Investor's Corner

LIVE BLOG: Tesla (TSLA) Q4 and Full Year 2020 earnings call summary

Tesla’s (NASDAQ:TSLA) fourth-quarter and full year earnings call comes on the heels of an impressive quarter that saw the electric car maker post $10.7 billion in revenue and $903 million non-GAAP net income. With these results, Tesla has now maintained its profitability for six consecutive quarters.

As revealed in the company’s Q4 FY 2020 Update Letter, Tesla currently sits on $19.4 billion in cash, thanks to a capital raise of $5 billion that further strengthened the company’s war chest. This should allow Tesla to pursue its projects in the United States and abroad, particularly in Texas and Berlin, where two Gigafactories are currently being built. Tesla has also taken the wraps off the Model S and Model X refresh, ending a long period of speculation among electric vehicle enthusiasts.

The following are live updates from Tesla’s Q4 FY 2020 earnings call. I will be updating this article in real-time, so please keep refreshing the page to view the latest updates on this story. The first entry starts at the bottom of the page.

16:34 PT – And that’s it for the Q4 FY 2020 earnings call, everyone! Tons of new info have been shared over the call, and considering what was discussed, it seems like 2021 would be a pretty exciting year once more. With that said, thanks for joining us this time once more for our live blog. We’ll see you in the Q1 2021 earnings call!

16:31 PT – Gene Munster from Loup Ventures asks about the Semi and if the vehicle is the first to achieve full autonomy considering that its routes are extremely predictable. Musk responds that this will indeed be the case. No retraining would be needed to adapt FSD for the Semi, the CEO explained, though some adjustments would need to be made.

16:28 PT – Emmanuel Rosner from Deutsche Bank asks about the cost efficiencies of the 4680 battery cell, as well as the company’s affordable car. Musk notes that three or four years would be a good timeframe to reach such goals. Baird, on the other hand, asks about X (Elon Musk’s possible umbrella company). Musk notes that he expects to be with Tesla for the next years. “I expect to be CEO of Tesla for several years in the future,” Musk said, though he noted that nobody should be CEO forever. “It would be nice to have more than free time in my hands,” Musk remarked, but “the mission is not over yet and there’s still a long way to go before we can make a dent in the world’s acceleration to sustainable energy.” The same is true for solar and stationary storage. There’s still so much work to be done.

16:23 PT – RBC Capital Markets asks about the electric van market. “Tesla is definitely going to make an electric van at one point,” Musk said, though he reiterates that the constraint lies in battery supply. He mentions the Semi, which uses a lot of cells. Musk notes that the Semi would make sense to produce once Tesla addresses its battery constraint. Simply put, when the 4680 is produced in volume, the Semi will come. Musk also talks about Tesla’s next-generation computer. He notes that Tesla’s next-gen chip would be 3x more powerful than the company’s current custom hardware, which is still not being utilized to its full potential today. “We’ve not been rushing the V2 computer. It’s coming along,” Musk said.

16:18 PT – Alex Potter from Piper Sandler asks about Tesla’s intention to increase its battery supply from its suppliers, and if suppliers need to produce 4680 cells. Musk notes that it does not. “It is not required,” Musk said, adding that even the new Model S still uses the 18650 form factor. He noted that Tesla will be retiring its old battery form factors in due time, but it’s better to have some flexibility. “Over time, it would make sense to have a consistency with battery form factor,” he adds. As for Tesla’s growth rate, Elon notes that Tesla poised to massive growth. “We do think we can maintain a growth rate of 50% for many years to come,” he said.

16:15 PT – Dan Levy from Credit Suisse asks about regulatory credits. Kirkhorn highlights that regulatory credit sales are difficult to forecast. He notes that most of Q4’ regulatory credit sales were not forecasted at all. They are simply not predictable. That being said, Tesla is not dependent on it nor does it rely on regulatory credits.

