Investor's Corner

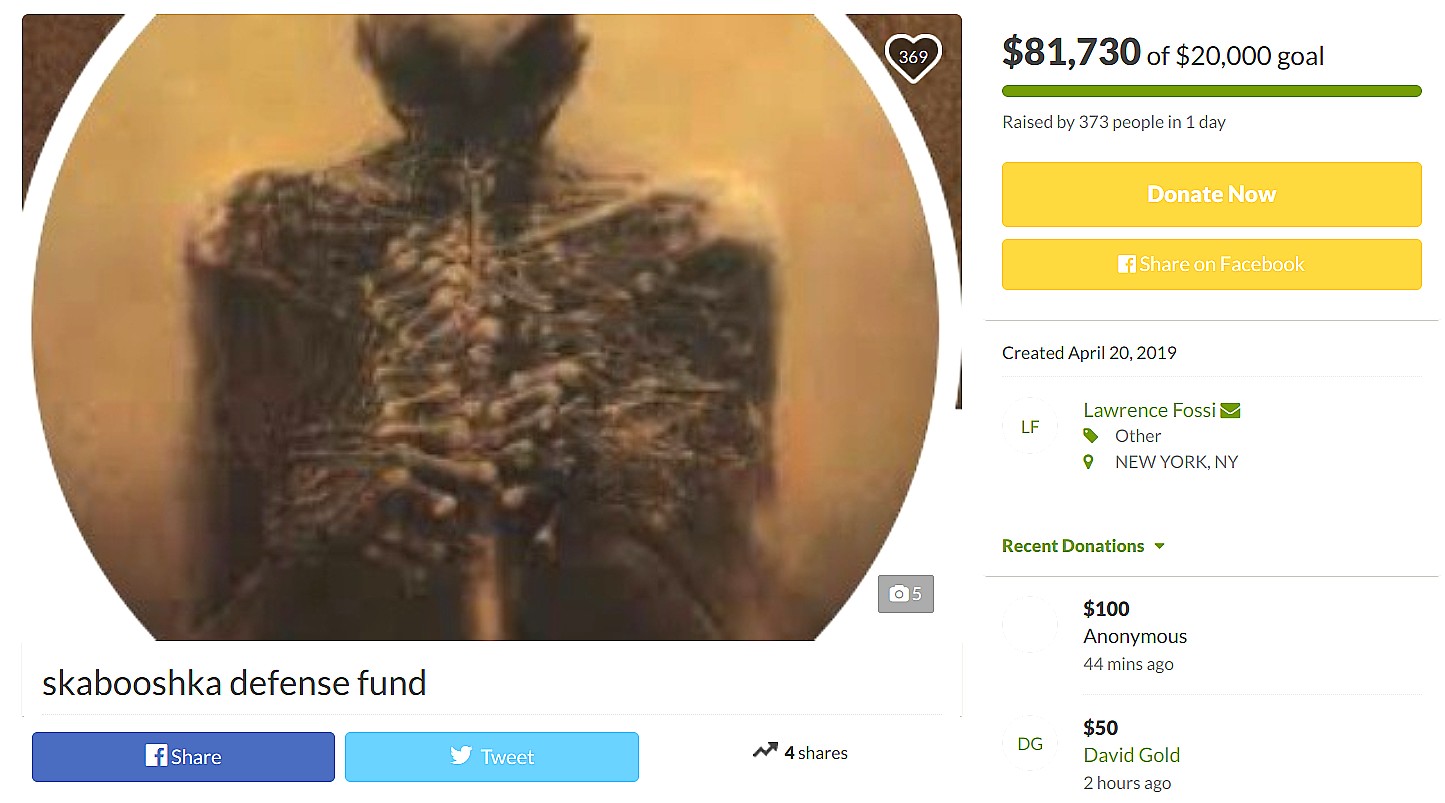

Tesla bears start GoFundMe page for TSLA short accused of harassing Fremont workers

One of Tesla’s fiercest critics who was reportedly forced to cease his online initiatives against the company has returned to start a GoFundMe page for another TSLA bear, who was recently issued a temporary restraining order for stalking, harassing, and endangering a group of employees from the Fremont factory. The fundraiser has been successful so far, with 373 people raising over $81,000 in just one day.

On Friday, the Alameda County Superior Court in CA granted a temporary restraining order against Randeep Hothi, the man behind @skabooshka, a prominent anti-Tesla account on Twitter. Tesla accused Hothi of committing several offenses against the company, including injuring a member of its security personnel, and later, and harassing a group of employees who were filming a demonstration of Navigate on Autopilot in a company-owned Model 3. The temporary restraining order is effective until May 7, when a hearing is set for the noted TSLA bear.

With Hothi’s hearing approaching, the TSLAQ community (a group of individuals aiming for Tesla to fall) has mobilized to raise funds for their fellow detractor. The GoFundMe page was started by Lawrence Fossi, a fierce Tesla critic who wrote and tweeted under the pseudonym Montana Skeptic. Fossi was one of the TSLAQ community’s most active members, at least until he was reportedly forced to cease his online activities after Elon Musk contacted his boss to complain about his actions. Fossi described the goal of the GoFundMe page for Hothi as follows.

