Tesla investor Gary Black, a former Bernstein analyst, has decided to offload his Tesla shares after accurately predicting the over 700% surge in the automaker’s stock price in 2020. Black announced this morning that the “absence of clear FY’21 delivery guidance,” and other factors were the reason for his decision.

Black posted a Tweet on Monday morning announcing that he has exited his TSLA positions after being a long-term shareholder since August 2019. In addition to Tesla’s undefined delivery guidance for 2021, “increased odds of a 1Q miss, and a more risky capital allocation policy/higher earnings variability were the primary factors,” he said.

Disclosure: I have exited my $TSLA positions after being long since August 2019. The absence of clear FY’21 delivery guidance, increased odds of a 1Q miss, and a more risky capital allocation policy/higher earnings variability were the primary factors.

— Gary Black (@garyblack00) February 8, 2021

In other tweets, Black explained his distaste of the company’s decision to invest in Bitcoin. “It’s a small risk from a valuation standpoint,” he said. “On the other hand, it adds more volatility to TSLA’s earnings stream, and may highlight a change in risk tolerance within $TSLA.”

I have to think about it and will try to speak with the company. At a $1.5B maximum loss ($1.30/share), it’s a small risk from a valuation standpoint. On the other hand, it adds more volatility to TSLA’s earnings stream, and may highlight a change in risk tolerance within $TSLA.

— Gary Black (@garyblack00) February 8, 2021

Black bought Tesla shares in August 2019 due to the expanding electric vehicle market, and Tesla had proven itself to be the most likely company to dominate the sector. With new vehicles that expanded across different segments, like the Cybertruck, Model Y crossover, and the Semi, along with the company’s expanding focus on battery production and affordability, it seemed like an ideal investment for Black to get involved with. He was right, as 2020 proved to be the company’s biggest year yet. It delivered just shy of 500,000 vehicles, produced over 509,000, and recorded profits in all four quarters.

Walking away with a tasty profit, Black says that he will look for a lower entry point to become a shareholder again. However, the lack of delivery guidance from Tesla during its Q4 2020 Earnings Call was something that didn’t sit well with some investors, Black being one of them.

Tesla is currently in the process of building two new production facilities: One in Germany and one in Texas. While both production plants are set to begin production in mid-2021, Tesla does not have a definitive start date for manufacturing or deliveries for either facility. Therefore, it is difficult for the company to outline an exact production or delivery rate.

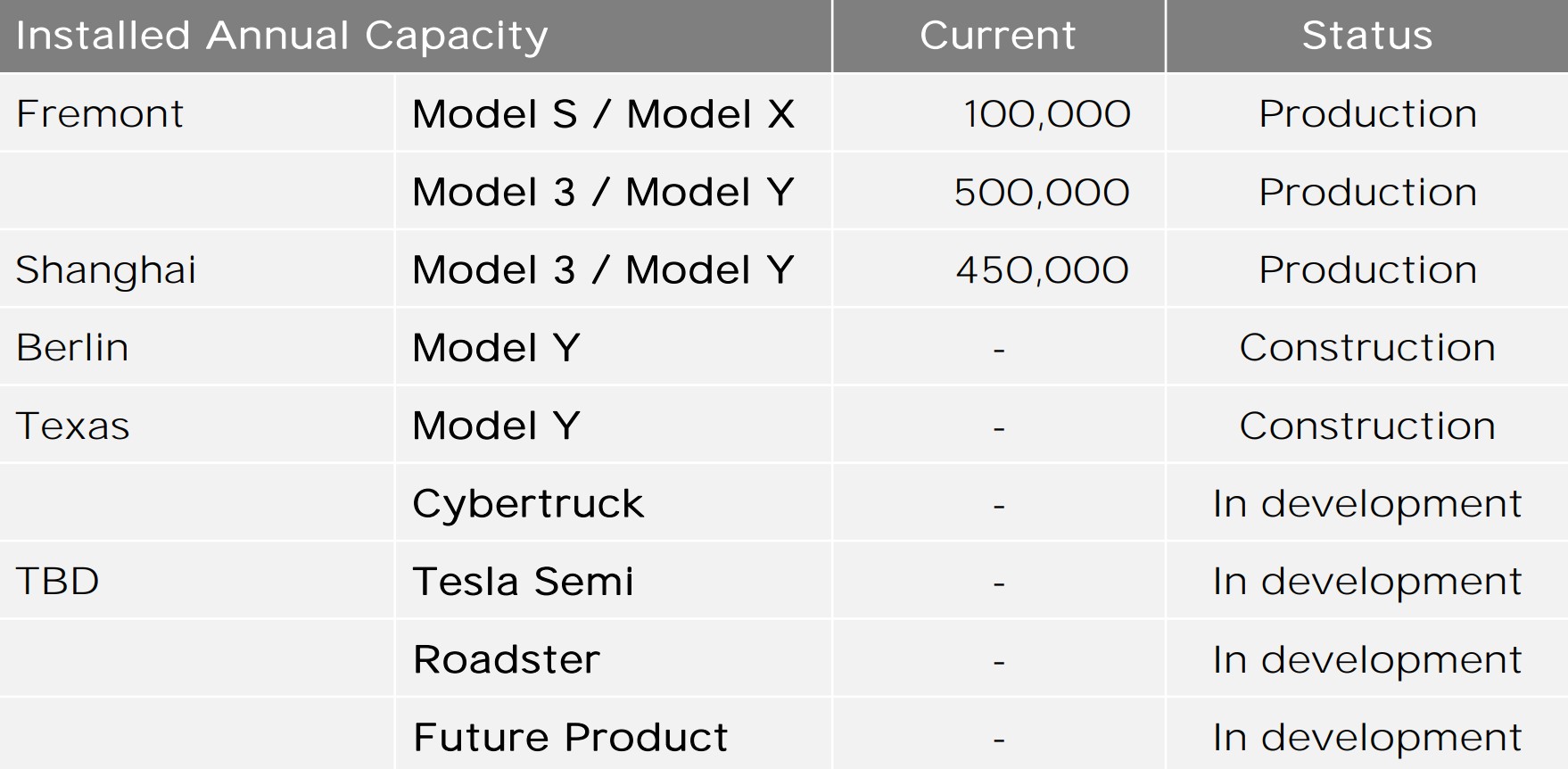

The only concrete numbers Tesla offered during the Q4 Earnings session were located in its Shareholder Deck. It outlined Fremont and Giga Shanghai’s production of the Model S, Model 3, Model X, and Model Y, with a combined rate of 1,050,000 cars per year.

Credit: Tesla

But, this does not mean that Tesla will deliver that many cars. The production rate can be looked at as a “best-case scenario,” meaning if there are no production halts, malfunctions in equipment, or revisions to production lines, Tesla would likely produce 1,050,000 cars. Some analysts, like Bill Selesky of Argus, have estimated what Tesla will produce and deliver in 2021. Argus said in a note to investors that it expects Tesla to produce 952,000 cars this year.

Black added more comments regarding the company’s decision to invest in Bitcoin, and wrote:

“I go back to my criticism of $TSLA earnings calls, which already stood out for their vagueness, lack of detail, and non-discussion of strategic priorities. If $TSLA purchased $1.5B in #bitcoin in January, why not share the logic with shareholders on the earnings call?”

2/ I go back to my criticism of $TSLA earnings calls, which already stood out for their vagueness, lack of detail, and non-discussion of strategic priorities. If $TSLA purchased $1.5B in #bitcoin in January, why not share the logic with shareholders on the earnings call?

— Gary Black (@garyblack00) February 8, 2021

Disclosure: Joey Klender is a TSLA shareholder.