16:12 PT – Analyst questions begin. First up is from Oppenheimer asking about FSD regulations. Tesla notes that it will be all about reliability. There’s a slowdown in Europe, while China’s shown an interest in Level 4 or even Level 5 autonomy. As for the US, it will be all about how reliable autonomous software will be. As for the supply chain, Jerome Guillen notes that there are still challenges related to COVID, though work is underway to address this.

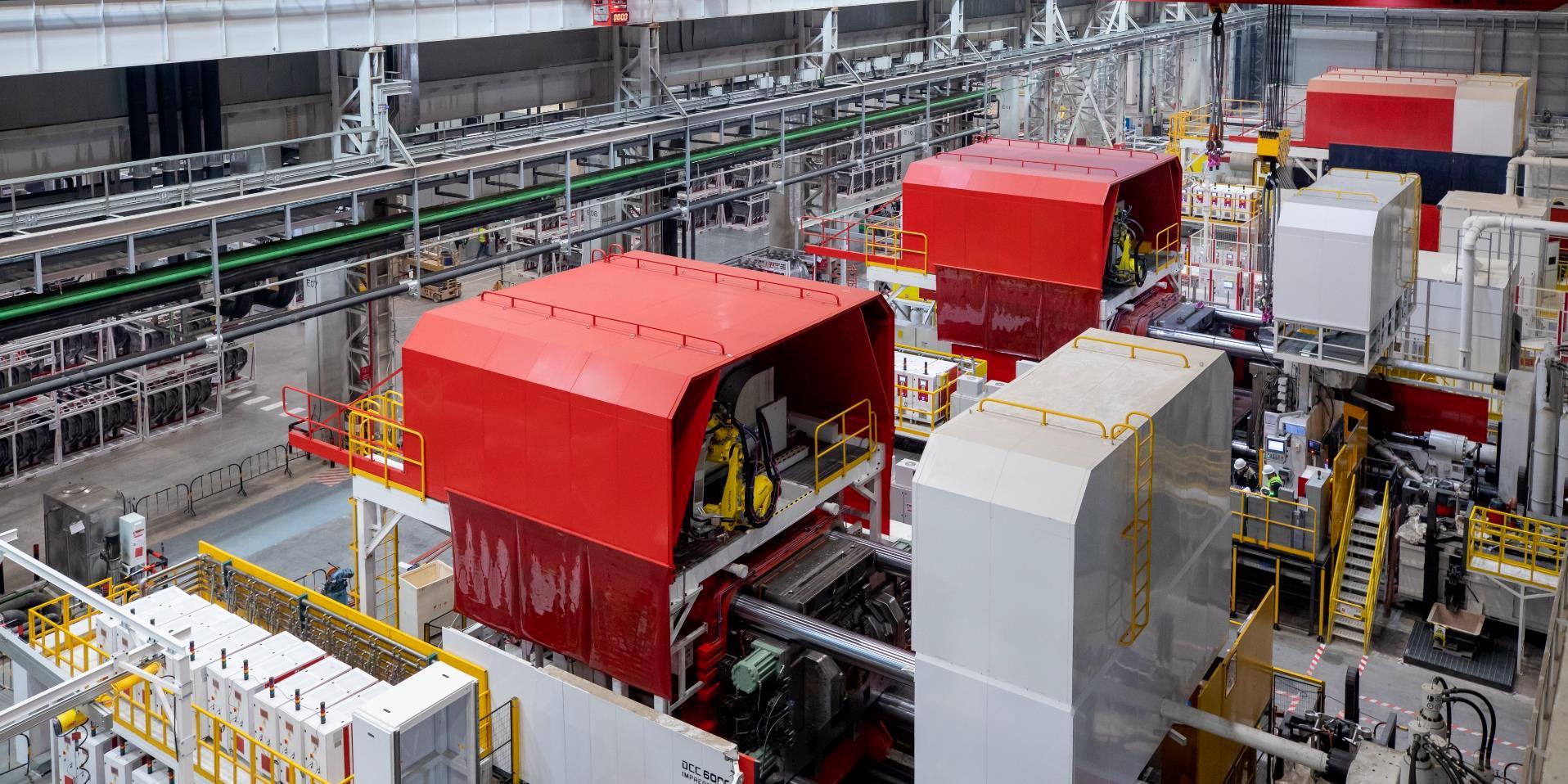

16:10 PT – As for Cybertruck development and 2021 deliveries, Musk stated that Tesla is finished with the vehicle’s engineering. Tesla has the necessary designs to make the Cybertruck work. Tesla will be using 8,000-ton press for the Cybertruck, which is more formidable than the Giga Press used for the Model Y, which is a 6,000-ton press.

16:08 PT – Elon also discusses Tesla’s China operations and its success, though he notes that FSD take rate in the country is conservative. He notes that Tesla has to work hard in ensuring that FSD and Autopilot work well in roads outside North America. As for Tesla’s long-term earnings being tied to profit per unit of battery capacity, Musk responded that this is indeed the case. EV makers can’t grow faster than their battery capacity. “Fundamentally, growth is dependent on cell production,” Musk said, noting that Tesla’s efforts to produce its own cells is to produce more batteries, not to compete with its suppliers. “Our goal with making our own cells is not to intimidate our suppliers. It is to supplement our suppliers,” Musk said.

16:04 PT – Addressing an inquiry from an institutional investor about Tesla’s possible plans to license its software like Autobidder to third party or OEMs. “We’re very open to licensing our software to other OEMs,” Musk said, adding that Tesla is in talks to license Autopilot to other companies. “We’re more than happy to license that to other car companies, and the same goes for Autobidder,” the CEO noted. He also mentions that the Supercharger Network will be fine for sharing too.