I am Lawrence J. Fossi and wrote at Seeking Alpha under the pseudonym of Montana Skeptic. I learned today that Tesla Inc. has obtained an ex parte (only one side represented) temporary restraining order against $TSLAQ member @skabooshka.

What will follow over the next two weeks or so is “discovery” (depositions, written questions) and an evidentiary hearing to determine whether Tesla can obtain a temporary injunction. Tesla alleges @skabooshka is a dangerous person. I believe he is a seeker of truth who has done valuable work and deserves a vigorous and capable defense.

Tesla’s TRO application was triggered by @skabooshka’s effort to determine the true nature of the forthcoming “Investor Autonomy Event”. I believe important First Amendment rights are at issue, and urge you to support his effort.

Funds will be used to pay @skabooshka’s legal expenses in defending against the Tesla legal action, and in bringing any appropriate counterclaims. Any and all excess funds will be donated to a good related cause, with full disclosure about the recipient or recipients, and proof of donation sent to all donors. Many thanks.

Hothi has received an outpouring of support from the Tesla bear community. A look through the donations given to the fundraiser so far shows several known Tesla shorts, including Stanphyl Capital’s Mark Spiegel (who is tapped at times as a source for TSLA insights by mainstream media), @TeslaCharts, and Fossi himself donating significant amounts. In an update to the fundraiser, Fossi pledged that the money raised through the GoFundMe page will strictly be used for Hothi’s legal needs.

While the response to Hothi’s GoFundMe page is quite impressive, it should be noted that Tesla only filed a restraining order against the Tesla bear after he reportedly endangered the lives of three Tesla employees. On April 16, three employees were filming in a Model 3 when Hothi reportedly stalked and harassed them. So aggressive were Hothi’s actions that the Model 3’s crash avoidance systems were activated. Fearing for their safety, one of the Tesla employees in the vehicle promptly called the police to report the incident.

According to Tesla, the April incident was not the first time that Hothi committed acts against the company. Back in February, the TSLA short reportedly struck a security employee with his car when the latter was about to give him a verbal warning for trespassing into the Fremont factory’s grounds. The matter was also reported to the police, who attempted to issue a warning notice of trespass. Unfortunately, the warning was never given since Hothi proved uncooperative in meeting with Fremont police officers.

Investor's Corner

Tesla gets tip of the hat from major Wall Street firm on self-driving prowess

“Tesla is at the forefront of autonomous driving, supported by a camera-only approach that is technically harder but much cheaper than the multi-sensor systems widely used in the industry. This strategy should allow Tesla to scale more profitably compared to Robotaxi competitors, helped by a growing data engine from its existing fleet,” BoA wrote.

Tesla received a tip of the hat from major Wall Street firm Bank of America on Wednesday, as it reinitiated coverage on Tesla shares with a bullish stance that comes with a ‘Buy’ rating and a $460 price target.

In a new note that marks a sharp reversal from its neutral position earlier in 2025, the bank declared Tesla’s Full Self-Driving (FSD) technology the “leading consumer autonomy solution.”

Analysts highlighted Tesla’s camera-only architecture, known as Tesla Vision, as a strategic masterstroke. While technically more challenging than the multi-sensor setups favored by rivals, the vision-based approach is dramatically cheaper to produce and maintain.

This cost edge, combined with Tesla’s rapidly expanding real-world data engine, positions the company to scale robotaxis far more profitably than competitors, BofA argues in the new note:

“Tesla is at the forefront of autonomous driving, supported by a camera-only approach that is technically harder but much cheaper than the multi-sensor systems widely used in the industry. This strategy should allow Tesla to scale more profitably compared to Robotaxi competitors, helped by a growing data engine from its existing fleet.”

The bank now attributes roughly 52% of Tesla’s total valuation to its Robotaxi ambitions. It also flagged meaningful upside from the Optimus humanoid robot program and the fast-growing energy storage business, suggesting the auto segment’s recent headwinds, including expired incentives, are being eclipsed by these higher-margin opportunities.

Tesla’s own data underscores exactly why Wall Street is waking up to FSD’s potential. According to Tesla’s official safety reporting page, the FSD Supervised fleet has now surpassed 8.4 billion cumulative miles driven.

Tesla FSD (Supervised) fleet passes 8.4 billion cumulative miles

That total ballooned from just 6 million miles in 2021 to 80 million in 2022, 670 million in 2023, 2.25 billion in 2024, and a staggering 4.25 billion in 2025 alone. In the first 50 days of 2026, owners added another 1 billion miles — averaging more than 20 million miles per day.

This avalanche of real-world, camera-captured footage, much of it on complex city streets, gives Tesla an unmatched training dataset. Every mile feeds its neural networks, accelerating improvement cycles that lidar-dependent rivals simply cannot match at scale.

