Investor's Corner

Tesla’s ‘big week’ set to get automaker back on track with big picture story: firm

Tesla’s “big week,” which includes a quarterly delivery report with major implications and a Robotaxi unveiling event that could truly set the tone for the company moving forward, is set to get the automaker back on track with its big picture story, Wedbush said in a new note.

That is, if Tesla can come through on both.

Wedbush put out its third note in the past two weeks on Tuesday morning, all trying to set a good narrative for what the Q3 delivery figures and Robotaxi event could mean for the stock.

It’s no secret Tesla has been relatively lackluster in terms of stock performance in 2024. It’s only up 2.36 percent for the year, but a delivery beat for Q3, which could set the tone for Q4, and a robust and informational Robotaxi unveiling event, could both help end the year with more growth.

Wedbush’s Dan Ives provided some color on the delivery picture in the note:

“After a bumpy 1H for Musk & Co. as the company saw softer EV demand along with the broader industry earlier in the year, we believe 3Q will provide a solid rebound looking to 2H for the company as China continues to heat up and price/demand stabilization has continuously been seen throughout the quarter.”

As for the Robotaxi unveiling event, Ives said:

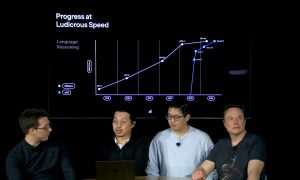

“Next Thursday, October 10th, Tesla will be hosting its long-awaited “We, Robot” Robotaxi event after the market at the Warner Bros. movie studio in Los Angeles, which we will be attending live for this historic event. We believe Robotaxi Day will be a seminal and historical day for Musk and Tesla and marks a new chapter of growth around autonomous, FSD, and AI future at Tesla. We continue to believe Tesla is the most undervalued AI name in the market, and we expect Musk & Co. to unveil some “game-changing” autonomous technology at this event next week.”

Wedbush has high expectations for the Robotaxi unveiling event. Tesla has hyped it up plenty. Musk has agreed it could be the biggest event for Tesla since the Model 3 unveiling. While it could be groundbreaking, there is a lot to consider, especially the fact that a lackluster event could be more damaging than complimenting to the Tesla story.

The note pushes Tesla to update investors on Cybercab scaling, the overall cost per mile, a rideshare app, and a demonstration of the capabilities. These are nearly looked at as non-negotiables for the event, and if Tesla does not come up with a display of these things, shareholders could come away disappointed.

Tesla expected to unveil ‘game changing’ autonomous tech next week: Wedbush

That is not to say it will be a complete failure. Another note from Barclays on Monday noted that some Tesla shareholders will be “entrenched” in their outlook on the company, and even if the Robotaxi unveiling is flat and disappointing, it is unlikely to change much.

Still, Wedbush believes the Robotaxi event is the next step in Tesla’s robust story as a company:

“With very few industry events as widely anticipated as this, we believe Musk will address the near-term pain points seen by investors and the company’s long-term vision as Tesla goes through its second transformation not seen since the Model 3/Y production overhaul.”

Wedbush maintained its ‘Outperform’ rating and a $300 price target.

I’d love to hear from you! If you have any comments, concerns, or questions, please email me at joey@teslarati.com. You can also reach me on Twitter @KlenderJoey, or if you have news tips, you can email us at tips@teslarati.com.

Elon Musk

Tesla investors will be shocked by Jim Cramer’s latest assessment

Jim Cramer is now speaking positively about Tesla, especially in terms of its Robotaxi performance and its perception as a company.

Tesla investors will be shocked by analyst Jim Cramer’s latest assessment of the company.

When it comes to Tesla analysts, many of them are consistent. The bulls usually stay the bulls, and the bears usually stay the bears. The notable analysts on each side are Dan Ives and Adam Jonas for the bulls, and Gordon Johnson for the bears.

Jim Cramer is one analyst who does not necessarily fit this mold. Cramer, who hosts CNBC’s Mad Money, has switched his opinion on Tesla stock (NASDAQ: TSLA) many times.

He has been bullish, like he was when he said the stock was a “sleeping giant” two years ago, and he has been bearish, like he was when he said there was “nothing magnificent” about the company just a few months ago.

Now, he is back to being a bull.

Cramer’s comments were related to two key points: how NVIDIA CEO Jensen Huang describes Tesla after working closely with the Company through their transactions, and how it is not a car company, as well as the recent launch of the Robotaxi fleet.

Jensen Huang’s Tesla Narrative

Cramer says that the narrative on quarterly and annual deliveries is overblown, and those who continue to worry about Tesla’s performance on that metric are misled.

“It’s not a car company,” he said.

He went on to say that people like Huang speak highly of Tesla, and that should be enough to deter any true skepticism:

“I believe what Musk says cause Musk is working with Jensen and Jensen’s telling me what’s happening on the other side is pretty amazing.”