16:00 PT – Tesla service issues are addressed. Automotive Director Jerome Guillen notes that Tesla is looking to improve service amidst the company’s efforts to reduce service needs as possible. The executive noted that mobile service will play a huge part in this, with 40% of service needs in the US are now done through mobile. In terms of service appointments, Guillen notes that Tesla has 140 service centers in North America, with customers getting an appointment within 10 days. The pace of opening centers in North America is ramping, with Tesla planning on opening dozens in the first half of this year. He also explains that in terms of app vs phone support, apps are more robust. He notes that Tesla is investing everything it can on the app. “Our emphasis is on the app… It’s the way of the future,” he said.

15:57 PT – As for Tesla’s run rate for 4680 cell production, Elon Musk noted that the company is installing capacity to produce 200 GWh per year around 2022. Drew Baglino adds that with the S-curve of production, one could be off a bit, but Tesla is progressing through this S-curve as fast as possible.

15:52 PT – The second Say question from a retail investor is asked. FSD transfers. Elon notes that Tesla is not looking into this at this time. He mentions FSD’s price increases, and the fact that the market is undervaluing FSD considering its potential. He did note that Tesla will be offering subscriptions within the next month or two, which should help with pricing. As for the dry coating of the battery electrode for 4680 cells, VP of Technology Drew Baglino notes that the challenges are being addressed today. Tesla’s Roadrunner site in Fremont is getting better with its dry electrode process and its 4680 cell manufacturing. The setup for a 10 GWh annual production rate is there already. It’s only a matter of time.

15:49 PT – The first questions from Say are asked. First up, “What is currently holding Tesla back from being the market share leader in solar?” Musk notes that Tesla does indeed plan on being the market share leader. He explains that attention is now being put on solar, which should improve its ramp. “It won’t be long before Tesla becomes the leader in solar.” Kirkhorn also highlights that having industry-leading pricing is pivotal in dominating the solar industry. This is something that Tesla is doing right now.

