense

During the Q&A portion of the call, Tesla Vice President of Vehicle Engineering Lars Moravy pointed out that more than 90% of vehicle miles traveled today involve two or fewer passengers. This, the executive noted, directly informed the design of the Cybercab.

“Autonomy and Cybercab are going to change the global market size and mix quite significantly. I think that’s quite obvious. General transportation is going to be better served by autonomy as it will be safer and cheaper. Over 90% of vehicle miles traveled are with two or fewer passengers now. This is why we designed Cybercab that way,” Moravy said.

Elon Musk expanded on the point, emphasizing that there is no fallback for Tesla’s bet on the Cybercab’s autonomous design. He reiterated that the autonomous two seater’s production is expected to start in April and noted that, over time, Tesla expects to produce far more Cybercabs than all of its other vehicles combined.

“Just to add to what Lars said there. The point that Lars made, which is that 90% of miles driven are with one or two passengers or one or two occupants, essentially, is a very important one… So this is clearly, there’s no fallback mechanism here. It’s like this car either drives itself or it does not drive… We would expect over time to make far more CyberCabs than all of our other vehicles combined. Given that 90% of distance driven or distance being distance traveled exactly, no longer driving, is one or two people,” Musk said.

Tesla’s robotaxi lineup is already here

The more interesting takeaway from the Q4 and FY 2025 earnings call is the fact that Tesla does not need the Cybercab to serve every possible passenger scenario, simply because the company already has a functional Robotaxi model that scales by vehicle type.

The Cybercab will handle the bulk of the Robotaxi network’s trips, but for groups that need three or four seats, the Model Y fills that role. For higher-end or larger-family use cases, the extended-wheelbase Model Y L could cover five or six occupants, provided that Elon Musk greenlights the vehicle for North America. And for even larger groups or commercial transport, Tesla has already unveiled the Robovan, which could seat over ten people.

Rather than forcing one vehicle to satisfy every use case, Tesla’s approach mirrors how transportation works today. Different vehicles will be used for different needs, while unifying everything under a single autonomous software and fleet platform.

News

Tesla Cybercab spotted with interesting charging solution, stimulating discussion

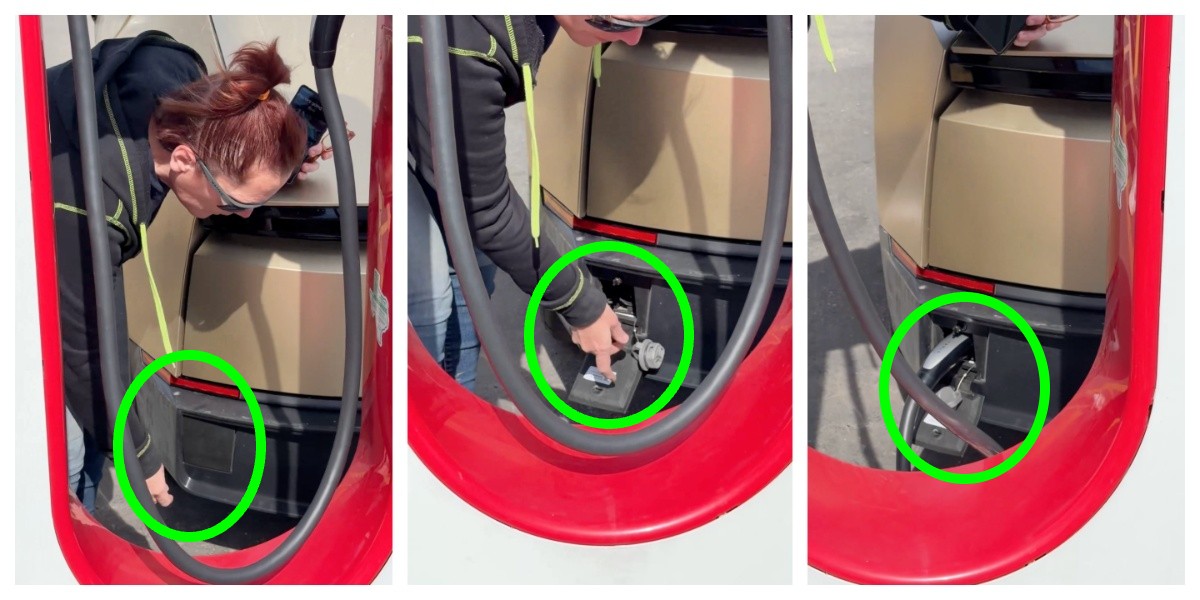

The port is located in the rear of the vehicle and features a manual door and latch for plug-in, and the video shows an employee connecting to a Tesla Supercharger.