Tesla self-driving development gets huge compliment from NVIDIA CEO

Robotaxi Launch

Many media outlets are being extremely negative regarding the early rollout of Tesla’s Robotaxi platform in Austin, Texas.

There have been a handful of small issues, but nothing significant. Cramer says that humans make mistakes in vehicles too, yet, when Tesla’s test phase of the Robotaxi does it, it’s front page news and needs to be magnified.

He said:

“Look, I mean, drivers make mistakes all the time. Why should we hold Tesla to a standard where there can be no mistakes?”

It’s refreshing to hear Cramer speak logically about the Robotaxi fleet, as Tesla has taken every measure to ensure there are no mishaps. There are safety monitors in the passenger seat, and the area of travel is limited, confined to a small number of people.

Tesla is still improving and hopes to remove teleoperators and safety monitors slowly, as CEO Elon Musk said more freedom could be granted within one or two months.

Investor's Corner

Tesla gets $475 price target from Benchmark amid initial Robotaxi rollout

Tesla’s limited rollout of its Robotaxi service in Austin is already catching the eye of Wall Street.

Venture capital firm Benchmark recently reiterated its “Buy” rating and raised its price target on Tesla stock (NASDAQ: TSLA) from $350 to $475 per share, citing the company’s initial Robotaxi service deployment as a sign of future growth potential.

Benchmark analyst Mickey Legg praised the Robotaxi service pilot’s “controlled and safety-first approach,” adding that it could help Tesla earn the trust of regulators and the general public.

Confidence in camera-based autonomy

Legg reiterated Benchmark’s belief in Tesla’s vision-only approach to autonomous driving. “We are a believer in Tesla’s camera-focused approach that is not only cost effective but also scalable,” he noted.

The analyst contrasted Tesla’s simple setup with the more expensive hardware stacks used by competitors like Waymo, which use various sophisticated sensors that hike up costs, as noted in an Investing.com report. Compared to Tesla’s Model Y Robotaxis, Waymo’s self-driving cars are significantly more expensive.

He also pointed to upcoming Texas regulations set to take effect in September, suggesting they could help create a regulatory framework favorable to autonomous services in other cities.

“New regulations for autonomous vehicles are set to go into place on Sept. 1 in TX that we believe will further help win trust and pave the way for expansion to additional cities,” the analyst wrote.

Tesla as a robotics powerhouse

Beyond robotaxis, Legg sees Tesla evolving beyond its roots as an electric vehicle maker. He noted that Tesla’s humanoid robot, Optimus, could be a long-term growth driver alongside new vehicle programs and other future initiatives.