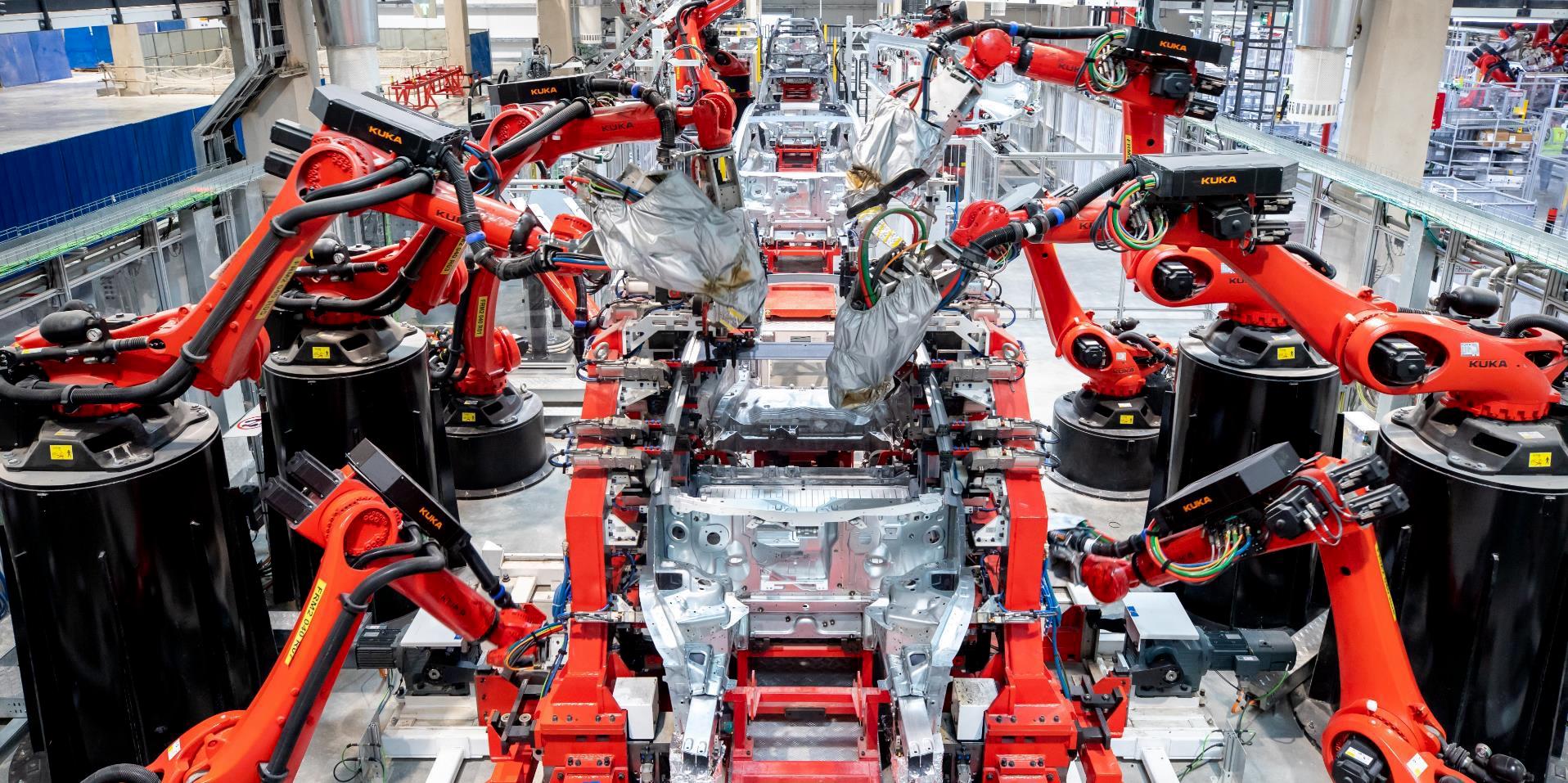

15:45 PT – CFO Zachary Kirkhorn takes the floor. He highlights Tesla’s strong free cash flow, which secures the company’s funds for its programs. He also mentions that Tesla relies less on debts now, especially as the company establishes its momentum with its sixth consecutive profitable quarter. He also explains automotive margins in Q4, noting that it was affected by the changes in the Model S and Model X line for the refresh, as well as the deployment of machines like the Giga Press in Fremont.

