Energy

Tesla reduces Solar + Powerwall pricing amid CA wildfire power outages

With wildfires blazing through portions of California, Tesla CEO Elon Musk has knocked $1,000 off the price of Solar+Powerwall prices as of today in an effort to provide some assistance to homeowners affected by the power outages resulting from the ongoing fires.

Musk took to Twitter just hours after many residents of Los Angeles were required to evacuate their homes because of wildfires threatening the region. The Tesla CEO tweeted out numerous updates on the advantages of Tesla solar, like its ability to prevent power blackouts in the event of natural disasters. Musk also offered a $1,000 discount to customers in California who are directly affected by the ongoing wildfires.

If you’re directly affected by wildfire power outages, Tesla is reducing Solar+Powerwall prices by $1000 as of today

— Elon Musk (@elonmusk) October 28, 2019

The price reduction for its Solar+Powerwall package stands as another gesture from the electric car maker and its CEO. Musk has always maintained that Tesla’s purpose is not simply to make money. Rather, it is determined to accelerate the world’s adoption of sustainable solutions. Electric cars are one thing, but having homes switch to solar power with a battery-based backup is also a key pillar for this vision.

The value of a solar system and home battery unit is emphasized during times of power outages, such as those affecting parts of CA today. Due to the ongoing fires, particularly the Getty and Kincade Fires, portions of the state have been cut off from power. As noted by a recent CNN report, over a million residents across California currently face multiple days without power. It is these homeowners that stand as potential customers for Tesla’s Solar+Powerwall solutions.

Tesla started pushing its Energy business more this third quarter as the company hit its stride in its Model 3 production, and it showed in the company’s Q3 2019 results. Kunal Girotra, Tesla’s Senior Director, Energy Operations, described this rise in the third-quarter earnings call. “Our solar deployments rose by almost 50% over last quarter, and our energy storage deployments, which include Powerwalls and Powerpacks, grew by 15% to an all-time high of 477 megawatt hours,” he said.

We don’t make much money on this product, so $1000 actually means a lot

— Elon Musk (@elonmusk) October 28, 2019

These improvements came partly as a result of Tesla revamping his residential solar business, launching an affordable rental system that could cost homeowners as low as $50 a month. The company also took the wraps off its new solar solutions for businesses. These updates were accompanied by transparent pricing that gave customers clear expectations about their solar systems.

That being said, Elon Musk has admitted that Tesla does not really turn much of a profit on Solar+Powerwall installations or orders, adding that the $1,000 price reduction is significant. Musk has offered discounts in the past on Tesla’s solar products, including a nationwide price reduction after Pacific Gas and Electric (PG&E) announced mandatory power shutoffs in order to prevent wildfires in Northern California.

The fires in Los Angeles are very reminiscent of last year’s wildfires in the same region. The blazes in 2018 were the worst fires ever recorded in California’s history, destroying over 1.89 million acres of land, according to the California Department of Forestry and Fire Protection.

Energy

Tesla meets Giga New York’s Buffalo job target amid political pressures

Giga New York reported more than 3,460 statewide jobs at the end of 2025, meeting the benchmark tied to its dollar-a-year lease.

Tesla has surpassed its job commitments at Giga New York in Buffalo, easing pressure from lawmakers who threatened the company with fines, subsidy clawbacks, and dealership license revocations last year.

The company reported more than 3,460 statewide jobs at the end of 2025, meeting the benchmark tied to its dollar-a-year lease at the state-built facility.

As per an employment report reviewed by local media, Tesla employed 2,399 full-time workers at Gigafactory New York and 1,060 additional employees across the state at the end of 2025. Part-time roles pushed the total headcount of Tesla’s New York staff above the 3,460-job target.

The gains stemmed in part from a new Long Island service center, a Buffalo warehouse, and additional showrooms in White Plains and Staten Island. Tesla also said it has invested $350 million in supercomputing infrastructure at the site and has begun manufacturing solar panels.

Empire State Development CEO Hope Knight said the agency was “very happy” with Giga New York’s progress, as noted in a WXXI report. The current lease runs through 2029, and negotiations over updated terms have included potential adjustments to job requirements and future rent payments.

