Energy

Tesla’s value is based on a vision of a better tomorrow

On Monday, April 10, 2017, Tesla, Inc. (NASDAQ: TSLA) shares closed at $312.39, surpassing the stalwart General Motors Corporation (NYSE: GM) by market cap. This was a revolutionary day in the world of U.S. automakers, coming just a week after Tesla exceeded the century-old, reliable Ford Motor Company (NYSE: F) in value.

Tesla lost $773 million last year. Traditional U.S. automakers are financially healthy and consistently sell the vehicles they manufacture. Tesla CEO Elon Musk has acknowledged on Twitter that the company was “absurdly overvalued if based on the past.” So, what is the “past” in the world of automakers, and why is Tesla, a company that sells millions of vehicles less than other major U.S. automakers, surging ahead?

The answer lies in Tesla’s ability to identify that — contrary to prevailing political discourse about the need for coal, oil and natural gas industries — more and more people are ready to make the switch to electric vehicles. And Tesla has built its company assets around that vision for a better, more sustainable world that no longer relies on fossil fuels for transportation and energy.

Tesla stock is not based on the past

A stock is a “concrete representation of partial ownership of a publicly traded company,” according to Motley Fool. A share in a stock represents the company’s big picture of revenue, earnings, cash flow, and shareholder’s equity, among other factors. Okay, Tesla’s Gigafactories outside Reno and in Buffalo have tangible book value with equipment, buildings, and land. But that’s not enough for the recent exceptional Tesla valuation. Tesla’s price-to-earning ratio, or how long a stock will take to pay back an investment, is quite uncertain.

New aerial shots of Tesla Gigagafactory 1 taken March, 2017

The company’s value seems to be hinged on a non-traditional investment perspective that Ford and GM are falling fast. It’s a result of a common fear that their vehicle sales have hit their peak, that their once-stellar levels of production and return will never again be achieved. Moreover, Tesla benefits from a historical growth rate of the company’s earnings.

In other words, Tesla stock has soared in the past three years, up nearly 40 percent this year alone. Tesla, as Musk noted on Twitter, is all about “risk adjusted future cash flows.”

Electricity is our friend, and Tesla knows it

Electric vehicles offer many positive benefits as we attempt to alleviate the effects of global warming. They produce fewer greenhouse gasses when powered by plants that don’t produce greenhouse gasses. Better yet, EVs can be powered by decentralized power sources like the Tesla Powerwall for residences or the Tesla Powerpack for business energy independence or as a companion to existing utility power generation. A cleaner electric grid can contribute other environmental advantages like decreased consumption of water and less depletion of natural resources like steel and copper materials.

Electric vehicles are shaking up long-established industries at a much faster rate than anyone anticipated. Electricity mixes in North America are increasingly moving away from fossil fuel reliance and onto hydro and other renewable energies. We’re using energy more wisely with electric vehicles. There’s a significant reduction in the CO2 equivalent emissions from swapping a fossil-fuel powered car for an EV. Transport emissions comprise a statistically significant portion of the emissions that have contributed to anthropogenic climate change.

The folks at Tesla have been aware of the benefits of electricity-based transportation since the company’s inception.

U.S. automakers lag behind in alternative energy technology applications

Instead of moving toward technological innovations that could revolutionize the U.S. auto industry, the Big Three automakers lobbied the new Trump administration to reduce Corporate Average Fuel Economy targets of 50 miles per gallon by 2025. The move sent a stark message to a consumer base that is ready for a safe, reliable, fossil-free transportation future. Allegiances with the Trump administration sent signals that U.S. automakers are not ready with the necessary R&D to provide energy efficiency, alternative power, or autonomous driving.

Meanwhile, every Tesla comes standard with adapters to plug into common household outlets. The company states that a Tesla owner can charge up to 52 miles of range per hour right from home by plugging in the Tesla “like a mobile phone.” Tesla supercharger stations are strategically placed to minimize stops during long distance travel. Conveniently located near restaurants, shopping centers, and WiFi hot spots, the company says that each station contains multiple Superchargers to help Tesla drivers get back on the road quickly.

As we wrote here at Teslarati after the U.S. presidential election in November, over the past 50 years, automobiles have been our freedom machines, a means of both transportation and personal identity expression. In the same way that Henry Ford matched a youthful and euphoric generation to the combustion-engine automobile, so, too, do automakers need to design strategic moves to shape the industry’s evolution. Electric vehicles are at the heart of that vision for tomorrow’s consumer domestic transportation.

Tesla stock is valued, not by traditional measures, but by a vision that appeals to a generation of individuals who believe we can achieve a sustainable world. And we hold to that belief by investing in a stock like Tesla, which gives us hope against extraordinary odds.

Energy

Tesla launches Cybertruck vehicle-to-grid program in Texas

The initiative was announced by the official Tesla Energy account on social media platform X.