15:43 PT – Musk talks about how to justify Tesla’s high valuation. He explains that FSD will play a huge part in this. In conclusion, Musk noted that 2020 was just the beginning in terms of profitability. “It will be exciting,” he said. Provided that 2021 is relatively normal (unlike 2020), Musk is optimistic that Tesla can reach new heights. “We think 2021 will be more exciting…it’s going to be a great year for Tesla. Many new great products coming out,” he said.

15:40 PT – Musk also talks about the FSD beta rollout. “We have made massive improvements to FSD Beta,” he said. He adds that there are almost 1K people testing the software at this point. “It’s very common to have no interventions in drives to places that I’ve never been to,” Musk said, sharing some of his experiences with the FSD beta.

15:38 PT – Tesla Model S and Model X production is ongoing now. Model S Plaid will start deliveries next month. Model S Plaid will come a bit later. “It’s really a tremendous improvement over the prior version.” The Model S will be the first production car ever that will be able to go from 0-60 mph in under 2 seconds. “This is a luxury sedan that can go 0-60 in less than 2 seconds, and it will have the capability to seat seven people with its third row seats,” Musk remarked. More details to come later this week.

15:35 PT – Elon’s opening remarks. He recaps 2020, calling it a defining year for Tesla, especially when as the company accomplishes its target of delivering and producing half a million cars. That’s despite the challenging year. Free cash flow is healthy despite spending quite a lot of money. Simply put, Tesla has enough funds for its ambitious projects. Elon notes that Model 3 and Model Y are ramping in Shanghai and Fremont, and the heat pump is also rolled out to all vehicles. He also talks about Giga Berlin, Texas, and the Roadrunner site in Fremont.

15:32 PT – And it begins! Martin Viecha Senior Director of Investor Relations takes the floor. He introduces Elon Musk and Zachary Kirkhorn and a number of Tesla executives.

15:25 PT – Last few minutes guys. Here we go.

15:21 PT – Ok, guys, homestretch here. Who has bets on the earnings call starting on Elon Time? Then again, the earnings results are positive, so Tesla may be quite excited.

15:20 PT – I also just realized that the Model S and Model X refresh’s 17″ display is probably identical to the one used in the Cybertruck. Now I’m wondering if the Semi will use two of these screens. Kinda makes sense, doesn’t it?

15:15 PT – Also noteworthy is that the Model S and Model X refresh is now taking the fight to the world’s best luxury sedans with in terms of comfort as well. As could be seen in Tesla’s online configurator, both flagship vehicles are now equipped with a 22-speaker system with new microphone setup, which paves the way for active noise canceling tech. We reported on this recently, as could be seen here.

15:00 PT – Another thing that’s particularly notable is Tesla’s subtle, continued efforts to kill the FUD against electric cars. The Model S and Model X refresh are both equipped with a heat pump, which should enable the flagship vehicles to perform five times as many high-speed quarter-mile runs as before. Repeatability? Check.

14:45 PT – Several things stick out from the Q4 FY 2020 Update Letter. I’m particularly impressed with the company’s performance in its Energy business. Tesla Energy has long been underrated, and it’s always pushed to the background by the company’s auto business. But every quarter, Tesla Energy is becoming more and more prominent. In 2020, energy battery deployment surpassed 3 GWh for the first time. That’s some serious momentum.

14:30 PT – Well, well, well, looks like I’m early this time around. Please do check back in a bit as we will be covering the entire Q&A session. There’s usually a ton of interesting tidbits of information that get shared in Tesla’s earnings calls. Some analysts’ questions are also usually unforgettable.

14:15 PT – Good day, everyone, and welcome to another live blog of Tesla’s earnings call! While Tesla missed Wall Street’s EPS estimates, the company did post a huge profit and its war chest is very formidable now. But all the exciting financials aside, there’s very little doubt that the EV community is currently most excited about the Model S and Model X refresh. The wait for these vehicles has been significant, but boy oh boy, are they worth it.