Some lawmakers remain skeptical, however. Assemblymember Pat Burke questioned whether the reported job figures have been fully verified. State Sen. Patricia Fahy has also continued to sponsor legislation that would revoke Tesla’s company-owned dealership licenses in New York. John Kaehny of Reinvent Albany has argued that the project has not delivered the manufacturing impact originally promised as well.

Knight, for her part, maintained that Empire State Development has been making the best of a difficult situation.

“(Empire State Development) has tried to make the best of a very difficult situation. There hasn’t been another use that has come forward that would replace this one, and so to the extent that we’re in this place, the fact that 2,000 families at (Giga New York) are being supported through the activity of this employer. It’s the best that we can have happen,” the CEO noted.

Energy

Tesla launches Cybertruck vehicle-to-grid program in Texas

The initiative was announced by the official Tesla Energy account on social media platform X.

Tesla has launched a vehicle-to-grid (V2G) program in Texas, allowing eligible Cybertruck owners to send energy back to the grid during high-demand events and receive compensation on their utility bills.

The initiative, dubbed Powershare Grid Support, was announced by the official Tesla Energy account on social media platform X.

Texas’ Cybertruck V2G program

In its post on X, Tesla Energy confirmed that vehicle-to-grid functionality is “coming soon,” starting with select Texas markets. Under the new Powershare Grid Support program, owners of the Cybertruck equipped with Powershare home backup hardware can opt in through the Tesla app and participate in short-notice grid stress events.

During these events, the Cybertruck automatically discharges excess energy back to the grid, supporting local utilities such as CenterPoint Energy and Oncor. In return, participants receive compensation in the form of bill credits. Tesla noted that the program is currently invitation-only as part of an early adopter rollout.

The launch builds on the Cybertruck’s existing Powershare capability, which allows the vehicle to provide up to 11.5 kW of power for home backup. Tesla added that the program is expected to expand to California next, with eligibility tied to utilities such as PG&E, SCE, and SDG&E.

Powershare Grid Support

To participate in Texas, Cybertruck owners must live in areas served by CenterPoint Energy or Oncor, have Powershare equipment installed, enroll in the Tesla Electric Drive plan, and opt in through the Tesla app. Once enrolled, vehicles would be able to contribute power during high-demand events, helping stabilize the grid.

Tesla noted that events may occur with little notice, so participants are encouraged to keep their Cybertrucks plugged in when at home and to manage their discharge limits based on personal needs. Compensation varies depending on the electricity plan, similar to how Powerwall owners in some regions have earned substantial credits by participating in Virtual Power Plant (VPP) programs.