Tesla Cybercab units are being tested publicly on roads throughout various areas of the United States, and a recent sighting of the vehicle’s charging port has certainly stimulated some discussions throughout the community.

The Cybercab is geared toward being a fully-autonomous vehicle, void of a steering wheel or pedals, only operating with the use of the Full Self-Driving suite. Everything from the driving itself to the charging to the cleaning is intended to be operated autonomously.

But a recent sighting of the vehicle has incited some speculation as to whether the vehicle might have some manual features, which would make sense, but let’s take a look:

🚨 Tesla Cybercab charging port is in the rear of the vehicle!

Here’s a great look at plugging it in!!

— TESLARATI (@Teslarati) January 29, 2026

The port is located in the rear of the vehicle and features a manual door and latch for plug-in, and the video shows an employee connecting to a Tesla Supercharger.

Now, it is important to remember these are prototype vehicles, and not the final product. Additionally, Tesla has said it plans to introduce wireless induction charging in the future, but it is not currently available, so these units need to have some ability to charge.

However, there are some arguments for a charging system like this, especially as the operation of the Cybercab begins after production starts, which is scheduled for April.

Wireless for Operation, Wired for Downtime

It seems ideal to use induction charging when the Cybercab is in operation. As it is for most Tesla owners taking roadtrips, Supercharging stops are only a few minutes long for the most part.

The Cybercab would benefit from more frequent Supercharging stops in between rides while it is operating a ride-sharing program.

Tesla wireless charging patent revealed ahead of Robotaxi unveiling event

However, when the vehicle rolls back to its hub for cleaning and maintenance, standard charging, where it is plugged into a charger of some kind, seems more ideal.

In the 45-minutes that the car is being cleaned and is having maintenance, it could be fully charged and ready for another full shift of rides, grabbing a few miles of range with induction charging when it’s out and about.

Induction Charging Challenges

Induction charging is still something that presents many challenges for companies that use it for anything, including things as trivial as charging cell phones.

While it is convenient, a lot of the charge is lost during heat transfer, which is something that is common with wireless charging solutions. Even in Teslas, the wireless charging mat present in its vehicles has been a common complaint among owners, so much so that the company recently included a feature to turn them off.

Production Timing and Potential Challenges

With Tesla planning to begin Cybercab production in April, the real challenge with the induction charging is whether the company can develop an effective wireless apparatus in that short time frame.

It has been in development for several years, but solving the issue with heat and energy loss is something that is not an easy task.

In the short-term, Tesla could utilize this port for normal Supercharging operation on the Cybercab. Eventually, it could be phased out as induction charging proves to be a more effective and convenient option.

News

Tesla confirms that it finally solved its 4680 battery’s dry cathode process

The suggests the company has finally resolved one of the most challenging aspects of its next-generation battery cells.

Tesla has confirmed that it is now producing both the anode and cathode of its 4680 battery cells using a dry-electrode process, marking a key breakthrough in a technology the company has been working to industrialize for years.

The update, disclosed in Tesla’s Q4 and FY 2025 update letter, suggests the company has finally resolved one of the most challenging aspects of its next-generation battery cells.

Dry cathode 4680 cells

In its Q4 and FY 2025 update letter, Tesla stated that it is now producing 4680 cells whose anode and cathode were produced during the dry electrode process. The confirmation addresses long-standing questions around whether Tesla could bring its dry cathode process into sustained production.

The disclosure was highlighted on X by Bonne Eggleston, Tesla’s Vice President of 4680 batteries, who wrote that “both electrodes use our dry process.”

Tesla first introduced the dry-electrode concept during its Battery Day presentation in 2020, pitching it as a way to simplify production, reduce factory footprint, lower costs, and improve energy density. While Tesla has been producing 4680 cells for some time, the company had previously relied on more conventional approaches for parts of the process, leading to questions about whether a full dry-electrode process could even be achieved.

4680 packs for Model Y

Tesla also revealed in its Q4 and FY 2025 Update Letter that it has begun producing battery packs for certain Model Y vehicles using its in-house 4680 cells. As per Tesla:

“We have begun to produce battery packs for certain Model Ys with our 4680 cells, unlocking an additional vector of supply to help navigate increasingly complex supply chain challenges caused by trade barriers and tariff risks.”

The timing is notable. With Tesla preparing to wind down Model S and Model X production, the Model Y and Model 3 are expected to account for an even larger share of the company’s vehicle output. Ensuring that the Model Y can be equipped with domestically produced 4680 battery packs gives Tesla greater flexibility to maintain production volumes in the United States, even as global battery supply chains face increasing complexity.