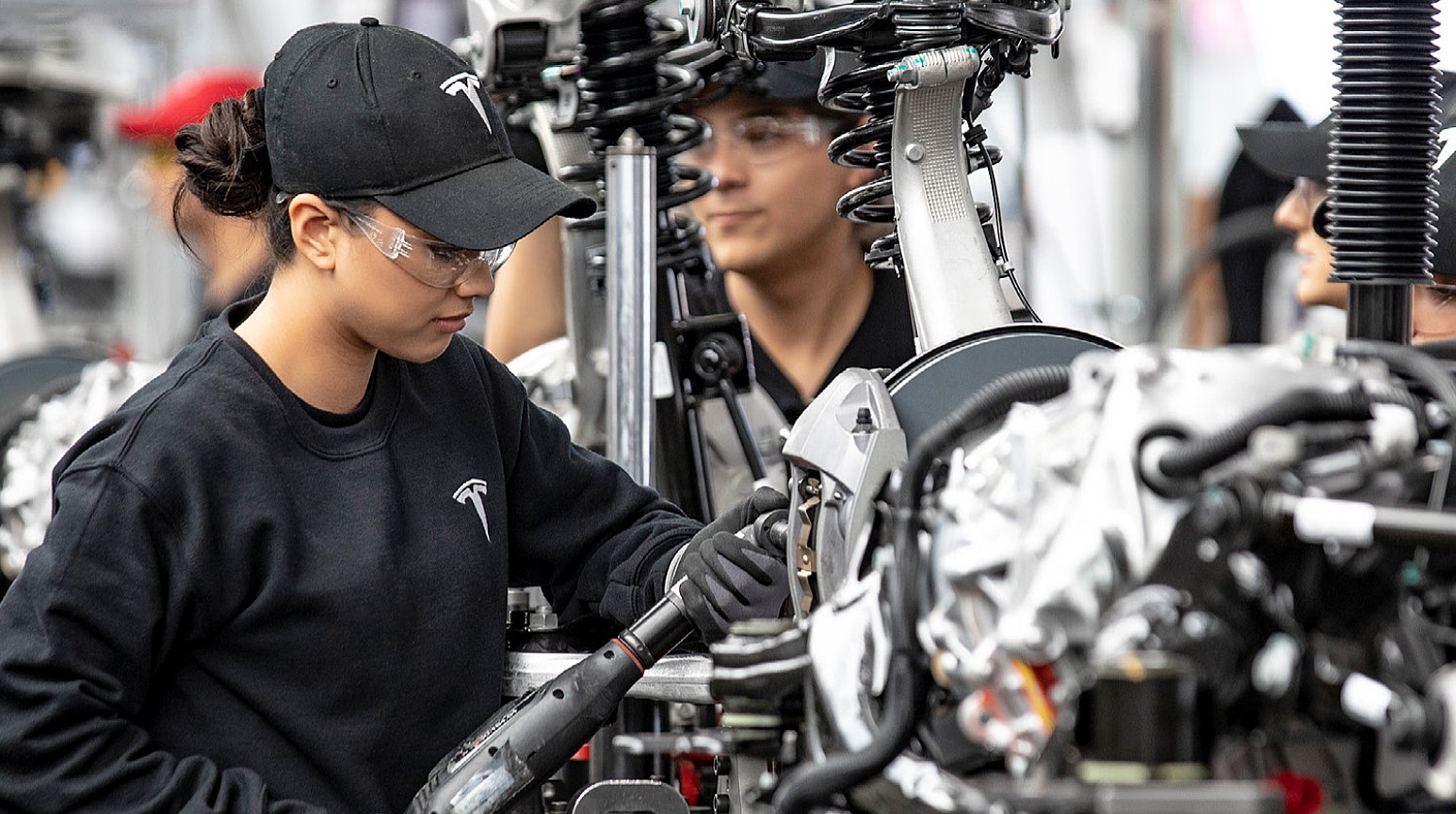

“In our view, the company is undergoing an evolution from a trailblazing vehicle OEM to a high-tech automation and robotics company with unmatched domestic manufacturing scale,” he wrote.

Benchmark noted that Tesla stock had rebounded over 50% from its April lows, driven in part by easing tariff concerns and growing momentum around autonomy. With its initial Robotaxi rollout now underway, the firm has returned to its previous $475 per share target and reaffirmed TSLA as a Benchmark Top Pick for 2025.

Elon Musk

Tesla blacklisted by Swedish pension fund AP7 as it sells entire stake

A Swedish pension fund is offloading its Tesla holdings for good.

Tesla shares have been blacklisted by the Swedish pension fund AP7, who said earlier today that it has “verified violations of labor rights in the United States” by the automaker.

The fund ended up selling its entire stake, which was worth around $1.36 billion when it liquidated its holdings in late May. Reuters first reported on AP7’s move.

Other pension and retirement funds have relinquished some of their Tesla holdings due to CEO Elon Musk’s involvement in politics, among other reasons, and although the company’s stock has been a great contributor to growth for many funds over the past decade, these managers are not willing to see past the CEO’s right to free speech.

However, AP7 says the move is related not to Musk’s involvement in government nor his political stances. Instead, the fund said it verified several labor rights violations in the U.S.:

“AP7 has decided to blacklist Tesla due to verified violations of labor rights in the United States. Despite several years of dialogue with Tesla, including shareholder proposals in collaboration with other investors, the company has not taken sufficient measures to address the issues.”

Tesla made up about 1 percent of the AP7 Equity Fund, according to a spokesperson. This equated to roughly 13 billion crowns, but the fund’s total assets were about 1,181 billion crowns at the end of May when the Tesla stake was sold off.

Tesla has had its share of labor lawsuits over the past few years, just as any large company deals with at some point or another. There have been claims of restrictions against labor union supporters, including one that Tesla was favored by judges, as they did not want pro-union clothing in the factory. Tesla argued that loose-fitting clothing presented a safety hazard, and the courts agreed.

(Photo: Tesla)

There have also been claims of racism at the Fremont Factory by a former elevator contractor named Owen Diaz. He was awarded a substantial sum of $137m. However, U.S. District Judge William Orrick ruled the $137 million award was excessive, reducing it to $15 million. Diaz rejected this sum.

Another jury awarded Diaz $3.2 million. Diaz’s legal team said this payout was inadequate. He and Tesla ultimately settled for an undisclosed amount.

AP7 did not list any of the current labor violations that it cited as its reason for

-

News5 days ago

News5 days agoTesla Robotaxi’s biggest challenge seems to be this one thing

-

News2 weeks ago

News2 weeks agoTesla confirms massive hardware change for autonomy improvement

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoElon Musk slams Bloomberg’s shocking xAI cash burn claims

-

News2 weeks ago

News2 weeks agoTesla features used to flunk 16-year-old’s driver license test

-

News2 weeks ago

News2 weeks agoTesla China roars back with highest vehicle registrations this Q2 so far

-

News2 weeks ago

News2 weeks agoTexas lawmakers urge Tesla to delay Austin robotaxi launch to September

-

News2 weeks ago

News2 weeks agoTesla dominates Cars.com’s Made in America Index with clean sweep

-

News2 weeks ago

News2 weeks agoTesla’s Grok integration will be more realistic with this cool feature