Cybertruck

Tesla updates Cybertruck owners about key Powershare feature

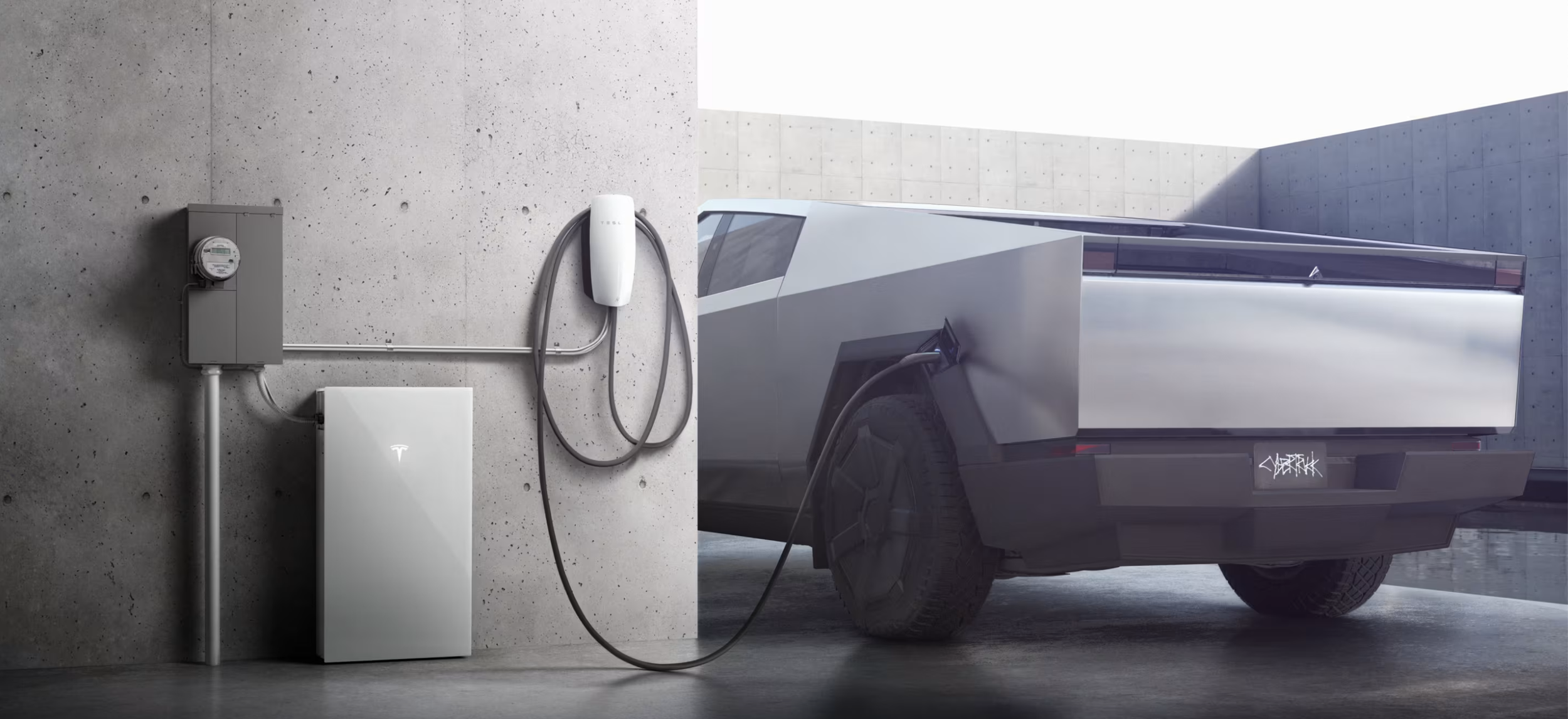

Tesla is updating Cybertruck owners on its timeline of a massive feature that has yet to ship: Powershare with Powerwall.

Powershare is a bidirectional charging feature exclusive to Cybertruck, which allows the vehicle’s battery to act as a portable power source for homes, appliances, tools, other EVs, and more. It was announced in late 2023 as part of Tesla’s push into vehicle-to-everything energy sharing, and acting as a giant portable charger is the main advantage, as it can provide backup power during outages.

Cybertruck’s Powershare system supports both vehicle-to-load (V2L) and vehicle-to-home (V2H), making it flexible and well-rounded for a variety of applications.

However, even though the feature was promised with Cybertruck, it has yet to be shipped to vehicles. Tesla communicated with owners through email recently regarding Powershare with Powerwall, which essentially has the pickup act as an extended battery.

Powerwall discharge would be prioritized before tapping into the truck’s larger pack.

However, Tesla is still working on getting the feature out to owners, an email said:

“We’re writing to let you know that the Powershare with Powerwall feature is still in development and is now scheduled for release in mid-2026.

This new release date gives us additional time to design and test this feature, ensuring its ability to communicate and optimize energy sharing between your vehicle and many configurations and generations of Powerwall. We are also using this time to develop additional Powershare features that will help us continue to accelerate the world’s transition to sustainable energy.”

Owners have expressed some real disappointment in Tesla’s continuous delays in releasing the feature, as it was expected to be released by late 2024, but now has been pushed back several times to mid-2026, according to the email.

Foundation Series Cybertruck buyers paid extra, expecting the feature to be rolled out with their vehicle upon pickup.

Cybertruck’s Lead Engineer, Wes Morrill, even commented on the holdup:

As a Cybertruck owner who also has Powerwall, I empathize with the disappointed comments.

To their credit, the team has delivered powershare functionality to Cybertruck customers who otherwise have no backup with development of the powershare gateway. As well as those with solar…

— Wes (@wmorrill3) December 12, 2025

He said that “it turned out to be much harder than anticipated to make powershare work seamlessly with existing Powerwalls through existing wall connectors. Two grid-forming devices need to negotiate who will form and who will follow, depending on the state of charge of each, and they need to do this without a network and through multiple generations of hardware, and test and validate this process through rigorous certifications to ensure grid safety.”

It’s nice to see the transparency, but it is justified for some Cybertruck owners to feel like they’ve been bait-and-switched.