Investor's Corner

Tesla patents aluminum “spray quench” process for molecular-level strengthening

Tesla has submitted a patent that describes a new, more effective cooling process for manufacturing high-strength aluminum components to be used in its product line.

The patent entitled, “System and Method for Facilitating Pulsed Spray Quench of Extruded Objects”, describes a quenching process that aims to increase the strength, rigidity, and energy absorption of aluminum alloy components. A multi-way spray nozzle system would cool extruded aluminum with an atomized spray of liquid.

“A system includes a billet die at a proximal end configured to accept a billet and form an extrudate, a quench chamber located adjacent to the billet die for receiving the extrudate and comprising at least one pulsed width modulation (PWM) atomizing spray nozzle and a control module in communication with the at least one PWM atomizing spray nozzle and configured to independently control a liquid pressure, a gas pressure, a spray frequency, a duty cycle and flow rate of each at least one PWM atomizing spray nozzle,” reads the patent abstract.

Vehicles today use 6XXX aluminum alloys, which make up the front and rear bumpers, side and back steps, and knee bolsters of a car, the Kobelco Technology Review stated. Tesla also indicates within the patent that it uses 6XXX alloys for its vehicles. After these parts are extruded, they enter a quenching process, which is simply the process of cooling the metal after it has been heated.

Currently, Tesla utilizes a quenching process that involves cooling recently extruded aluminum alloys by soaking the parts in water. This process of quenching is recognized as “quick cooling.” While other cooling means are available, such as air cooling and furnace cooling, soaking the parts in water is the most time-effective method for automotive manufacturing.

However, Tesla’s patent recognizes the adverse effects that quick cooling aluminum alloy parts can have on the structural integrity of the metal. Quick-cooling can not only lead to deformation and warping of metal parts, but things can change chemically as well.

Magnesium silicide, or Mg2Si, is present in these aluminum alloy parts, and quick cooling them can inhibit the compound’s ability to set in the metal. Without the proper setting of Mg2Si by quick-cooling the aluminum alloy in water, the metal requires a higher extrusion pressure and becomes more sensitive to heat, according to Light Metals 2014. The combination of these two properties can effectively compromise the mechanical properties of the final product, making the frame of the vehicle lose strength through the manufacturing process.

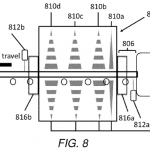

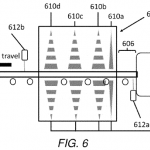

Tesla plans to utilize a multi-way spraying system to cool extruded aluminum parts, eliminating the soaking process that is used by so many manufacturers of aluminum alloy. In the patent, the company describes a quenching system that would spray newly extruded metals at varying rates depending on the size of the part. Between one half-gallon and 10 gallons of water per minute would cool the metal in question.

- Tesla’s described cooling process. (Credit: U.S. Patent Office)

- Tesla’s described cooling process. (Credit: U.S. Patent Office)

Two pyrometers would be placed at both the proximal and distal ends of the quench chamber. These would hold the responsibility of maintaining the metal’s temperature through the quenching process. The pyrometers would communicate with the system to ensure proper cooling temperatures, making sure the aluminum does not cool too quickly, allowing the Mg2Si to set. In conjunction with the temperature control, spray frequency, liquid pressure, gas pressure, and flow rate will also be monitored to ensure maximum strength after extradition is complete.

Tesla’s recognition of the flaws in quick-cooling extruded metals indicates the company’s realization that increased strength of a car’s frame could improve with a more efficient cooling technique.

In the teardown of the Model Y, Sandy Munro complimented Tesla’s use of what he called the “aluminum rear crush plate.” The piece is located at the trunk hatch and is designed to fold in the event of a rear-impact. The part saves the sides of the body from being compromised in a crash, which can ultimately total the vehicle if the chassis bends excessively.