Tesla has launched a vehicle-to-grid (V2G) program in Texas, allowing eligible Cybertruck owners to send energy back to the grid during high-demand events and receive compensation on their utility bills.

The initiative, dubbed Powershare Grid Support, was announced by the official Tesla Energy account on social media platform X.

Texas’ Cybertruck V2G program

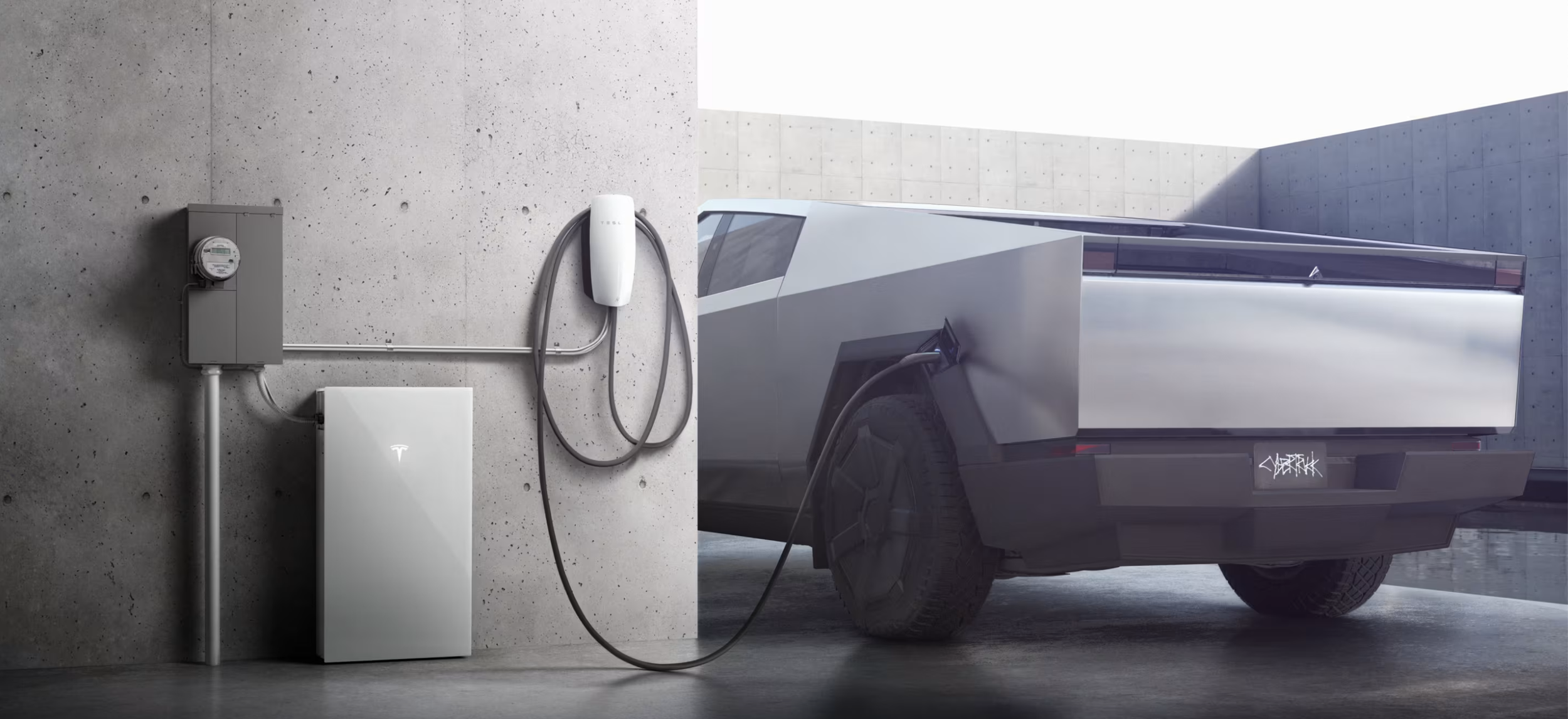

In its post on X, Tesla Energy confirmed that vehicle-to-grid functionality is “coming soon,” starting with select Texas markets. Under the new Powershare Grid Support program, owners of the Cybertruck equipped with Powershare home backup hardware can opt in through the Tesla app and participate in short-notice grid stress events.

During these events, the Cybertruck automatically discharges excess energy back to the grid, supporting local utilities such as CenterPoint Energy and Oncor. In return, participants receive compensation in the form of bill credits. Tesla noted that the program is currently invitation-only as part of an early adopter rollout.

The launch builds on the Cybertruck’s existing Powershare capability, which allows the vehicle to provide up to 11.5 kW of power for home backup. Tesla added that the program is expected to expand to California next, with eligibility tied to utilities such as PG&E, SCE, and SDG&E.