Don’t hesitate to contact us for news tips. Just send a message to tips@teslarati.com to give us a heads up.

Investor's Corner

Tesla could save $2.5B by replacing 10% of staff with Optimus: Morgan Stanley

Jonas assigned each robot a net present value (NPV) of $200,000.

Tesla’s (NASDAQ:TSLA) near-term outlook may be clouded by political controversies and regulatory headwinds, but Morgan Stanley analyst Adam Jonas sees a glimmer of opportunity for the electric vehicle maker.

In a new note, the Morgan Stanley analyst estimated that Tesla could save $2.5 billion by replacing just 10% of its workforce with its Optimus robots, assigning each robot a net present value (NPV) of $200,000.

Morgan Stanley highlights Optimus’ savings potential

Jonas highlighted the potential savings on Tesla’s workforce of 125,665 employees in his note, suggesting that the utilization of Optimus robots could significantly reduce labor costs. The analyst’s note arrived shortly after Tesla reported Q2 2025 deliveries of 384,122 vehicles, which came close to Morgan Stanley’s estimate and slightly under the consensus of 385,086.

“Tesla has 125,665 employees worldwide (year-end 2024). On our calculations, a 10% substitution to humanoid at approximately ($200k NPV/humanoid) could be worth approximately $2.5bn,” Jonas wrote, as noted by Street Insider.

Jonas also issued some caution on Tesla Energy, whose battery storage deployments were flat year over year at 9.6 GWh. Morgan Stanley had expected Tesla Energy to post battery storage deployments of 14 GWh in the second quarter.

Musk’s political ambitions

The backdrop to Jonas’ note included Elon Musk’s involvement in U.S. politics. The Tesla CEO recently floated the idea of launching a new political party, following a poll on X that showed support for the idea. Though a widely circulated FEC filing was labeled false by Musk, the CEO does seem intent on establishing a third political party in the United States.

Jonas cautioned that Musk’s political efforts could divert attention and resources from Tesla’s core operations, adding near-term pressure on TSLA stock. “We believe investors should be prepared for further devotion of resources (financial, time/attention) in the direction of Mr. Musk’s political priorities which may add further near-term pressure to TSLA shares,” Jonas stated.

Investor's Corner

Two Tesla bulls share differing insights on Elon Musk, the Board, and politics

Two noted Tesla bulls have shared differing views on the recent activities of CEO Elon Musk and the company’s leadership.

Two noted Tesla (NASDAQ:TSLA) bulls have shared differing views on the recent activities of CEO Elon Musk and the company’s leadership.

While Wedbush analyst Dan Ives called on Tesla’s board to take concrete steps to ensure Musk remains focused on the EV maker, longtime Tesla supporter Cathie Wood of Ark Invest reaffirmed her confidence in the CEO and the company’s leadership.

Ives warns of distraction risk amid crucial growth phase

In a recent note, Ives stated that Tesla is at a critical point in its history, as the company is transitioning from an EV maker towards an entity that is more focused on autonomous driving and robotics. He then noted that the Board of Directors should “act now” and establish formal boundaries around Musk’s political activities, which could be a headwind on TSLA stock.

Ives laid out a three-point plan that he believes could ensure that the electric vehicle maker is led with proper leadership until the end of the decade. First off, the analyst noted that a new “incentive-driven pay package for Musk as CEO that increases his ownership of Tesla up to ~25% voting power” is necessary. He also stated that the Board should establish clear guidelines for how much time Musk must devote to Tesla operations in order to receive his compensation, and a dedicated oversight committee must be formed to monitor the CEO’s political activities.

Ives, however, highlighted that Tesla should move forward with Musk at its helm. “We urge the Board to act now and move the Tesla story forward with Musk as CEO,” he wrote, reiterating its Outperform rating on Tesla stock and $500 per share price target.