While the crush plate is durable and prevents excessive damage to the body of the Model Y, the quick-cooling process used during manufacturing could ultimately make the crush plate less sustainable than what it could be. Not to mention, the front bumper, rear bumper, side and back steps, and knee bolsters are also made of aluminum. Using a different cooling technique could eventually lead to an even safer Tesla vehicle, which already has many five-star crash safety ratings from several organizations located around the world.

Read Tesla’s patent for a new aluminum cooling process below.

Tesla SYSTEM AND METHOD FOR FACILITATING PULSED SPRAY QUENCH OF EXTRUDED OBJECTS by Joey Klender on Scribd

Elon Musk

Elon Musk hints Tesla investors will be rewarded heavily

“Hold onto your Tesla stock. It’s going to be worth a lot, I think. That’s my bet,” Musk said.

Elon Musk recently hinted that he believes Tesla investors will be rewarded heavily if they continue to hold onto their shares, and he reiterated that in a new interview that the company released on its social accounts this week.

Musk is one of the most successful CEOs in the modern era and has mammothed competitors on the Forbes Net Worth List over the past year as his holdings in his various companies have continued to swell.

Tesla investors, especially those who have been holding shares for several years, have also felt substantial gains in their portfolios. Over the past five years, the stock is up over 78 percent. Since February 2019, nearly seven years ago to the day, the stock is up over 1,800 percent.

Musk said in the interview:

“Hold onto your Tesla stock. It’s going to be worth a lot, I think. That’s my bet.”

Elon Musk in new interview: “Hold on to your $TSLA stock. It’s going to be worth a lot, I think. That’s my bet.” pic.twitter.com/cucirBuhq0

— Sawyer Merritt (@SawyerMerritt) February 26, 2026

It’s no secret Musk has been extremely bullish on his own companies, but Tesla in particular, because it is publicly traded.

However, the company has so many amazing projects that have an opportunity to revolutionize their respective industries. There is certainly a path to major growth on Wall Street for Tesla through its various future projects, including Optimus, Cybercab, Semi, and Unsupervised FSD.

- Optimus (Tesla’s humanoid robot): Musk has discussed its potential for tasks like childcare, walking dogs, or assisting elderly parents, positioning it as a massive long-term driver of company value.

- Cybercab (Tesla’s robotaxi/autonomous ride-hailing vehicle): a fully autonomous vehicle geared specifically for Tesla’s ride-sharing ambitions.

- Semi (Tesla’s electric truck, with mentions of expansion, like in Europe): brings Tesla into the commercial logistics sector.

- Unsupervised FSD (Full Self-Driving software achieving full autonomy without human supervision): turns every Tesla owner’s vehicle into a fully-autonomous vehicle upon release

These projects specifically are some of the highest-growth pillars Tesla has ever attempted to develop, especially in Musk’s eyes, as he has said Optimus will be the best-selling product of all-time.

Many analysts agree, but the bullish ones, like Cathie Wood of ARK Invest, are perhaps the one who believes Tesla has incredible potential on Wall Street, predicting a $2,600 price target for 2030, but this is not even including Optimus.

She told Bloomberg last March that she believes that the project will present a potential additive if Tesla can scale faster than anticipated.

Elon Musk

Tesla stock gets latest synopsis from Jim Cramer: ‘It’s actually a robotics company’

“Turns out it’s actually a robotics and Cybercab company, and I want to buy, buy, buy. Yes, Tesla’s the paper that turned into scissors in one session,” Cramer said.

Tesla stock (NASDAQ: TSLA) got its latest synopsis from Wall Street analyst Jim Cramer, who finally realized something that many fans of the company have known all along: it’s not a car company. Instead, it’s a robotics company.

In a recent note that was released after Tesla reported Earnings in late January, Cramer seemed to recognize that the underwhelming financials and overall performance of the automotive division were not representative of the current state of affairs.

Instead, we’re seeing a company transition itself away from its early identity, essentially evolving like a caterpillar into a butterfly.

The narrative of the Earnings Call was simple: We’re not a car company, at least not from a birds-eye view. We’re an AI and Robotics company, and we are transitioning to this quicker than most people realize.