Tesla owners themselves will tell you the suite gets better with every release, bringing new features and improvements to its self-driving project.

The $460 target implies roughly 15 percent upside from recent trading levels around $400. While regulatory and safety hurdles remain, BofA’s endorsement signals growing institutional conviction that Tesla’s data advantage is not hype; it’s a tangible moat already delivering billions of miles of proof.

Elon Musk

SpaceX IPO could push Elon Musk’s net worth past $1 trillion: Polymarket

The estimates were shared by the official Polymarket Money account on social media platform X.

Recent projections have outlined how a potential $1.75 trillion SpaceX IPO could generate historic returns for early investors. The projections suggest the offering would not only become the largest IPO in history but could also result in unprecedented windfalls for some of the company’s key investors.

The estimates were shared by the official Polymarket Money account on social media platform X.

As noted in a Polymarket Money analysis, Elon Musk invested $100 million into SpaceX in 2002 and currently owns approximately 42% of the company. At a $1.75 trillion valuation following SpaceX’s potential $1.75 trillion IPO, that stake would be worth roughly $735 billion.

Such a figure would dramatically expand Musk’s net worth. When combined with his holdings in Tesla Inc. and other ventures, a public debut at that level could position him as the world’s first trillionaire, depending on market conditions at the time of listing.

The Bloomberg Billionaires Index currently lists Elon Musk with a net worth of $666 billion, though a notable portion of this is tied to his TSLA stock. Tesla currently holds a market cap of $1.51 trillion, and Elon Musk’s currently holds about 13% to 15% of the company’s outstanding common stock.

Founders Fund, co-founded by Peter Thiel, invested $20 million in SpaceX in 2008. Polymarket Money estimates the firm owns between 1.5% and 3% of the private space company. At a $1.75 trillion valuation, that range would translate to approximately $26.25 billion to $52.5 billion in value.

That return would represent one of the most significant venture capital outcomes in modern Silicon Valley history, with a growth of 131,150% to 262,400%.

Alphabet Inc., Google’s parent company, invested $900 million into SpaceX in 2015 and is estimated to hold between 6% and 7% of the private space firm. At the projected IPO valuation, that stake could be worth between $105 billion and $122.5 billion. That’s a growth of 11,566% to 14,455%.

Other major backers highlighted in the post include Fidelity Investments, Baillie Gifford, Valor Equity Partners, Bank of America, and Andreessen Horowitz, each potentially sitting on multibillion-dollar gains.

Elon Musk

Elon Musk hints Tesla investors will be rewarded heavily

“Hold onto your Tesla stock. It’s going to be worth a lot, I think. That’s my bet,” Musk said.

Elon Musk recently hinted that he believes Tesla investors will be rewarded heavily if they continue to hold onto their shares, and he reiterated that in a new interview that the company released on its social accounts this week.

Musk is one of the most successful CEOs in the modern era and has mammothed competitors on the Forbes Net Worth List over the past year as his holdings in his various companies have continued to swell.

Tesla investors, especially those who have been holding shares for several years, have also felt substantial gains in their portfolios. Over the past five years, the stock is up over 78 percent. Since February 2019, nearly seven years ago to the day, the stock is up over 1,800 percent.

Musk said in the interview:

“Hold onto your Tesla stock. It’s going to be worth a lot, I think. That’s my bet.”

Elon Musk in new interview: “Hold on to your $TSLA stock. It’s going to be worth a lot, I think. That’s my bet.” pic.twitter.com/cucirBuhq0

— Sawyer Merritt (@SawyerMerritt) February 26, 2026

It’s no secret Musk has been extremely bullish on his own companies, but Tesla in particular, because it is publicly traded.

However, the company has so many amazing projects that have an opportunity to revolutionize their respective industries. There is certainly a path to major growth on Wall Street for Tesla through its various future projects, including Optimus, Cybercab, Semi, and Unsupervised FSD.

- Optimus (Tesla’s humanoid robot): Musk has discussed its potential for tasks like childcare, walking dogs, or assisting elderly parents, positioning it as a massive long-term driver of company value.

- Cybercab (Tesla’s robotaxi/autonomous ride-hailing vehicle): a fully autonomous vehicle geared specifically for Tesla’s ride-sharing ambitions.

- Semi (Tesla’s electric truck, with mentions of expansion, like in Europe): brings Tesla into the commercial logistics sector.

- Unsupervised FSD (Full Self-Driving software achieving full autonomy without human supervision): turns every Tesla owner’s vehicle into a fully-autonomous vehicle upon release

These projects specifically are some of the highest-growth pillars Tesla has ever attempted to develop, especially in Musk’s eyes, as he has said Optimus will be the best-selling product of all-time.

Many analysts agree, but the bullish ones, like Cathie Wood of ARK Invest, are perhaps the one who believes Tesla has incredible potential on Wall Street, predicting a $2,600 price target for 2030, but this is not even including Optimus.

She told Bloomberg last March that she believes that the project will present a potential additive if Tesla can scale faster than anticipated.