Tesla CEO Elon Musk has responded to Ives’ suggestions with a brief comment on X. “Shut up, Dan,” Musk wrote.

Cathie Wood reiterates trust in Musk and Tesla board

Meanwhile, Ark Investment Management founder Cathie Wood expressed little concern over Musk’s latest controversies. In an interview with Bloomberg Television, Wood said, “We do trust the board and the board’s instincts here and we stay out of politics.” She also noted that Ark has navigated Musk-related headlines since it first invested in Tesla.

Wood also pointed to Musk’s recent move to oversee Tesla’s sales operations in the U.S. and Europe as evidence of his renewed focus in the electric vehicle maker. “When he puts his mind on something, he usually gets the job done,” she said. “So I think he’s much less distracted now than he was, let’s say, in the White House 24/7,” she said.

TSLA stock is down roughly 25% year-to-date but has gained about 19% over the past 12 months, as noted in a StocksTwits report.

Investor's Corner

Cantor Fitzgerald maintains Tesla (TSLA) ‘Overweight’ rating amid Q2 2025 deliveries

Cantor Fitzgerald is holding firm on its bullish stance for the electric vehicle maker.

Cantor Fitzgerald is holding firm on its bullish stance for Tesla (NASDAQ: TSLA), reiterating its “Overweight” rating and $355 price target amidst the company’s release of its Q2 2025 vehicle delivery and production report.

Tesla delivered 384,122 vehicles in Q2 2025, falling below last year’s Q2 figure of 443,956 units. Despite softer demand in some countries in Europe and ongoing controversies surrounding CEO Elon Musk, the firm maintained its view that Tesla is a long-term growth story in the EV sector.

Tesla’s Q2 results

Among the 384,122 vehicles that Tesla delivered in the second quarter, 373,728 were Model 3 and Model Y. The remaining 10,394 units were attributed to the Model S, Model X, and Cybertruck. Production was largely flat year-over-year at 410,244 units.

In the energy division, Tesla deployed 9.6 GWh of energy storage in Q2, which was above last year’s 9.4 GWh. Overall, Tesla continues to hold a strong position with $95.7 billion in trailing twelve-month revenue and a 17.7% gross margin, as noted in a report from Investing.com.

Tesla’s stock is still volatile

Tesla’s market cap fell to $941 billion on Monday amid volatility that was likely caused in no small part by CEO Elon Musk’s political posts on X over the weekend. Musk has announced that he is forming the America Party to serve as a third option for voters in the United States, a decision that has earned the ire of U.S. President Donald Trump.

Despite Musk’s controversial nature, some analysts remain bullish on TSLA stock. Apart from Cantor Fitzgerald, Canaccord Genuity also reiterated its “Buy” rating on Tesla shares, with the firm highlighting the company’s positive Q2 vehicle deliveries, which exceeded its expectations by 24,000 units. Cannacord also noted that Tesla remains strong in several markets despite its year-over-year decline in deliveries.

-

Elon Musk1 week ago

Elon Musk1 week agoTesla investors will be shocked by Jim Cramer’s latest assessment

-

Elon Musk3 days ago

Elon Musk3 days agoElon Musk confirms Grok 4 launch on July 9 with livestream event

-

Elon Musk15 hours ago

Elon Musk15 hours agoxAI launches Grok 4 with new $300/month SuperGrok Heavy subscription

-

News7 days ago

News7 days agoTesla Model 3 ranks as the safest new car in Europe for 2025, per Euro NCAP tests

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoA Tesla just delivered itself to a customer autonomously, Elon Musk confirms

-

Elon Musk1 week ago

Elon Musk1 week agoxAI’s Memphis data center receives air permit despite community criticism

-

Elon Musk2 weeks ago

Elon Musk2 weeks agoTesla’s Omead Afshar, known as Elon Musk’s right-hand man, leaves company: reports

-

News2 weeks ago

News2 weeks agoXiaomi CEO congratulates Tesla on first FSD delivery: “We have to continue learning!”