Powershare Grid Support

To participate in Texas, Cybertruck owners must live in areas served by CenterPoint Energy or Oncor, have Powershare equipment installed, enroll in the Tesla Electric Drive plan, and opt in through the Tesla app. Once enrolled, vehicles would be able to contribute power during high-demand events, helping stabilize the grid.

Tesla noted that events may occur with little notice, so participants are encouraged to keep their Cybertrucks plugged in when at home and to manage their discharge limits based on personal needs. Compensation varies depending on the electricity plan, similar to how Powerwall owners in some regions have earned substantial credits by participating in Virtual Power Plant (VPP) programs.

Cybertruck

Tesla updates Cybertruck owners about key Powershare feature

Tesla is updating Cybertruck owners on its timeline of a massive feature that has yet to ship: Powershare with Powerwall.

Powershare is a bidirectional charging feature exclusive to Cybertruck, which allows the vehicle’s battery to act as a portable power source for homes, appliances, tools, other EVs, and more. It was announced in late 2023 as part of Tesla’s push into vehicle-to-everything energy sharing, and acting as a giant portable charger is the main advantage, as it can provide backup power during outages.

Cybertruck’s Powershare system supports both vehicle-to-load (V2L) and vehicle-to-home (V2H), making it flexible and well-rounded for a variety of applications.

However, even though the feature was promised with Cybertruck, it has yet to be shipped to vehicles. Tesla communicated with owners through email recently regarding Powershare with Powerwall, which essentially has the pickup act as an extended battery.

Powerwall discharge would be prioritized before tapping into the truck’s larger pack.

However, Tesla is still working on getting the feature out to owners, an email said:

“We’re writing to let you know that the Powershare with Powerwall feature is still in development and is now scheduled for release in mid-2026.

This new release date gives us additional time to design and test this feature, ensuring its ability to communicate and optimize energy sharing between your vehicle and many configurations and generations of Powerwall. We are also using this time to develop additional Powershare features that will help us continue to accelerate the world’s transition to sustainable energy.”

Owners have expressed some real disappointment in Tesla’s continuous delays in releasing the feature, as it was expected to be released by late 2024, but now has been pushed back several times to mid-2026, according to the email.

Foundation Series Cybertruck buyers paid extra, expecting the feature to be rolled out with their vehicle upon pickup.

Cybertruck’s Lead Engineer, Wes Morrill, even commented on the holdup:

As a Cybertruck owner who also has Powerwall, I empathize with the disappointed comments.

To their credit, the team has delivered powershare functionality to Cybertruck customers who otherwise have no backup with development of the powershare gateway. As well as those with solar…

— Wes (@wmorrill3) December 12, 2025

He said that “it turned out to be much harder than anticipated to make powershare work seamlessly with existing Powerwalls through existing wall connectors. Two grid-forming devices need to negotiate who will form and who will follow, depending on the state of charge of each, and they need to do this without a network and through multiple generations of hardware, and test and validate this process through rigorous certifications to ensure grid safety.”

It’s nice to see the transparency, but it is justified for some Cybertruck owners to feel like they’ve been bait-and-switched.

Energy

Tesla starts hiring efforts for Texas Megafactory

Tesla’s Brookshire site is expected to produce 10,000 Megapacks annually, equal to 40 gigawatt hours of energy storage.

Tesla has officially begun hiring for its new $200 million Megafactory in Brookshire, Texas, a manufacturing hub expected to employ 1,500 people by 2028. The facility, which will build Tesla’s grid-scale Megapack batteries, is part of the company’s growing energy storage footprint.

Tesla’s hiring efforts for the Texas Megafactory are hinted at by the job openings currently active on the company’s Careers website.

Tesla’s Texas Megafactory

Tesla’s Brookshire site is expected to produce 10,000 Megapacks annually, equal to 40 gigawatt hours of energy storage, similar to the Lathrop Megafactory in California. Tesla’s Careers website currently lists over 30 job openings for the site, from engineers, welders, and project managers. Each of the openings is listed for Brookshire, Texas.

The company has leased two buildings in Empire West Business Park, with over $194 million in combined property and equipment investment. Tesla’s agreement with Waller County includes a 60% property tax abatement, contingent on meeting employment benchmarks: 375 jobs by 2026, 750 by 2027, and 1,500 by 2028, as noted in a report from the Houston Business Journal. Tesla is required to employ at least 1,500 workers in the facility through the rest of the 10-year abatement period.

Tesla’s clean energy boom

City officials have stated that Tesla’s arrival marks a turning point for the Texas city, as it highlights a shift from logistics to advanced clean energy manufacturing. Ramiro Bautista from Brookshire’s economic development office, highlighted this in a comment to the Journal.

“(Tesla) has great-paying jobs. Not just that, but the advanced manufacturing (and) clean energy is coming to the area,” he said. “So it’s not just your normal logistics manufacturing. This is advanced manufacturing coming to this area, and this brings a different type of job and investment into the local economy.”