Tesla stock gets another analysis from Jim Cramer, and investors will like it

Tesla’s Q4 Earnings Call featured plenty of analysis from CEO Elon Musk and others, and some of the more minor details of the call were even indicative of a company that is moving toward AI instead of its cars. For example, the Model S and Model X will be no more after Q2, as Musk said that they serve relatively no purpose for the future.

Instead, Tesla is shifting its focus to the vehicles catered for autonomy and its Robotaxi and self-driving efforts.

Cramer recognizes this:

“…we got results from Tesla, which actually beat numbers, but nobody cares about the numbers here, as electric vehicles are the past. And according to CEO Elon Musk, the future of this company comes down to Cybercabs and humanoid robots. Stock fell more than 3% the next day. That may be because their capital expenditures budget was higher than expected, or maybe people wanted more details from the new businesses. At this point, I think Musk acolytes might be more excited about SpaceX, which is planning to come public later this year.”

He continued, highlighting the company’s true transition away from vehicles to its Cybercab, Optimus, and AI ambitions:

“I know it’s hard to believe how quickly this market can change its attitude. Last night, I heard a disastrous car company speak. Turns out it’s actually a robotics and Cybercab company, and I want to buy, buy, buy. Yes, Tesla’s the paper that turned into scissors in one session. I didn’t like it as a car company. Boy, I love it as a Cybercab and humanoid robot juggernaut. Call me a buyer and give me five robots while I’m at it.”

Cramer’s narrative seems to fit that of the most bullish Tesla investors. Anyone who is labeled a “permabull” has been echoing a similar sentiment over the past several years: Tesla is not a car company any longer.

Instead, the true focus is on the future and the potential that AI and Robotics bring to the company. It is truly difficult to put Tesla shares in the same group as companies like Ford, General Motors, and others.

Tesla shares are down less than half a percent at the time of publishing, trading at $423.69.

Elon Musk

Tesla to a $100T market cap? Elon Musk’s response may shock you

There are a lot of Tesla bulls out there who have astronomical expectations for the company, especially as its arm of reach has gone well past automotive and energy and entered artificial intelligence and robotics.

However, some of the most bullish Tesla investors believe the company could become worth $100 trillion, and CEO Elon Musk does not believe that number is completely out of the question, even if it sounds almost ridiculous.

To put that number into perspective, the top ten most valuable companies in the world — NVIDIA, Apple, Alphabet, Microsoft, Amazon, TSMC, Meta, Saudi Aramco, Broadcom, and Tesla — are worth roughly $26 trillion.

Will Tesla join the fold? Predicting a triple merger with SpaceX and xAI

Cathie Wood of ARK Invest believes the number is reasonable considering Tesla’s long-reaching industry ambitions:

“…in the world of AI, what do you have to have to win? You have to have proprietary data, and think about all the proprietary data he has, different kinds of proprietary data. Tesla, the language of the road; Neuralink, multiomics data; nobody else has that data. X, nobody else has that data either. I could see $100 trillion. I think it’s going to happen because of convergence. I think Tesla is the leading candidate [for $100 trillion] for the reason I just said.”

Musk said late last year that all of his companies seem to be “heading toward convergence,” and it’s started to come to fruition. Tesla invested in xAI, as revealed in its Q4 Earnings Shareholder Deck, and SpaceX recently acquired xAI, marking the first step in the potential for a massive umbrella of companies under Musk’s watch.

SpaceX officially acquires xAI, merging rockets with AI expertise

Now that it is happening, it seems Musk is even more enthusiastic about a massive valuation that would swell to nearly four-times the value of the top ten most valuable companies in the world currently, as he said on X, the idea of a $100 trillion valuation is “not impossible.”

It’s not impossible

— Elon Musk (@elonmusk) February 6, 2026

Tesla is not just a car company. With its many projects, including the launch of Robotaxi, the progress of the Optimus robot, and its AI ambitions, it has the potential to continue gaining value at an accelerating rate.

Musk’s comments show his confidence in Tesla’s numerous projects, especially as some begin to mature and some head toward their initial stages.